Introduction

Milk and dairy products constitute a nutritionally important food matrix that is widely consumed in many countries. Milk fat serves as a crucial component to produce standard commodities such as butter, cream, cheese and whole milk powder (Mohan et al., Reference Mohan, O'Callaghan, Kelly and Hogan2021). Besides its contribution to flavour, fat also plays a role in the technological properties and visual attributes of milk and is associated with the desirable consumer attributes of cream (McCarthy et al., Reference McCarthy, Lopetcharat and Drake2017). From an animal research perspective, some milestones in milk fat research need to be noted. Modifying dietary lipids in ruminant diets has emerged as the most practical, fast and effective means to change milk fatty acid (FA) profile, which started with the aim of increasing milk fat per cent by feeding oilseeds to cattle (Wood, Reference Wood1894). Investigations into effects of dietary fats on dairy cattle were initiated at Cornell University from 1929 until 1943, yielding valuable insights into the role of fats in dairy cow rations (Palmquist and Jenkins, Reference Palmquist and Jenkins2017). Subsequently, Reiser et al. (Reference Reiser, Gibson, Carr and Lamp1951) first described the rumen biohydrogenation process, explaining how dietary polyunsaturated fatty acids (PUFA) are transformed into various end-products and by-products, including saturated fatty acids (SFA) and trans fatty acids (TFA: Bionaz et al., Reference Bionaz, Vargas-Bello-Pérez and Busato2020). Notably, the accidental discovery of conjugated linoleic acid (CLA) in 1978 by Michael W. Pariza at the University of Wisconsin while studying mutagens in grilled beef (Pariza et al., Reference Pariza, Ashoor, Chu and Lund1979) marked a significant turning point in this field and led to extensive research on CLA, particularly rumenic acid (cis-9, trans-11 CLA), which is almost exclusively found in ruminant derived products. In some experimental models it has been demonstrated to have anti-cancer (Ko et al., Reference Ko, Kim, Park, Lee, Kim, Kim and Kim2020) and anti-inflammatory (Zheng et al., Reference Zheng, Gao, Zhu, Meng and Walker2020) properties.

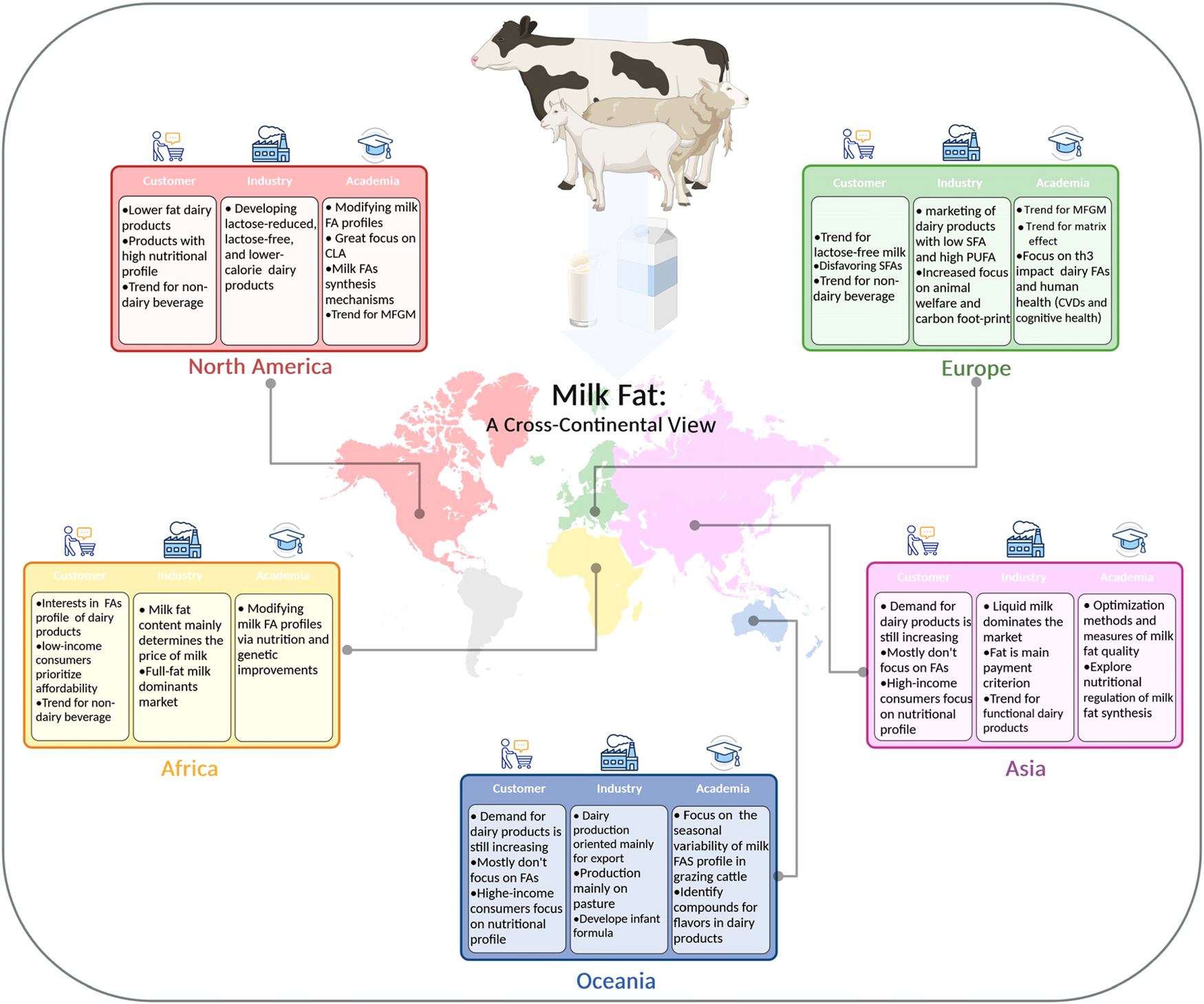

The varying interests of industry and stakeholders in milk fat are mirrored in the policies and research initiatives undertaken in different countries. Therefore, this position paper assimilates knowledge from six regions: North America (United States and Mexico), Europe (United Kingdom, Spain, Italy, and Finland), Africa (Egypt), Asia (China and Bangladesh), and Oceania (New Zealand). We discuss milk fat research and how it plays a critical role in shaping the future of dairy food technology. The following sections delve into intercontinental research endeavours in the field of milk fat emanating from our research network, fostering a richer understanding of the intricate relationships between milk fat, policy, and research (Fig. 1).

Figure 1. Milk fat: a cross-continental view (Created with BioRender.com).

This manuscript is a cross-continental narrative Research Reflection as it involves collaborations between researchers or institutions located in different continents. The manuscript accounts for diverse perspectives where there is access to varied data of global impact but has challenges, such as language barriers, differences in research practices and regulations, and varying cultural norms. Therefore, the variety of discussed information will not be the same for each of the countries. This Research Reflection does not include South America, and this will warrant further attention as it has made great contributions to the global dairy industry. All co-authors have worked with milk fat at some point in their careers, and we have written this article because we consider that the topic has lost attention at least in some parts of the world.

Milk consumption and milk fat from a consumer perspective

North America

In the US, per capita consumption of fluid milk shows a long-running downward trend (declining by around one half between 1970 and 2019, attributable to shifts in dietary patterns; USDA, 2023). Whilst the introduction of plant-based drinks has contributed to this trend, they are not the primary driver, which is probably related to consumer perception. Also, over the past two decades, US dairy has shifted to decrease in milk fat content and an increase in low-fat cheese production. In 2000, the average milk fat content was 2.01%, decreasing to 1.83% in 2012. However, a subsequent renewed interest of consumers in milk fat led industry to reach an average milk fat content of 2.10% in 2019 (USDA, 2023). The overall consumption of all types of cheese experienced an upsurge with a swifter growth for low-fat types. The current production of American-type cheeses (Cheddar, Colby, Monterey and Jack) is 44% higher than 2000 levels (USDA, 2023). Regarding liquid milk, consumers are becoming much more nutrition-conscious in their beverage choices, so the competition from non-milk beverages increases and a segment of consumers look for milk-based products that are low fat and have high protein and calcium contents as well as reduced calorie content (Barbano, Reference Barbano2017). However, drinking milk is generally recommended over non-dairy beverages due to positive health effects. For example, a recent meta-analysis suggested that dairy product consumption may have inverse associations with type 2 diabetes risk, mainly due to the anti-diabetogenic effects of dairy fat (Parodi, Reference Parodi2016). The current ‘Dietary Guidelines for Americans, 2020–2025’ recommends daily consumption of 2–3 cup-equivalents of dairy products, but it is estimated that only about 10% of the US population meets this guideline.

Mexico has followed a similar trend as the US, with consumption of dairy products and fluid milk decreasing in the past years, and non-dairy products taking important market positions as consumers are more aware of their alleged benefits. In addition, Mexican consumers desire one-stop shopping, driving the growth of hypermarkets and supermarkets. However, inflation in the overall market and lower purchasing power are creating high sensitivity to prices and causing consumers to cut back and seek promotional deals. Opportunities in the region will be at both ends of the spectrum, from premium dairy items (such as flavoured milk and added-value drinking yogurts) to core staple products (like powdered milk and yogurt) representing key categories.

Europe

Consumer knowledge, perception and purchasing behaviour of dairy products vary from country to country. A recent study on consumer perceptions of milk fat in several countries (Denmark, the UK, and the US) reported that awareness of milk saturated fat was higher among respondents from the UK (53%) than from Denmark (44%) and the US (38%; Vargas-Bello-Pérez et al., Reference Vargas-Bello-Pérez, Faber, Osorio and Stergiadis2020). Milk fat was perceived as healthy in all 3 countries and whole and semi-skim milk were less consumed in Denmark (20 and 36%, respectively) compared with the UK (50 and 49%, respectively) and the US (47 and 50%, respectively).

In the UK, the consumption of liquid milk between 1970 and 2000 has shifted, with a decline in whole milk consumption and a rise in semi-skimmed and skimmed milk consumption (Kliem and Givens, Reference Kliem and Givens2011; DEFRA, 2022). This trend has been mirrored in other countries such as France, Denmark, Italy and Germany (Kliem and Givens, Reference Kliem and Givens2011). The cause of the decline in whole milk consumption (and consumption of other dairy products) can be partially attributed to the surge in popularity of plant-based milk alternatives, as well as increased consumer awareness of sources of saturated fat in their diet following publication of the UK Food Standards Agency's report on ‘Saturated Fat and Energy Intake’ (Food Standards Agency, 2008). It is important to note that it is too early to establish the real relevance plant-based milk alternatives vs. milk, even though their popularity seems to be growing.

In Spain, cow milk dominates the market while goat milk consumption is growing due to its perceived health benefits. However, semi-skimmed cow milk is preferred by Spanish consumers, followed by skimmed and whole milk (Collantes, Reference Collantes2021). Notably, overall liquid milk consumption has decreased by 7% since 2008. Meanwhile, lactose-free milk is gaining popularity, while demand for milk enriched with calcium, vitamin D or omega-3 FA is declining. Concerns around dairy farm profitability and sustainability, animal welfare and rural depopulation have led to promotional efforts by industry organizations (e.g. InLac; Interprofessional Dairy Organization and FeNIL; National Federation of Dairy Industries), and research has focused on promoting the benefits of dairy fat intake (López and Lainez, Reference López Iglesias and Lainez Andrés2022).

Plant-based drink consumption has increased significantly, however there is still a lot of misinformation regarding nutritional facts (López Iglesias and Lainez Andrés, Reference López Iglesias and Lainez Andrés2022).

In Finland, the number of dairy production factories as well as milk producers have decreased markedly in 20 years. Also, milk consumption has dropped in this country from 227.6 kg per capita in 1970 to 99.2 kg per capita in 2021, with a shift towards skimmed and semi-skimmed milk (NRIF, 2022). The consumption of butter has decreased since 1962, while the consumption of cheese has increased. Also, yogurt consumption has risen while sour milk consumption has fallen (NRIF, 2022). There has been a long-standing debate surrounding dietary saturated fats and their impact on cardiovascular diseases (CVDs) (Puska and Jaini, Reference Puska and Jaini2020) and finally The National Nutrition Council of Finland supported policies promoting low-SFA dairy products (Jallinoja et al., Reference Jallinoja, Jauho and Mäkelä2016). Recently, a study of 320 Finnish consumers which investigated willingness to pay using a hypothetical choice experimental design with four attributes (type of animal feed, saturated fat content, Carbon Trust label and price) revealed preferences for low-price butter derived from milk produced by cows fed with regular feed that carries the ‘Carbon Trust’ label as well as ‘reduced staurated fat’ claim (Asioli et al., Reference Asioli, Zhou, Halmemies-Beauchet-Filleau, Vanhatalo, Givens, Rondoni and Turpeinen2023). In other words, participants responded to both perceived health and environmental benefit claims. One-third of these participants (predominantly the younger and more highly educated) were willing to pay a premium price for butter derived from milk produced by cows fed with rapeseed feed. There has been considerable media debate amongst Finnish consumers regarding the relative benefits/risks of dairy fats vs. vegetable oils (Jallinoja et al., Reference Jallinoja, Jauho and Mäkelä2016) and more recently plant-derived beverages have become more popular.

Examples from Africa and Asia

In Egypt, milk fat content determines the price of milk, with a basic milk price assigned to 3% fat content (Soliman and Mashhour, Reference Soliman and Mashhour2011). Historically, whole milk consumption has exceeded that of low-fat or de-fatted (skim) milk in Egypt. However, a gradual increase in the demand for fat-reduced milk has been observed in recent years, followed by a renewed upsurge in the preference for whole milk (Soliman and Mashhour, Reference Soliman and Mashhour2011). Egyptian consumers perceive dairy products as a source of health benefits, however rising prices have altered preferences. Yogurts, sour milk, soft and hard cheeses, liquid milk and butter are the most consumed dairy products. Margarine has become more popular as butter prices rise (EU, 2019). Recently, consumers have become increasingly interested in the FA composition of milk, particularly CLA and omega-3 FAs, however, high costs hinder the market's growth. The low-income consumers still prioritize affordability, which may include products with high TFAs (El-Hossainy et al., Reference El-Hossainy Ayah, Ahmed, Kheder, Nour Sohair and El-Sawy2021). Plant-based and non-dairy beverage products are increasing in the Egyptian markets, however, the shift towards these products is still weak and needs more emphasis on their nutritive value (El-Hossainy et al., Reference El-Hossainy Ayah, Ahmed, Kheder, Nour Sohair and El-Sawy2021).

In China, dairy production reached 30.55 million tons in 2023, with liquid milk making up over 90%. Demand for dairy products is still increasing with per capita consumption reaching 14.4 kg in 2021, a 10.6% annual increase (Song et al., Reference Song, Yang, Wang and Sun2022). China's dairy market offers various products, including liquid milk, milk powder, condensed milk and cheese. Higher-income consumers prioritize nutrition, taste, price, sales channels and packaging when purchasing dairy products (Yang et al., Reference Yang, Wang, Ma and Cheng2021). Despite the growth, China's dairy consumption falls behind developed countries. At present, lipid-optimized products attract consumers, especially those labelled ‘grass fed’ or ‘grazing’.

In Bangladesh, milk processors use a payment system based on milk fat percentage (Karmaker et al., Reference Karmaker, Das and Iqbal2020). The Bangladesh Standards and Testing Institution (BSTI) sets minimum legal requirements for milk fat in the market (Hossain et al., Reference Hossain, Jahan and Khatun2022). Research on milk and dairy products in Bangladesh primarily focuses on total fat content. The consumption of liquid milk has been greatly challenged by different soft and energy drinks. The purchasing capacity of the individuals is another concern, especially the allocation of family budget for dairy items is often not sufficient. Also, adulteration, including watering milk, skimming milk and adding low-cost animal and/or vegetable fat and/or oil to milk (or synthetic milk), is a customer concern (Hossain et al., Reference Hossain, Jahan and Khatun2022).

Oceania

Dairy production in New Zealand has historically oriented towards export markets (Aziz et al., Reference Aziz, Samsudin, Nambiar, Aziz, Li and Zhong2019). Approximately 95% of the milk produced in New Zealand is earmarked for export, accounting for around a third of the volume traded. Notably, New Zealanders are among the highest annual per capita consumers of milk (~110 kg) and butter (~6 kg: NZPC, 2020). So, New Zealand's dairy industry conducts research on milk fat to meet consumer demands and preferences abroad in export-oriented countries (Galtry, Reference Galtry2013; Aziz et al., Reference Aziz, Samsudin, Nambiar, Aziz, Li and Zhong2019), focusing on the impact of pasture feeding on its quality. Grazed pasture is the primary feed source for cows resulting in a series of studies focused on understanding the seasonal variability of milk fat composition. Feeding grain can alter the flavour profile of the milk, and studies have identified specific compounds responsible for ‘grassy’ notes associated with pasture feeding (Aziz et al., Reference Aziz, Samsudin, Nambiar, Aziz, Li and Zhong2019). Studies have identified compounds responsible for distinct flavours and aromas, enabling the optimization of milk and dairy products for international markets (Bendall, Reference Bendall2001; Wales and Kolver, Reference Wales and Kolver2017).

Studies covering consumer perception of milk fat

Consumer perception of milk fat has been extensively studied to understand its impact on purchasing decisions and dietary preferences (Vargas-Bello-Pérez et al., Reference Vargas-Bello-Pérez, Faber, Osorio and Stergiadis2020; Martínez-Padilla et al., Reference Martínez-Padilla, Faber, Petersen and Vargas-Bello-Pérez2023). Studies consistently show that milk fat content significantly influences the taste and flavour perception of dairy products. Higher fat content often correlates with a richer, creamier taste, which many consumers find more satisfying and enjoyable (Waldron et al., Reference Waldron, Hoffmann, Buchheim, McMahon, Goff, Crowley and Siong2020). Milk fat contributes to the smoothness and mouth-coating texture of dairy products like milk, yogurt and ice cream, and consumers often associate higher fat content with a more indulgent and pleasant mouth feel (Waldron et al., Reference Waldron, Hoffmann, Buchheim, McMahon, Goff, Crowley and Siong2020). Consumer attitudes towards milk fat have evolved with changing dietary guidelines and health trends. While some consumers prioritize low-fat or skim milk due to perceived health benefits (lower calorie and fat content), others view whole milk and full-fat dairy products as more natural and less processed (Vargas-Bello-Pérez et al., Reference Vargas-Bello-Pérez, Faber, Osorio and Stergiadis2020).

There is ongoing debate and varying consumer beliefs regarding the nutritional benefits of different milk fat levels. Some consumers prefer higher fat content for its perceived satiety and nutritional value (fat-soluble vitamins and essential fatty acids), while others opt for lower fat content for weight management or cardiovascular health reasons (McCarthy et al., Reference McCarthy, Lopetcharat and Drake2017). Milk fat content influences culinary practices and recipes. Chefs and home cooks often choose specific fat levels for cooking, baking and preparing dishes based on desired texture, flavour extraction and cooking techniques (Marcus, Reference Marcus2013). Consumer perception of milk fat is also shaped by labelling and marketing strategies. Clear labelling indicating fat content (eg whole milk, 2% milk, skim milk) helps consumers make informed choices based on their preferences and dietary goals (Hoque et al., Reference Hoque, Xie and Nazneen2018). Consumer perception of milk fat can vary significantly across regions and cultures. Some cultures traditionally favour higher-fat dairy products for their culinary heritage and cultural preferences (Vargas-Bello-Pérez et al., Reference Vargas-Bello-Pérez, Tajonar, Foggi, Mele, Simitzis, Mavrommatis and Toro-Mujica2022). Over time, there have been shifts in consumer preferences towards reduced-fat or fat-free dairy products driven by health consciousness and dietary trends. However, there remains a steady consumer demand for whole milk and full-fat dairy products based on taste, texture, and perceived nutritional benefits (Kumari et al., Reference Kumari, Solanki, Sudhakaran, Minj, Sudhakaran and Kumari2020).

Integrating these studies provides a comprehensive understanding of how consumer perception of milk fat influences purchasing decisions, dietary choices, and overall satisfaction with dairy products. This knowledge is valuable for dairy industry stakeholders in product development, marketing strategies and meeting consumer preferences effectively. The authors of this reflection believe that consumer knowledge, perception, and purchasing behavior vary across countries and regions, influenced by factors such as cultural background, income level and nutritional awareness. We note that in developed countries (especially in North America and Europe) there is a shift in consumer preferences towards low-fat milk, skim milk and plant-based drink options. This trend is driven by concerns about saturated fat intake and animal welfare beside the window-dressing of non-dairy beverages. On the other hand, in developing countries (especially Africa and some parts of Asia) where affordability is a priority, dairy products remain popular. We also stress the need for dairy industries to address emerging trends and consumer concerns, such as sustainability, animal welfare and nutritional value, to maintain their competitive edge in the market.

Milk fat from an industrial perspective

Milk fat plays a crucial role in the dairy industry for several reasons (Waldron et al., Reference Waldron, Hoffmann, Buchheim, McMahon, Goff, Crowley and Siong2020). Milk fat contributes significantly to the flavour and texture of dairy products, and it provides richness and enhances the overall sensory experience of dairy products. Milk fat is important for processing flexibility allowing the manufacture of different products based on fat percentages and contributes to the texture, meltability and overall performance (Chandan, Reference Chandan, Chandan, Kilara and Shah2015) during processing and storage. Also, milk fat content influences the economic value of milk as higher-fat milk commands a premium price in the market, which is beneficial for dairy farmers and processors (Wiley, Reference Wiley2007). The following paragraphs will explain specific details about the dairy industry from different geographical regions.

North America

Milk fat has become valuable in the US dairy market, making up more than 50% of the price paid to milk producers (Santos and De Vries, Reference Santos and De Vries2019). Following a consumer shift towards healthier, sustainable, and ethically sourced products, the industry has developed novel technologies such as lactose-reduced and lactose-free milk variants. More recently, a novel approach combining partial lactose removal through ultrafiltration with enzymatic hydrolysis of the remaining lactose has yielded a lower-calorie, lactose-reduced fluid milk product (Barbano, Reference Barbano2017). In Mexico, milk is segmented according to fat content (whole, semi-skimmed, and skimmed milk) but few efforts have been made to introduce more novel milk types. In North America, the North American Free Trade Agreement (NAFTA) regulates the production of dairy products that can be exported or imported (Kondaridze and Luckstead, Reference Kondaridze and Luckstead2023). However, each country such as the United States, Mexico, and Canada has an economic system and a consumer culture that allows the production of certain variants in the dairy supply in the market of these countries.

Europe

In the UK, the launch of the ‘Saturated Fat and Energy Intake’ program in 2008, led to growing industry interest in improving the FA profile of milk and dairy products by dietary alteration (Dairy4future, 2021). One product arising from research following this was whole milk containing less SFA, but it is no longer commercially available. There have been other efforts by the UK industry to meet consumer demand in terms of milk fat composition. Two products with enhanced long-chain omega-3 PUFA contents (achieved by either fortifying fresh milk with fish oil emulsion or adding fish oil to dairy cow diets) were launched in 2005, but again these are no longer commercially available, perhaps partially due to the higher production costs for these products.

The dairy industry in Spain has absorbed all the increase in domestic milk production, so that in the last decade the volume of milk processed has increased by 1.3 million tons. More than half of this increase went to cheese production and the rest to yogurts, desserts and industrial products, compared to stabilization in packaged liquid milk. Changes in the business structure have occurred, thanks to the growth of medium-sized dairy industries that are committed to more sustainable production systems and good animal welfare practices (López and Lainez, Reference López Iglesias and Lainez Andrés2022).

The Italian dairy industry, specifically the fluid milk sector, has undergone considerable changes over the past few decades. However, 60–80% of national milk yield is used for cheese making with high added value. The pursuit of liberalization is not a novel phenomenon within the EU, and the 2003 Reform prompted farm-gate competitiveness, and created a more market-driven industry, leading to intense competition and profit redistribution along the supply chain (Cassandro, Reference Cassandro2003).

Currently, Finnish dairy market offers fat-modified products, especially butter-vegetable oil mixtures, using different vegetable oils such as rapeseed, olive, and linseed. Carbon-neutral and animal welfare-friendly practices are increasingly important, with dairy companies paying more for farmers committed to animal welfare. Dairy companies market their products as free-range (loose housing, year-round access to outdoors and grazing during summertime), increased animal health, soy-free, and GMO-free feeding as well as using organic labelling. Finnish dairy companies have expanded into plant-based drinks and other plant-based dairy-like products. In addition, in recent years high-protein and sugar-reduced dairy products have become more important in the market.

Although in the European Union, there are certain common laws for the member countries, the dairy industry in each country works based on what their economic system allows them as well as the culture of dairy consumption that exists in each country.

Examples from Africa and Asia

The dairy industry is a key component of Egypt's food system. The government highly supports the dairy industry via legalization and financial support (Soliman and Mashhour, Reference Soliman and Mashhour2011). In addition to government support, the Chamber of Food Industries, operating under the auspices of the Federation of Egyptian Industries, acts as a prominent entity advocating for the interests of the dairy industry. Furthermore, research institutions and universities collaborate closely with the industry, offering consultancy services and addressing challenges faced by this sector.

In China, the dairy industry is increasingly emphasizing the development of functional dairy products and catering to diverse age groups. Functional dairy products are made by precisely adding functional ingredients to raw milk. Examples include high-end products with deep-sea fish oil and phospholipids (for improving bone- and cardiovascular- health in older adults) and with algal oil DHA, vitamin A and vitamin D to promote healthy growth and development in children. Ongoing research and development efforts continue to drive innovation in this area towards ‘zero sugar’, high fiber, probiotics and special contributions such as organic milk powders and products that address lactose intolerance (Wang et al., Reference Wang, Wang, Wang, Gao and Sun2021).

Milk production in Bangladesh falls short of meeting demand, leading funding agencies to support initiatives that boost output. However, funding is limited, and the industry doesn't invest enough in research. In addition, the use of non-dairy beverages such as soy milk and coconut milk to replace/be used along with milk has yet to reach the industry (Hossain et al., Reference Hossain, Jahan and Khatun2022). Dairy farmers receive higher payments for more fat. Adulteration and fat losses during the handling and processing of milk are major concerns.

The cases of Africa (Clay and Yurco, Reference Clay and Yurco2020) and Asia (Zolin et al., Reference Zolin, Cavapozzi and Mazzarolo2021) each deserve a thorough review, however in these regions of the world it is necessary to consider geopolitical situations and agronomic conditions that can greatly limit or promote the development of the dairy industry.

Oceania

In recent years, the New Zealand dairy industry has focused on the development of premium products for consumers in Asian countries, particularly in China, with the narrative of naturalness in pastoral production (Galtry, Reference Galtry2013). The New Zealand milk sector makes a major contribution to infant formula, and the research in milk fat has focused on the role of some milk fat components, especially phospholipids (sphingomyelin, gangliosides, ceramides and milk fat globule proteins) as key for the neural development of infants (Galtry, Reference Galtry2013; Aziz et al., Reference Aziz, Samsudin, Nambiar, Aziz, Li and Zhong2019). Dairy ingredients such as SureStart™ have been developed for use in paediatric formulas to support cognitive function. These ingredients seek to increase the concentration of phospholipids in infant formula to levels comparable to those found in human breast milk.

The dairy industry has been adapting to cope with changing consumer preferences, with a focus on developing lower-calorie, lower-fat and more sustainable products. These adaptations have gained momentum in some countries resulting in dairy products that are well-received by the consumer. In North America, innovative products such as lactose-reduced and lactose-free milk variants have emerged, while in Europe, fat-modified and FA-improved products have been developed. All these advancements have prioritized environmentally friendly and animal welfare-friendly practices. However, in countries where the primary focus of industry is maximizing production without concern for environmental impact and health benefits, it is unrealistic to expect swift changes and conform to worldwide trends owing to various cultural, economical, and political issues.

Milk fat from an academic perspective

North America

The success of current and future initiatives aimed at promoting the consumption of dairy products will, in part, rely on the public's perception of their potential health benefits. Recent research has shifted its focus from modifying milk FA profiles to investigating the effects of other milk fat components on human health, particularly bovine milk fat globule membranes (MFGM). Several reviews from both sides of the Atlantic have emphasized critical aspects of MFGM, including its role in brain-immune-gut axis development in early life; fat digestion during infancy, and milk fat droplet size regulation and implications for digestion (Wooding and Kinoshita, Reference Wooding and Kinoshita2023; Yao et al., Reference Yao, Ranadheera, Shen, Wei and Cheong2023). In addition to advancing our understanding of milk fat synthesis mechanisms (Wooding, Reference Wooding2023), there is a need to bridge the gap between animal science and dairy food science to develop practical applications for human nutrition. In Mexico, for the past 15 years research on milk FA has been divided into humans (Escalante-Araiza and Gutiérrez-Salmeán, Reference Escalante-Araiza and Gutiérrez-Salmeán2021), animals (especially ruminants; Vargas-Bello-Pérez et al., Reference Vargas-Bello-Pérez, Faber, Osorio and Stergiadis2020) and dairy products (Ochoa-Flores et al., Reference Ochoa-Flores, Hernández-Becerra, Velázquez-Martínez, Piña-Gutiérrez, Hernández-Castellano, Toro-Mujica and Vargas-Bello-Pérez2021). Funding bodies have been interested in supporting research initiatives focused on milk fat or any other milk bioactive compound but today most research funding (National Council of Humanities, Sciences, and Technologies; CONAHCYT) supports projects which have a social application.

Europe

Within the UK, The Scientific Advisory Committee on Nutrition (SACN) recommends limiting SFA to 10% of total energy intake and TFA to 2%. However, adult intake of SFA remains higher than the SACN recommendation (SACN, 2019). The impact of modified FA dairy products on human health was recently determined via a randomized controlled trial at the University of Reading (‘Replacement of SFAs in dairy on total cholesterol, RESET’), during which SFAs in milk, cheese, and butter were replaced with cis-monounsaturated fatty acids (cis-MUFAs) by changing the dairy cow diet. The study reported improved blood lipid profiles, vascular function, and reduced cardiovascular disease (CVD) risk markers (Vasilopoulou et al., Reference Vasilopoulou, Markey, Kliem, Fagan, Grandison, Humphries and Lovegrove2020). Also, there is still active research on the n-3 PUFA content of milk fat, especially for organic milk. However, it should be remembered that even the n-3 PUFA content of organic milk is still very low compared with other sources of dietary n-3 PUFA, and it is still debatable whether this would be nutritionally meaningful if all consumers switched from conventionally- to organically-produced milk. It should also be considered that the majority of n-3 PUFA in milk is in the form of α-linolenic acid (ALNA), rather than the biologically active longer chain n-3 PUFA EPA and DHA.

Numerous large-scale nutritional studies conducted in Spain, specifically the Predimed and Predimed Plus, have investigated the relationship between dairy product consumption and cognitive function within the context of the Mediterranean diet and the results showed no clear prospective associations between consumption of most consumed dairy products and cognition (Ni et al., Reference Ni, Nishi, Babio, Martínez-González, Corella and Castañer2022). That said, recent research aimed at incorporating MFGM into different dairy products is providing promising results in the prevention of age-associated cognitive decline (Calvo et al., Reference Calvo, Kohen, Díaz-Mardomingo, García-Herranz, Baliyan, Tomé-Carneiro, Colmenarejo, Visioli, Venero and Fontecha2023).

Italy is a leader in research on the FA profile of small ruminant dairy products ranging from FA characterization of cheeses to the use of FA as biomarkers for production seasons (Formaggioni et al., Reference Formaggioni, Malacarne, Franceschi, Zucchelli, Faccia, Battelli and Summer2020). In contrast, research on milk fat modification in Finland has been limited and mostly focused on mitigating enteric methane emissions and modulating milk fat depression in early lactation (Jallinoja et al., Reference Jallinoja, Jauho and Mäkelä2016).

Examples from Africa and Asia

Enhancing and optimizing milk fat and its FA profile has received significant attention in Egyptian research institutions and universities. Notably, there has been a greater focus on augmenting fat and healthy FA content in comparison to other milk constituents, such as protein. This may be attributed to the possibility of affecting milk fat content/composition through many strategies including animal nutrition and genetic improvement (Soliman and Mashhour, Reference Soliman and Mashhour2011).

In China, precision nutrition is a common issue addressed by researchers in the field of dairy farming, such as the dietary addition of 5% rumen-protected polyunsaturated fatty acids (sesame oil) to increase the content of UFA, MUFA, and CLA in milk (Xu et al., Reference Xu, Yang, Cao, Duan, Ma, Wang and Guo2022). Research in the milk processing field focuses on optimizing milk fat quality, including altering inherent lipid components, and adding exogenous lipids (Song et al., Reference Song, Yang, Wang and Sun2022). In terms of basic scientific research on milk fat, the National Natural Science Foundation of China (NSFC) has largely funded research exploring the mechanism of nutritional regulation of milk fat synthesis, milk fat depression syndrome, and infant milk fat digestion.

Bangladesh is very active in characterizing FA from different dairy products such as cheese, butter, ghee, doi, and rasomalai from buffalo (Asif et al., Reference Asif, Deb, Habib, Harun-ur-Rashid, Sarker, Shahjadee and Islam2021). This is perhaps one of the leading countries in using these ruminants focused on dairy production.

Oceania

There is a great trend for searching the effects of milk phospholipids on cognitive development in infants, as well as exploring their potential to address brain function decline in adulthood. Other research interests include the development of ‘nutrient bundles’ based on milk phospholipids and enriched with other nutrients such as vitamins to deliver benefits on cognition, mood and sight (da Silva et al., Reference da Silva, Colleran and Ibrahim2021; Yao et al., Reference Yao, Ranadheera, Shen, Wei and Cheong2023). Furthermore, research has also been conducted to characterize the composition of MFGM ingredients (Brink et al., Reference Brink, Herren, McMillen, Fraser, Agnew, Roy and Lönnerdal2020), providing a deeper understanding of the complex chemical entities present in milk phospholipids, informing animals and clinical trials.

Author insights

Modifying milk fat composition has shown promise in improving blood lipid profiles, and vascular function and reducing cardiovascular disease risk markers. Research on milk fat modification has primarily focused on enhancing the nutritional value of dairy products for human health, rather than addressing environmental concerns. There is a need for more research on the practical applications of milk fat modification in human nutrition, as well as bridging the gap between animal science and dairy food science.

Implications for the dairy industry

In writing this Reflection, it has become clear that milk fat has been and continues to be important for the dairy industry, not only for the development of different dairy products but also as a factor that promotes economic gains for both farmers and different actors in the chain of dairy production. The dairy industry has been very receptive to the needs and demands of consumers and this is reflected in the development of products that are even made with alternative inputs to milk (for example non-dairy drinks made from oilseed crops).

Perhaps for the industry, the scientific development related to the improvement of FAs in milk fat is not a priority, but the total amount of milk fat is, since it is important for the processing and manufacturing of different products. The dairy industry is likely to continue searching for alternatives to dairy fat that may have similar sensory and processing characteristics. However, along with this, the dairy industry will have to do a lot of work around water and pollution management (Finnegan et al., Reference Finnegan, Clifford, Goggins, O'Leary, Dobson, Rowan, Xiao, Miao, Fitzhenry, Leonard, Tarpey, Gil-Pulido, Gao and Zhan2018; Shine et al., Reference Shine, Murphy and Upton2020). Society, as well as governments, have more demands and the dairy industry is no exception in its responsibility in the face of global warming. Therefore, in the immediate future, the carbon footprint and chemical elements will be a big issue that the industry will have to take care of.

South America

This research reflection did not consider South America, and further attention must be given to this region as it plays a significant role in the dairy industry, both as a producer and exporter of dairy products. While countries in this region may not always be top-of-mind when discussing dairy, their impact on international markets cannot be overlooked. Here are some key points highlighting South America's influence on the global dairy industry. South American countries, particularly Argentina, Brazil, and Uruguay, are major producers of dairy products, including milk, cheese, and butter. These countries have sizable dairy industries with modern production facilities and large-scale dairy farms, favourable climate conditions for dairy farming, and competitive production costs, allowing them to supply dairy products to various regions around the world. South American dairy exports play a crucial role in the worldwide dairy trade dynamics. They contribute to meeting the demand for dairy products in regions where production may be limited or seasonal, thus helping to stabilize international dairy prices and supply.

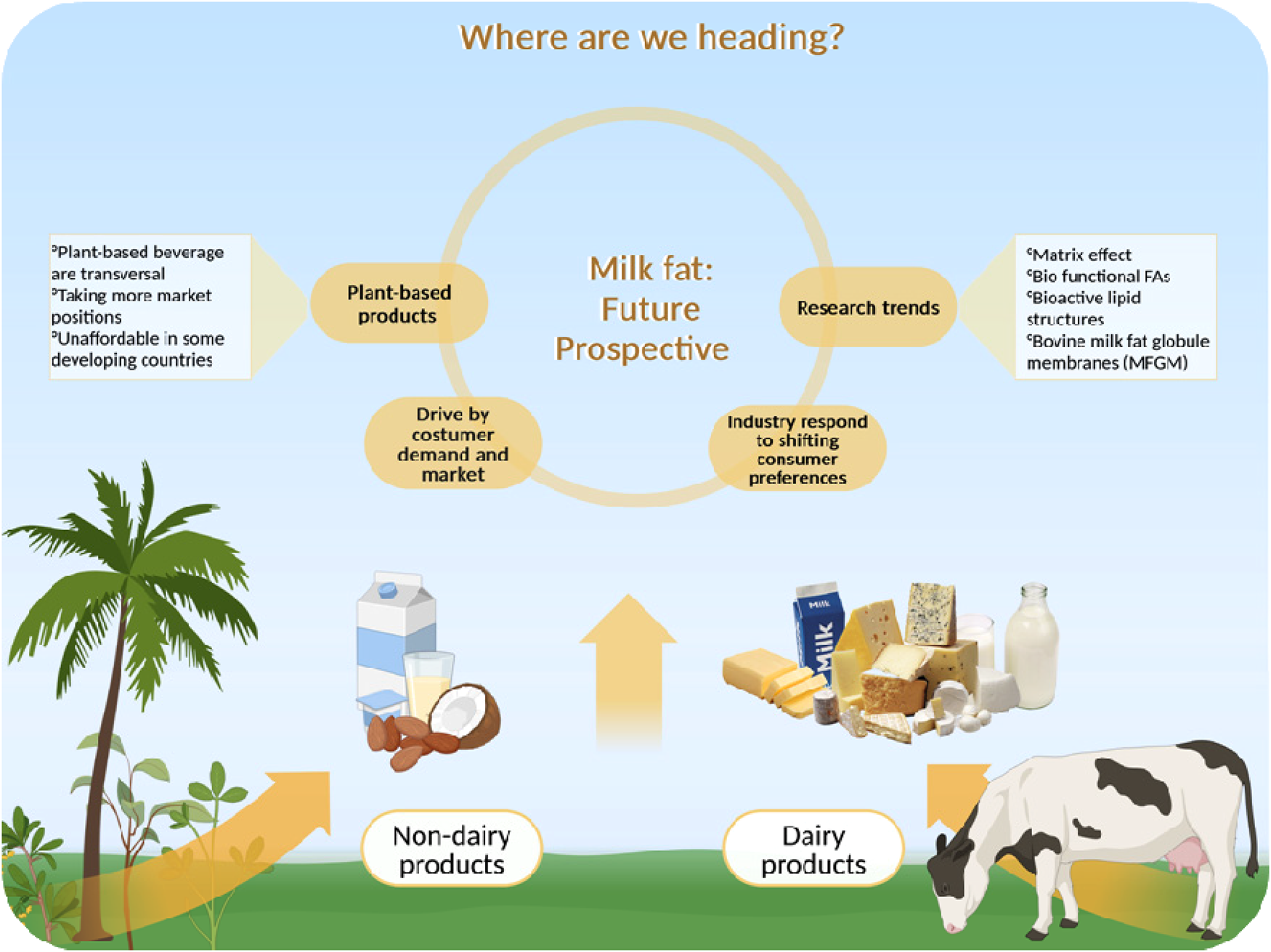

Prospective opportunities for the future

Currently, the intensity of scientific research into milk fat (and strategies to change it) is perhaps not as high as it once was, due to different phenomena which vary depending on geographical location. As highlighted earlier in this opinion paper, support for research on milk fat depends on the market, consumer expectations/awareness, and productive priorities, and until now this has mainly focused on the development of milk enriched in bio-functional FA. Recently, non-dairy products have taken more market positions in many countries, but their prices as well as the long-term effects of their consumption seem to prevent their macro spread.

Regarding current and near-future research interests related to milk fat, efforts appear to be shifting away from trying to manipulate the concentration of individuals/groups of FAs within milk fat. Instead, there is a growing body of evidence suggesting that despite the typical FA profile of milk fat, higher dairy intake has a neutral or protective effect on cardiometabolic health risk factors, compared with lower intakes (Poppitt, Reference Poppitt2020), possibly due to other beneficial components of milk. Recent research suggests that different dairy products may differentially affect these risk factors, leading to the concept of a ‘matrix effect’, which has been supported by both animal and human (Mohan et al., Reference Mohan, O'Callaghan, Kelly and Hogan2021) studies. The matrix effect is primarily attributed to hard cheeses vs. other dairy products, where the physico-chemical properties of the cheese are believed to limit lipid absorption in the gastrointestinal tract. Several mechanisms have been suggested to explain this phenomenon, including the formation of calcium soaps of FAs in the small intestine leading to increased faecal fat excretion (Brink et al., Reference Brink, Herren, McMillen, Fraser, Agnew, Roy and Lönnerdal2020; Yao et al., Reference Yao, Ranadheera, Shen, Wei and Cheong2023). Elucidation of the underlying mechanism remains a continued research interest for both researchers and industry professionals with potentially far-reaching implications for milk production, dairy processing, and human health outcomes.

Other near-future priorities may involve investigating the role of additional bioactive lipid structures present in milk. Milk fat is compartmentalized into milk fat globules, consisting of a predominantly triglyceride (TAG) core surrounded by a triple-layer MFGM rich in phospholipids, including sphingolipids. These lipids have been reported to inhibit fat absorption, neutralize bacterial endotoxins, and have anti-inflammatory and anti-pathogen action in rodent models (Yao et al., Reference Yao, Ranadheera, Shen, Wei and Cheong2023). Following milk processing and the disruption of the milk fat globule, these lipids tend to be enriched in aqueous fractions such as buttermilk, serum and whey (da Silva et al., Reference da Silva, Colleran and Ibrahim2021). The fascination with augmenting and isolating milk phospholipids endures, underpinned by the diverse health benefits correlated with these MFGM constituents. Further research is necessary to elucidate the impacts of temperature, shear and pressure on the structural chemistry and stability of milk fat under diverse processing conditions. Moreover, modulating milk FA profiles via dietary manipulations, genetic selection, and regulation of gene expression present opportunities. As depicted schematically in Figure 2, the future is exciting!

Figure 2. Milk fat: prospective opportunities for the future (Created with BioRender.com).