Across the world, growing housing costs have effectively locked the working and the middle class out of some of the world’s most productive cities (Glaeser and Cutler Reference Glaeser and Cutler2021), thereby increasing economic segregation (Ganong and Shoag Reference Ganong and Shoag2017), lowering overall economic prosperity (Hsieh and Moretti Reference Hsieh and Moretti2019), and fueling political discontent (Ansell et al. Reference Ansell, Hjorth, Nyrup and Larsen2022; Larsen et al. Reference Larsen, Hjorth, Dinesen and Sønderskov2019). In both Europe and the United States, restrictive land use policies are at least partially responsible for creating a scarcity of housing that limits affordability (Bertaud Reference Bertaud2018; Glaeser and Gyourko Reference Glaeser and Gyourko2018). So, why do cities not issue permits for more housing to better keep up with rising demand?

Researchers, policy makers, and pundits often point to local control over land use policy as a potential culprit (Glaeser and Ward Reference Glaeser and Ward2009; Infranca Reference Infranca2019; Schuetz Reference Schuetz2022). They argue that local control leads to more restrictive land use policies, because it makes the relevant policy makers responsive to a smaller electorate. When the electorate is small, more citizens will live near any proposed housing development. This means that a large fraction of the electorate will experience the negative local externalities that accompany the siting of new housing, such as congestion or lower housing prices, and organize to oppose development. On the contrary, if power is given to regional or state governments, the electorate is much larger, and the power of those who live near new developments—that is, the potential opposition—will be diluted. Similar arguments have been used to explain why jurisdiction size correlates with land use policy (Favilukis and Song Reference Favilukis and Song2023; Marantz and Lewis Reference Marantz and Lewis2022) and why changing from at-large to district elections reduces housing supply (Hankinson and Magazinnik Reference Hankinson and Magazinnik2023; Mast Reference Mast2024). Overall, existing research suggests that as the size of the electorate to which policy makers are responsive increases, land use policy becomes less restrictive.

This article challenges the commonly held assumption that local governments with smaller electorates are more likely to adopt restrictive housing policies; in fact, we suggest that they sometimes permit more house building. Specifically, we argue that policy makers weigh the risk of facing local opposition to new construction against the potential benefits of pursuing growth (Peterson Reference Peterson1981), and that the benefits to pursuing urban growth through building housing are particularly strong for smaller local governments. This is because the tax base of smaller jurisdictions is more exposed to negative economic shocks because any shock is less likely to balance out across the small population. Moreover, smaller jurisdictions can compete more effectively with other jurisdictions for new residents because relocation over shorter distances is less costly (Tiebout Reference Tiebout1956). In this way, smaller local governments are likely to have a stronger interest in—and greater capacity for—raising tax revenue by using the permitting of new housing to attract additional taxpayers.

To explore this theoretical argument, we study a reform that consolidated Danish municipalities into larger local governments. Only two-thirds of all Danish municipalities were consolidated, leaving us with a control group that was unaffected by the reform. Using administrative data on housing permits and construction over 25 years and a difference-in-differences approach, we find that consolidation led to a reduction in housing permits and completions. Consistent with our theoretical argument, this effect was most pronounced in areas where consolidation reduced tax-base volatility and dramatically increased jurisdiction size. We also explore and reject alternative explanations, such as changes in the demand for land, in political composition, or in demography.

By demonstrating that politicians permit less housing when they become accountable to a larger electorate, our study pushes us to think differently about how politicians set land use policy, a critical policy area that shapes patterns of inequality, voting behavior, and local economic conditions. In doing so, we contribute to an emerging body of research examining how fiscal policy connects with land use policy (Hilbig and Wiedemann Reference Hilbig and Wiedemann2024). Specifically, our findings support the notion that local fiscal autonomy plays a critical role in shaping incentives for land use regulation, with greater autonomy encouraging less restrictive policies when local governments stand to gain revenue from population growth (Krimmel Reference Krimmel2022).

Although the exact scope of our findings remains uncertain, they clearly challenge the notion that greater local control over land use will always—or even most of the time—lead to more restrictive housing policies. In addition, our findings show that land use policy is driven not solely by the strength of NIMBY homeowners but also by the incentives that local governments have to pursue urban growth—and these incentives vary across different localities and according to jurisdiction size. More broadly, our study highlights the importance of considering the unique pressures faced by local governments when shaping policy, such as limited fiscal autonomy and intense interjurisdictional competition. Although these dynamics have been central to classic works on local politics (e.g., Peterson Reference Peterson1981; Tiebout Reference Tiebout1956), they have been overlooked in more recent scholarship on local government (Trounstine Reference Trounstine2009; Warshaw Reference Warshaw2019).

The Politics of Land Use and Local Control

The politics of land use is key to understanding contemporary debates on urban development and housing affordability. Land use regulation is traditionally one of the major functions of local government (Peterson Reference Peterson1981; Schuetz Reference Schuetz2022): it is used to manage space, specifically the “pace, location, and extent of development” (Pendall, Puentes, and Martin Reference Pendall, Puentes and Martin2006) through different regulatory policies, including “zoning, planning, growth boundaries, development fees, and growth caps” (Trounstine Reference Trounstine2020). It is largely through contestation over land use policy, such as debates over zoning regulations and development projects, that different stakeholders in the local built environment exert their preferences.

There is a growing literature that tries to explain why certain localities have more or less stringent land use regulation, specifically as it pertains to the permitting of new housing. These studies tend to focus either on differences in the power of particular political actors, such as differences in the strength of developer interests (Ouasbaa, Solé-Ollém, and Viladecans-Marsal Reference Ouasbaa, Solé-Ollé and Viladecans-Marsal2022; Peterson Reference Peterson1981) and changes in partisanship (de Benedictis-Kessner, Jones, and Warshaw Reference De Benedictis-Kessner, Jones and Warshaw2022), or on demographic factors that might increase demand for more stringent land use, such as the racial and economic composition of the metro area (Danielson Reference Danielson1976; Sahn Reference Sahn2021; Trounstine Reference Trounstine2020). In this article, however, our focus is not on variation in political elites or the mass electorate but on the political institutions that govern how they interact. In particular, we want to understand how and why voters and politicians might interact differently when land use is set by small as opposed to large local governments.

Existing work suggests that the degree of local control is an important determinant of variation in land use policy (Glaeser, Gyourko, and Saks Reference Glaeser, Gyourko and Saks2005) and makes consistent predictions about how local control affects the politics of land use. If politicians want to permit new housing, they need to site it somewhere within their jurisdiction. Homeowners tend to oppose new homes in their backyard (Einstein, Glick, and Palmer Reference Einstein, Glick and Palmer2019; Fischel Reference Fischel2001; Hankinson Reference Hankinson2018) because of concern for their property values or congestion or as a means to exclude certain groups. If the power over land use is placed in a small jurisdiction, these NIMBY homeowners are empowered by the relatively short distance between politicians and residents (Hankinson and Magazinnik Reference Hankinson and Magazinnik2023; Marantz and Lewis Reference Marantz and Lewis2022). This gives local politicians an incentive to pander to this group of voters, even if it means forgoing long-term growth (Favilukis and Song Reference Favilukis and Song2023; Mullin and Hansen Reference Mullin and Hansen2023). Conversely, when power is vested in very large jurisdictions, it becomes easier for politicians to ignore the demands of homeowners living near proposed residential development sites because they constitute a smaller fraction of the electorate.

The key variable of interest in this account of land use politics is the size of the electorate to which local governments are responsive. If it is a small electorate, politicians have a strong electoral incentive to block new housing. If it is a large electorate, this electoral incentive is diluted. A number of studies seems to confirm that the size of the electorate does influence land use policy. First, in the United States at least, some of the most restrictive land use policies exist in the places where the jurisdiction size is smallest. This is particularly apparent in the Northeast, where zoning is controlled by small townships. On the West Coast, zoning is also quite restrictive, and direct democratic institutions, such as the voter initiative, give localities the same type of power that townships have in the East. In the South, where counties are larger and there is no voter initiative, zoning is much less restrictive (Fischel Reference Fischel2015; Saiz Reference Saiz2010). Consistent with these patterns, both Marantz and Lewis (Reference Marantz and Lewis2022) and Favilukis and Song (Reference Favilukis and Song2023) find that, in the United States, smaller local governments permit less housing. Two recent studies document how changes from at-large to district elections have large negative effects on the permitting of new housing in general and on multifamily housing in particular (Hankinson and Magazinnik Reference Hankinson and Magazinnik2023; Mast Reference Mast2024). Notably, both studies effectively address potential confounders by examining the same jurisdictions before and after a change in the electoral system—with the Hankinson and Magazinnik (Reference Hankinson and Magazinnik2023) study doing so at very low levels of aggregation, allowing them to analyze not just how much housing is permitted but also where it is permitted.

Although these studies help us understand how electoral institutions influence housing policy, there are also limits to what we can learn from them. In the studies of changes from at-large to district elections, the electorate to which individual politicians are responsive changes, but its overall size remains the same. As we lay out later, the incentives to build new housing may vary with the overall size of the electorate, and these studies might miss this. At the same time, studies that do consider variation in the overall size of the electorate or jurisdiction are often correlational and may therefore be subject to confounding. Finally, all these studies focus on the US context, even though the fundamental theoretical mechanism—that NIMBY homeowners are more powerful in small electorates—should be quite universal.Footnote 1

In addition to these empirical concerns, there are theoretical reasons to suspect that existing work may overstate the differences in how land use politics operates in smaller versus larger jurisdictions. Regardless of jurisdiction size, the costs of siting new housing are concentrated, whereas the benefits are diffuse. This gives NIMBY homeowners a greater incentive to make their voices heard in the political process, potentially skewing policy making in their favor, even in very large electorates (Einstein, Palmer, and Glick Reference Einstein, Palmer and Glick2019; Hill Reference Hill2022; Olson Reference Olson1971).

A City Interest in Urban Growth?

Existing work on how politicians set land use policy in response to electoral incentives tends to focus primarily on the obstacles they might face in building new housing (Brouwer and Trounstine Reference Brouwer and Trounstine2024). This is also true in the literature on how local control or jurisdiction size shapes land use policy, which focuses on how NIMBY opposition to new housing might be larger in smaller jurisdictions. However, earlier work on land use policy had a fundamentally different perspective on the incentives facing local governments. For instance, both Molotch (Reference Molotch1976) and Bridges (Reference Bridges1999) argue that local governments are essentially growth machines that seek to attract residents and investment, often at almost any cost.

The definitive account of this perspective on urban growth was presented by Peterson (Reference Peterson1981) in his book City Limits. Peterson argues that cities want to maintain or enhance “the economic position, social prestige, or political power of the city” (11). Cities pursue growth because they do not control their borders, which allows people and capital to move freely. As a result, cities must implement policies that attract residents and investments (see also Diamond Reference Diamond2017; Fischel Reference Fischel2005). Peterson’s theory is primarily a systems theory, focusing on how cities navigate the pressures they face from other cities, as well as from mobile capital and labor. Yet Peterson (Reference Peterson1981) does briefly explain why elected officials would act in line in with what he calls the city interest in urban growth, noting that “few policies are more popular than economic growth and prosperity” and that “local officials usually have a sense of community responsibility” (45). That is, local officials feel both an electoral incentive and a personal responsibility to expand the city.Footnote 2

Given the current widespread housing shortage, it is understandable that most accounts of the politics of housing emphasize the role of organized opposition, with the notion of a city interest in urban growth receding into the background. However, taking that interest into account allows for an investigation of the different incentives local policy makers face and how these incentives interact.

Smaller Local Governments Might Have a Stronger City Interest in Urban Growth

As the preceding sections have made clear, local officials navigate competing principals when deciding whether to permit more housing. On one hand, they weigh the potential long-term benefits of attracting new residents; on the other, they consider the risk of electoral backlash from NIMBY opposition. Various factors, such as electoral competitiveness and the likely demographics of new residents, can shape where local governments land in this trade-off. We argue that one of these factors is the size of the local government itself. We develop this argument in three steps. First, we examine why cities may seek to build more housing to attract new residents. Second, we identify the institutional features that must be in place for this interest to emerge. Third, we map out how these institutional features interact with jurisdiction size.

Why might local governments have a city interest in building more housing? Imagine that a local negative economic shock—for instance, a plant closure or a large group of people aging into retirement—shrinks the city’s tax base. The city now faces a choice: it must either cut back on public services or expand the tax base by raising taxes or attracting new taxpayers. Raising taxes is often less attractive, because it might drive away high earners and negatively affect residents’ personal finances. Therefore, cities have a strong incentive to attract new taxpayers. A key condition for achieving this goal is expanding the city’s housing stock. Additionally, divesting certain owned land for development can provide immediate funds to address a potential budgetary deficit. The drawback of this strategy is that it takes time to develop land and for citizens to move in. As a precaution, cities might therefore steadily try to expand their tax base as insurance against future negative shocks; for an argument along these lines, see Bridges (Reference Bridges1999). Of course, cities also risk that new housing will attract individuals who will consume more public services than they pay for in taxes, putting upward pressure on taxes. However, this risk can be mitigated by zoning for low-density development, which will be more expensive and allow cities to attract people of a desired level of income (Fischel Reference Fischel2015).

A city interest in permitting more residential development is predicated on four conditions. First, the city needs to be a general-purpose government that controls zoning. If the zoning authority is separate from the section of city government that controls revenues and services, then the link between fiscal pressures and housing construction becomes more tenuous. Second, new citizens must translate into more tax revenue (Krimmel Reference Krimmel2022). The type of revenue matters less because it could be both property and income taxes, but attracting new citizens clearly needs to increase the tax base of the municipality for new housing to be in the city interest.Footnote 3 Third, there needs to be some latent risk of a substantial negative shock to the city’s tax base. Otherwise, there is little reason for a city to take the risk, in terms of who moves in, involved in building more housing. Fourth, there needs to be some interjurisdictional competition for residents (Büchler and Ehrlich Reference Büchler and van Ehrlich2023). If citizens are unable to or not interested in moving to the city, then building more housing will not have the desired effect of attracting them.

The first two of these conditions—the presence of general-purpose governments and the ability to expand the tax base by building more housing—can be thought of as a scope condition for our theoretical argument. The third and fourth conditions—the likelihood of negative shocks and prospects for interjurisdictional competition—vary with jurisdiction size and might therefore explain why smaller local governments have a stronger interest in building more housing. As such, the probability of experiencing large negative shocks to the tax base is much larger in small local governments. When the governing unit is larger, local economic shocks will have a much smaller relative impact on the tax base and will be more likely to be offset by positive shocks elsewhere in the jurisdiction. In addition, smaller local governments face more intense interjurisdictional competition. It is harder to attract citizens across large jurisdictions, and it is much more costly for residents to move away. Imagine that a new college graduate has gotten a job in a large city, and she is within commuting distance, no matter where she lives in this city. Assume that the city consists either of four municipalities or a single city government. Here, the individual municipalities would clearly need to compete more for this worker than the single city government would. By extension, it would also be easier for the large city government to respond to fiscal shocks by raising taxes, because this government needs to worry less than the smaller governments about citizens moving out of the jurisdiction in response to tax hikes (Diamond Reference Diamond2017).

In conclusion, policy makers in small and large jurisdictions need to balance the potential electoral cost of permitting new housing against the benefits that permitting housing might have in satisfying the city interest in a stable and growing tax base. Yet small local governments are more at risk of negative shocks to their tax base, and they are able to more effectively attract new citizens. Therefore, the city interest in a stable and growing tax base is more tightly linked to an expansion of the housing stock in smaller local governments. Based on these considerations, we offer the novel prediction that for general-purpose local governments with some fiscal independence, smaller local governments will permit more housing.

Research Design: A Reform That Consolidated Danish Local Governments

We examine how the size of local governments affects land use decisions by analyzing a 2007 consolidation reform in Denmark, which significantly and abruptly expanded the jurisdiction sizes of several municipalities. Danish local governments are fiscally independent, general-purpose entities. This is the kind of institutional context in which our theoretical argument predicts that smaller governments would have stronger incentives to permit more housing. The consolidation reform thus offers a unique context for exploring our argument empirically.

We study the effects of the reform using a difference-in-difference design, comparing changes in land use outcomes in areas where the jurisdiction size increased to changes in land use outcomes in areas where the jurisdiction size remained the same. This approach has clear advantages over cross-sectional studies that simply look at differences in land use policies between smaller and larger municipalities. In particular, the difference-in-difference design examines how changes in jurisdiction size within the same area and, by and large, with the same electorate, affect land use policy, holding constant many of the factors that might confound this relationship in cross-sectional analyses. Moreover, the design allows us to be more explicit about the exact identifying assumption of parallel trends and to probe how plausible this identifying assumption is.

That said, we recognize that the reform constitutes a bundled treatment, making it difficult to fully disentangle the effects of increased jurisdiction size from other concurrent changes, such as shifts in political dynamics or governance structures after amalgamation. However, we believe the advantages of leveraging this reform as an exogenous shock clearly outweigh the disadvantages. By allowing us to observe changes within the same local context before and after a jurisdictional restructuring, the design provides a much stronger empirical foundation for assessing the causal relationship between jurisdiction size and land use decisions than cross-sectional comparisons alone.

We present more context on Danish local governments and the reform before describing our data and analytical approach.

Fiscal and Land Use Policy in Danish Local Governments

Denmark’s administrative structure consists of five regions, which operate under the central government; there are municipalities within each region. The country has a population of approximately 5.95 million: a significant majority (88.5%) reside in cities or small towns (Fertner et al. Reference Fertner, Hansen, Winther, Groth, Servillo, Brovaronem and Demichelis2022). The metropolitan areas of Copenhagen and Aarhus are the most densely populated, but there are notable population centers in other parts of the country, including in eastern Jutland and on Funen.

Each Danish municipality is governed by a city council elected every four years using proportional representation (Kjær, Hjelmar, and Leth Olsen Reference Kjær, Hjelmar and Olsen2010). Both before and after the reform, Danish municipalities can be characterized as general-purpose local governments (Houlberg and Klausen Reference Houlberg, Klausen, Lackowska, Szmigiel-Rawska and Teles2021). They provide public services such as schools, daycare, and elder care; administer utilities; distribute social transfers; and, crucially, set land use policy through extremely detailed local plans: these plans specify which type of housing is permitted and where, set minimum lot sizes and floor area ratios, decide which areas can be developed for commercial and residential use, and so on. These rules are enforced by requiring all developers to apply for construction permits that are approved or denied by the municipality. Although this approval process is usually handled by administrators, the city councils can decide to waive parts of the local plan under certain conditions, and they also have ways of delaying projects that conform to the local plans by requiring thorough and costly audits of construction projects. Thus, city councils have wide latitude in shaping how the land they have jurisdiction over is developed, and it is a topic they spend a lot of time on. In an analysis of Danish local policy agendas, Mortensen, Loftis, and Seeberg (Reference Mortensen, Loftis and Seeberg2022) find that 10% of all agenda items in local city council meetings are on land use.

Local governments also enjoy a considerable amount of fiscal autonomy regarding which services they want to prioritize and the taxes they collect. Municipalities levy both a property and an income tax, with taxation providing roughly 70% of all municipal revenue (OECD 2023). However, local governments’ fiscal policy is limited by both interjurisdictional tax competition (Nannestad Reference Nannestad2019) and national regulation. Local governments are neither allowed to run deficits nor to go bankrupt. If a municipality faces recurring fiscal difficulties, it is placed under administrative supervision by the national government. Moreover, aggregate spending limits are set in annual negotiations with the national government once a year (Serritzlew Reference Serritzlew2005). Even so, Danish local governments have clear incentives to attract new taxpayers to offset the risk of negative shocks to their tax base.

The Reform and Its Consequences

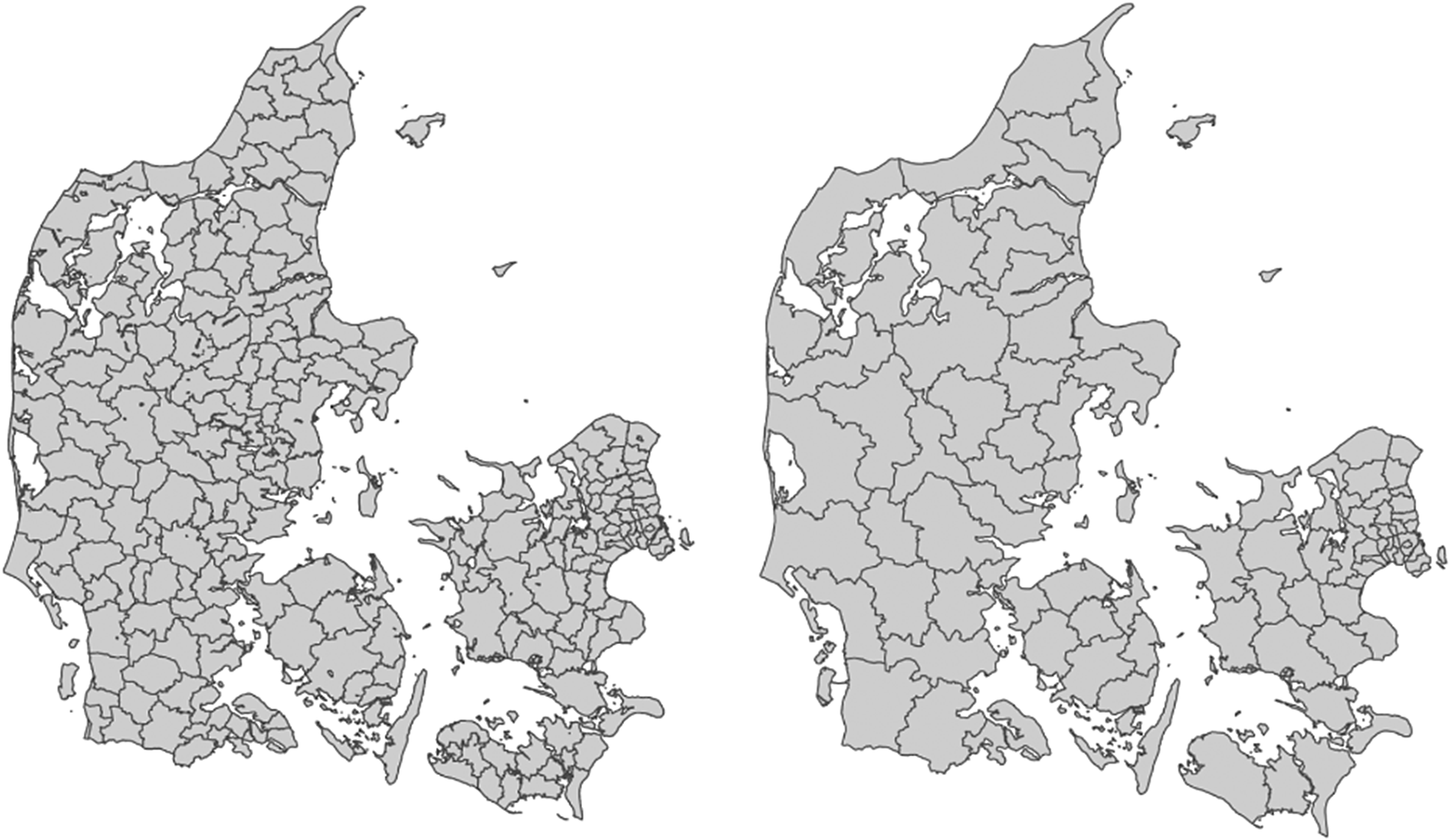

In 2004, a government-commissioned report recommended that the jurisdiction size of local governments in Denmark should be increased to ensure efficient and competent public service delivery. To this end, the Danish parliament approved a semi-voluntary merger reform in 2005. The reform required that all municipalities with fewer than 20,000 people merge with one or more of their neighbors to form new municipalities with more than 30,000 inhabitants. Some small municipalities were allowed to continue with a cooperative arrangement on service provision with a larger neighboring municipality.Footnote 4 Figure 1 shows the municipal boundaries before and after the reform. In the end, 271 municipalities were reduced to 98, with 31 municipalities being allowed to continue unchanged and the remaining municipalities being amalgamated into 66 new units.Footnote 5

Figure 1 Municipal Boundaries before and after the Reform

All municipalities except Bornholm shown on this map. Bornholm is excluded from the map (and the analysis) because it was not affected by the reform.

Figure 2 shows that the average size of the amalgamated municipalities significantly exceeded the target of 30,000 inhabitants, reaching nearly double that figure with an average population of 53,000. The geographical area of these municipalities expanded substantially as well. On average, their area increased from approximately 150–600 square kilometers. Although the reform did not affect overall spending levels (Blom-Hansen et al. Reference Blom-Hansen, Houlberg, Serritzlew and Treisman2016), it did influence the volatility of revenue streams and the intensity of competition between jurisdictions. We find that the reform reduced the volatility of the tax base and the amount of intermunicipal mobility. How large is the decrease in volatility? In online appendix B we show that the average year-over-year change in tax revenue drops by -1.3 percentage points in response to the reform. This is a 15% decline relative to the pre-reform average.

Figure 2 Average Jurisdiction Size before and after the Reform

Estimates based on regression model with year indicators, a treatment indicator, and an interaction between them. See online appendix G for the underlying regression estimates.

In online appendix A we provide descriptive statistics of key municipal characteristics, such as homeownership, income, share of foreigners, and tax levels. These statistics reveal large baseline differences, with unaffected municipalities tending to be larger, less urban, and less economically well-off, with fewer immigrants and higher homeownership rates. Although these differences may influence permitting behavior, our difference-in-differences design focuses on changes over time rather than baseline levels. Additional analyses of pre-reform trends in the same municipal characteristics, also detailed in online appendix A, reveal no important or major relative changes across affected and unaffected municipalities.

A Dataset on Local Land Use Policy

To determine whether the reform affected land use policy, we constructed a balanced panel dataset on housing permits for the years 1995–2020, focusing on areas covered by the new municipal boundaries established after the reform. By aggregating up to the new municipal boundaries, we can hold the size of the areas we study constant over time and then leverage the within-area differences in jurisdiction size created by the reform.

We collected these data from Statistics Denmark’s building registry (www.statistikbanken.dk). The registry data provide annual information on construction activity in Denmark categorized by construction phase, building use, ownership, and project type, with geographic detail at municipal, regional, and national levels. This information is widely used for economic analysis, policy planning, and as input for national accounts and European statistics.

These data enable us to distinguish between market-rate and public housing, as well as between different kinds of homes. Moreover, we do not only have information on the number of permits or the number of new homes permitted. Indeed, the data allow us to compute the exact floor area in square meters that the municipality permitted in a given year. This provides a precise measure of how much living space the municipality allowed to be built, accounting for the size of homes. It enables the densification of existing homes to count just as much as the construction of new ones, and it gives greater weight to larger homes—those with more space for more people—than to smaller ones.

The data are derived from Statistic Demark’s Building and Housing Registry (BBR). Municipalities are required to register all individual building permits in this database, ensuring comprehensive coverage and consistency over time. This contrasts with, for instance, the Building Permit Surveys conducted by the US Census Bureau, which rely on aggregate figures reported by cities and state governments.

Statistical Model and Key Measures

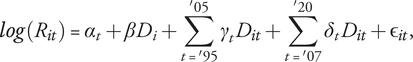

We estimate the effect of the reform using this dataset by estimating a series of multiperiod difference-in-difference models

$$ \mathit{\log}\left({R}_{it}\right)={\alpha}_t+\beta {D}_i+\sum \limits_{t{=}^{\prime }95}^{^{\prime }05}{\gamma}_t{D}_{it}+\sum \limits_{t{=}^{\prime }07}^{^{\prime }20}{\delta}_t{D}_{it}+{\unicode{x025B}}_{it}, $$

$$ \mathit{\log}\left({R}_{it}\right)={\alpha}_t+\beta {D}_i+\sum \limits_{t{=}^{\prime }95}^{^{\prime }05}{\gamma}_t{D}_{it}+\sum \limits_{t{=}^{\prime }07}^{^{\prime }20}{\delta}_t{D}_{it}+{\unicode{x025B}}_{it}, $$

where

![]() $ R $

represents the permitted or completed square meters of housing floor area per capita in area

$ R $

represents the permitted or completed square meters of housing floor area per capita in area

![]() $ i $

in year

$ i $

in year

![]() $ t $

for some or all types of housing. We normalize by the number of citizens in the municipality in 2005 (just before the reform) to remove variation on the dependent variable that is driven by differences in the size of the municipalities. We also take the log, allowing us to interpret our coefficients as relative changes:

$ t $

for some or all types of housing. We normalize by the number of citizens in the municipality in 2005 (just before the reform) to remove variation on the dependent variable that is driven by differences in the size of the municipalities. We also take the log, allowing us to interpret our coefficients as relative changes:

![]() $ {\alpha}_t $

is a year-fixed effect, and

$ {\alpha}_t $

is a year-fixed effect, and

![]() $ {D}_i $

is an indicator of whether an area experienced an increase in the average jurisdiction size as a result of the reform.

$ {D}_i $

is an indicator of whether an area experienced an increase in the average jurisdiction size as a result of the reform.

![]() $ {D}_{it} $

are a series of indicator variables that are equal to 1 in year

$ {D}_{it} $

are a series of indicator variables that are equal to 1 in year

![]() $ t $

if area

$ t $

if area

![]() $ i $

experienced an increase in jurisdiction size.

$ i $

experienced an increase in jurisdiction size.

![]() $ {\unicode{x025B}}_{it} $

is the error term.

$ {\unicode{x025B}}_{it} $

is the error term.

The key coefficients of interest are the

![]() $ {\delta}_t $

’s, which capture the average change in

$ {\delta}_t $

’s, which capture the average change in

![]() $ \mathit{\log}(R) $

(housing policy outcomes) relative to our baseline, 2006, in areas that experienced an increase in jurisdiction size due to the reform net the relative change in areas where jurisdiction size remained unaffected. These coefficients provide the difference-in-differences estimates of the reform’s effect. To test the plausibility of the key identifying assumption in this model—the parallel trends assumption—we use the

$ \mathit{\log}(R) $

(housing policy outcomes) relative to our baseline, 2006, in areas that experienced an increase in jurisdiction size due to the reform net the relative change in areas where jurisdiction size remained unaffected. These coefficients provide the difference-in-differences estimates of the reform’s effect. To test the plausibility of the key identifying assumption in this model—the parallel trends assumption—we use the

![]() $ {\gamma}_t $

coefficients. This assumption requires that areas affected by the reform would have followed the same housing policy trajectory as unaffected areas had the reform not occurred. If we find that

$ {\gamma}_t $

coefficients. This assumption requires that areas affected by the reform would have followed the same housing policy trajectory as unaffected areas had the reform not occurred. If we find that

![]() $ {\gamma}_t=0 $

for all pre-reform periods, it suggests that both “treated” and “untreated” areas were following similar trends before the reform. This strengthens the case that, in the absence of the reform, these areas would have continued to move in parallel.

$ {\gamma}_t=0 $

for all pre-reform periods, it suggests that both “treated” and “untreated” areas were following similar trends before the reform. This strengthens the case that, in the absence of the reform, these areas would have continued to move in parallel.

As part of our analysis, we also use a simpler difference-in-difference model, where we average across pre- and post-reform periods by subbing our yearly indicator for the post-reform indicator

![]() $ T $

. This allows us to summarize the effect of the reform in a single difference-in-difference coefficient.

$ T $

. This allows us to summarize the effect of the reform in a single difference-in-difference coefficient.

Choosing the appropriate baseline year for studying the effects of the reform is not straightforward. Because the reform officially took effect in 2007, we use 2006 as the baseline year. However, the reform was passed in 2005, and the newly elected city councils for the amalgamated municipalities assumed office on January 1, 2006; thus, these councils could have begun preparing for the transition at that time. As a result, one could argue that 2005—or even 2004—might serve as a more suitable baseline. Nonetheless, as the following analyses demonstrate, the results remain largely consistent regardless of the baseline year chosen.

In addition to data on housing permits, we also collected data on various demographic features of the municipalities. Among other things, we use these variables to estimate differences in the extent to which the reform (1) increased the jurisdiction size of municipalities and (2) decreased the volatility of their tax base. To do so, we calculate the difference in population size (

![]() $ n $

), area (

$ n $

), area (

![]() $ a $

), and volatility in the tax base (

$ a $

), and volatility in the tax base (

![]() $ v $

) between a new municipality and a weighted average of the old municipalities that this new municipality consists of, weighing the pre-reform estimate by the relative size of the old municipalities. For each new municipality

$ v $

) between a new municipality and a weighted average of the old municipalities that this new municipality consists of, weighing the pre-reform estimate by the relative size of the old municipalities. For each new municipality

![]() $ i $

that consists of

$ i $

that consists of

![]() $ k $

old municipalities, we thus define the weighted change in jurisdiction size as

$ k $

old municipalities, we thus define the weighted change in jurisdiction size as

![]() $ \Delta {n}_i={n}_i/{\sum}_{j=1}^k\left({n}_j\frac{n_j}{n_i}\right) $

and

$ \Delta {n}_i={n}_i/{\sum}_{j=1}^k\left({n}_j\frac{n_j}{n_i}\right) $

and

![]() $ \Delta {a}_i={a}_i/{\sum}_{j=1}^k\left({a}_j\frac{a_j}{a_i}\right) $

. We measure population size and area right before the reform in 2005. Our change in volatility measure is based on the average year-on-year changes in tax revenue in the 10 years before the reform. We then compare the weighted average actual volatility

$ \Delta {a}_i={a}_i/{\sum}_{j=1}^k\left({a}_j\frac{a_j}{a_i}\right) $

. We measure population size and area right before the reform in 2005. Our change in volatility measure is based on the average year-on-year changes in tax revenue in the 10 years before the reform. We then compare the weighted average actual volatility

![]() $ \left({\sum}_{j=1}^k{v}_i\frac{n_j}{n_i}\right) $

with a counterfactual estimate

$ \left({\sum}_{j=1}^k{v}_i\frac{n_j}{n_i}\right) $

with a counterfactual estimate

![]() $ \left(\hat{v_j}\right) $

of what volatility would have been if the municipalities had already had a joint revenue stream with the municipalities they eventually merged with. That is, we define the change in volatility as

$ \left(\hat{v_j}\right) $

of what volatility would have been if the municipalities had already had a joint revenue stream with the municipalities they eventually merged with. That is, we define the change in volatility as

![]() $ \Delta {vol}_i={\sum}_{j=1}^k\;\left({v}_i\frac{n_j}{n_i}\right)-\hat{v_j} $

.

$ \Delta {vol}_i={\sum}_{j=1}^k\;\left({v}_i\frac{n_j}{n_i}\right)-\hat{v_j} $

.

For more details on changes in tax revenue and our volatility measure, see online appendix C. Descriptive statistics on all variables can be found in online appendix D.

The Effect of the Reform on Land Use: Larger Municipalities, Less Housing

We begin our analysis by examining the amount of market-rate housing permitted in areas where the average municipality size did and did not increase before and after the reform. As shown in the top panel of figure 3, there was a notable difference in housing permits before the reform, with smaller municipalities—soon to be amalgamated—permitting more market-rate housing. However, after the reform, we observe a gradual convergence across the different areas.

Figure 3 Effect of the Reform on Permits for Market-Rate Housing

Top panel shows logged yearly averages with 95% confidence intervals for areas where the jurisdiction size increased following the reform and areas where it did not. The bottom panel shows differences between affected and unaffected municipalities relative to the difference in 2006 with 95% confidence intervals (i.e., the difference-in-difference estimates).

Figure 3 also presents the pre- and posttreatment difference-in-difference effects estimated using a multiperiod model. The difference-in-difference effects on housing supply in the years following the reform gradually become negative and are statistically significant from 2013. The effect in the later period is substantial, suggesting that the increase in jurisdiction size led to a roughly 50% decrease in the amount of housing permitted.Footnote 6 Finally, figure 3 shows that housing permit trends are roughly parallel across affected and unaffected municipalities. This supports the key identifying assumption that, without the reform, affected municipalities would have followed the same trend. The lack of a pre-reform difference also indicates no anticipation effects, meaning that amalgamated jurisdictions did not significantly increase or decrease housing construction in expectation of the reform.

Why is the reform’s effect gradual, rather than immediate? One key factor is the financial crisis, which significantly reduced construction activity post-reform, likely masking differences in permit issuance across municipalities. Additionally, local politicians and administrators likely needed time to adapt to the reform’s strategic incentives, with learning and institutional adjustments shaping behavior gradually over the first decade. Although this gradual effect is understandable, it does raise the concern of whether other factors might have differentially influenced the areas where jurisdiction size increased. However, a survey of changes in the planning and fiscal policy reveals no other reforms or changes in this period (Foged, Andersen, and Andersen Reference Foged, Andersen and Andersen2017; Lund Reference Lund2016).

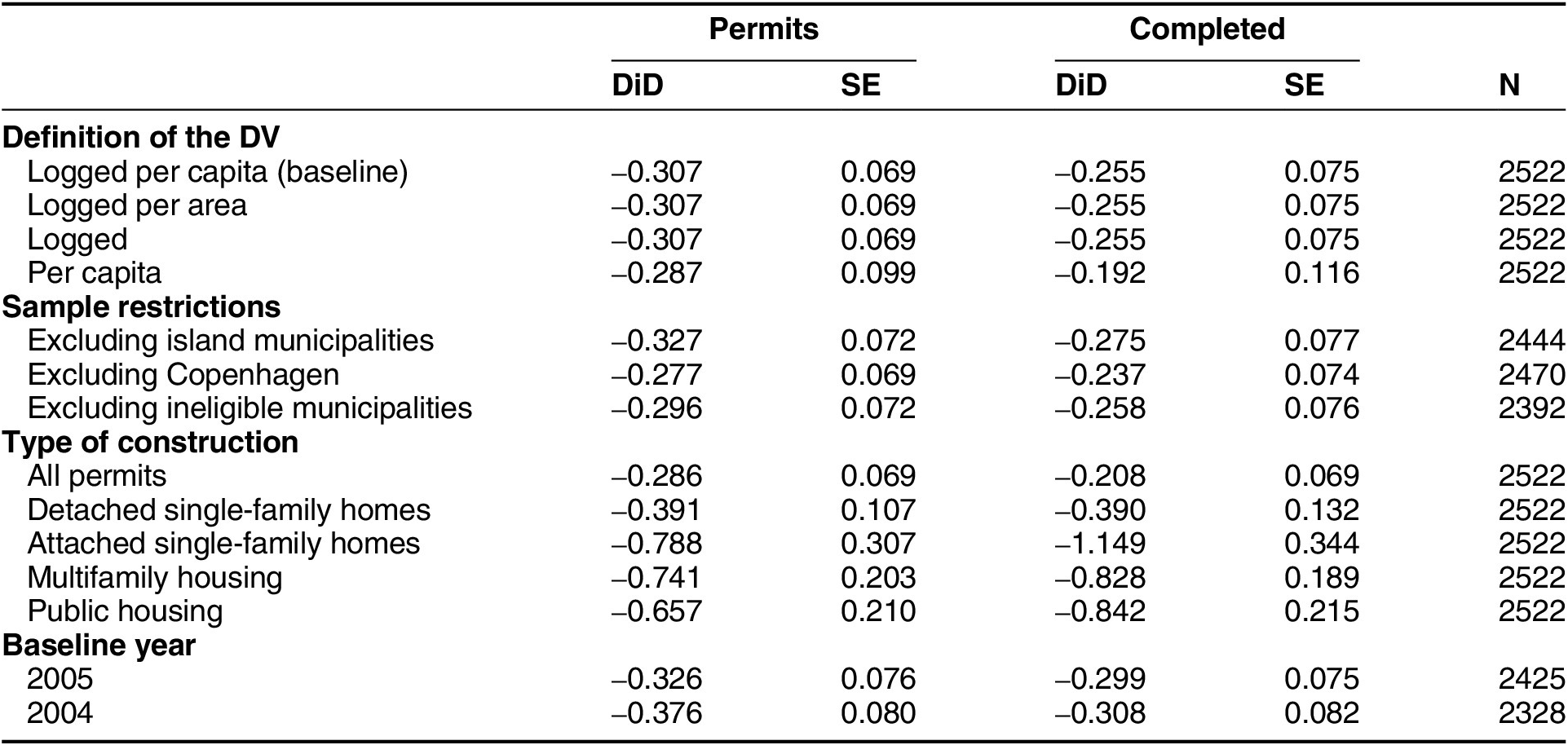

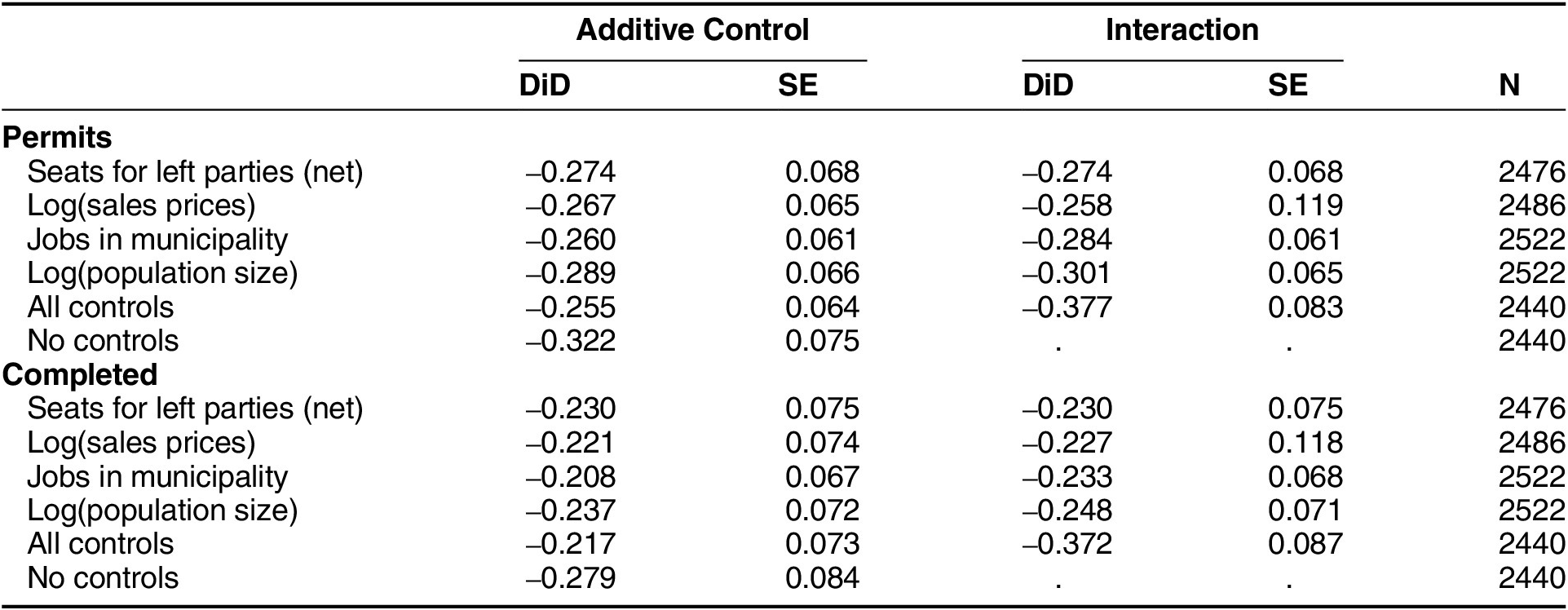

Table 1 examines the robustness of the reform’s effect on land use policy outcomes. In our robustness analyses we use our simple difference-in-difference estimator, which summarizes the effect of the reform in a single estimate. All results are shown for both permitted and completed housing. First, we show that our key result—the increase in jurisdiction size led to a decrease in the amount of housing permitted and completed—does not depend on how we define the outcome variable. We find a sizable, statistically significant negative effect across all definitions; it does not matter whether we use permits or completed housing, normalize housing construction by area and population size, or use no normalization. We also show that changing the baseline year to 2005 or 2004 makes no difference in the results.

Table 1 How Robust Is the Effect of Jurisdiction Size on the Supply of Housing?

Notes: Standard errors clustered at the municipal level.

Two municipalities were not allowed to increase their jurisdiction size because of their pre-reform administrative status as both regional and municipal governments, and some small island municipalities were given exemptions from the reform to preserve local control in those communities. In table 1, we show that excluding these “never-takers” who stood outside the reform process has a negligible impact on the results. Another concern is that the municipalities affected by the reform may not be permitting less construction but are recording permits in a different way or that developers are applying for a different type of permit as jurisdiction size increases. To sidestep this concern, we show that there is a statistically significant negative effect on the sum of all construction permits.

We also identify difference-in-difference effects on permits for different types of housing. Notably, we identify a statistically significant, negative effect for housing in all categories, including multifamily housing, attached single-family homes (rowhouses), and detached single-family homes. In relative terms, the effect is largest for multifamily housing and smallest for detached single-family homes. It is important to note, however, that permits for detached single-family homes are much more prevalent than permits for multifamily housing, so in absolute terms, this is the category where we see the largest drop in permitted and completed housing. We also identify a large negative effect for public housing; however, this effect is estimated with a considerable degree of uncertainty. Even so, the effect of the reform on the permitting of public housing deserves special consideration, because it may appear counterintuitive given our argument that the effect of the reform is driven by larger municipalities having less of an incentive to attract taxpayers. Here, it is important to note that the baseline level of public housing permits is much lower than that of market-rate permits, meaning that very little of the overall increase in housing production can be ascribed to public housing. The effect might be explained by long-standing inclusionary zoning policies in some municipalities, which require a certain percentage of newly permitted housing to be designated as public housing. In these municipalities, any expansion of the market-rate housing stock will be accompanied by a small increase in public housing.

In appendix F we also present results for a synthetic difference-in-difference estimator (Arkhangelsky et al. Reference Arkhangelsky, Athey, Hirshberg, Imbens and Wager2021), which adjusts for any imbalances in pretreatment trends. This does not change the results, and the effect of the reform is of about the same size and statistically significant in these models as well.

Why Does Municipal Consolidation Lead to Less Housing?

Following the consolidation reform, the newly formed, larger municipalities began to permit less residential development. This aligns with our argument that smaller local governments have a stronger incentive to grow their housing stock to attract new taxpayers, because smaller municipalities are more vulnerable to negative economic shocks and can more easily draw new residents from nearby jurisdictions. In this section, we provide further evidence to support these theoretical mechanisms and examine several alternative explanations for the observed effects of the reform.

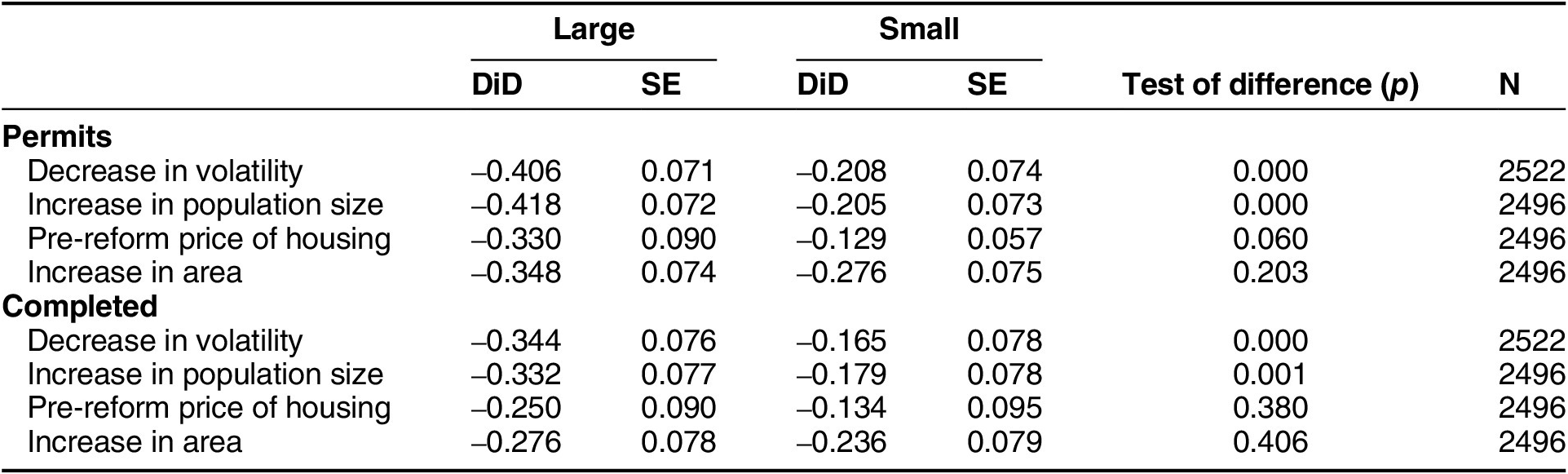

If the increase in jurisdiction size led to the construction of fewer homes because the tax base became less exposed to negative economic shocks, then we should expect increases in jurisdiction size to have the largest effect where they led to a large reduction in the exposure of the tax base to negative shocks. To explore this, we use a measure of changes in tax-base volatility, which compares volatility in the municipalities’ total revenue 10 years before the reform to the volatility they would have experienced if they had already been part of a single, larger municipality. (For more details on this volatility measure, see online appendix C.) This gives us a prereatment municipal-level indicator of how much the reform reduced the potential for tax volatility. For local governments that did not experience an increase in jurisdiction size as a result of the reform, this measure is naturally zero. For all other jurisdictions it is a negative number. This allows us to examine whether the largest reductions in housing permits are located in the areas where volatility decreased the most. To do so, we split the consolidated municipalities into two groups based on the median level of volatility reduction. This leaves us with a trichotomous treatment variable, which we use in place of our dichotomous treatment variable in our simple difference-in-difference model: it gives us a separate difference-in-difference estimate for municipalities with a large and a small decrease in tax volatility. We present these estimates in table 2, which also include a p-value associated with a Wald test of no differences between the two difference-in-difference estimates.

Table 2 Where Is the Effect of the Reform Largest?

Note: Robust standard errors clustered at the municipal level.

In line with our expectations, areas that experienced a larger potential decrease in volatility as a result of the reform also saw a larger drop in housing permits. The relative drop was twice as large in the areas with a large, as opposed to a small, decrease in tax-base volatility, and this difference is statistically significant. This reduction in volatility is, of course, largely a result of the increase in population size, and therefore, we also find that the effect of the reform is larger in areas where the population size increased relatively more (i.e., above the median increase) as a result of the reform.

If the increase in jurisdiction size led to the construction of fewer homes because it became less important to attract new taxpayers, then we should also expect increases in jurisdiction size to have the largest effect among the municipalities that were in a good position to attract new taxpayers before the reform. To explore whether this was the case, we split local governments in Denmark into two groups based on the average square-meter price of housing in the 10 years leading up to the reform and then calculated the difference-in-difference estimate for these two groups. In effect, we included a three-way interaction between the treatment, time, and price indicators and then derived our estimates from this model. As is evident from the results reported in table 2, the effect of the reform is concentrated in the local governments where prices were relatively high before the reform. This difference in estimated effects is only statistically significant for permits; however, the difference in estimated effects are roughly the same for both permits and completed housing. This suggests that the reform had a smaller impact on residential development in areas where there was not a lot of demand for new housing and where those who could buy new housing might have been relatively poorer. The concentration of an effect in high-price areas is consistent with the effect of the reform being driven by a change in the local government’s interest in attracting new high-earning taxpayers.

We also look at whether the effect of the reform was larger for local governments that experienced a larger increase in the total area of the municipality. On average, people who lived in local governments that saw only a small increase in the total area of the jurisdiction did not have to move much farther to find a competing local government, attenuating the effect the reform might have had on interjurisdictional competition. Consistent with this, we estimate a somewhat larger effect of the reform for local governments that experienced a large (i.e., above the median) increase in the geographical size of their jurisdiction. However, as evidenced by table 2, this difference in effect size of 20–30% is not statistically significant.

Overall, our findings suggest that municipalities that were able to attract high earners before the reform, but that experienced more stable revenue streams afterward, were significantly more likely to reduce the permitting of new housing. This indicates that the reform’s impact varies based on observable indicators of how much each municipality’s incentive to permit housing declined as a result of the reform.

Alternative Explanations

One potential concern with our findings is that the observed effects could be driven by changes in the permitting process after the reform, rather than shifts in political incentives. Specifically, the reform may have altered administrative efficiency in ways that affected how easily developers could obtain permits, either by making municipalities more efficient or by slowing down decision making.

A possible argument is that larger, consolidated municipalities became more efficient after the reform, potentially streamlining the permitting process. However, if increased efficiency were a major factor, we would expect the opposite effect: more efficient municipalities should be inclined to permit more housing, because bureaucratic improvements would reduce bottlenecks and alleviate concerns about overburdening local services. Instead, we observed a decline in housing permits after municipal consolidation. Additionally, prior research on jurisdiction size and municipal efficiency does not suggest a strong effect. Blom-Hansen et al. (Reference Blom-Hansen, Houlberg, Serritzlew and Treisman2016) find no systematic relationship between jurisdiction size and local service effectiveness. Although their study focuses on cost effectiveness rather than managerial nimbleness, it does not provide evidence that amalgamation increases the administrative capacity needed to process housing permits more efficiently.

Another concern is that larger, more complex administrations could be less nimble and more cumbersome, leading to a slowdown in the permitting process. If this were driving the observed effects, we would expect to see an immediate slowdown in permitting after the reform, potentially followed by a return to prior levels as the new administrative structures stabilized. However, figure 3 does not support this explanation. Instead of a sharp post-reform drop followed by recovery, we observe a gradual and sustained decline in housing permits. This pattern is inconsistent with a short-term bureaucratic adjustment but aligns with a shift in local incentives regarding residential development.

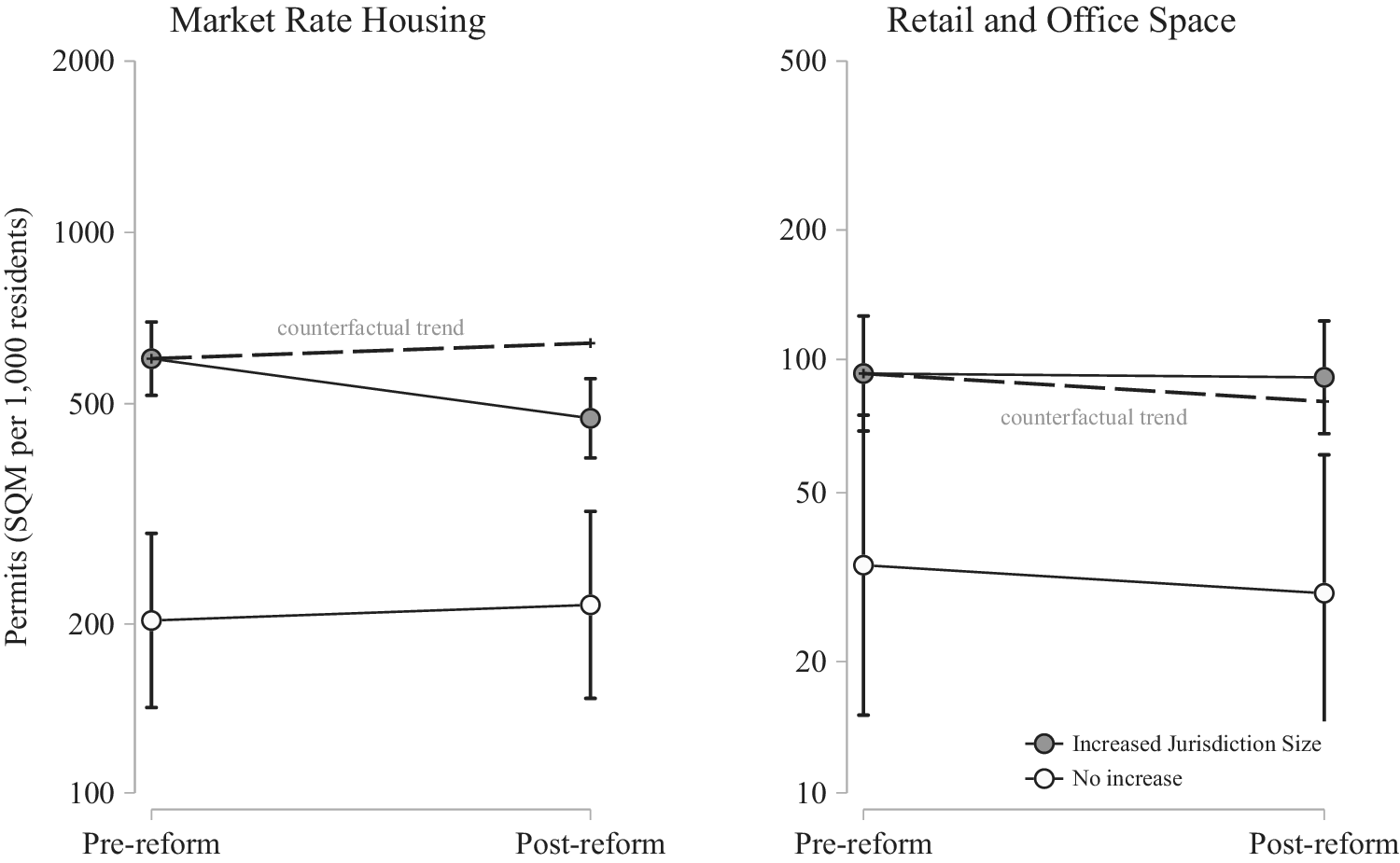

Moreover, if the observed decline in housing permits were due to a general slowdown in municipal permitting processes, we should also expect to observe a similar trend in nonhousing permits, such as those for retail and office space. These types of permits serve as a useful placebo test because, in the Danish context, municipalities do not directly benefit from commercial development through sales or corporate taxes. Unlike residential permits, which increase the local tax base by attracting new residents, commercial permits do not generate significant fiscal revenue for municipalities.Footnote 7

Figure 4 compares trends in retail and residential development before and after the reform in municipalities that experienced jurisdiction size increases versus those that did not. Using a simple difference-in-differences estimator, we find only a small, statistically insignificant positive effect of the reform on nonhousing permits (

![]() $ \gamma =.11 $

,

$ \gamma =.11 $

,

![]() $ {se}_{\gamma }=.19 $

). By contrast, the corresponding effect for market-rate housing is negative and three times larger (see table 2). This suggests that the decline in housing permits is not part of a broader permitting slowdown but is instead specific to residential development.

$ {se}_{\gamma }=.19 $

). By contrast, the corresponding effect for market-rate housing is negative and three times larger (see table 2). This suggests that the decline in housing permits is not part of a broader permitting slowdown but is instead specific to residential development.

Figure 4 Effect of the Reform on Permits for Market-Rate Housing and for Retail and Office Space

Logged averages before and after the reform with 95% confidence intervals. Dashed line represents the trend in permits for the areas with no increase in jurisdiction size; that is, the counterfactual trend.

A related alternative explanation for our findings is that they reflect changes in developer behavior rather than shifts in policy-maker incentives. However, we find this unlikely for several reasons. First, municipal border changes do not directly alter the fundamental incentives that guide developers’ decisions. Developers prioritize locations where demand and profitability are highest, and these underlying economic factors remain largely unaffected by administrative restructuring. Second, although developers may initially face uncertainty in navigating a newly restructured municipal government, such transitional frictions are unlikely to persist over the extended period covered in our study. With more than a decade of post-reform data, any temporary adjustment costs should have dissipated, making it unlikely that they explain the patterns we observe. Third, if developers were driving the observed effects, we would expect the impact of the reform to be most pronounced in areas with weaker housing demand, where changes in municipal governance might shift marginal development decisions. Instead, we find the opposite: the effects are strongest in high-demand, high-price areas, which suggests that changes in political incentives, rather than developer behavior, are the primary driver.

Turning to other alternative explanations, table 3 presents results from a series of difference-in-differences models that incorporate statistical controls serving as proxies for competing hypotheses. We add controls for (1) the number of seats in the city council for the left net seats for the right, because some studies suggest left-wing politicians might be more supportive of building new housing (de Benedictis-Kessner, Jones and Warshaw Reference De Benedictis-Kessner, Jones and Warshaw2022); (2) the log of sale prices of homes, because lower demand for homes might be driving the difference between affected and nonaffected municipalities; (3) the number of jobs in the municipality, which also affects the demand to live in the municipality; and (4) population size, which serves as a further proxy for the demand for housing. Even though some of these variables are post-treatment, it is useful to see whether our results are explained away by them. The controls are included additively at first, and then we interact them with our “treatment” dummy indicating whether an area is affected by the reform and with the dummy indicating whether we are in the pre- or posttreatment period. Table 3 also includes our baseline model without controls estimated on the sample for which we have data on the control variables.Footnote 8 Although there is some variation in the estimated effect of the reform on permits and completed square meters across the different models, the results do not shift markedly.

Table 3 Alternative Explanations for the Reform’s Effect

Note: Robust standard errors clustered at the municipal level.

Conclusion

Amid the housing affordability crisis in advanced democracies, political scientists have sought to understand why local governments struggle to address supply shortages effectively. This study tries to understand how differences in the size of local government affect housing supply by studying the effect of municipal mergers on housing production in Denmark. Using a difference-in-difference design, it shows that an increase in jurisdiction size leads to the construction of less market-rate housing, which suggests that, under certain conditions, smaller local governments will build more housing.

We argue that the institutional structure of fiscally independent, general-purpose governments creates an environment where expanding the housing supply aligns with the interest of small local governments. Specifically, we illustrate how the institutional setting in which a city operates shapes policy-makers’ incentives to be more responsive to either current or potential residents. We demonstrate that given these competing principals, smaller local governments are more likely than larger ones to permit housing development as a means of attracting new taxpayers, thereby mitigating negative shocks to the municipal tax base. That is because for small municipalities, the potential opposition from current residents to house construction may be outweighed by the tax revenue generated by attracting new residents.

This explanation is supported by evidence showing that the impact on housing supply is strongest in areas where the reform significantly reduced tax-base volatility. Beyond size, other factors—such as the intensity of local opposition or the level of electoral competition—may similarly shape how to navigate these competing principals. For instance, past work suggests that both municipal competition (Büchler and Ehrlich 2023) and electoral competitiveness (Solé-Ollé and Viladecans-Marsal Reference Solé-Ollé and Viladecans-Marsal2012) shape land use regulation. Future research should build on this research and our own findings to explore further these dynamics empirically.

Our findings challenge existing work on the politics of land use, which argues that politicians will permit less housing when they are responsive to smaller electorates because the voices of NIMBY homeowners count more in these contexts (Hankinson and Magazinnik Reference Hankinson and Magazinnik2023; Marantz and Lewis Reference Marantz and Lewis2022; Mast Reference Mast2024; Schuetz Reference Schuetz2022). This divergence from previous work raises the question of why our results differ. As discussed earlier, we believe that our methodological approach offers certain advantages, particularly in comparing the same people and places over time and examining changes in the size of the overall electorate, rather than the electorate individual politicians are responsive to. However, other factors may also explain the divergent findings. Specifically, our argument suggests that the relationship between local government size and housing policy may vary depending on the institutional structure in which local governments are embedded. Differences in these institutions might help explain the differences between the literature, which primarily focuses on the United States, and our findings in the Danish context.

Two key differences between the Danish context and the United States stand out in terms of which institutional characteristics create a favorable environment for policy makers to pursue urban growth. The first is the centrality of own-source tax revenue. In Denmark, 70% of total municipal revenue is generated from taxes, 89% of which represents local income taxes (OECD 2016a). In the United States, in contrast, only 42% of local general revenue comes from taxes, 30% of which is generated through property taxes (Tax Foundation 2022; Urban Institute 2021). This difference in relying on taxes as a source for local revenue may explain the potentially different relationship between local control and housing supply. In particular, we presume that local policy makers have an incentive to attract new taxpayers. This incentive is naturally much weaker if local tax revenue is a smaller portion of total revenue or, more broadly, when taxes paid by residents are not collected locally (Economist 2021). Second, in Denmark, local governments are all-purpose governments. In our account of local governments, they feel the pressure of fiscal volatility and decide to build housing to attract residents to stabilize the revenue stream. In a fragmented local governance framework, prevalent across most of the United States, this mechanism is less likely to prevail. The city or county might feel the pressure, yet if it lacks jurisdiction over zoning, it cannot build housing to alleviate these fiscal concerns. Conversely, the housing authority, although possessing the capacity to act, does not feel the pressure in the same way and has no reason to take action.

Although the relationship between local government size and land use policy might be different in the United States, this does not diminish the significance of our results. For one, our argument should also apply to countries like Sweden, Switzerland, and Norway (OECD 2016b; 2016c; 2016d). They too have a relatively high reliance on tax revenue at the local level and unified governing authority at the local level. Therefore, the dynamics identified here may also be applicable to cases such as these. In the end, this is of course an empirical question, and we hope future work will study how local governance regimes shape housing policy outcomes across and within countries (for an example, see Hilbig and Wiedemann Reference Hilbig and Wiedemann2024). Even for scholars primarily interested in the United States, however, these results offer a valuable lesson: local control can be compatible with increased house building if the incentives for local governments are structured appropriately.

More broadly, this article helps us understand public goods provision under institutional constraints. Our findings reaffirm that to understand local policy outcomes, we must look beyond municipal policy-making processes and try to understand the institutional context in which local governments are embedded and how this context shapes the city interest (Fischel Reference Fischel2005; Peterson Reference Peterson1981).

Supplementary material

To view supplementary material for this article, please visit http://doi.org/10.1017/S1537592725000799.

Data replication

Data replication sets are available in Harvard Dataverse at: https://doi.org/10.7910/DVN/K87D6F.

Acknowledgements

This research is supported by the Carlsberg Foundation, grant CF21-0205 and is part of the ERC Project POLICITY (Grant. No. 802244). We want to thank Michael Hankinson, Paul Lewis, Hanno Hilbig, Andreas Wiedemann, Søren Serritzlew, Alexander Sahn, and participants in the Oslo University seminar series on comparative politics; the Princeton Workshop in Spatial Inequality; and the DPSA 2022 annual meeting for their valuable comments. We want to thank Marc Sabatier Hvidkjær for research assistance.