Refine search

Actions for selected content:

179 results

2 - China’s Economic Displacement of the US in Latin America

- from Part I - Economic Displacement

-

- Book:

- Economic Displacement

- Published online:

- 19 November 2025

- Print publication:

- 31 December 2025, pp 25-54

-

- Chapter

- Export citation

Ottoman Justice and Political Economy of Empires: Venetian Merchants in Seventeenth-Century Ottoman Courts

-

- Journal:

- Comparative Studies in Society and History , First View

- Published online by Cambridge University Press:

- 21 October 2025, pp. 1-26

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Does ‘going green’ promote global value chain integration?

-

- Journal:

- Environment and Development Economics , First View

- Published online by Cambridge University Press:

- 22 September 2025, pp. 1-23

-

- Article

- Export citation

Populism and Institutional Fortitude: Philippine Engagement With International Law And Institutions During The Duterte Administration

-

- Journal:

- Asian Journal of International Law , First View

- Published online by Cambridge University Press:

- 29 July 2025, pp. 1-24

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Telecoupled social–ecological systems: the case of avocado in Chile

- Part of

-

- Journal:

- Global Sustainability / Volume 8 / 2025

- Published online by Cambridge University Press:

- 04 July 2025, e23

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Binding the flows: Why trade is central for a global plastics treaty

- Part of

-

- Journal:

- Cambridge Prisms: Plastics / Volume 3 / 2025

- Published online by Cambridge University Press:

- 23 June 2025, e17

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Trade and the Politics of Electoral Reform

-

- Journal:

- International Organization / Volume 79 / Issue 2 / Spring 2025

- Published online by Cambridge University Press:

- 01 July 2025, pp. 358-379

- Print publication:

- Spring 2025

-

- Article

- Export citation

Exploring the Impact of China’s Retaliatory Tariffs on US Soybean Exports with Machine Learning Techniques

-

- Journal:

- Journal of Agricultural and Applied Economics / Volume 57 / Issue 2 / May 2025

- Published online by Cambridge University Press:

- 24 March 2025, pp. 240-258

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

11 - Production and the Enforcement of Rationality

- from Part II - Economic Analysis and Policy Without Preferences

-

- Book:

- Economics without Preferences

- Published online:

- 02 January 2025

- Print publication:

- 16 January 2025, pp 213-222

-

- Chapter

- Export citation

9 - Welfare and Policymaking: Pareto without Preferences

- from Part II - Economic Analysis and Policy Without Preferences

-

- Book:

- Economics without Preferences

- Published online:

- 02 January 2025

- Print publication:

- 16 January 2025, pp 176-200

-

- Chapter

- Export citation

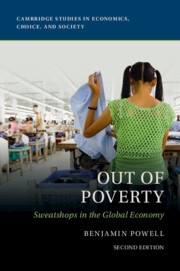

1 - Introduction

-

- Book:

- Out of Poverty

- Published online:

- 02 January 2025

- Print publication:

- 09 January 2025, pp 1-8

-

- Chapter

- Export citation

2 - The Anti-Sweatshop Movement

-

- Book:

- Out of Poverty

- Published online:

- 02 January 2025

- Print publication:

- 09 January 2025, pp 9-22

-

- Chapter

- Export citation

Out of Poverty

- Sweatshops in the Global Economy

-

- Published online:

- 02 January 2025

- Print publication:

- 09 January 2025

Introduction

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 1-14

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

3 - Intellectual Property, Global Inequality, and Subnational Policy Variations

- from Part I - Theoretical, Empirical, and Policy Issues

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 81-105

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

12 - Managed Trade and Technology Protectionism

- from Part III - Intellectual Property and Global Inequality

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 305-323

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

1 - Intellectual Property Rights and Inequality

- from Part I - Theoretical, Empirical, and Policy Issues

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 17-46

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

11 - Inequality and Intellectual Property

- from Part III - Intellectual Property and Global Inequality

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 279-304

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

10 - Inequality and Asymmetry in the Making of Intellectual Property a Constitutional Right

- from Part II - Intellectual Property and National Inequalities

-

-

- Book:

- Intellectual Property, Innovation and Economic Inequality

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024, pp 252-276

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

Intellectual Property, Innovation and Economic Inequality

-

- Published online:

- 05 December 2024

- Print publication:

- 12 December 2024

-

- Book

-

- You have access

- Open access

- Export citation