Refine search

Actions for selected content:

26946 results in Economic history

Part IV - Navigating Waves of Globalization, 1990 to the Present

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 203-284

-

- Chapter

- Export citation

Contents

-

- Book:

- Soldiers, Wages, and the Hellenistic Economies

- Published online:

- 21 May 2024

- Print publication:

- 09 May 2024, pp vii-viii

-

- Chapter

- Export citation

Part II - Making Miracles, 1950–1973

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 57-136

-

- Chapter

- Export citation

Index

-

- Book:

- Soldiers, Wages, and the Hellenistic Economies

- Published online:

- 21 May 2024

- Print publication:

- 09 May 2024, pp 244-250

-

- Chapter

- Export citation

Contents

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp vii-viii

-

- Chapter

- Export citation

Bibliography

-

- Book:

- Soldiers, Wages, and the Hellenistic Economies

- Published online:

- 21 May 2024

- Print publication:

- 09 May 2024, pp 217-243

-

- Chapter

- Export citation

Notes

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 285-317

-

- Chapter

- Export citation

Part I - No Mere Incantation

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 11-56

-

- Chapter

- Export citation

2 - The Miracle Makers

- from Part I - No Mere Incantation

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 35-56

-

- Chapter

- Export citation

List of Maps

-

- Book:

- Soldiers, Wages, and the Hellenistic Economies

- Published online:

- 21 May 2024

- Print publication:

- 09 May 2024, pp xx-xx

-

- Chapter

- Export citation

8 - The Hauntings of the Past

- from Part III - Sustaining Miracles, 1973–1989

-

- Book:

- Ruins to Riches

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024, pp 156-182

-

- Chapter

- Export citation

The fiscal transformation of the Spanish Carrera de Indias in the 17th century: a reinterpretation

-

- Journal:

- Revista de Historia Economica - Journal of Iberian and Latin American Economic History / Volume 42 / Issue 2 / September 2024

- Published online by Cambridge University Press:

- 15 April 2024, pp. 171-192

- Print publication:

- September 2024

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

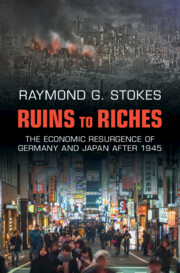

Ruins to Riches

- The Economic Resurgence of Germany and Japan after 1945

-

- Published online:

- 12 April 2024

- Print publication:

- 09 May 2024

1930: first modern crisis

-

- Journal:

- Financial History Review / Volume 30 / Issue 3 / December 2023

- Published online by Cambridge University Press:

- 08 April 2024, pp. 277-307

-

- Article

- Export citation

FHR volume 30 issue 3 Cover and Back matter

-

- Journal:

- Financial History Review / Volume 30 / Issue 3 / December 2023

- Published online by Cambridge University Press:

- 08 April 2024, pp. b1-b2

-

- Article

-

- You have access

- Export citation

FHR volume 30 issue 3 Cover and Front matter

-

- Journal:

- Financial History Review / Volume 30 / Issue 3 / December 2023

- Published online by Cambridge University Press:

- 08 April 2024, pp. f1-f2

-

- Article

-

- You have access

- Export citation

Liquidating government debt and creating a secondary asset market: trading patterns, market behavior and prices on government liabilities in Sweden, c. 1719–1765

-

- Journal:

- Financial History Review / Volume 30 / Issue 3 / December 2023

- Published online by Cambridge University Press:

- 04 April 2024, pp. 355-379

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Index

-

- Book:

- Race, Taste and the Grape

- Published online:

- 16 March 2024

- Print publication:

- 28 March 2024, pp 341-354

-

- Chapter

- Export citation

Note on the Text

-

- Book:

- Race, Taste and the Grape

- Published online:

- 16 March 2024

- Print publication:

- 28 March 2024, pp vi-vi

-

- Chapter

- Export citation

Note on Measurements

-

- Book:

- Race, Taste and the Grape

- Published online:

- 16 March 2024

- Print publication:

- 28 March 2024, pp xvi-xvi

-

- Chapter

- Export citation