Introduction

Fiscal discipline, the sustainable balancing of government outlays with revenues, is perhaps one of the most extensively theorized objects of inquiry in political science and political economy. Yet, works on budgetary politics in European countries have failed to take properly into account the influence of a European Union (EU) oversight procedure of fiscal discipline which has been operating since the early 1990s. Perhaps because it has never led to the imposition of sanctions, this excessive deficit procedure has been considered irrelevant or failing. In this article, I will argue instead that this regime displays several features international relations scholars deem important to ensure compliance. Supranational scrutiny potentially generates enough domestic political costs and protracted noncompliance engenders serious enough risks of undermining the whole monetary union that governments under scrutiny adjust their fiscal policies to accommodate its requests. My analysis indicates that, if a government has been under procedural inspection during the year when the budget is drafted, it reduces its deficit by around 0.56 per cent of the gross domestic product (GDP). This is quite a substantial effect, considering that the Treaty of Maastricht sets a 3 per cent ceiling of the deficit‐GDP ratio, and it is not confounded by the financial assistance countries have received. Moreover, estimates from exact matching on treatment histories indicate that these effects peak after 4 to 5 years.

This result is set against a comprehensive array of established and recent theories of the public deficit, building on Franzese's (Reference Franzese2002, 126–195) seminal study of 20 OECD countries from the late‐1950s to 1990. My analysis covers all EU member countries from 1994 to 2019 and employs the latest innovative measures of political determinants. Among the main political processes which have shaped fiscal discipline in Europe in these two and a half decades, I illustrate how executive fractionalization has exerted its expected delaying effect on fiscal consolidation when countries were experiencing high levels of indebtedness, and how executive polarization (i.e., coalitions of governing parties holding highly different views) has exercised a significant counterbalancing effect in facilitating fiscal consolidation. When governments have faced a low risk of being replaced by ideologically very different ones, their ideological inclinations have guided their fiscal policies, but all executives have reverted to deficit spending as they expected to face national elections. Importantly though, I show that supranational monitoring of the budgeting process has offset the expansionary pressures engendered by these political dynamics.

In the following section, I introduce the excessive deficit procedure and explain why it should affect national fiscal policies. Next, I review the political‐economic theories of fiscal discipline, the main results and the limits of their empirical applications. I then discuss the measurement of the economic and political determinants of public deficits. The empirical section builds on the recent analysis of Fortunato and Loftis (Reference Fortunato and Loftis2018), but it greatly extends and better specifies the causal mechanisms, considering especially those discussed by Franzese (Reference Franzese2002, 128–150). It then provides a comprehensive assessment of the impact of supranational oversight and compares it to that of other main political determinants. Lastly, it zeros in on the interaction between oversight and electoral pressures and the impact of oversight across policy reforms. The conclusion highlights how these results have major implications for democratic policy making in European countries and for the ongoing attempts at expanding the fiscal capacity of the EU.

International oversight of fiscal discipline

With the entry into force of the Treaty of Maastricht, EU member countries established an oversight regime of fiscal discipline, designed as a policy flanking the planned monetary union. Starting in 1994, states have to report to the European Commission twice a year their planned and actual (or estimated) levels of government deficit and debt for the current year and the preceding four years. If the Commission considers that an excessive deficit exists in a member state,Footnote 1 it recommends that the EU Council of ministers (specifically, the Economic and Financial Affairs configuration) adopt a decision to that effect. An excessive deficit procedure is then opened and the Council issues recommendations to the member state concerned with a view to reducing the deficit within a given period. Failure to act leads to a ratcheting up of the pressure with further decisions, up to the imposition of fines. The procedure is terminated once the Council abrogates its initial decision. Between 1994 and 2019, the Council established the existence of an excessive deficit 52 times. The government deficit of every country, except for Estonia and Luxembourg, has been deemed excessive at least once, and in some cases twice or thrice. A procedure has lasted on average 4 years, from a minimum of about 10 months (Germany in 1994–1995) to a maximum of 10 years (Spain in 2009–2019).

The regime displays several features that are deemed important to ensure observance of its provisions (e.g., Downs et al., Reference Downs, Rocke and Barsoom1996; Tallberg, Reference Tallberg2002). On the one hand, supranational monitoring is associated with recommendations, notices and ratcheting sanctions.Footnote 2 These have never been imposed (and could be counterproductive by aggravating an already perilous budgetary position of a government) but, as I argue below, fiscal recklessness per se can have dire consequences for a monetary union. On the other hand, the regime emphasizes comparability and transparency of public accounts, with the Commission operating as the rule interpreter and issuer of guidances. A European system of national and regional accounts was adopted in 1996, and a 2005 reform set new obligations for member states and delegated more powers to the Commission to improve the quality of statistical data (e.g., Franchino & Mariotto, Reference Franchino and Mariotto2020; Heipertz & Verdun, Reference Heipertz and Verdun2010).

Yet, the impact of this regime on national budgeting is poorly investigated. Some studies ignore it, even though they include EU countries in the post‐1993 period in their analysis (Brender & Drazen, Reference Brender and Drazen2005; Harrinvirta & Mattila, Reference Harrinvirta and Mattila2001; Perotti & Kontopoulos, Reference Perotti and Kontopoulos2002). Other works seem to suggest that the regime made a difference only when there was a credible threat of exclusion from the eurozone. Wehner (Reference Wehner2010b, 222), for instance, finds that the countries expected to adopt the euro (including Greece) run lower deficits in the 2 years prior to 1999 (see also, De Haan & Sturm, Reference De Haan and Sturm2000; Hallett & Lewis, Reference Hallett and Lewis2008; Volkerink & De Haan, Reference Volkerink and De Haan2001).Footnote 3 Mink and De Haan (Reference Mink and De Haan2006) report the presence of political budget cycles in the post‐1999 period, suggesting that abiding by the regime's rules may not pay politically once a country has joined the monetary union. These results have led some scholars to consider the regime ‘failed’ (De Haan et al., Reference De Haan, Berger and Jansen2004, 235) or ‘irrelevant’ (Leblond, Reference Leblond2006, 970). And some economic studies have reached similar conclusions (Fatás & Mihov, Reference Fatás, Mihov, Alesina and Giavazzi2010; Ioannou & Stracca, Reference Ioannou and Stracca2014).

But a more careful analysis of recent works suggests that it may not be the case. Fortunato and Loftis (Reference Fortunato and Loftis2018) find, in their pooled regression, that the post‐Maastricht period has a weak negative impact on deficits. Similarly, De Haan et al. (Reference De Haan, Jong‐A‐Pin and Mierau2013) report that the post‐1999 period is associated with greater fiscal discipline.Footnote 4 These works use time indicators that do not distinguish between countries in or out of the eurozone, let alone those under an excessive deficit procedure. They also do not extend beyond 2004, or 2009 for some countries in Fortunato and Loftis (Reference Fortunato and Loftis2018).

De Jong and Gilbert (Reference De Jong and Gilbert2020, 18) provide the strongest indication that the regime may matter. Considering EU countries from 1999 to 2016, these scholars find that a recommendation for a 1 per cent fiscal adjustment is associated with a 0.51 per cent improvement in the structural budget balance if a country is not receiving financial assistance. However, aside from the focus on the structural balance, the only political variable included in this work is a planned election‐year indicator.

I expect the oversight of the excessive deficit procedure to engender a reduction of budget deficits. Two related dynamics may underpin this expectation. First, a decision by a collective body of finance ministers that establishes the presence of an excessive deficit and the subsequent scrutiny may lead to charges of fiscal irresponsibility by the national mass media and opposition parties. This could engender political costs for parties in governments by tearing off at least somewhat the veil of ignorance of fiscally illuded voters that would have otherwise rewarded them for a debt‐fuelled economic growth and may now instead punish them for economic mismanagement. Second, regardless of the credibility of the sanctions, protracted non‐compliance could encourage emulation by fellow governments, thus undermining the whole regime with possible serious repercussions. The primary objective of this policy is to prevent negative externalities arising from fiscal indiscipline. Assuming an inflation‐averse central bank, in a monetary union, these externalities range from higher interest rates, (common) currency appreciation, trade imbalances, up to default, financial contagion and, in the long run, lower capital accumulation and output. Regardless of the appropriateness of precisely these fiscal rules, governments, which share a common monetary policy and cannot take advantage of currency fluctuations to soften the transmission of these effects, can plausibly try to reduce their exposure and set up an efficacious system of oversight of national fiscal policies. Finance ministers are not oblivious to these issues and, if their country's deficit is considered excessive, they are likely to be receptive to the pressure to comply from their colleagues in the Council as they would not wish in the future to be at the receiving end of negative externalities originating from fiscal indiscipline in fellow member countries. Finance ministers are also in charge of one of the most important portfolios of the national cabinet (Warwick & Druckman, Reference Warwick and Druckman2001) and they tend to be more fiscally hawkish than their colleagues. On the back of supranational oversight and risks of electoral sanctions, they may successfully use these arguments and their elevated stature with colleagues in charge of spending ministries to rein in the excess. These dynamics should operate more cogently in countries that are members of the eurozone, but compliance with fiscal rules is also a condition for joining the monetary union. Oversight may therefore display its effects also on governments wishing to adopt the single currency.

Political economy theories of fiscal discipline

The empirical corroboration of this expectation has to be set against the alternative causal mechanisms which have been put forward over the past forty years by the extraordinarily rich literature on the political economy of public spending. I concisely review the most prominent theories here.

Multiple constituencies and distributive politics

One of the most established theories sees public spending being confronted by a tragedy of the commons. According to one variant of this perspective, political parties have priorities for spending programs that provide, at least in part, disproportionate benefits to their supporters. Parties are primarily held electorally accountable for spending decisions in these domains of interest of their voters and can successfully shift the blame on coalition partners for fiscal outcomes in other policy areas. As a result, their demand for spending will fail to fully internalize the costs of these programs. Since the benefits are concentrated on their supporters while the costs are shared across the electorate through taxation, the demand will be excessive, spending will increase and deplete the tax base.

Coalition governments are more severely beset by this common‐pool resource problem than single‐party governments. In the latter circumstance, the party as a whole is held accountable by the electorate for all its spending decisions because voters do not distinguish among party factions. For coalition governments instead, the possibility to discriminate and hold electorally accountable individual parties creates an electoral common‐pool problem (Persson et al., Reference Persson, Roland and Tabellini2007, 157). Moreover, smaller parties internalize these costs even less than large parties because they represent a smaller portion of the electorate. Spending, therefore, increases with the number of parties in government (Bawn & Rosenbluth, Reference Bawn and Rosenbluth2006). Evidence indeed indicates that coalition governments and larger coalitions are associated with more public spending (e.g., Bawn & Rosenbluth, Reference Bawn and Rosenbluth2006; Perotti & Kontopoulos, Reference Perotti and Kontopoulos2002; Persson et al., Reference Persson, Roland and Tabellini2007; Volkerink & De Haan, Reference Volkerink and De Haan2001). However, a larger public sector does not imply less fiscal discipline. Studies on OECD or Western European countries which cover up to the mid‐1990s, report an association between executive fractionalization and budget deficits (e.g., Balassone & Giordano, Reference Balassone and Giordano2001; Perotti & Kontopoulos, Reference Perotti and Kontopoulos2002; Volkerink & De Haan, Reference Volkerink and De Haan2001). But other works, that extend further into the 1990s, fail to unearth this relation (Fortunato & Loftis, Reference Fortunato and Loftis2018; Harrinvirta & Mattila, Reference Harrinvirta and Mattila2001).Footnote 5

One reason for these inconclusive results could be that this problem operates at the level of the legislature or the broader political system, rather than within the executive. Volkerink and de Haan (Reference Volkerink and De Haan2001), for instance, find a positive association between the effective number of legislative parties and budget deficits in OECD countries between the 1970s and the early 1990s but, again, Fortunato and Loftis (Reference Fortunato and Loftis2018) fail to corroborate this finding for the following period. Taking a broader perspective of the multiple constituencies involved in a political system, Franzese (Reference Franzese2002, 158–159) shows that the effective number of electoral districts has exacerbated, while presidentialism has attenuated, this common‐pool resource problem. To my knowledge, no work has extended his analysis beyond 1990.

Fractionalized and polarized governments and delayed stabilization

A second reason could be that executive fractionalization operationalizes a different causal mechanism that emphasizes a government's weakness or inability to take decisions. According to the theory of veto players, fractionalized and polarized coalitions, composed of different parties who can veto policy, may retard fiscal adjustments when facing a high debt burden (and may hinder deficits at low levels of debt). Indeed, unlike earlier works (De Haan & Sturm, Reference De Haan and Sturm1994, Reference De Haan and Sturm1997), Franzese (Reference Franzese2002, 158–159) finds executive fractionalization and (more weakly) polarization to be critical in delaying fiscal stabilization in these conditions. Again, to my knowledge, no work has replicated this analysis beyond 1990.

Fractionalized governments and budgetary rules

A final reason for the inconclusive impact of fractionalization in the more recent period could be in the rules of the budgeting process that operate within each country. Maintaining fiscal discipline may be easier if the budgetary powers are centralized in the hands of actors with incentives to internalize costs, and if constraints to limit the size of the budget are in place. For instance, the minister of finance may explicitly set, at the formulation stage, budgetary limits for the spending ministers; or the possibility to amend the budget during parliamentary approval may be severely curtailed. Although earlier works on EU countries focus on the direct impact of rules on fiscal outcomes (e.g., De Haan & Sturm, Reference De Haan and Sturm1994; von Hagen & Harden, Reference von Hagen and Harden1995), their effect is more probably conditioned by the nature of the political environment. But even considering this interaction, Hallerberg et al. (Reference Hallerberg, Strauch and von Hagen2009, 89–93) and De Haan et al. (Reference De Haan, Jong‐A‐Pin and Mierau2013) reach different conclusions about the relevance of these rules.

Electoral budget cycles

A second important theme in the political economy of fiscal discipline emphasizes electoral effects. The pressure to accrue electoral support should intensify with the prospect of new elections. Since voters tend to reward government parties for good economic performance in the more recent past, the executive may be tempted to stimulate the economy by increasing deficit spending, preferably targeted on its electoral base, in the period closer to the elections. These dynamics engender political business cycles. Evidence from OECD or Western European countries indeed indicates that governments run higher deficits in election years (e.g., Franzese, Reference Franzese2002, 179–181; Hallerberg et al., Reference Hallerberg, Strauch and von Hagen2009, 81–83; Harrinvirta & Mattila, Reference Harrinvirta and Mattila2001; Mink & De Haan, Reference Mink and De Haan2006). Recently, Fortunato and Loftis (Reference Fortunato and Loftis2018) have shed new light on these dynamics. Since legislative election timing is not fixed and known in advance in semipresidential and parliamentary democracies, governments may begin to ramp up spending in the expectation of parliamentary dissolution and, if they outlive their expected duration, they would keep up spending until the elections to maintain such support, accumulating deficits as a result. Focusing on Western European countries between the early 1970s to the late 2000s, Fortunato and Loftis (Reference Fortunato and Loftis2018) find shorter expected government duration to be associated with higher deficits. My analysis builds on this study since it includes this more sophisticated measure of the risk of parliamentary dissolution, but it expands its geographical coverage and greatly extends the set of theories subject to investigation.

Partisan budget cycles and strategic debt‐manipulation

A last important theme addresses partisan effects. According to the standard partisan theory of fiscal discipline, left‐leaning governments are expected to run larger deficits than their right‐leaning counterparts because their core supporters favour a larger government. However, most of the time, government ideology appears to have no significant impact on deficits (e.g., Fortunato & Loftis, Reference Fortunato and Loftis2018; Harrinvirta & Mattila, Reference Harrinvirta and Mattila2001; Perotti & Kontopoulos, Reference Perotti and Kontopoulos2002; Wehner, Reference Wehner2010a, Reference Wehner2010b). In some cases, it has a modest effect (Fabrizio & Mody, Reference Fabrizio and Mody2006; Mink & De Haan, Reference Mink and De Haan2006), especially if a government faces a high risk of replacement (Franzese, Reference Franzese2002, 181–183). An augmented variant of this argument, therefore, asserts that governments facing a high risk of being replaced may attempt to manipulate deficits to constrain the fiscal situation inherited by future governments. They may simply accumulate debt (Alesina & Tabellini, Reference Alesina and Tabellini1990) or the manipulation may depend on the ideological inclination of the government (Franzese, Reference Franzese2002, 154). For instance, right‐wing governments may produce deficits while left‐wing governments may reduce deficits as the replacement risk increases (Persson & Svensson, Reference Persson and Svensson1989). Again, this augmented theory of partisan effects has not been subject to an empirical analysis covering European countries post‐1990.

Data and method

I investigate my core expectation by greatly expanding the specification of Fortunato and Loftis’ (Reference Fortunato and Loftis2018) model, in light of the gamut of explanatory mechanisms discussed above. For a more thorough counterfactual examination, this model is then extended to the pre‐Maastricht period. I finally produce estimates of treatment effects derived from the exact matching of treatment histories.

Deficit and oversight: My dependent variable is the measure of Deficit that is employed in the excessive deficit procedure: the difference between the total expenditure and the total revenue of the general government, as defined in the European system of national and regional accounts, as a percentage of the GDP. Oversight, which is operationalized by the variable Excessive deficit procedure (EDP), measures the proportion of a given year a country has been under surveillance. To account for eurozone membership, I include an interaction with a binary indicator Eurozone (EMU) that takes the value of one if a country uses the euro in a given year, including the year preceding adoption, which is when the European Council approves the applications of membership.

I use six of the seven political explanatory variables employed by Fortunato and Loftis (Reference Fortunato and Loftis2018).Footnote 6 To facilitate comparison with their work, I discuss the operationalization of electoral effects first, then that of common‐pool resource problems, executive features, budgetary rules and, finally, partisan effects. The measurement of each explanatory mechanism is also greatly enriched, especially in light of the seminal work of Franzese (Reference Franzese2002: 158‐9).Footnote 7

Electoral risk: For electoral effects, I measure the Expected duration of a government broadly following the procedure employed by Fortunato and Loftis (Reference Fortunato and Loftis2018). I first re‐estimate Chiba et al. (Reference Chiba, Martin and Stevenson2015) competing risks model of government survival using an expanded dataset of 673 governments. I then employ a nonparametric bootstrap to produce a duration mean from a distribution of 1,000 predicted survival times for each cabinet. Next, I subtract from these values the number of days the cabinet has been in office at the time the budget for a given year has been submitted to parliament.Footnote 8 If this value exceeds the constitutionally mandated deadline for legislative elections, it is trimmed back to such maximum duration (more details are provided in the Supporting Information Appendix).

Constituencies: The number of Parties in government and the Effective number of parties in the legislature (Laakso & Taagepera, Reference Laakso and Taagepera1979) account for common‐pool resource issues. In the case of more than one cabinet per year, I weigh the sum of the number of parties in each cabinet by the share of the year in office, excluding periods of caretaking and post‐election government formation. In the case of elections, party fusion or fission, I compute a similar time‐weighted sum for the effective number of parties in the legislature.

I add three macroinstitutional variables that, according to Franzese (Reference Franzese2002, 139–143), may further attenuate or aggravate this problem. Given their slowly changing nature, they are promising factors that could explain cross‐country differences. Powerful presidents may ease this problem since they face a national‐wide constituency. Twelve countries are semipresidential during the period of my inquiry (plus Czechia since 2013 with the introduction of a popularly elected president) (Elgie, Reference Elgie2011, 29), but presidential powers vary considerably. I, therefore, include an indicator variable for effective Semipresidentialism which takes the value of one for those five countries where presidential powers in legislative and nonlegislative matters score six or above in the measure developed by Roper (Reference Roper2002, 260). On the other hand, the resource problem may worsen as the number of electoral districts and effective federal regions increases, since geographically concentrated interests enjoy greater representation. To measure the Effective number of electoral districts, I use a variety of sources, including Golder (Reference Golder2005), Birch (Reference Birch2001), the election reports in Electoral Studies, and the political data of the European Journal of Political Research. If more than one electoral tier is used, the effective number is the seat‐weighted sum of the number of districts at each tier. For the Number of regions in effectively federal countries, I take into account both the regionalization that occurred across Europe in the 1990s as well as the important differences in effective fiscal decentralization across countries. I count the number of subnational authorities that set the rate of at least one major tax, which is equivalent to having a score of three or above of the regional fiscal autonomy measure produced by Marks et al. (Reference Marks, Hooghe and Schakel2008). Unlike Franzese (Reference Franzese2002, 154), I do not add the squared terms of these variables since I do not find evidence of a curvilinear effect.Footnote 9 Lastly, I add a variable measuring the share of legislative seats held by agrarian and ethnic cabinet parties out of the total number of seats of government parties. Franzese (Reference Franzese2002) suggests that these parties could exacerbate the resource problem because they tend to concentrate geographically. I use Döring and Manow's (Reference Döring and Manow2021) classification of party families to identify these parties as well as Franzese's (Reference Franzese2002, 141) operationalization.

Executive fractionalization and polarization, and budgetary rules: In Fortunato and Loftis (Reference Fortunato and Loftis2018), the number of Parties in government is then interacted with a Budgetary constraint index to account for the effect of rules on budgetary outcomes. This is a measure of the formal rules that act as constraints on government spending, employed by Martin and Vanberg (Reference Martin and Vanberg2013). The number of cabinet parties is however also the linchpin to another important political‐economic theory that emphasizes the delaying effects of executive fractionalization and polarization on fiscal consolidation. Therefore, I interact the number of Parties in government and the Government range (the absolute distance between the highest and lowest left‐right scores of cabinet parties from the comparative manifestos project – see more details below), with the previous year's debt‐to‐GDP ratio (Franzese, Reference Franzese2002: 144–146).Footnote 10

Partisan orientation and replacement risk: As a measure of Government ideology, I use the seat‐weighted mean of the left‐right scores of cabinet parties from the comparative manifestos project (Volkens et al., Reference Volkens, Krause and Lehmann2020). If more than one cabinet has been in office in a given year, I compute the time‐weighted sum of the government ideologies. Following Franzese (Reference Franzese2002, 148–149), to test the augmented variant of these partisan effects, I interact the ideology of a government with its Replacement risk, which is the expected probability of losing office in a year (the inverse of the actual government duration), times the standard deviation of the government ideology across 9 years, centred on the present year. This risk measures the probability of being replaced by ideologically different governments.

Economic conditions and other control variables: Like Fortunato and Loftis (Reference Fortunato and Loftis2018), I include a Caretaker time variable which measures the share of a given year that a caretaker government has been in power, including the post‐election government formation period. These scholars also control for two variables drawn from the basic economic tax‐smoothing theory. The Unemployment rate accounts for spending shocks, while Trade openness for open‐economy shocks of public finances. Following Franzese (Reference Franzese2002: 150), I add a further three economic determinants: the Real GDP growth rate to account for revenues shocks, the Expected inability to pay and service the debtFootnote 11 (the difference between the expected real interest and real growth rates – a measure of market pressure), and an augmented operationalization of open‐economy shocks where the Terms of trade (the ratio of export prices to import prices) interact with Trade openness. Footnote 12

If capital markets are imperfect, public debts may serve transfer functions between and across generations. As a result, older and poorer countries could run larger deficits. Following both Franzese (Reference Franzese2002) and Fortunato and Loftis (Reference Fortunato and Loftis2018), I account for these roles by the GDP per capita at constant 2010 US dollars and the Dependency ratio. Voters may also fail to incorporate the Ricardian equivalence between current deficits and future taxes and, therefore, they may reward public spending and punish taxing. If the tax structure is particularly complex, politicians may be inclined to exploit this fiscal illusion and run deficits to get re‐elected. I measure these fiscal illusory effects with the Total tax share of government revenues.Footnote 13 Higher values indicate simpler tax structures that should discourage opportunistic deficits.

Following De Jong and Gilbert (Reference De Jong and Gilbert2020), I finally account for the periods during which countries applied for, or received, financial assistance from the EU and the International Monetary Fund during the global financial crisis and the eurozone crisis to address the difficulties they were experiencing in refinancing their debts. Since financial support depended on the implementation of economic adjustment programmes, this conditionality may have engendered fiscal discipline. Financial assistance measures the proportion of a given year a country has been negotiating or receiving assistance. The Supporting Information Appendix provides additional information on data sources, measurements and descriptive statistics (Table A1).

Following Fortunato and Loftis (Reference Fortunato and Loftis2018) and earlier works, I estimate an autoregressive distributed lag model that includes one‐year lags of both the dependent and independent variables, as well as concurrent realizations of the economic and demographic variables. Following Franzese (Reference Franzese2002, 150), I add two further temporal effects (the two‐year lagged deficit and debtFootnote 14 as a percentage of GDP) and a spatial effect (Average deficit∼i, the average of other EU countries’ deficit ratios). This specification accounts for the autoregressive and spatial properties of spending patterns and for the fact that the effects of political variables are primarily felt not when budgets are implemented, but when they are drafted and adopted (Bawn & Rosenbluth, Reference Bawn and Rosenbluth2006, 261; Martin & Vanberg, Reference Martin and Vanberg2013, 961). Only the indicator variable EMU enters the model in its concurrent realization since it measures membership or expected membership of the eurozone in a given year. For instance, the 1998 budget is affected by the realizations of the political variables in 1997 as well as the expectation that the European Council would decide on membership in 1998 (hence, EMU = 1).

The impact of international oversight on fiscal discipline

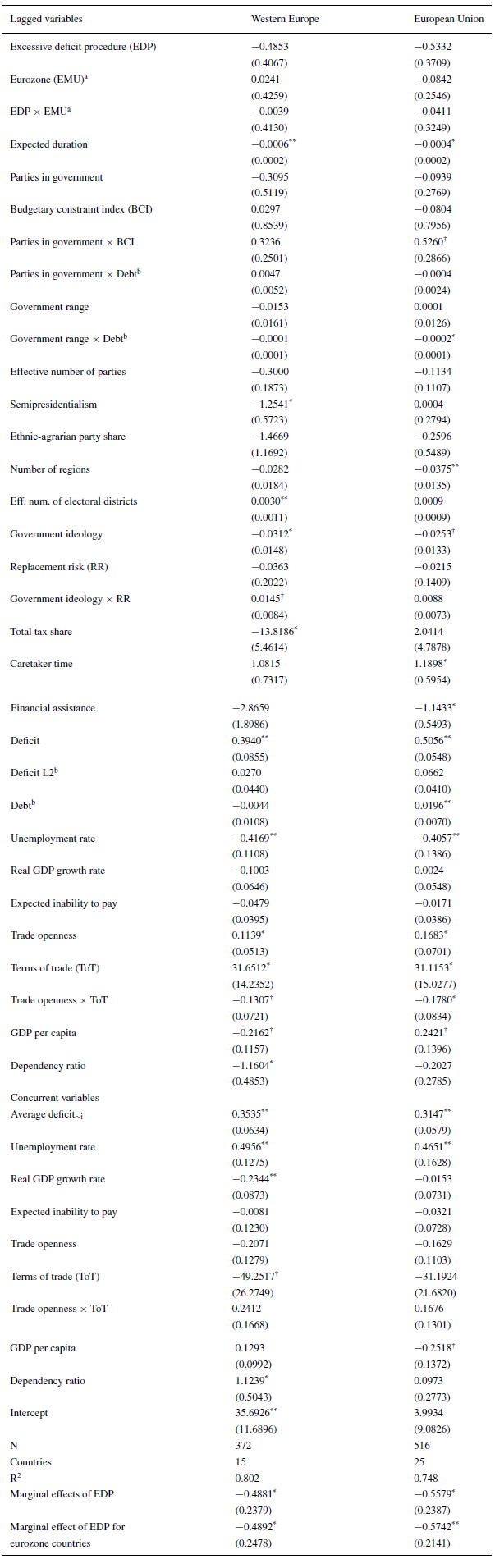

Table 1 reports the main results. The first model includes the same set of countries as Fortunato and Loftis (Reference Fortunato and Loftis2018), but my period of observation covers only the years a country has been an EU member up to 2019. This implies that I add on average twelve years of observations, while I truncate the pre‐Maastricht period. The second model extends the analysis to all EU countries since their membership, except for Croatia, Cyprus, and Malta which, as I explain in the Supporting Information Appendix, drop out because of missing data. Similarly to Franzese (Reference Franzese2002: 158–159), fixed effects are excluded from these models because they obscure the substantive explanations based on slowly‐changing variables and worsen the overall performance in explaining the observed patterns by at least ten percentage points.Footnote 15 However, they will be reintroduced below where I extend the analysis to the pre‐Maastricht period in order to compute treatment effects.

Table 1. The political economy of fiscal discipline (1994–2019)

Notes: Dependent variable: deficit/GDP. Models account for random effects. Robust standard errors in parentheses adjusted for country clusters. Average marginal effects computed for one year of oversight under the excessive deficit procedure.

**p < 0.01;

*p < 0.05;

†p < 0.1.

a Since EMU measures also expected membership, it enters the regression in its concurrent realization.

b These variables enter the regression at year t‐2.

The bottom two rows in Table 1 report the average marginal effects, for all countries and conditioned on eurozone membership, of the scrutiny of the excessive deficit procedure. The expectation is corroborated, more convincingly so if we include all EU countries. A full year of oversight during budget drafting leads a government of a eurozone country to reduce the deficit on average by 0.57 per cent of GDP. This figure falls within the 0.5–1 per cent range of the most common recommendations of structural adjustment that eurozone countries under oversight have received between 1999 and 2016 (De Jong & Gilbert, Reference De Jong and Gilbert2020, 6). Considering the 3 per cent deficit ceiling of the Treaty of Maastricht, the impact of oversight is substantial. For a country like the Netherlands (GDP of €639 billion in 2010), it means an impressive improvement of the budget balance by €3.67 billion. The unconditioned impact of oversight on deficits is slightly lower (0.56 per cent of GDP on average) but it is still large and significant, indicating that surveillance displays its effects also on governments outside the eurozone. That actual monetary union membership does not matter much seems plausible if we consider that even Danish and Swedish governments tried to adopt the euro, only for their plans to be rebuffed in referendums.

The impact of oversight is not confounded by that of financial assistance, which is substantial as expected. In the full sample, governments that have been negotiating or benefiting from assistance throughout the full year when the budget is drafted, reduced their deficits on average by 1.14 per cent of GDP. Even if I exclude assisted countries because budgetary consolidation may be attached to disbursements, a full year of oversight leads to a deficit reduction of 0.66 per cent of GDP (p < 0.01).

One concern is that governments may choose to be subject to supranational monitoring. A right‐leaning executive facing the prospect of losing office may loosen its fiscal stance to purposely face oversight. It may then implement the tighter policy it actually prefers and shift the blame on the EU. If governments self‐select into being monitored, this kind of procedural manipulation would cast doubt on the notion that supranational oversight exogenously engenders fiscal discipline. However, I find no evidence of governmental ideology, across any level of replacement risk, or expected duration to be significantly related to periods under scrutiny (see Supporting Information Table A6 and Figure A1). Given the uncertainty, perhaps it should not be surprising that executives do not engage in such procedural strategizing.

Other political features of the country under oversight, such as public or governmental scepticism about the EU, also do not appear to matter. Finance ministers stay away from such political considerations since they may come back to haunt them in the future. Instead, as should be, the fiscal performance of the relevant country and of the EU as a whole (i.e., lagged deficits and lagged average of other countries’ deficits) are strongly associated with periods of oversight. The procedure, in other words, raises awareness among national executives of the temporal and spatial implications of their policies. This non‐random assignment however begs the question of what governments would have done had they not been subject to oversight. In my dataset, I do not observe the deficit of non‐supervised countries that have, for instance, high lagged deficits, given that such lagged deficits trigger oversight. In other words, some covariates are associated with both assignment and outcome.

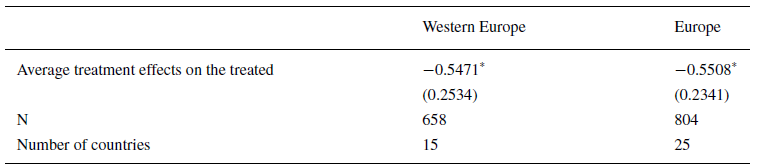

To address this issue, I have extended the dataset to the period preceding the Treaty of Maastricht up to the early 1970s, using the data from Fortunato and Loftis (Reference Fortunato and Loftis2018)Footnote 16 and Franzese (Reference Franzese2002), and estimated the difference‐in‐differences average treatment effects on the treated governments (i.e., under oversight). Table 2 indicates that the effect of oversight is an average reduction of 0.55 per cent of GDP over the mean deficit that would have been observed had governments not been subject to monitoring.

Table 2. Average effects of oversight on potential deficit means of treated countries

Notes: Difference‐in‐differences estimates adjusted for the covariates of the models in Table 1 and country fixed effects. Robust standard errors in parentheses adjusted for country clusters.

*p < 0.05. Auxiliary results are reported in Table A7 in the Supporting Information Appendix.

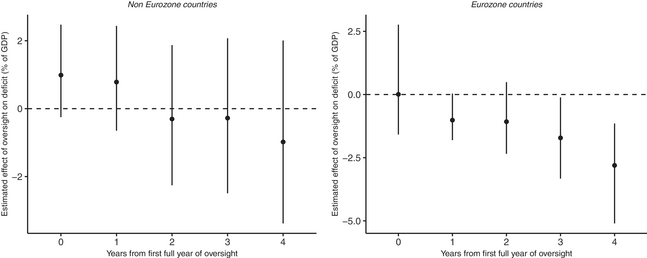

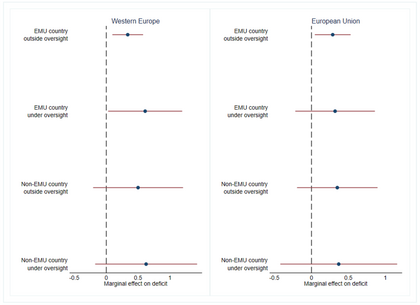

As I mentioned earlier, I do not find evidence of anticipatory effects (i.e., procedural strategizing). Countries are exposed to repeated treatments, that is, they switch between being under surveillance and outside surveillance, and treatments occur at different times and for different durations (see the treatment variation plot in Supporting Information Figure A2). Alternation in treatment status and variation in assignment time and duration, however, preclude the possibility of examining the appropriateness of the parallel trend assumption required for standard difference‐in‐differences estimates. To address this issue, at least partially, I employ the matching method for panel data recently developed by Imai et al. (Reference Imai, Kim and Wang2022). For the time being, this procedure works only for binary treatment indicators. Therefore, I consider a country treated if it has been under oversight for an entire year, including the year when the Council has terminated the procedure since it seems appropriate to account for some carryover effects.Footnote 17 I have then matched each treated country in a given year to a set of control countries that have the same treatment history in the preceding 2 years. This procedure adjusts for time‐specific unobserved confounders while, given the nature of the oversight, it allows for a reasonable balance between controlling for carryover effects, that is, the effects of the treatment history on the deficit, and limiting the number of unmatched treated units.Footnote 18 Following the applications by Imai et al. (Reference Imai, Kim and Wang2022), I have used all the lagged covariates of the model in Table 1 to refine the matched sets.Footnote 19 Figure 1 displays the estimated average effects on the deficit of the treated countries over a period of 5 years – one more than the average duration of the oversight spells. There is no contemporaneous effect of oversight but governments rein in their deficits over time. After four to five years, eurozone governments produce deficits that are on average between 1.72 and 2.81 per cent of GDP lower than that of governments with identical treatment histories and similar covariate distributions but which were not supervised in year t0.

Figure 1. Estimated average effects of oversight on the deficits of the treated countries. Note: The estimates are based on the exact matching of the treatment histories during the 2 years preceding the first full year of oversight. Matched sets are refined with Mahalanobis distance matching up to five matches, using the lagged covariates of the model in Table 1. Treatment reversal is allowed. Vertical bars are the 95 per cent confidence intervals derived from a bootstrapping procedure of 500 iterations.

The impact of oversight and selected political determinants compared

To better appreciate the impact of oversight, I compare it to that of selected political determinants as resulting from Table 1.

Expected government duration and risk of parliamentary dissolution

As a government's expected time in office draws to a close, it begins to accumulate budget deficits. In the year it is expecting parliamentary dissolution, a national executive produces a deficit that is larger by, on average, between 0.32 and 0.45 per cent of GDPFootnote 20 than the deficit produced by a government expecting dissolution within 2 years (1.6 standard deviations). The figures are very close to the 0.42 per cent reported by Fortunato and Loftis (Reference Fortunato and Loftis2018, 948). The impact of a two‐year shortening of expected duration is, however, fully offset by that of one year of supranational oversight during budget drafting.

Fractionalization and polarization of governments

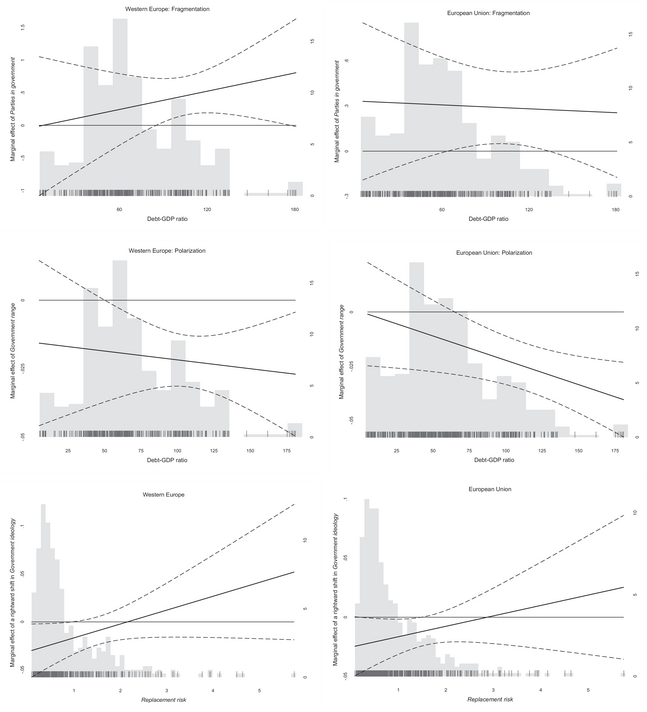

Some of the most prominent results of Franzese (Reference Franzese2002) are the effects of government fractionalization and polarization on fiscal discipline. The top two panels in Figure 2 replicate his analysis (Franzese, Reference Franzese2002, 176, 179) by displaying their marginal effects across levels of debt. If budgetary rules are relatively constraining, higher fractionalization leads as expected to higher deficits when a country is highly indebted. In these circumstances, the addition of a party to a coalition government produces an average increase in the deficit of 0.45 per cent of GDP in Western Europe and 0.29 per cent across all the countries. The size of the effects is lower than in the past (cf. Franzese, Reference Franzese2002, 188) and it decreases as budgetary rules loosen. Moreover, the slope of the curve is contrary to expectations in the full sample (see top row left panel in Figure 2), so the effects become insignificant at further higher levels of debt. In other words, fractionalization does not appear to impede fiscal consolidation in Central and Eastern Europe. Overall, when debt is high, the impact of adding one party to a governing coalition is fully offset by a yearly surveillance of budget drafting.

Figure 2. Marginal effects of fractionalization, polarization and ideology. Note: In the top two panels, the budgetary constraint index is set at a standard deviation above its mean. Curves shift upward as constraints increase. Positive and significant effects occur at high debt ratios and budgetary constraints for Western Europe, but only at mid‐high debt ratios in the full sample because of the downward sloping curve. Histograms underlaid.

On the other hand, more polarization (a larger Government range) significantly reduces deficits at high levels of indebtedness (see the middle panel in Figure 2). At relatively high debt‐to‐GDP ratios (a standard deviation above the mean), a standard deviation increase in range, approximately the difference between the mean polarization of Belgian and Greek governments, leads to a deficit reduction of between 0.31 and 0.34 per cent of GDP. Thus, while fractionalization is still an impediment to fiscal consolidation, more heterogeneous governments have been more successful at reducing deficits. This is not in line with the expectation that more divided governments produce smaller policy shifts. As Franzese (Reference Franzese2002, 178) conjectures, successful fiscal consolidation may require the involvement of a broad set of interests.Footnote 21

Government ideology and risk of replacement

The bottom panels in Figure 2 display the marginal effect of a rightward shift in government ideology across levels of replacement risk. A higher risk does not engender a higher deficit (see also Figure A7 in the Supporting Information appendix), but governments are more likely to follow their ideological inclinations when the risk of being replaced by ideologically different ones is low. Right‐leaning governments tend to reduce deficits, while left‐leaning governments tend to increase them. If the risk of replacement raises, they are less likely to entertain these options. Unlike the findings of Franzese (Reference Franzese2002, 181–183), this behaviour is in line with the theoretical expectations of Persson and Svensson (Reference Persson and Svensson1989). When the risk of replacement is a standard deviation lower than the mean, a standard deviation rightward shift, the difference between the German Christian democrat‐liberal coalition and the Christian democrat‐social democrat coalition in the 2010s, is associated with a reduction in the deficit by between 0.32 and 0.42 per cent of GDP. But the impact of this shift is offset by a year of supranational monitoring of the budgeting process.

Other interesting results concern, for instance, macroinstitutional features, such as effective semipresidentialism and electoral districting, and the simplicity of the tax structure which may have discouraged the exploitation of voters’ fiscal illusion. These factors account for some differences between Western European countries. I discuss these results in section 6 of the Supporting Information Appendix but, before concluding, I explore how oversight and electoral pressures have interacted and whether the impact of oversight has varied across reform periods.

The impact of oversight on fiscal discipline: Extensions

Oversight and electoral pressures

The pressure to accrue support in the proximity of new elections is one of the most important political drivers of deficit spending, but how does it interact with the pressure from oversight? To explore this, I have added to the models in Table 1 a three‐way interaction between Expected duration, EDP and EMU. Figure 3 illustrates the marginal effects of a two‐year shortening of expected government duration across four scenarios. Electoral pressures do not dissipate for governments under oversight since these effects remain positive at similar levels. However, estimates are more uncertain, and this is not due to fewer observations but because some of these governments are less eager to entertain fiscal expansion. There is, therefore, some indication that being under surveillance may lower the electoral benefits of profligacy, perhaps because charges of fiscal irresponsibility are more persuasive in the presence of a supranationally determined excessive deficit. For instance, following oversight, the Swedish and German governments posted a budget surplus during their election years in 1998 and 2013, respectively. This topic surely deserves further research.

Figure 3. Marginal effect on deficit of a two‐year shortening of expected government duration. Note: Marginal effects of expected duration derived from models adding three‐way interactions between Expected duration, EDP and EMU to the models in Table 1. For the oversight scenarios, they are computed for a full year (i.e. EDP = 1). Horizontal bars are the 95 per cent confidence intervals. [Colour figure can be viewed at wileyonlinelibrary.com]

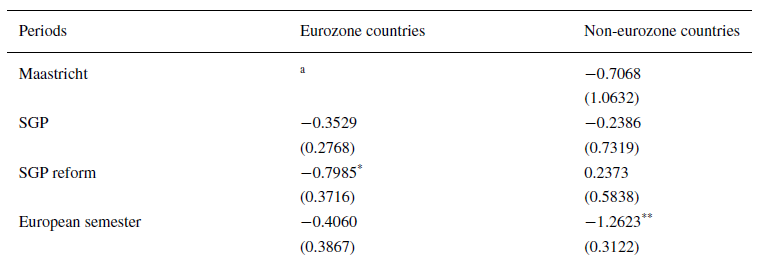

The impact of oversight across reforms of the policy

Since its establishment, three reforms have modified the procedure and the criteria for determining compliance: the Stability and Growth Pact in July 1997, its reform in June 2005, and the European Semester reform in November 2011. Does the impact of oversight vary across reforms? To investigate this, I have added to the European Union model in Table 1 a three‐way interaction between EDP, EMU and a one‐year lagged period indicator. Table 3 reports the marginal effects of oversight across reform periods and eurozone membership. The effects are negative across almost all circumstances and they do not differ significantly among themselves. There is thus limited evidence, especially for eurozone countries, that oversight has been more effective in some periods. Monitored eurozone governments consolidated more extensively after the SGP reform and this resonates with De Jong and Gilbert's (Reference De Jong and Gilbert2020, 11, 19) findings about their better compliance record in the pre‐crisis period. Several non‐eurozone governments were under oversight just prior to the institutionalization of the European semester, which occurred in the midst of the crisis. This explains the only positive value. These governments then consolidated after this reform.

Table 3. Marginal effects of oversight across reform periods and eurozone membership

Note: Periods: Maastricht 1994–1996; SGP (Stability and Growth Pact) 1997–2004; SGP reform 2005–2011; European semester (Six Pack and Fiscal Compact) 2012–2019.

Table 3. Not applicable. N = 516.

**p < 0.01;

*p < 0.05.

Conclusion

Far from being irrelevant or a failure, supranational oversight has shaped national budgetary processes to a significant extent. The impact of one year of monitoring during budget drafting offsets that of a two‐year shortening of expected duration, or the addition of one party to a government coalition when debt is high, or a leftward shift in government ideology when the risk of replacement is low. And politics matters as much as economics in determining the fiscal policies of European countries, almost literally. Starting from a model with only temporal effects, spatial effects and lagged debt levels as a benchmark, the improvement in explaining the overall observed variation in deficit by including economic conditions exceeds only slightly the improvement one would obtain from adding political determinants.

There are two important implications of these results. First, there is nothing normatively wrong with democratically elected executives trying to win elections, pursue their policy priorities, or cater to their constituencies. So, that governments have not given up their freedom to choose the timing and extent of their deficit spending, if they have been fiscally disciplined, is good news. But actual or expected membership of a monetary union has strings attached. Excessive fiscal profligacy normally leads financial markets to doubt a country's ability to meet its obligations. Eventually, governments will have to put their house in order or face the distressing prospect of default, if growth or inflation are not readily achievable. In a monetary union, the effects of profligacy and default, and the vagaries of market behaviour reverberate more severely, as the sovereign debt crisis showed. Thus, the excessive deficit procedure has been designed to address the legitimate concerns of limiting these negative externalities. The effectiveness of this regime is, therefore, reassuring, and – the second implication of this study – it is crucial for the fledging EU fiscal policy.

Since the sovereign debt crisis and during the recent pandemic, the EU has been expanding its limited fiscal capacity that, according to several observers, has been a serious flaw of the monetary union. Opponents of these developments raise legitimate concerns about the waste of public resources on governments whose fiscal performance is poorly scrutinized. Showing that the excessive deficit procedure is not irrelevant may assuage these worries and strengthen the mutual trust required for developing an EU‐wide fiscal capacity.

Surely, I have only scratched the surface of the politics of fiscal oversight with this work, but its results point to interesting avenues for future research. A more systematic analysis of the factors associated with the use of this procedure, besides those discussed here, is warranted. A closer look at the domestic narratives of oversight may better flesh out the mechanisms behind its effectiveness. Lastly, the recent diffusion of domestic independent monitoring bodies – an institutional innovation triggered by the sovereign debt crisis and now mandated by EU law – may in the future render the procedure redundant but, for the time being, we at least can say that it works.

Acknowledgements

I would like to thank Michael Becher, Carlos Closa, Nicolò Conti, Catherine E. De Vries, David Levine, Livio Di Lonardo, Philipp Genschel, Erik Jones, Lanny Martin, Massimo Morelli, Gianluca Passarelli, Thomas Sattler and Simon Hix as well as the participants at seminars of the Bocconi University, the European University Institute, the Sapienza University, and at the 2021 Annual Conference of the European Political Science Association.

Online Appendix

Additional supporting information may be found in the Online Appendix section at the end of the article:

Online Appendix

Supporting information