Refine search

Actions for selected content:

50 results

2 - The Advent of the Centrally Coordinated Multi-corporate Enterprise

-

- Book:

- Profit and Power

- Published online:

- 18 December 2025

- Print publication:

- 22 January 2026, pp 62-89

-

- Chapter

- Export citation

9 - The Hidden Empire

-

- Book:

- Profit and Power

- Published online:

- 18 December 2025

- Print publication:

- 22 January 2026, pp 177-190

-

- Chapter

- Export citation

Chapter 2 - Responsibilities and Obligations

- from Part I - Human Rights and State Responsibilities

-

- Book:

- The Politics of Human Rights

- Published online:

- 12 November 2025

- Print publication:

- 06 November 2025, pp 34-75

-

- Chapter

- Export citation

Chapter 4 - Perpetrators of Human Rights Violations

- from Part II - Explaining Human Rights Violations

-

- Book:

- The Politics of Human Rights

- Published online:

- 12 November 2025

- Print publication:

- 06 November 2025, pp 110-143

-

- Chapter

- Export citation

Norm Contestation in the BHR Field—The Role of Corporate Actors as Entrepreneurs, Antipreneurs, and Saboteurs

-

- Journal:

- Business and Human Rights Journal / Volume 9 / Issue 3 / October 2024

- Published online by Cambridge University Press:

- 22 November 2024, pp. 381-401

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Corporations, CSR and Self Regulation: What Lessons from the Global Financial Crisis? – ERRATUM

-

- Journal:

- German Law Journal / Volume 25 / Issue 7 / October 2024

- Published online by Cambridge University Press:

- 07 November 2024, p. 1219

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

The Relationality of Community Development Agreements towards a Human Rights Due Diligence Good Faith Requirement

-

- Journal:

- Canadian Yearbook of International Law / Annuaire canadien de droit international / Volume 61 / November 2024

- Published online by Cambridge University Press:

- 21 October 2024, pp. 237-258

- Print publication:

- November 2024

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

19 - Human Rights Obligations of Non-state Actors

-

- Book:

- International Human Rights Law and Practice

- Published online:

- 08 February 2024

- Print publication:

- 15 February 2024, pp 851-900

-

- Chapter

- Export citation

Governing Global Tax Dodgers: The “Group of Four” and the Taxation of Multinational Corporations, 1970s–1980s

-

- Journal:

- Business History Review / Volume 97 / Issue 3 / Autumn 2023

- Published online by Cambridge University Press:

- 23 November 2023, pp. 547-574

- Print publication:

- Autumn 2023

-

- Article

- Export citation

7 - SMEs: An Untapped Platform for Sustainable CSR Penetration and Practice in Developing and Emerging Markets

- from Part II - Infusing Corporate Social Responsibility in Corporate Governance

-

-

- Book:

- Corporate Social Responsibility Across the Globe

- Published online:

- 15 June 2023

- Print publication:

- 01 June 2023, pp 155-174

-

- Chapter

- Export citation

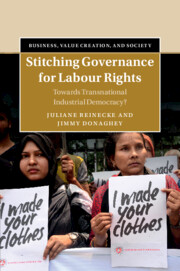

1 - Introduction

-

- Book:

- Stitching Governance for Labour Rights

- Published online:

- 09 March 2023

- Print publication:

- 16 March 2023, pp 1-21

-

- Chapter

- Export citation

Stitching Governance for Labour Rights

- Towards Transnational Industrial Democracy?

-

- Published online:

- 09 March 2023

- Print publication:

- 16 March 2023

Partners with Benefits: When Multinational Corporations Succeed in Authoritarian Courts

-

- Journal:

- International Organization / Volume 77 / Issue 1 / Winter 2023

- Published online by Cambridge University Press:

- 09 February 2023, pp. 144-178

- Print publication:

- Winter 2023

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

In the Middle: American Multinationals in China and Trade War Politics

-

- Journal:

- Business and Politics / Volume 24 / Issue 4 / December 2022

- Published online by Cambridge University Press:

- 12 August 2022, pp. 348-376

-

- Article

- Export citation

Mining Boom and Contentious Politics across Central America: Elites, Movements and Party Systems

-

- Journal:

- Journal of Latin American Studies / Volume 54 / Issue 2 / May 2022

- Published online by Cambridge University Press:

- 28 March 2022, pp. 253-281

- Print publication:

- May 2022

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

6 - The Supply Chain Frontier

- from Part II - Roadblock Politics

-

- Book:

- Roadblock Politics

- Published online:

- 13 January 2022

- Print publication:

- 20 January 2022, pp 146-175

-

- Chapter

- Export citation

15 - Entangled Hopes

- from Part IV - Situating Entanglements

-

-

- Book:

- Entangled Legalities Beyond the State

- Published online:

- 29 October 2021

- Print publication:

- 11 November 2021, pp 399-423

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

12 - Hidden in the Shades

- from Part III - Weaving Transnational Legalities

-

-

- Book:

- Entangled Legalities Beyond the State

- Published online:

- 29 October 2021

- Print publication:

- 11 November 2021, pp 318-350

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

Nestlé United States, Inc. v. Doe. 141 S. Ct. 1931.

- Part of

-

- Journal:

- American Journal of International Law / Volume 115 / Issue 4 / October 2021

- Published online by Cambridge University Press:

- 15 October 2021, pp. 694-700

- Print publication:

- October 2021

-

- Article

-

- You have access

- HTML

- Export citation

15 - The Business Sector and the Rights to Work and Just and Favourable Conditions of Work

-

-

- Book:

- The Cambridge Companion to Business and Human Rights Law

- Published online:

- 10 September 2021

- Print publication:

- 09 September 2021, pp 330-358

-

- Chapter

- Export citation