Few topics have received more attention from social scientists in the developed world than democracy. Scholars and citizens of North America and Europe have expressed a strong belief that democratic political systems, whatever their faults, are conducive to the well-being of national populations and regional and world peace.Footnote 1 Although discussions of democracy go back at least as far as the ancient Greeks, and although they were prominent in the writings of Enlightenment philosophers and nineteenth and twentieth-century political theorists,Footnote 2 it is only in recent decades that the topic has received systematic investigation. The starting point for this treatment is generally believed to be a 1959 essay by Seymour Martin Lipset, who argued that economic development and broad acceptance of the legitimacy of a nation’s government were the primary prerequisites for a democratic system. Lipset’s thesis has received an enormous amount of attention and has long been a source of controversy. Scores of scholars have tested his argument, especially regarding the role of economic development. Others have suggested alternative factors as determinants of democracy, including a population’s level of education,Footnote 3 inequality in levels of income and wealth,Footnote 4 a nation’s position in the world economy,Footnote 5 the size and role of various social classes,Footnote 6 and a nation’s economic performance once democracy has been established.Footnote 7 Surprisingly, however, there is one factor that has received virtually no attention in this literature: the concentration of private economic power. This is ironic because Lipset himself contributed to a body of work that focused explicitly on this issue.

In this paper, we examine the role of concentrated economic power in the prevalence of democracy. We argue, and demonstrate, based on an analysis of 120 countries over a 23-year period, that high concentration of economic power is a deterrent to democracy. Although we find that a nation’s average level of education is positively associated with democracy, other factors that have been claimed to play a role—including economic development, growth, and inequality—do not serve as significant predictors in most of our models. We do, however, find evidence that corporate political activity—in the form of political connections and engagement in political corruption—may amplify the negative effect of concentration on democracy. This suggests that political action may provide a means by which a high level of concentration undermines democracy.

Determinants of democracy

LipsetFootnote 8 himself performed an empirical test of his thesis regarding the role of economic development in democracy.Footnote 9 He showedFootnote 10 that among European and/or English-speaking countries, democracies had more than twice the per capita income, more than eight times the number of motor vehicles per person, and nearly four times the number of telephones per person as did unstable democracies or non-democracies. Democratic countries also consumed more energy per person, had higher levels of education, and were more heavily urbanized. Although Lipset’s thesis attracted controversy in its early yearsFootnote 11 as well as in subsequent ones,Footnote 12 his argument has, on balance, received a considerable amount of support. A review by Balaev suggests that the level of this support has declined in more recent years, however.Footnote 13

Scholars have examined several factors in addition to the effect of economic development. A number of studies have suggested a negative association between income inequality and democracy,Footnote 14 although both Houle and Ansell and SamuelsFootnote 15 found contrary evidence.Footnote 16 Subsequent authors have focused on factors such as globalization, social capital, national value systems, and cross-national network ties created by intergovernmental organizations as well as spatial proximity.Footnote 17

Implicit in some of this work is the assumption that the prevalence of democracy may be a function of the distribution of economic as well as political power. A high level of economic inequality can be viewed as a deterrent to democracy to the extent that the wealthy in a society are able to translate their resources into political power. In order to do this, however, an economic elite must have more than wealth. The group must also be politically organized, in that its members are capable of collective action to address their interests. In fact, one of the most important theoretical arguments in twentieth-century political theory involves the association between politically organized economic power and democracy. Yet interestingly, although LipsetFootnote 18 was a major contributor to this literature, the role of concentrated economic power has been almost completely absent from the literature on democracy. In his classic article on the subject, LipsetFootnote 19 made multiple references to the concentration of political power, and subsequent scholars have mentioned this issue as well. Despite its theoretical importance, however, the concentration of economic power has not yet received empirical treatment in cross-national studies of democracy. We turn now to a discussion of the relevance of this variable, as well as how it has been applied in studies of political power and outcomes.

Concentrated economic power and democracy

All known democracies in the modern world have existed in countries with capitalist economic systems.Footnote 20 All capitalist countries have not been democracies, however. In fact, despite their historical correlation, the relation between democracy and capitalism, especially capitalist systems dominated by large corporate organizations, is far from obvious. Max Weber, writing in 1905, at the peak of the rise of large corporations in the United States and Germany, asked whether democracy could ever be possible under a highly developed capitalism.Footnote 21 Berle and Means expressed concerns about the concentration of economic power brought on by the rise of the large, management-controlled corporation.Footnote 22 This concern with concentrated power was subsequently addressed by Schumpeter, who, noting the widespread apathy among the general public and the domination of political decision-making by elites, asked how it was possible under such conditions for democracy to persist.Footnote 23 Schumpeter’s answer to the question was based on the existence of divisions within the elite, driven by conflicts of interest, which, he believed, played themselves out through the electoral process. As long as the elites were divided, Schumpeter reasoned, there would always be a portion of the group that would be removed from power at a particular moment. If the public is unhappy with its representation, the out-of-power elites can, through the electoral process, appeal for people to remove those in power. The ability to remove representatives through the electoral process thus became, for Schumpeter, the primary basis of democracy.Footnote 24

This conception of democracy as the competition for votes among an otherwise largely passive electorate was further developed by Lipset in his introduction to the classic book, Political Parties, by Michels.Footnote 25 Responding to Michels’s claim that any large organization (and, by extension, society) must ultimately develop into an oligarchy, Lipset argued that as long as there are organized groups that must compete for the votes of constituents, it will be necessary for political leaders to be responsive to their public. As with Schumpeter, the viability of this conception depends on the extent to which the competing elites represent substantively distinct viewpoints and policies.

The discussions by Schumpeter and Lipset referred to political elites, primarily elected officials. If the public is largely removed from politics, however, the possibility exists that those with significant resources will be able to exert disproportionate influence. This concern, which in the United States dates back to Thomas Jefferson, reached a height during the late nineteenth and early twentieth centuries, as fears of a “Money Trust” dominated by the heads of large corporate empires became a major political issue.Footnote 26 In the 1950s, two sociologists, Floyd Hunter and C. Wright Mills, argued that in the United States, local and national politics respectively were dominated by a group of organized, and largely unified, elites, who used their financial resources and social connections to influence elected officials.Footnote 27

In response to these arguments, Robert Dahl, an eminent political scientist, presented a conception of political power that has been accepted by virtually all scholars of the role of elites in politics.Footnote 28 For a group to be powerful, Dahl reasoned, it required two things: a high level of resources and a high level of unity. Unless the elites identified by Hunter and Mills could be shown to be unified, Dahl’s argument suggested, their wealth or connections as individuals would be insufficient to constitute a fully coherent political actor.

To apply Dahl’s argument, one must first determine which actors have disproportionately high levels of resources. The question then becomes, how unified are those actors? Although mid-twentieth century observers suggested that there were multiple groups in Western societies with significant resources, including actors within the government and organized labor, there was considerable agreement that the highest levels of resources were held by large, for-profit corporations. Some observers, most notably John Kenneth Galbraith, argued that the power of the state and organized labor was sufficient to balance out the power of business, and Dahl himself noted the importance of organized interest groups, which in today’s context would include consumer and environmental activists.Footnote 29 Others, however, believed that due to their size and financial strength, major corporations held the greatest potential to exercise political power.Footnote 30 The question was, to what extent were these large corporations able to achieve a unified position that would allow them to act collectively to pursue jointly agreed-upon goals? On this question, there was enormous disagreement. One school of thought, descended from Hunter and Mills, known as elite theory, suggested that despite differences on relatively minor issues, large corporations, through peak associations, bolstered by social ties, were capable of reaching a unified perspective that allowed them to exercise overarching political power. A competing school, descended from Schumpeter, Lipset, and Dahl, known as pluralism, suggested that despite occasionally successful attempts at coalition building, corporations in different industries experienced built-in conflicts of interest that rendered collective action on a system-wide level extremely difficult, if not impossible, to achieve.Footnote 31

It is important to note that the key issue in this debate was not the tenability of Dahl’s theoretical argument: virtually all parties accepted Dahl’s idea that a well-endowed group with a general unity of interest and an ability to act collectively in pursuit of its interests was likely to exercise disproportionate political power. Virtually all parties also agreed that private economic actors were those with the highest levels of resources. Recall that for Schumpeter and Lipset, it is only because of the conflicts of interest among societal elites that democracy is possible. If we apply this concept to a society with an economy dominated by large, for-profit corporations, it becomes evident that a unified, well-organized business community could pose a threat to democracy. The seriousness of the suggestion implicit in Dahl’s formulation—that democracy itself could be imperiled by the presence of a unified corporate community—accounts for why social scientists have expended so much energy examining the extent to which big business constitutes a unified political actor.Footnote 32 Empirically, however, far more attention has been paid to the study of whether big business is unified than to whether this presumed unity has generated observable political consequences. A body of scholarship in political sociology has demonstrated that the presence of social connections among corporate elites increases the likelihood of similar contributions to candidates for public office and similar positions in corporate testimony.Footnote 33 One study within this literature indicates that social connections among firms played a role in collective action in support of the North American Free Trade Agreement.Footnote 34 Most studies that have examined corporate political action in detail have been qualitative studies of particular cases, however.Footnote 35 Yet the larger implication of the formulations by Schumpeter, Lipset, and Dahl remains: to what extent does the unity of powerful private actors, that is, the concentration of private economic power, pose a threat to the existence or functioning of democratic political systems?

Economic concentration and corporate power

Although no one to our knowledge has examined the effect of concentrated economic power on the level of democracy itself, there is a literature on its role in determining political outcomes in democratic societies.Footnote 36 A pioneering work in this field was an article by Salamon and Siegfried.Footnote 37 Examining 110 industries within the United States in 1963, Salamon and Siegfried found, consistent with the assumption that economic resources are associated with political power, that industries with large firms experienced relatively low tax rates. Salamon and Siegfried’s approach to studying the political power of business inspired work by a number of scholars. Jacobs examined the effect of economic concentration (the percentage of total manufacturing assets controlled by the 100 largest American firms) on corporate tax rates from 1948 through 1978.Footnote 38 Despite controlling for several political and macroeconomic variables, he found that concentration was strongly negatively associated with corporate tax rates. This conclusion was later challenged by Quinn and Shapiro, who, using different measures and a different set of predictors, failed to replicate Jacobs’s finding on the negative effect of concentration.Footnote 39 Quinn and Shapiro did find that the prevalence of corporate political action committees—a variable they treated as an alternative indicator of business political organization—had a consistently negative effect on corporate tax rates. In that sense, the authors were in agreement that an organized big business community is able to exercise a disproportionately high level of political power. In a study of 35 industries, Esty and Caves found that the square of the industries’ four-firm concentration ratio was a significant positive predictor of an industry’s success in passing (or thwarting) bills in Congress, and industry lobbyists’ self-reported perceptions of political influence.Footnote 40

Despite their differences, all of these studies point to the same central concern: As Schumpeter, Lipset, and other political theorists warned, the existence of a unified elite posed significant problems for the functioning of democratic political systems. Following this tradition, the authors of the above empirical studies were all interested in the extent to which a unified business community was capable of exercising disproportionate political power. Although the exercise of private economic power does not necessarily nullify the viability of a democratic system, it can undermine the fairness of that system. If concentrated economic power can undermine the workings of democracy, it also stands to reason that it can negatively impact the emergence, durability, and/or quality of a country’s democratic institutions. Although factors such as economic development, world-system position, a well-developed civil society, and societal-wide cohesion can facilitate democracy, they do not ensure that it will occur, or remain. To the extent that economic elites believe that their privileges will be threatened by a system of universal rights, and to the extent that these elites are capable of achieving their political goals, a cohesive business community can be an impediment to democracy.

There are certainly situations in which the interests of business and the larger public coincide. Both prefer a strong economy, in that when firms are profitable, the public will have greater job opportunities and growing incomes. On the other hand, businesses can create externalities (such as polluting the environment) that run counter to the interests of the general public, and business and the public have potentially conflicting interests regarding who will pay the costs of those externalities. Businesses and the public also have conflicting interests over the distribution of the surplus—the difference between revenue and costs—created within firms. Businesses prefer higher profits and lower taxes, while employees prefer a greater share of the surplus in the form of wages, and they, along with members of the general public, prefer that businesses bear a greater share of the tax burden. In a democracy, the public can make claims, and exercise influence, over the distribution of these resources. In an autocracy, the public has fewer rights to make such claims and less ability to realize them, especially to the extent that the force of the state places limits on public action.

Although historically, democracy and capitalism have often been linked, the classic connection between the two was forged in nations characterized by a proliferation of small firms, in which economic power was dispersed. The United States, for example, was a largely agrarian society in its early years, and business firms were relatively small. It was when economic concentration developed in the late-1800s and a relatively small number of individuals held sway over groups of large companies that concerns arose about the deleterious effects that corporate capitalism could have on American democracy.Footnote 41 A key issue here is the extent to which economic power can be translated into political power. The scholarly evidence on the topic indicates that although the association is not perfect, when a nation’s economy is dominated by a relatively small number of large enterprises, the ability of the corporate community to act collectively to advance its interests is high.

This discussion suggests that although capitalism per se is not incompatible with democracy, a high concentration of economic power creates conditions under which corporate leaders have both the potential and an incentive to exercise political constraints on the public. The potential comes from two sources: on one hand, in highly concentrated economies, firms are large, meaning that they have a high level of resources; on the other hand, the existence of a relatively small number of dominant firms facilitates the ability for unified collective action, which increases the probability that they can exercise political influence.Footnote 42 In terms of incentive, given the often-conflicting interests between business firms and the general public (as described above), businesses may be more capable of achieving their goals to the extent that there are restrictions on the public’s ability to thwart those efforts. A highly concentrated business community may thus have both the motivation and the ability to seek limits on democratic freedoms. For this reason, we argue that the presence of concentrated economic power will act as a deterrent to democracy. This suggests the following:

The higher a nation’s level of economic concentration, the lower its level of democracy.

Before proceeding further, there is one issue that we need to address. We have argued that when corporate power is highly concentrated, businesses are likely to prefer reduced, rather than greater, democracy. There is evidence, however, that corporations may benefit from operating within democratic systems, especially when such systems prevent governments from imposing constraints or exerting direct control over them. In fact, autocratic states might prefer high levels of concentration, since the existence of a smaller number of major corporations renders them easier to control.Footnote 43 Note that this interpretation, if true, does not affect the negative relation between economic concentration and democracy. It does suggest a different basis of the relation, however.

Support does exist for this interpretation. Mitton shows, consistent with this argument, that the level of concentration in a country’s economy is negatively associated with the extent to which the country exhibits a high rule of law and low corruption.Footnote 44 Similarly, Perotti and Volpin show that the greater the “accountability” of a country’s political system, the lower the barriers to entry in various sectors, which reduces the level of concentration.Footnote 45 Menaldo shows that governments in weak states can manipulate financial markets to render them more concentrated.Footnote 46 Although some large banks benefit from these practices, Menaldo argues, the government leaders, not the banks, are the ones “calling the shots.” On the other hand, although Menaldo presents a sophisticated causal analysis, neither Mitton nor Perotti and Volpin are able to demonstrate that their state capacity variables have exogenous effects on concentration. In addition, although Weymouth (Reference Weymouth2016) demonstrates that a country’s level of democracy is a consistently positive predictor of its commitment to economic competition (and thus a low level of concentration), he also shows that the strength of anticompetitive interest groups, or what he calls the “rent-preserving alliance,” has a strong negative effect on a country’s support for economic competition, even when its level of democracy is controlled.Footnote 47 As Weymouth puts it, “The probability of antitrust reform decreases with economic concentration, because concentrated business represents a powerful lobby against reforms designed to increase competition.”Footnote 48 To be clear, we do not take issue with the possibility that the actions of autocratic states can lead to high levels of economic concentration, thus resulting in a negative relation between concentration and democracy. We note only that there are good reasons to believe that concentration has an effect on democracy, even if the reverse also occurs. In our analyses below, we apply several approaches to addressing the extent to which concentration is an exogenous cause of a country’s level of democracy.

If economic concentration does have a negative effect on democracy, however, does this mean that large corporations prefer autocracy? Clearly, there may be situations in which large corporations would prefer greater autonomy from the state, and therefore would be supportive of greater democratic rights. The repression that some corporations have faced under the current governments of Russia and China point to the dangers that businesses can experience under autocratic systems. There are two reasons to raise questions about this preference in general, however. First, even in democratic societies, some policy makers have encouraged high levels of concentration, on the same ground as those in autocracies: the fewer the number of major firms, the easier they are to regulate. Bradford et al., for example, show that the United States government has reduced its antitrust enforcement since the 1980s.Footnote 49 Second, and more importantly, the historical evidence suggests that in many cases, the leaders of large corporations do prefer autocratic governments. In Central America, for example, dominant American and local members of the coffee and fruit industries have frequently supported military dictatorships, which maintained extremely repressive conditions that allowed the firms to exploit local workers, paying them low wages and preventing their attempts at unionization.Footnote 50 Leaders of large corporations appear to have strongly supported a right-wing military coup in 1973 against a democratically elected government in Chile.Footnote 51 Similar conditions have occurred in Asian countries, including China, as well as the Philippines, in which local and global firms have benefited from similarly repressive conditions. Even in more developed countries, as Karl Polanyi famously described with respect to interwar Germany, capitalists have been willing to support fascist regimes when they believed that repression of labor was necessary to maintain their profits.Footnote 52 American firms have been willing to support extremely repressive measures during periods in which they perceived the threat of left-wing labor movements, including in the years immediately following World Wars I and II. The willingness of many American businesses to support Donald Trump in the 2024 election, on the ground that he would remove the regulations imposed by Joe Biden, provides a more recent example. There is some suggestive evidence that the willingness of big business to prefer autocratic governments might be disproportionately more pronounced in less developed countries. In our own data, we found a marginally significant positive interaction effect of the combination of concentration and GDP on a nation’s level of democracy. In other words, the more economically developed the country, the less negative was the effect of concentration on democracy. Given the above points, we believe that our hypothesized negative effect of concentration on democracy rests to a great extent on the fact that large corporations prefer to operate in an environment in which the state caters to their interests, which may include ensuring that workers and other potential opponents of big business have few rights, and little power to change the composition of the government, or its policies. We acknowledge, however, that this effect, as noted above, could also be a result of efforts by autocratic governments to encourage high levels of concentration. We address below the possibility that the causal direction may run from democracy to concentration as well as vice versa.

Data and methods

The data that we use to test the above hypothesis come from a variety of public and proprietary sources. We constructed our dataset by combining data from BankScope, the Cross National Time Series Data Archive, Correlates of War, Fraser Institute, Penn World Tables, Osiris, Polity IV, Quality of Governance, the Standardized World Income Inequality Database, the World Economic Forum, and World Development Indicators.Footnote 53 In addition, several authors of articles utilizing global measures of concentration generously shared their data with us, which we used for robustness checks. In this section, we describe each of our variables and their sources.

Democracy

As our dependent variable, we use a discrete measure of national democracy levels from the Polity IV project directed by Marshall, Gurr, and Jaggers.Footnote 54 Polity IV provides a score for a country’s regime type ranging from –10 (autocracy) to 10 (democracy) for all “major, independent states in the global system” from 1800 through 2014.Footnote 55 The scores assigned by Polity analysts are determined by component sub-scores in the areas of executive recruitment, constraints on executive authority, and political competition. As such, the construction of Polity IV democracy scores closely follows conceptual definitions of democracy, which highlight the main necessary elements of democracy as the existence of competition for political power by different groups, as well as institutional power holders being elected by the majority of a country’s populace.Footnote 56

Polity IV democracy scores have been used in thousands of studies.Footnote 57 Moreover, Polity scoring is often scrutinized by the numerous users of the data, resulting in constant revisions and improvements of the scoring, and an overall high accuracy of the data.Footnote 58 Finally, Polity scores are highly correlated with other commonly used measures of democracy constructed in somewhat alternative ways, such as Varieties of Democracy measures, Freedom House’s political rights and civil liberties ratings, and Vanhanen’s index of democracy.Footnote 59

Economic concentration

Our key independent variable is the concentration of economic power, which we operationalize in terms of the concentration of a country’s financial industry. As we noted earlier, concentration is an oft-used measure of the economic power wielded by business elites.Footnote 60 High levels of business concentration present opportunities for elites to coordinate decision-making as well as to formulate a more unified political voice.Footnote 61 In this paper, we focus more specifically on the degree of concentration within a country’s financial industry.

Historically, in the United States as well as globally, financial industry elites enjoyed highly concentrated economic power due to their control of credit, a status that was reflected in their central positions within networks of interlocking directorates.Footnote 62 Although the role of banks in the control of corporations appears to have shifted in recent years,Footnote 63 financial activity has played an increasingly significant role in the world economy over time, the consequences of which became evident during the financial crisis of 2008.Footnote 64

Our focus on the concentration of financial assets does depart from the concentration of industrial or total assets used by some of the other scholars in this area. Our decision to use financial rather than industrial concentration is based primarily on the advantage in scope that this measure provides. The data that we were able to locate on the concentration of industrial assets were available for only a relatively small subset of the country-years in our analysis. We do, however, consider alternative measures of concentration, including industrial concentration, in our robustness tests following our main analyses. Moreover, given the emphasis on financial elites in the studies cited above, there are reasons to believe that financial concentration may be a superior, or at least equally valid, indicator of business unity. Mizruchi showed, for example, that firms that shared directors with the same banks and whose stock was held by trust departments of the same financial institutions were disproportionately likely to contribute to the same political candidates and express similar positions in Congressional hearings.Footnote 65 These findings are consistent with the idea that when financial concentration is high, the similarity of political behavior by nonfinancial corporations will be high as well.Footnote 66

There is also evidence that concentration across a society’s financial and nonfinancial sectors is linked. An analysis by Cetorelli indicates that countries with highly concentrated banking sectors are disproportionately likely to have both larger nonfinancial corporations and more highly concentrated nonfinancial sectors.Footnote 67 The relation between bank concentration and industrial concentration is higher in less-developed than in more-developed countries, but the overall association is positive. Consistent with these findings, Cetorelli and Strahan, in a follow-up study, showed that nonfinancial firms face relatively high barriers to entry in countries with highly concentrated financial systems.Footnote 68 These findings suggest that the concentration of financial assets can serve as an alternative to the concentration of overall corporate assets as an indicator of concentrated economic power. Additionally, although we adopt the concentration of the financial industry as our primary measure due to its greater country-year coverage, we show in a robustness check that using an alternative measure—the overall economic concentration across manufacturing industries—yields analogous results (see Tables A6 and A7 in the Appendix). Financial concentration thus serves as a useful measure of the opportunities for coordination and cohesive political action at the highest levels of a nation’s economy.Footnote 69

Other possible indicators of business unity do exist. Our measure, however, provides a distinct empirical benefit over the most prominent alternative operationalization of business unity, based on network ties among firms. Although there is a rich sociological tradition of utilizing measures of interlocking directorates for studying business elites,Footnote 70 we chose instead a measure that provides unparalleled global country-year coverage. Simply put, our choice of financial industry concentration enabled us to perform an analysis of democracy around the world and across time, on a much larger scale than would have been possible with any available network-based measure. Given the difficulty of collecting longitudinal director interlock data even within a single country, the complexity of calculating network-level measures for a wide number of countries over several years is currently prohibitive. Even the most ambitious comparative studies of national interlock networks have generally been limited in scope by the availability of network data to fewer than 25 nations, and generally at either a single point in time or over a small number of years.Footnote 71

Our use of financial concentration to operationalize business unity is not perfect. To provide one example, although the decline in the density of network ties among large corporations in the United States is now well-documented,Footnote 72 this has occurred alongside an increase in the concentration of bank assets.Footnote 73 Given the extensive coverage that the measure of financial concentration provides, however, we believe that it serves as a legitimate, albeit conservative, proxy for the ability of powerful economic actors to exercise collective influence. It thus allows us to examine an important issue that requires the use of rich panel data.

We calculated our main independent variable as the share of the assets of the top three commercial banks within each country in a given year. The underlying data we used to calculate this measure come from Bureau van Dijk’s BankScope database of banks around the world, accessed through Compustat. In total, the BankScope database has 443,416 bank-year observations, for 205 countries from 1981 through 2016.Footnote 74 Given their unique global coverage, BankScope’s data are commonly used in studies of bank concentration.Footnote 75

We began with the BankScope database, which, in its original form, contains data on individual banks. We then followed the procedures detailed by Thibaut and Le in order to clean and standardize the data.Footnote 76 First, we removed all special financial institutions (such as central and clearing banks, multi-lateral government banks, and specialized government credit institutions). We thus retained only active commercial banks. Second, we removed bank-year observations that are duplicates, since some banks may file their financial statements several times a year. We used the latest possible report issued within the year since those tend to reflect the most up-to-date figures. Third, we ensured that the time stamp of financial reporting accurately corresponds to calendar years. Here we treated reports issued between January and March as referring to the previous calendar year. Fourth, we retained only the bank-year observations that contain data from financial reports based on the same accounting standards. We chose unconsolidated accounting reports since the overwhelming majority of banks provide reports according to this standard. In the original database, there are 354,729 bank-year observations (representing about 80 percent of the database) reporting unconsolidated numbers, compared to only 88,352 observations with consolidated numbers. Finally, for international banks that report in their local currencies, we also converted their reported figures from the foreign currency to the U.S. dollar. Once the data were cleaned in this way, we calculated the three-bank concentration ratio as the sum of the assets of the largest three commercial banks, divided by the assets of all of the country’s commercial banks. As noted, we also examine alternative indicators in the robustness tests following our main analyses.

Control variables

The substantial prior literature on the determinants of democracy suggests a number of factors to consider as control variables. Based on this literature, we include controls for a variety of national-level factors. These variables can be broadly categorized as 1) economic and 2) sociocultural country characteristics, and 3) measures of interactions among countries.

In terms of economic factors, we control for economic development and growth, based on the literature around Lipset’s classic paper,Footnote 77 as well as income inequalityFootnote 78 and each country’s stock of natural resources as an operationalization of the “resource curse” hypothesis.Footnote 79 As noted above, we use GDP per capita from the Penn World Tables as our measure of development.Footnote 80 Our measure of GDP growth per capita comes from World Development Indicators.Footnote 81 Gini market, our measure of the national level of income inequality, comes from the Standardized World Income Inequality Database.Footnote 82 The data on the countries’ stock of natural resources, including oil rents, natural gas rents, coal rents (hard and soft), mineral rents, and forest rents, come from the World Development Indicators.Footnote 83

As for sociocultural factors, we include as controls measures of literacy, population density, as well as internal (that is, within-country) conflict. Literacy has been found by several researchers to have a positive association with democracy.Footnote 84 Evidence on the relation between population density and support for democracy is mixed,Footnote 85 but there is some indication that the association is positive.Footnote 86 Internal conflict (such as civil wars), on the other hand, has been found to have a non-linear (inverted U-shaped) association with democracy.Footnote 87 We operationalize literacy as the percentage of a country’s population that is literate, per the Cross-National Time Series Data Archive.Footnote 88 The measure of population density (a country’s population divided by the country’s surface area) also comes from the Cross-National Time Series Data Archive. Additionally, we include a measure of within-country conflict events, such as assassinations, general strikes, guerrilla warfare, government crises, purges, riots, revolutions, and anti-government demonstrations. The Cross-National Time Series Data Archive provides a weighted index of these internal conflict events.

Finally, interactions among countries may also impact democracy levels within particular nations. Democracy may diffuse through trade networks, for example,Footnote 89 or through networks formed by countries’ joint participation in intergovernmental organizations.Footnote 90 International conflict may also influence global patterns of democracy.Footnote 91 To account for this process, we include a measure of balance of trade, calculated as the difference between a country’s exports and its imports.Footnote 92 In addition, we control for international disputes among countries, by including a dummy variable for whether the country was involved in a dispute with another country in a given year.Footnote 93 In supplemental tests, we include controls for a country’s position in the intergovernmental organizations network as well.Footnote 94 All of our control variables are time-variant.

Analysis

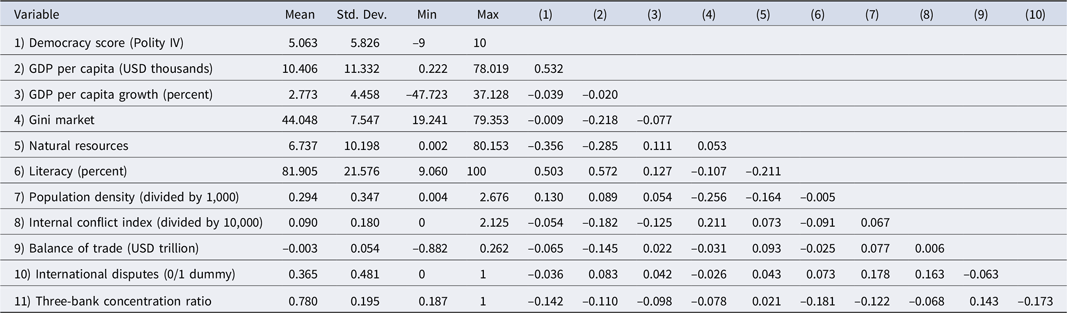

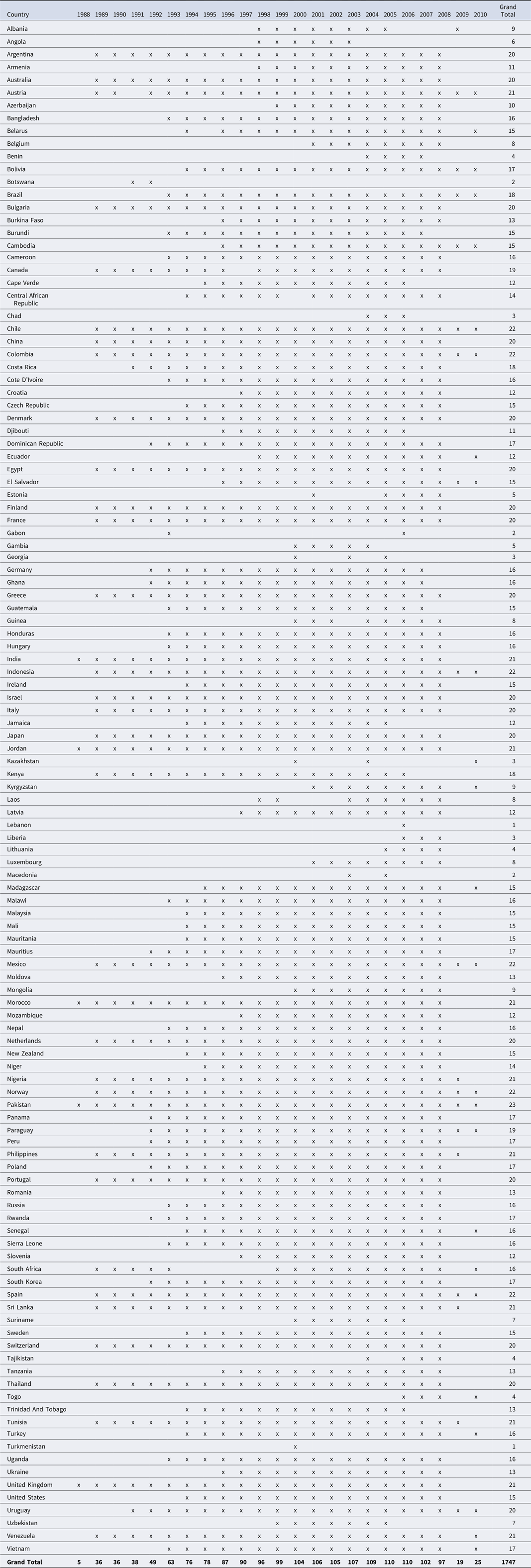

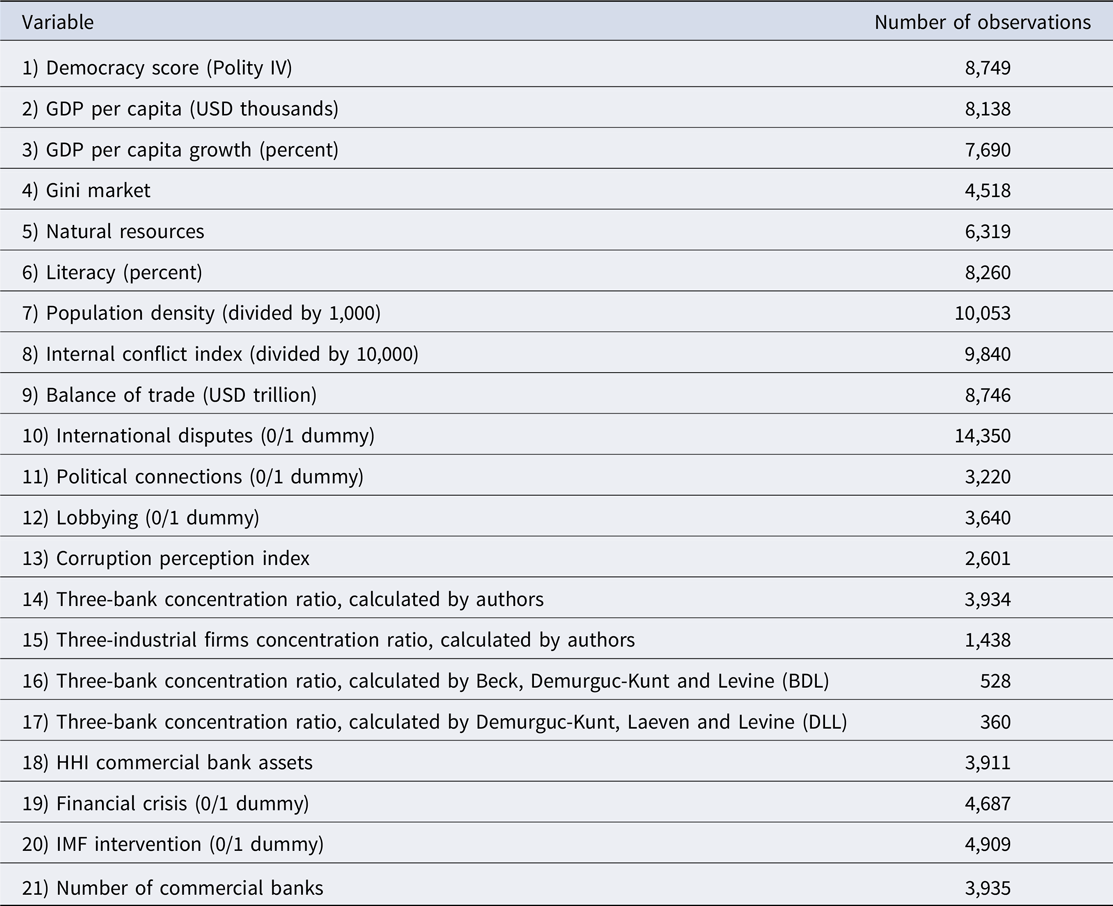

Our unit of analysis is the country-year. Our data are structured as an unbalanced panel, with varying numbers of observations for countries by years. Our primary analysis (introduced below) contains 1,747 observations, drawn from 120 countries, from 1988 through 2010. A list of countries and years included in our dataset appears in Table A1 of the Appendix. Descriptive statistics are included in Table 1.

Table 1: Descriptive statistics

(Obs = 1747).

As noted, our dependent variable is a discrete measure of democracy from Polity IV, which can vary from –10 to 10. This variable is, strictly speaking, ordinal. Although the distribution of the variable is approximately bimodal, with relatively high frequencies at the extremes, it is generally symmetric about the mean and contains sizable numbers of observations at all values. Given this symmetry and wide range of values, we estimated our models with linear regression, adjusted to account for the pooled cross-sectional time-series nature of our observations.

To account for possible unobserved heterogeneity, we also include country fixed effects, which control for all time-invariant country factors that could affect our dependent variable, such as history, language, geography, and climate.Footnote 95 We use robust standard errors, clustered by country, in order to fully account for within-country correlation of the error terms, as well as heteroskedasticity.Footnote 96 Because we expect some time to elapse before our hypothesized effects would lead a nation’s level of democracy to change, we lagged all of our exogenous variables by one year.Footnote 97 By using a fixed effects model, we are technically examining variation that occurs only within, rather than among, countries. In addition to being a conservative approach analytically, since it precludes the opportunity to account for factors that vary across countries, our use of a fixed effects model means that we are testing our hypothesis only within particular countries over time. There are good substantive reasons for focusing on within-country change. Levitsky and Ziblatt, for example, situate their discussion of the decline of democracy almost exclusively in terms of how particular countries become less democratic over time.Footnote 98 As we have noted, our use of fixed effects models also accords with a widely employed approach in the literature.Footnote 99

One issue raised by our discussion involves the extent to which economic concentration could be viewed as a consequence as well as a cause of democracy. As we saw earlier, it is possible that a high concentration of corporate assets would be more likely to be permitted in a non-democratic country than in a democratic one. Economic development has also been seen as a consequence as well as a cause of democracy, although the nature of the effect has been a source of considerable controversy, with some scholarsFootnote 100 suggesting a null effect of democracy on development and othersFootnote 101 finding a positive one. Our primary concern is the extent to which economic concentration serves as a deterrent to democracy. The possibility that economic concentration could be a consequence as well suggests the need for us to address this potential in our models. There is a broad and growing literature on this topic, and the number of approaches has expanded rapidly in recent years. In the analyses that follow, we address the possibility of reverse causality by including a lagged dependent variable (LDV). By controlling for the level of democracy in the prior year, we reduce the likelihood that the coefficients of the variables in our models, including concentration, are consequences of this variable.

There are potential problems with the use of lagged endogenous variables. The most commonly noted issue involves the fact that such variables are likely to be correlated with the errors, thus violating one of the key assumptions of ordinary least squares regression. There are also concerns that the coefficients in models with an LDV may be downwardly biased and that the effects may be sensitive to variations in the duration of the lags.Footnote 102 One possible alternative to our LDV model is the generalized method of moments (GMM) approach developed by Arellano and Bond.Footnote 103 This approach uses lagged values of the dependent variable and first differences of the exogenous variables as instruments and then computes the vector of regression coefficients using a variant of a weighted least squares estimator.Footnote 104 As Roodman has shown, however, the GMM model is most appropriate when the number of time points is small.Footnote 105 As he puts it, the number of instruments in GMM “tends to explode with T.”Footnote 106 Moreover, if T is sufficiently large, he notes (ibid), “a more straightforward fixed-effects estimator works.” Consistent with this latter point, an analysis by Beck and Katz suggests that the use of a lagged dependent variable in a fixed effects model is an appropriate method for addressing our problem, as long as the number of time periods is at least 20, which is the case for our data.Footnote 107 Given the issues with the GMM model, the findings above regarding the value of the LDV model, and the nature of our design, we believe that the fixed effects approach with a lagged dependent variable is the most appropriate model for our purposes. We therefore report the simple LDV with fixed effects results in the analyses that follow. We do, however, examine alternative models, discussed below, to ensure the robustness of our results.

The fixed effects model that we compute has the following specification:

where yit refers to the level of democracy of country i at time t, yit–1 refers to the dependent variable lagged by one year, the xit–1 matrix contains the time-variant country characteristics (such as GDP per capita, GDP growth per capita, and population density), all lagged by one year, αi represents the country fixed effect, and εit is the error term.

Results

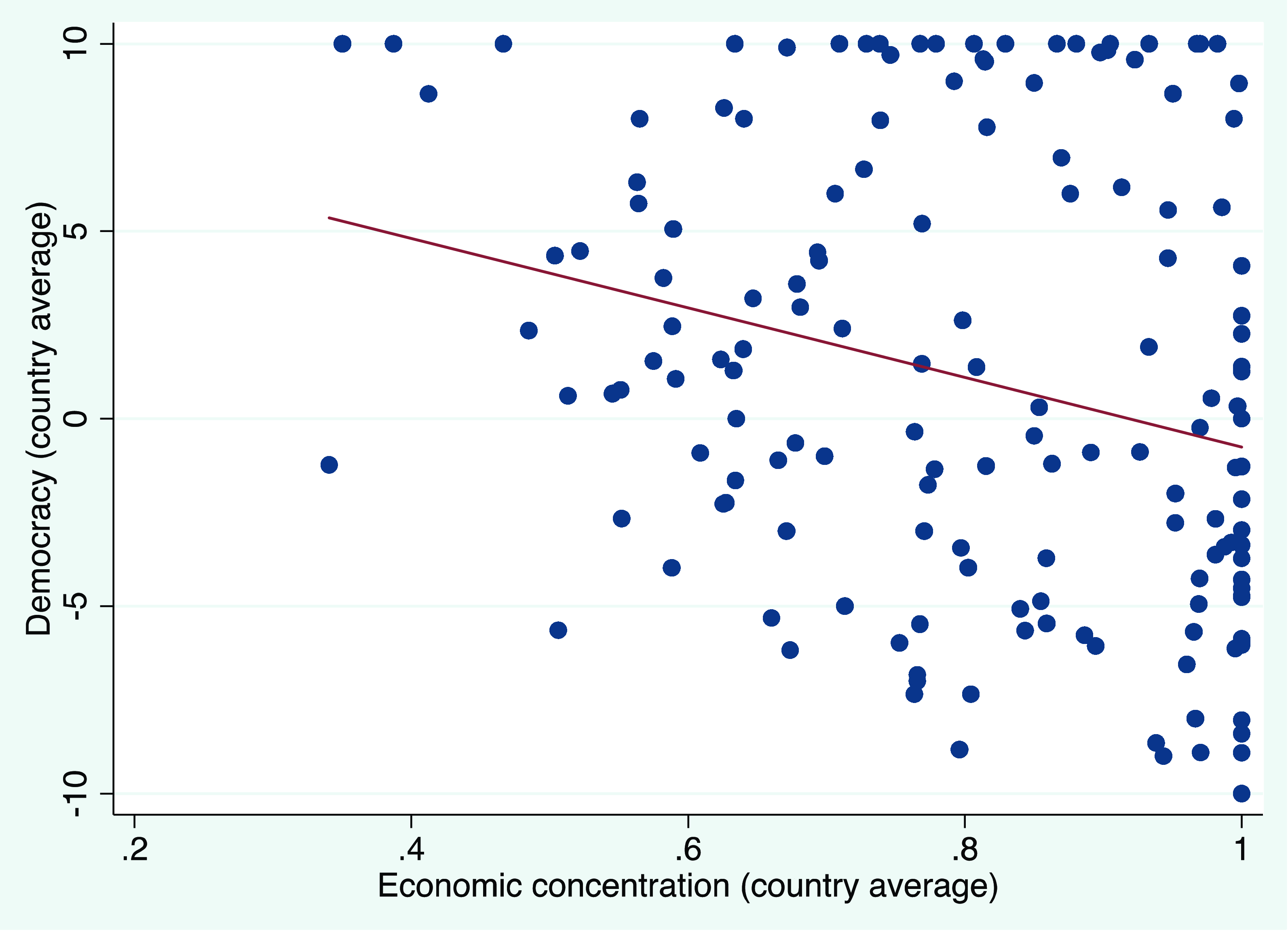

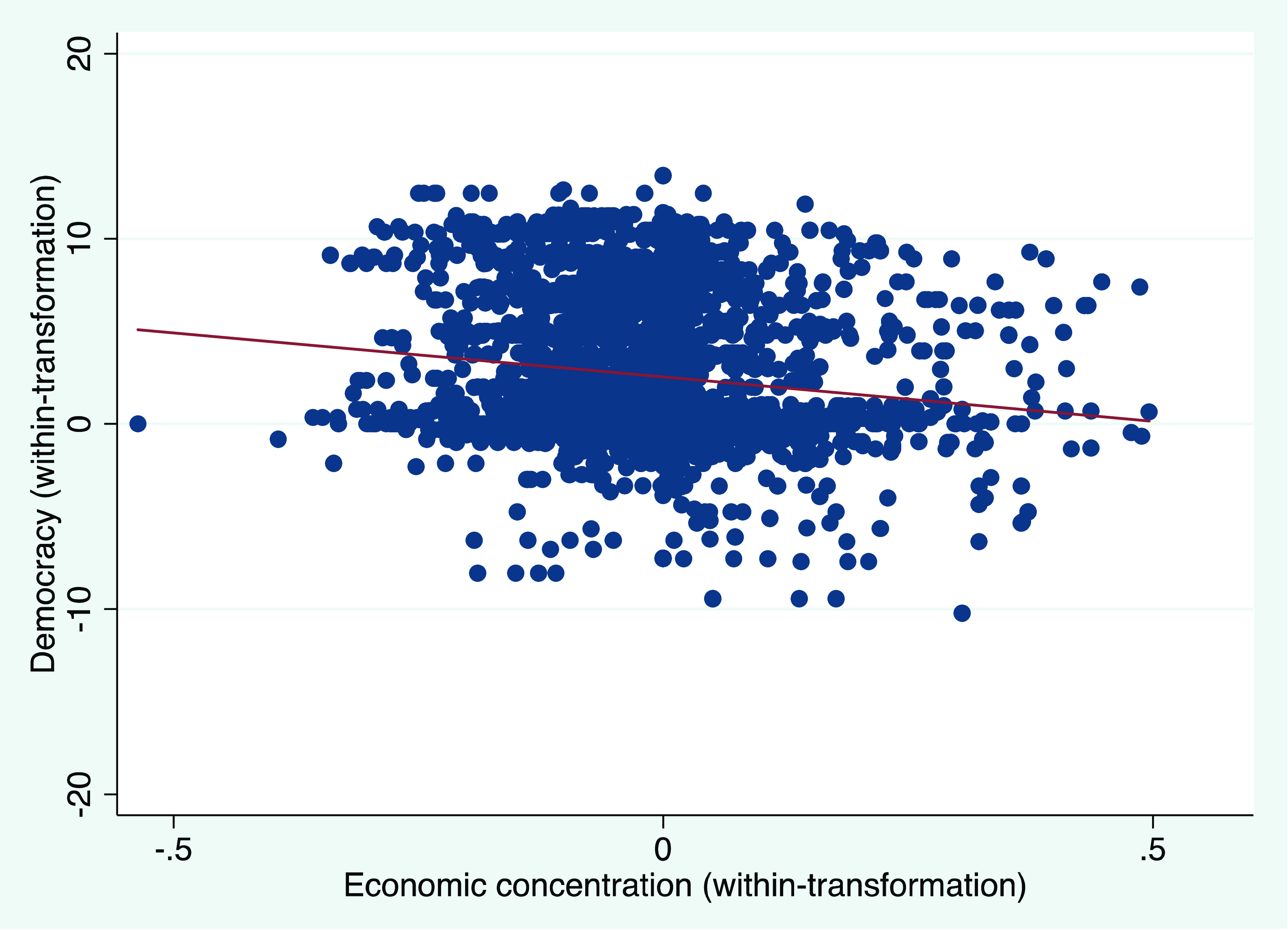

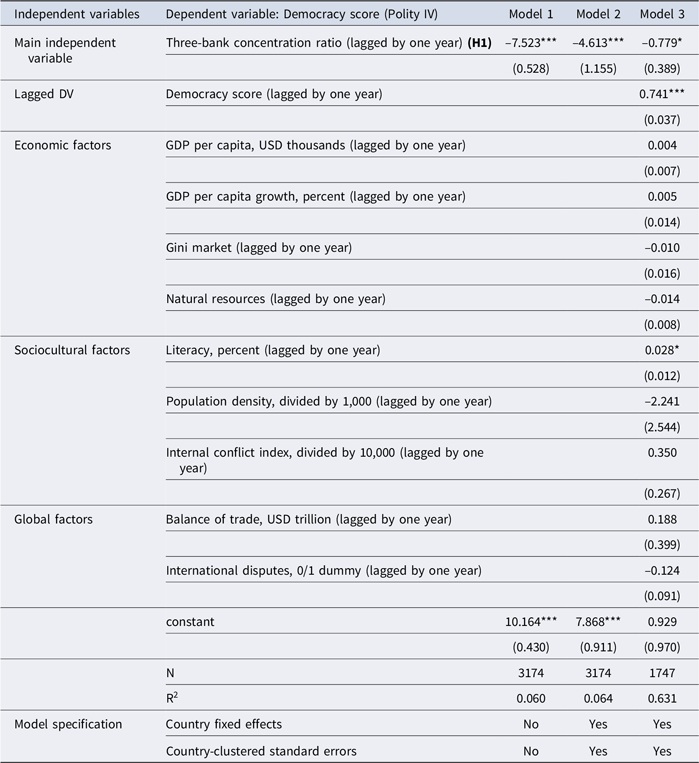

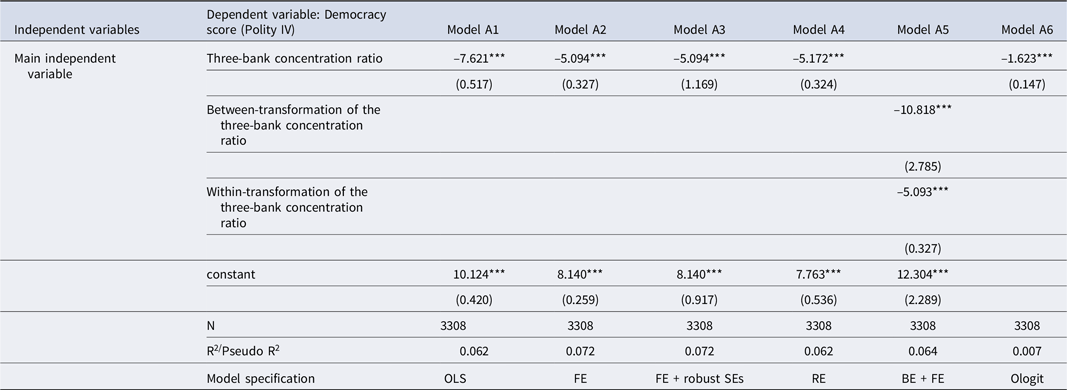

We begin by presenting the bivariate relation between economic concentration and democracy. Figure 1 presents the relation between the country averages of the two variables, while Figure 2 shows the relation between within-transformedFootnote 108 variables. In both graphs, we observe a downward-sloping trend line, indicating that the relation between economic concentration and democracy is negative. Regression models of the data in these graphs, presented in the Appendix, strongly confirm the negative effect. In Table A3, we see that, regardless of the statistical model employed (including simple OLS, random and fixed effects, ordinal logit, as well as a combination of betweenFootnote 109 - and within-effects), the bivariate relation between economic concentration and democracy is strongly significant (p < 0.001) and negative.

Figure 1. Graph of the Bivariate Relationship between Economic Concentration and Democracy (country averages).

Figure 2. Graph of the Bivariate Relationship between Economic Concentration and Democracy (within-transformed variables).

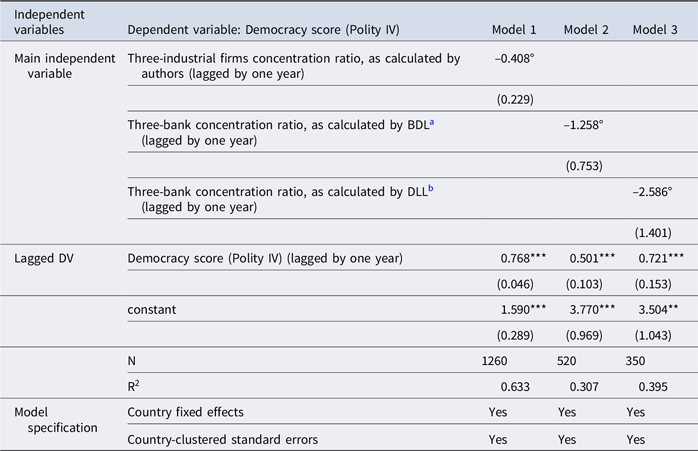

Our main analysis, in which we add our control variables to the simple bivariate relation, is presented in Table 2. Model 1 refers to the baseline specification, including only the lagged three-bank concentration ratio. In Model 2 we add country fixed effects and calculate country-clustered standard errors. Finally, in Model 3, we also include the full set of our control variables.

Table 2: Main results (full sample)

° p < .1, * p < 0.05, ** p < 0.01, *** p < 0.001 (two-tailed tests).

Across these models, we find support for our hypothesis. The concentration of commercial bank assets has a significant negative relation with democracy (p < .05) in our most conservative equation, Model 3, which includes all of our economic, sociocultural, and global control variables. In other words, increases in bank concentration are associated with decreases in the level of democracy.Footnote 110

In terms of our control variables, only two have statistically significant coefficients in Model 3. Literacy rates have a significant positive effect (p < .05) on democracy levels. As we have noted, educational attainment within countries has been commonly found to be a positive force in democratization.Footnote 111 We also find, not surprisingly, that lagged democracy level has a strong positive effect (p < .001) on current democracy level, indicating that democracy is strongly path-dependent, a finding that is well-established in the literature.Footnote 112 None of the additional control variables, including GDP per capita, have significant effects on the level of democracy. Although GDP per capita has a strongly positive bivariate correlation with democracy, .532 in Table 1, the coefficient in our regression model, although positive, is not statistically significant. The absence of a significant effect of GDP per capita is consistent with Acemoglu et al., who found that the significance of this variable disappeared with the inclusion of country-fixed effects.Footnote 113 Other control variables that had significant bivariate correlations with democracy level but had null effects in the regression model included natural resources (a correlation of –.356, consistent with the “resource curse” hypothesis), population density (a correlation of .130), balance of trade (–.065), and internal conflict (–.054).

Mechanisms: a preliminary examination

In presenting our argument—that a high level of economic concentration will reduce a nation’s level of democracy—we suggested that firms pursue their interests by attempting to influence government policy, and that this pursuit can lead to anti-democratic outcomes. The primary means by which firms pursue favorable government policies is by engaging in what is commonly referred to as corporate political activity (CPA), including lobbying and campaign contributions.Footnote 114 Firms also sometimes hire former government regulators, and their own employees sometimes join the agencies that regulate their firms, a process known as the “revolving door.”Footnote 115 Large firms, as well as those in more concentrated industries, are disproportionately likely to engage in CPA.Footnote 116 Cowgill, Prat, and Valleti, for example, found a positive association between mergers, which increase the size of firms, and the use of CPA, including lobbying and campaign contributions.Footnote 117 There is thus support for the idea that firms in concentrated industries may be particularly politically active.

Although engaging in CPA is not inherently antithetical to democracy, the practice may promote unfairness by creating an unlevel playing field, in which corporations receive favorable treatment.Footnote 118 Large firms in particular are likely to have relatively easy access to public officials. Their size and power may also allow them to influence the political actions of their own employees and contractors, as well as being viewed by government personnel as “too big to fail.”Footnote 119 The use of CPA may thus increase the ability of a business community with a high level of economic concentration to transform their economic power into political power, with potentially negative consequences for democratic institutions. We should therefore expect the role of concentration on democracy to be increasingly negative to the extent that large firms engage in various forms of political activity. To examine this suggestion, we examine three separate indicators of CPA for which data were available: lobbying, political connections, and engagement in political corruption.

Data on the global prevalence of CPA are not easily accessible. Here we draw on several sources that track the occurrence of lobbying, political connections, and corruption on a cross-national level. Although the CPA measures that we use are country-level as well as time-varying, their time period of coverage is not an exact match for the years in our dataset. For reasons we explain shortly, it was necessary to create time-invariant dummies based on the CPA variables, in which countries were either above or below average in terms of the prevalence of the tactics. In other words, if the level of firm lobbying, political connections, and corruption in a country in a given year was above the overall mean for that variable, we coded the variable 1. In all other cases, we coded the variable 0.

For our measure of lobbying, we draw on data from the World Bank Enterprise Survey, which surveys managers on various aspects of firm performance.Footnote 120 One wave of the survey (administered between 2002 and 2006 globally) taps into the firms’ use of lobbying. We use the lobbying survey item to calculate country-level means of lobbying prevalence, and then divide the countries in our main sample into those with high and low prevalence of lobbying, depending on whether the country-level mean was above or below the global average for the firm-level lobbying variable.

For our measure of political connections, we rely on the global dataset developed by Faccio,Footnote 121 and subsequently used in many other studies.Footnote 122 For the purposes of her study, Faccio tracked firm connections to politicians via their shareholders or top officers. We use Faccio’s variable for the share of connected firms in the national economy, by percentage of market capitalization. Again, we classify countries into those with high and low prevalence of political connections, depending on whether they are above or below the global mean for the variable.

Finally, as our source of data on corruption, we use the Corruption Perception Index (CPI), developed by Transparency International,Footnote 123 which uses expert ratings to classify countries’ prevalence of corruption, including payments to public officials, more commonly known as bribery. Bribery is a well-documented component of the CPA portfolio of firms, although its use varies substantially cross-nationally. In some countries, for example, it is customary for companies to provide gifts to public officials, regardless of whether such actions are legal. The CPI also includes measures of diversion of public funds, use of public office for private gain, nepotism in civil service, and state capture (the extent to which firms or their representatives have infiltrated or gained outsized influence over the national government). We reverse-coded the CPI so that higher values indicate higher levels of corruption, and then classified countries into high and low prevalence of corruption, depending on whether they are above or below the global mean for the variable.

The fact that we converted the scores of our CPA variables into dummies, based on whether the country-year was above or below the global mean for the variable, and the fact that we then examined the above and below-mean groups separately, requires explanation. Normally one would want to first examine interaction effects between concentration and the CPA variables before breaking the analysis into subsamples, in order to determine whether the sizes of the coefficients actually differ between the groups. We were not able to do this here because our CPA measures are time-invariant, meaning that there is no within-country variation across time. Because we deemed it necessary to use country fixed effects in our analysis, the only way to include these CPA variables in our models was to run the analysis separately for each group. It is also important to note that because of the limited coverage of these variables across countries and years, our analyses are based on an extremely truncated subsample of our data, ranging from a 66.1 percent reduction of cases in the best-case scenario to a 76.3 percent reduction in our worst-case one. The combination of the absence of within-country over-time variation in the CPA variables and the extremely small sample sizes in our models means that the results from these analyses must be taken as tentative, and at best suggestive.

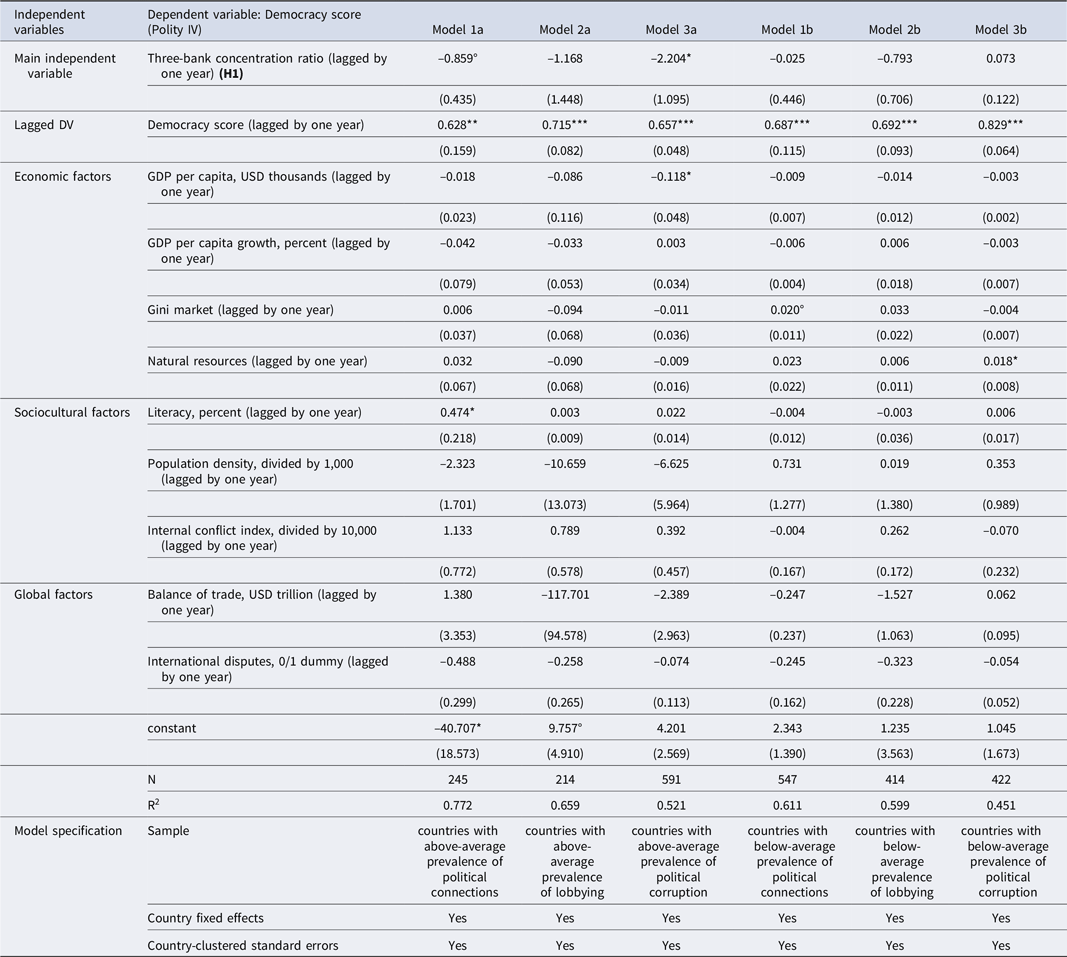

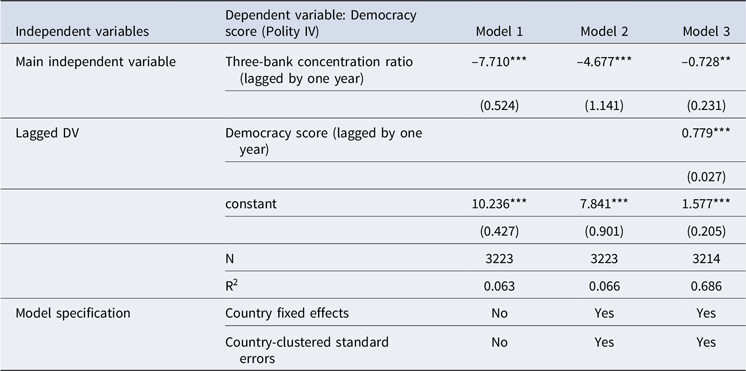

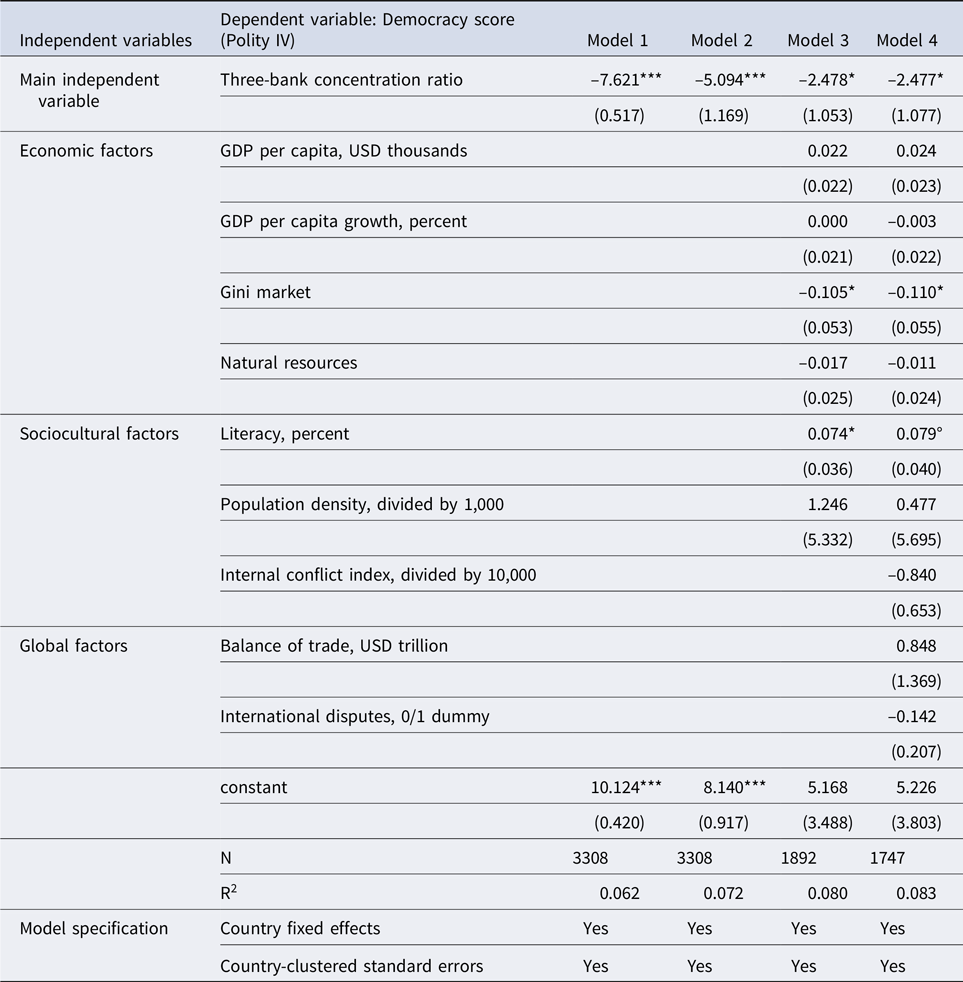

Table 3 presents the results of our subsample analysis. Models 1a–3a include country-years that are higher than average on each of the three CPA variables respectively, and Models 1b–3b include country-years that are lower than average in terms of CPA prevalence, again respectively.

Table 3: Mechanism testing (subsample analysis)

° p < .1, * p < 0.05, ** p < 0.01, *** p < 0.001 (two-tailed tests).

Across these models, economic concentration has a significant and negative effect (p < .05) in the subsample of countries with above-average corruption (Model 3a), and a marginally significant and negative effect (p < .10) in countries with above-average prevalence of political connections (Model 1a). In the models run on countries with below-average prevalence of CPA tactics, economic concentration never reaches significance, although it is negative for two of the three variables (Models 1b and 2b). Although these results are far from conclusive, they do at least suggest the possibility that in countries with relatively high levels of corporate political activity, the effect of concentration on democracy is more negative than in countries with relatively low levels of CPA. This suggests that corporate political activity might provide a mechanism by which economic concentration exhibits a negative effect on a nation’s level of democracy.

Robustness checks

In addition to our main models and the subsample analysis, we also ran a number of robustness checks. We focused on alternative samples, alternative measures of concentration, as well as alternative specifications of our models. We did this to ensure that our results are not biased, either in terms of missing data (and the resulting changes in the sample across models), choice of operationalization of our independent variable, or our modeling choices. We also conducted an additional examination of possible reverse causality.

As the models in Table 2 demonstrate, one important feature of our dataset is the difference in the numbers of observations across models due to missing data for specific variables. Table A2 in the Appendix presents the varying data coverage across variables, which drives the different numbers of observations across our models in Table 2. To address concerns about this potential problem, we conducted a robustness analysis to examine the extent to which the fluctuating numbers of observations across our models might affect our results. In Table A4, we present the results of our main models from Table 2, computed with linearly interpolated data and including only the lagged dependent variable (rather than the full set of controls) in addition to the independent variable, in order to maximize our number of observations. As is evident in Table A4, when we linearly interpolate the data to maximize our sample size and run a reduced analysis, keeping only the most significant control variable—lagged democracy score—we observe highly significant effects in the predicted direction for economic concentration, and coefficients similar in magnitude to those in the corresponding models of Table 2.

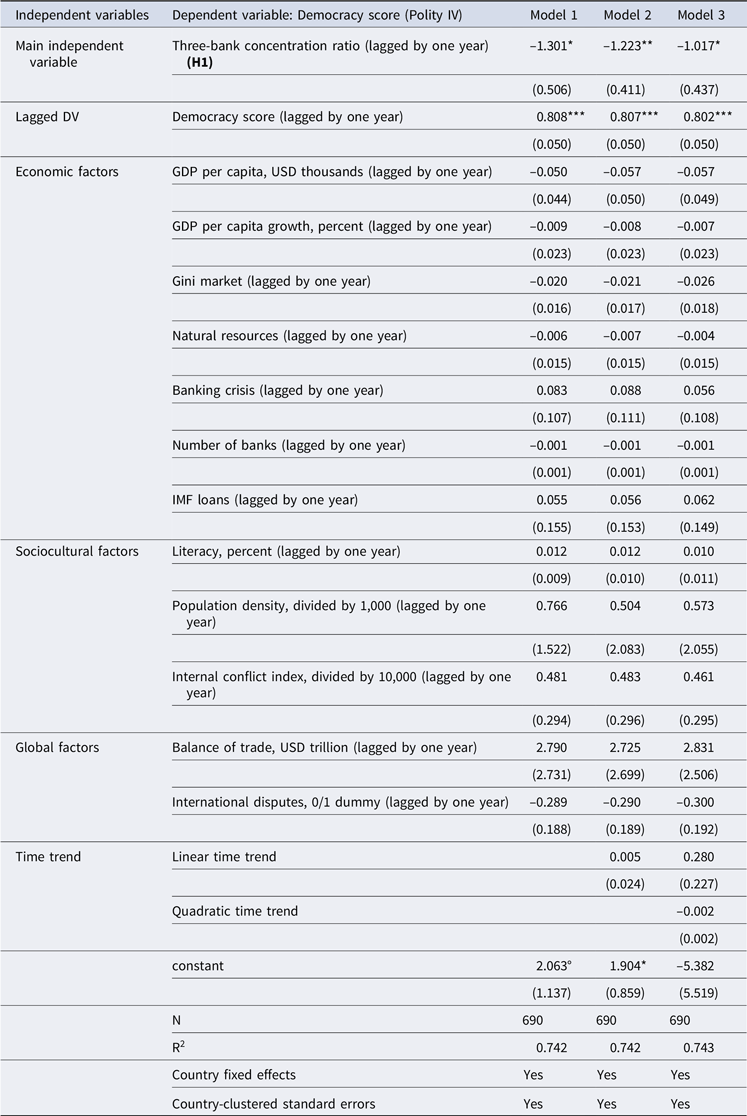

One factor that could have affected our results—in particular the effect of concentration on democracy—involves the financial conditions that each country was experiencing at a given point in time. It is possible that concentration (and potentially the level of democracy) could be affected by the size of the nation’s banking community,Footnote 124 the extent to which the country has acquired external sources of financing, and the extent to which the financial sector is in the midst of a crisis. As a proxy for the size of the nation’s banking community, we include a control for a country’s number of commercial banks, from BankScope. For external sources of financing, we include a dummy variable that captures whether a country has received (concessional and/or non-concessional) lending from the International Monetary Fund (the IMF).Footnote 125 As an indicator of banking crisis, we use a dummy variable indicating whether a country was experiencing a banking crisis in a given year.Footnote 126 We also examined a year time trend, both linear and quadratic, to account for the possibility that the overall level of democracy world-wide changed as a function of time. We present the results of this analysis in Table A5. In Model 1, we insert the three financial variables—the existence of a banking crisis, a country’s number of banks, and whether the country has received an IMF loan. In Models 2 and 3 we insert the linear and then the linear and quadratic time trend variables. As the models indicate, none of the three financial variables has an effect on democracy, nor does the inclusion of these variables affect the effect of concentration, except that the coefficients and T-statistics are actually larger in these models than they are in Model 3 of Table 2. The time trend variables, both the effect of year (Model 2) and the effects of year and its quadratic term (Model 3), are null as well. Note that when we include the three financial variables, our N declines by more than 60 percent—from 1,747 to 690. In addition, the effect of literacy, which is significantly positive in Model 3 of Table 2, becomes null in the models in Table A5. As we noted, the sizes of our coefficients for concentration, –1.301, with a T-statistic of –2.571 in Model 1, –1.223, with a T-statistic of –2.976 in Model 2, and –1.017, with a T-statistic of –2.327 in Model 3, are all larger than the coefficient of –.779, with a T-statistic of –2.002 in Model 3 of Table 2.Footnote 127

In Tables A6 and A7, we turn to our models with alternative operationalizations of the independent variable. In Table A6, we show our primary model (including our independent variable, lagged dependent variable, and full set of controls) employing alternative measures of concentration. In Model 1 of Table A6, we employ a measure of the concentration of industrial rather than financial assets. Using the Osiris database,Footnote 128 we calculated the concentration ratio for the top three manufacturing firms in each country, a procedure analogous to what we did with the BankScope data to calculate the concentration of financial assets. Because Osiris provides less country-year coverage than BankScope, we have a significantly smaller sample in Model 1 in Table A6 than in Model 3 from Table 2. The coefficient for economic concentration in manufacturing is negative, but it is not statistically significant. Other measures of bank concentration, calculated by Beck, Demurgüç-Kunt, and Levine (Model 2 of Table A6) and Demurgüç-Kunt, Laeven, and Levine (Model 3 of Table A6) also have negative but not significant coefficients.Footnote 129 In Model 4 we examine the Herfindahl-Hirschman Index (HHI) for financial assets of commercial banks. The coefficient for the HHI of bank assets is significantly negative, consistent with our main finding.

The lack of statistical significance across the first three models in Table A6 may be attributable to their far smaller Ns—ranging from 278 to 759—compared with the more than 1,700 observations in our main model in Table 2 and Model 4 in Table A6. This conjecture is supported by Table A7, in which we re-ran the first three models from Table A6 using linearly interpolated data, and with our lagged dependent variable as the only other regressor. The models in Table A7 are thus analogous to the first three models in Table A6, but they expand the number of observations by dropping the previously insignificant control variables and using linear interpolation to fill in the missing year observations. In these models, the industrial concentration ratio, as well as the alternative measures of bank concentration, all have negative and marginally significant effects, even with a sample that is still far smaller than that in our original models.Footnote 130

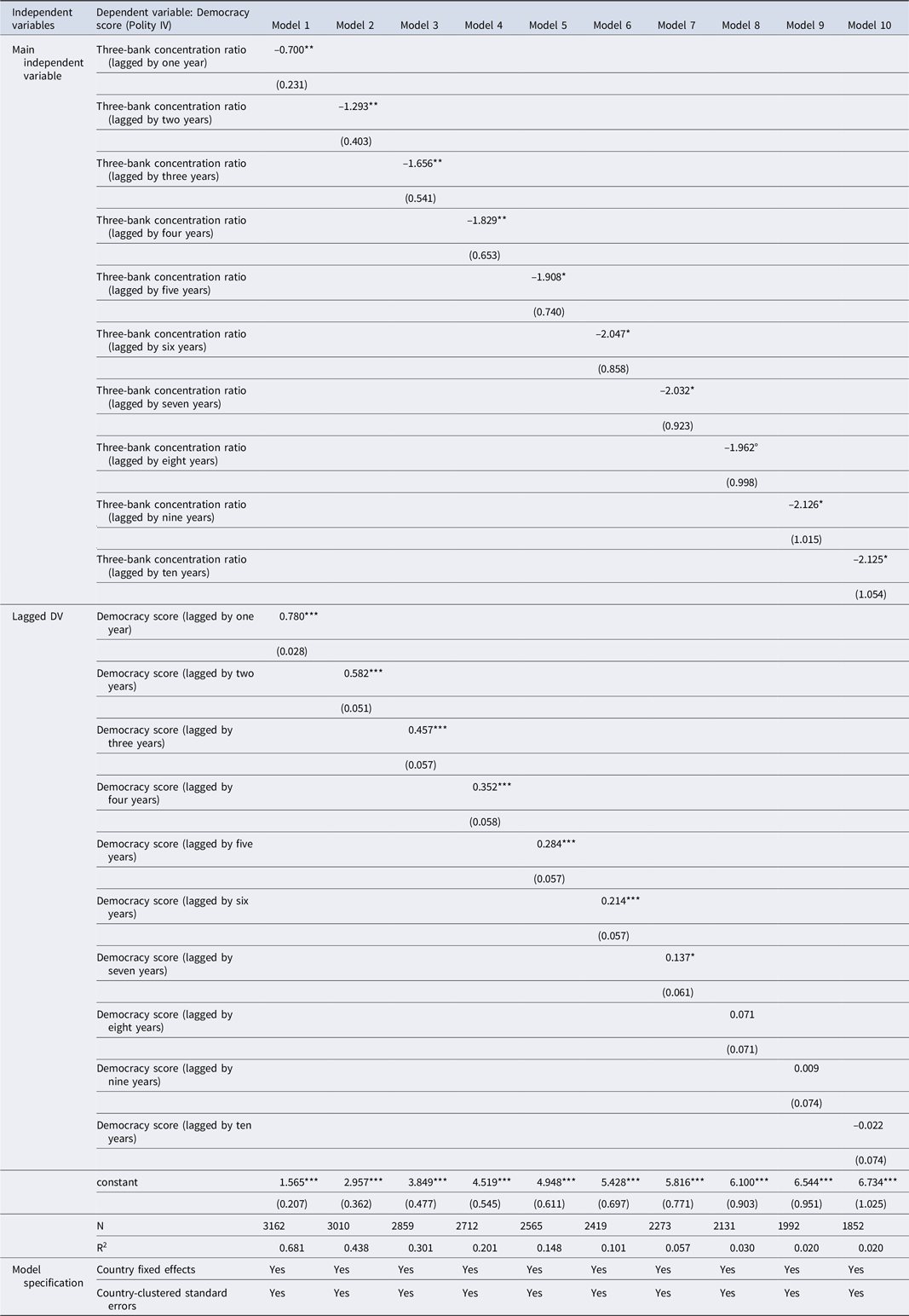

Finally, we note that our main effect is also robust to alternative specifications of the model. This was the case in both the simple bivariate models in Table A3, which show that the choice of model (from OLS, random or fixed effects, or ordinal logit) does not affect our main finding, and in the models including the full set of control variables in Table 2. It was also the case regardless of whether we lagged our exogenous variables, or whether we lagged the variables at different numbers of years, as might be expected from previous work.Footnote 131 As Table A8 in the Appendix confirms, not lagging any of our variables still produces a significant negative effect of economic concentration. As Models 1–10 in Table A9 show, we observe a significant negative effect of economic concentration at every level of lags from one through ten years. The sizes of the concentration coefficients actually increase with the time lag, most likely due to the declining sizes of the coefficients for the lagged dependent variable.

Although they are not unequivocal across the board, the overall results of our robustness tests generally confirm our hypothesized negative effect of the concentration of economic assets on the level of democracy. With the exception of a few tests involving alternative measures of concentration, we consider our main effect to be strongly robust, and even in those cases we were able to reproduce our results using linearly interpolated data. At the same time, we note that given our use of fixed effects along with numerous controls (including a lagged dependent variable), a sufficiently large N may be necessary to observe statistically significant effects, and it seems likely that the drivers of democracy work differently in different times and places. It will be useful to replicate our study to examine the boundary conditions of our main finding.

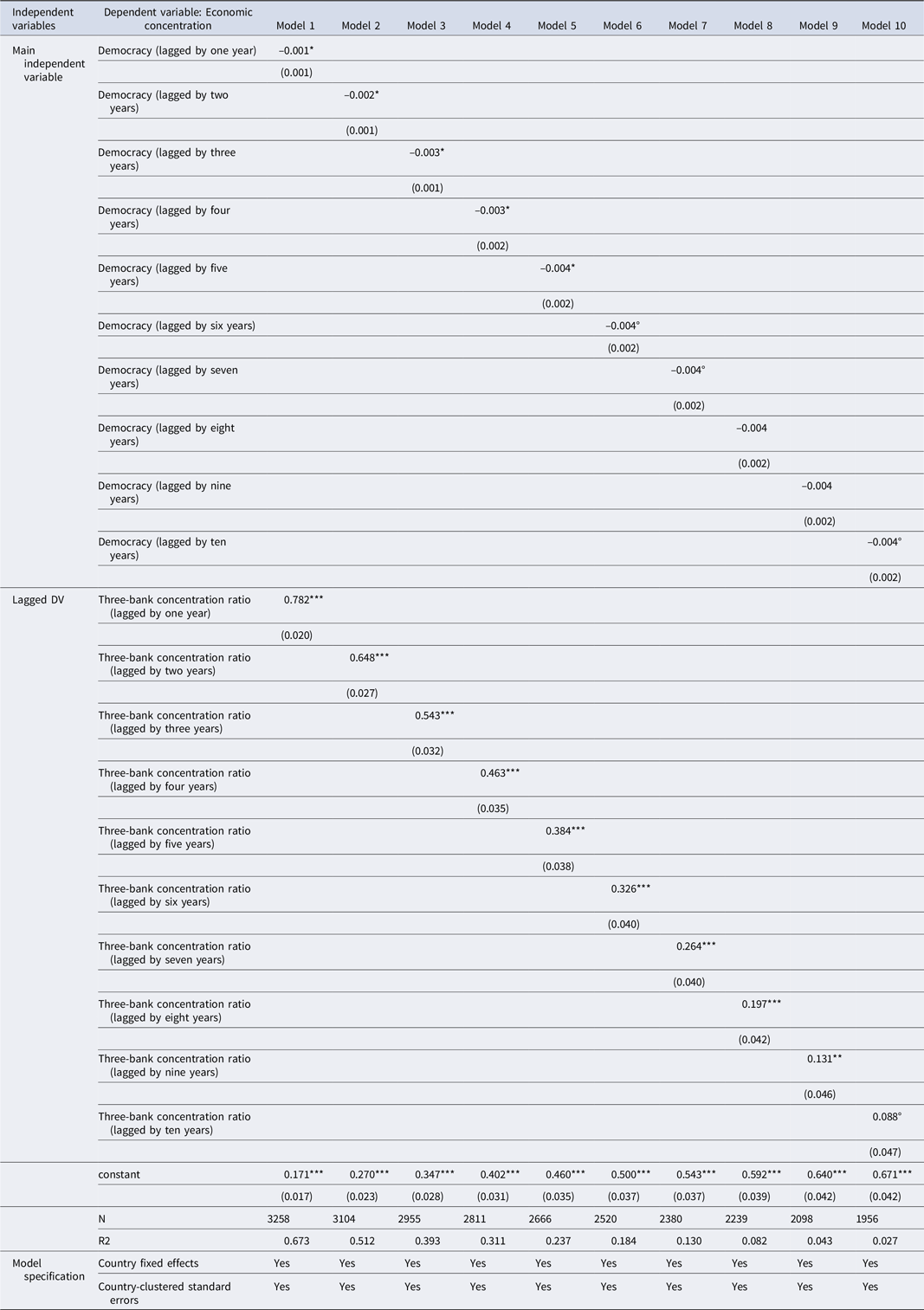

There is one additional point that we need to address, however. As we noted earlier, although we have made a number of efforts to demonstrate that concentration has an exogenous effect on democracy, the possibility remains that a portion of the effect of concentration that we have observed is endogenous. We have addressed this issue with the use of a lagged dependent variable, on the assumption that if we control for the prior year’s level of democracy, the remaining effect of concentration in the model is independent of democracy, and thus represents an exogenous effect. We also computed a generalized method of moments model, and (as we discuss in the following section) a two-stage model with an instrumental variable. We have not, however, examined the extent to which concentration itself is a function of democracy. In Table A10, we reproduce our analysis from Table A9, but with the exogenous and endogenous variables reversed. That is, we treat concentration as the dependent variable, democracy as our independent variable, and lagged values of concentration as controls, with lags ranging from one to ten years. As the models in Table A10 show, democracy does have a negative effect on concentration, suggesting the existence of reverse causality. On the other hand, unlike in our analyses in Table A9 (with concentration as the independent variable), in which every concentration coefficient is statistically significant, even with a ten-year lag, the democracy coefficients in Table A10 begin to lose statistical significance by a lag of six years and are only marginally significant in three of the lags from six through ten years. Note also the relative sizes of the coefficients in Tables A9 and A10. The coefficients for the effect of concentration on democracy in Table A9 range from a low (in absolute terms) of –.700 to a high of –2.126, which represents a range of a .120 to a .365 standard deviation change in democracy (where the standard deviation of democracy is 5.826). The coefficients for the effect of democracy on concentration in Table A10 range from a low of –.001 to a high of –.004, which represents a range of only a .005 to .020 standard deviation change in concentration (where the standard deviation of concentration is .195). This analysis does not demonstrate that there is no reverse causality: it seems apparent that a country’s level of democracy has a non-zero negative effect on its level of concentration. It does suggest, however, along with our other findings, that the there is a negative exogenous effect of concentration on democracy.

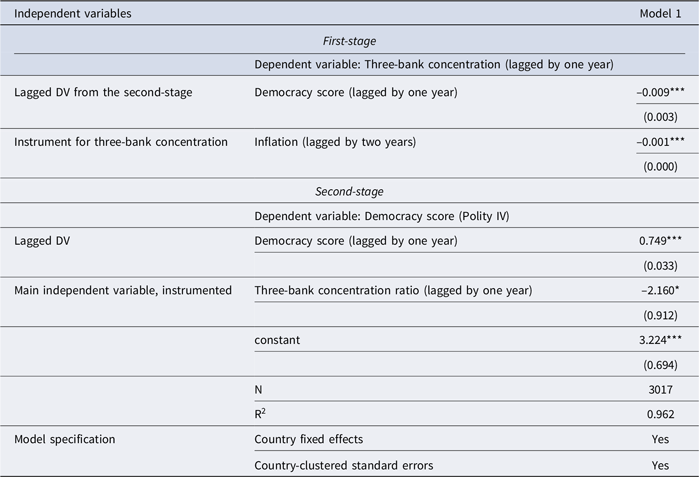

Instrumental variable estimate

Although we took pains in our above analyses to ensure that our observed effect of concentration on democracy was exogenous, we conducted a further investigation of the causal relation through an instrumental variable analysis. Specifically, we conducted a two-stage least squares analysis, in which we used a continuous measure of inflation (from the World Economic Forum)Footnote 132 as an instrument for economic concentration. Inflation is not a perfect instrument, because there is evidence that democratic countries have lower inflation rates than autocratic ones.Footnote 133 In our dataset, inflation has a null correlation with democracy, however (.011), which suggests the possibility that it could serve as a reasonable instrument, especially when lagged by two years (where the correlation is .0006). The results of this analysis appear in Table A11 in the Appendix. As is evident in the model, when instrumented by inflation, economic concentration retains its significant negative effect (p < .05). Again, because our instrument is imperfect, the results of this analysis are not definitive. When combined with our other findings, however, they do provide further suggestive evidence that the impact of economic concentration that we have demonstrated is in fact exogenous.

Discussion

Social scientists have devoted considerable effort to understanding the factors that lead some societies to be democratic, or more democratic than others. They have focused primarily on economic factors, most notably a nation’s level of development, and a range of social and cultural factors, including a nation’s class structure and its level of tolerance of opposing positions. Although there has been some attention paid to the level of inequality, of both income and wealth, one factor has largely escaped attention: the concentration of private economic power among large corporations. The lack of attention to this variable is surprising, in that there is a literature dealing with the role of concentrated economic power in the political efficacy of elites. We have attempted to bring together these two literatures by examining the extent to which the concentration of a nation’s financial sector is associated with its level of democracy. We argued that the presence of democracy can place constraints on the ability of economic elites to achieve their goals. As a result, economic elites, if they are able to engage in unified collective action, may provide an obstacle to the operation of democracy. We therefore hypothesized that the higher the level of concentrated financial power in a society, the lower the level of democracy. In an analysis of 120 countries over a 23-year period, from 1988 through 2010, we found support for this hypothesis: economic concentration has a robust negative effect on democracy. This finding speaks to the longstanding concern regarding the role of elite unity as a potential barrier to democracy. The debates that we discussed earlier in the paper revolved around the extent to which economic elites were capable of acting in a unified manner to advance their political goals. Regardless of where they stood on this question, however, proponents on all sides of the debate have agreed with Dahl that elite unity, where it exists, creates a potential impediment to democracy.Footnote 134 Although the measure we used—the concentration of financial assets—provides an imperfect indicator of elite unity, our results nevertheless provide support for Dahl’s claim.

Although our examination of corporate political activity helped specify some of the ways in which economic concentration might affect democracy, our analysis remains at a high level of aggregation. How might the effect of concentration operate on a more grounded level? Let us consider two examples. Several East Asian countries experienced a severe financial crisis in the late 1990s. In South Korea, prior to the crisis, the chaebols—Korean business groups analogous to the keiretsu in Japan—were closely aligned with the government, which allowed their leaders to borrow large sums of capital from state-controlled banks. A series of investigations conducted in the mid-1990s, prior to the crisis, revealed that various chaebol leaders had been lining the pockets of politicians dating back to the 1960s.Footnote 135 In 1981, sales of the top 100 firms accounted for 46.2 percent of manufacturing, and the country was firmly autocratic, with a Polity IV score of –5. As economic concentration dropped to 38.5 percent in 1987, Korea’s Polity IV score became positive for the first time during the period for which we have data, reaching a score of 1 in that year and 6 by 1990. When the financial crisis hit the heavily indebted chaebols in 1997, economic concentration further declined.Footnote 136 At that point, incoming president Kim Dae Jung, who had long been opposed to the chaebols’ role in political funding, was able to introduce significant political reforms. By 1998, Korea had reached a democracy level of 8.

A second, older, example comes from the United States, where the banking industry had a relatively low level of concentration in its formative period. In 1818, for example, there were 338 banks in the United States, with total assets of $160 million. By 1914, even at the height of the Money Trust era, there were 27,864 banks, with total assets of $27.3 billion (Acemoglu and Robinson Reference Acemoglu and Robinson2012: 34). Concentration in the American banking sector actually declined during this period, due in part to restrictions on branch banking. Because the major supporters of these small banks were populist politicians who relied on electoral support from farmers, there was little reason for the bankers to undermine American democracy.Footnote 137 Instead, the level of democracy in the United States increased during this period, with repeated (albeit incomplete) expansion of voting rights.Footnote 138

World history abounds with examples of business elites opposing democracy. This opposition may take various forms: supporting authoritarian rulers out of self-interest, opposing democratic reforms, or wielding a corrupting influence on politicians, thus skewing political outcomes in a pro-business direction. Not all cases are as easily observable as those we presented here. On the contrary, as Levitsky and Ziblatt show, the changes that occur as democratic countries slide into autocracy are often so gradual as to be virtually imperceptible.Footnote 139 Democratic freedoms are often chipped away slowly, and they can be enlarged slowly as well. It is therefore not necessary to observe drastic shifts in the level of democracy for the presence of concentrated power, as well as other factors, to have played a role.

Although our results on the effect of economic concentration on democracy are robust under multiple conditions, we were able to successfully replicate only two other previous findings in this literature. A nation’s level of literacy was a consistently strong positive predictor of democracy across our models. In a series of reduced models without lagged variables (including without the lagged dependent variable, see Table A8 in the Appendix) we also found, consistent with several earlier studies, a significant negative effect of income inequality (as measured by the Gini coefficient) on a nation’s level of democracy. This association disappeared in our main results in Table 1, however. The most widely examined variable in the literature, economic development, which we measured as GDP per capita, was not a statistically significant predictor in most of our models, although the effect was consistently positive and the variable had a strong bivariate correlation with democracy, as predicted by Lipset in his classic article.Footnote 140 Although the findings on this variable remain contested, this null effect in our multivariate models is consistent with more recent analyses.Footnote 141 It suggests that the effect of economic development on democracy is likely to be contingent on factors that have not been completely identified.

Our study also has important policy implications. Although the negative effect of economic concentration on democracy may strike some observers as cause for alarm, our mechanism analysis points to potential moderators of the effect. Thus, beyond the obvious, albeit politically contentious, solution of reducing economic concentration through stricter enforcement of antitrust laws, our paper also points to other potential policy levers. Given the amplifying effects of corporate political activity, particularly political connections, and corruption (including bribery), reducing the prevalence of both tactics, especially through more active enforcement efforts, may provide an alternative path to reducing any detrimental effects on democracy stemming from economic concentration.

Our study does have limitations. Although our results appear to be generally robust, they do not hold in every case, and it will be necessary to do considerable additional work to unpack the nature of the effect we have identified. Despite our efforts to ensure that the effect of concentration was exogenous, for example, we were not able to completely rule out the possibility of at least some level of reverse causality. We have examined alternative measures of business unity, but all of them are based on the concentration of economic assets, which requires an assumption that cohesiveness is easier to achieve among relatively small groups than among larger ones. This is a plausible assumption that accords with established theoryFootnote 142 and has received empirical support,Footnote 143 but the tenability of our conclusions would be strengthened if we were able to reproduce our findings with an alternative, network-based measure.