Introduction

Decarbonising the economy to mitigate climate change will necessitate costly adjustments to behaviour and consumption, particularly for those with large carbon footprints. Carbon pricing, and carbon taxes in particular, makes this explicit by imposing a monetary cost on CO

![]() $_2$ emissions, which is passed through to consumers of CO

$_2$ emissions, which is passed through to consumers of CO

![]() $_2$‐intensive goods and services. Yet, in spite of their larger carbon footprints, richer individuals generally exhibit higher levels of support for environmental policies (Fairbrother, Reference Fairbrother2012; Franzen & Meyer, Reference Franzen and Meyer2009; Kotchen et al., Reference Kotchen, Turk and Leiserowitz2017). This includes the case of carbon pricing, which increases the cost of such consuming carbon‐intensive goods.

$_2$‐intensive goods and services. Yet, in spite of their larger carbon footprints, richer individuals generally exhibit higher levels of support for environmental policies (Fairbrother, Reference Fairbrother2012; Franzen & Meyer, Reference Franzen and Meyer2009; Kotchen et al., Reference Kotchen, Turk and Leiserowitz2017). This includes the case of carbon pricing, which increases the cost of such consuming carbon‐intensive goods.

This is surprising in light of the growing societal awareness of ‘Carbon Inequality’. This refers to the fact that responsibility for CO

![]() $_2$ emissions within countries is unevenly distributed, with richer individuals being the primary contributor to the problem (Oehlmann et al., Reference Oehlmann, Linsenmeier, Kahlenborn, Götting, Klaas, Ciroth, Bunsen and Rossbach2021). In Germany, for example, individuals in the top 10 per cent of the income distribution are responsible for 26 per cent of Germany's CO

$_2$ emissions within countries is unevenly distributed, with richer individuals being the primary contributor to the problem (Oehlmann et al., Reference Oehlmann, Linsenmeier, Kahlenborn, Götting, Klaas, Ciroth, Bunsen and Rossbach2021). In Germany, for example, individuals in the top 10 per cent of the income distribution are responsible for 26 per cent of Germany's CO

![]() $_2$ emissions.Footnote 1 The distributive implications of carbon taxes are also widely discussed in debates about how the revenues of such taxes might be used to compensate those adversely affected by climate change policies (e.g. Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauer2019; Dolšak et al., Reference Dolšak, Adolph and Prakash2020; Jagers et al., Reference Jagers, Martinsson and Matti2019; Maestre‐Andrés et al., Reference Maestre‐Andrés, Drews and van den Bergh2019; Mildenberger et al., Reference Mildenberger, Lachapelle, Harrison and Stadelmann‐Steffen2022).

$_2$ emissions.Footnote 1 The distributive implications of carbon taxes are also widely discussed in debates about how the revenues of such taxes might be used to compensate those adversely affected by climate change policies (e.g. Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauer2019; Dolšak et al., Reference Dolšak, Adolph and Prakash2020; Jagers et al., Reference Jagers, Martinsson and Matti2019; Maestre‐Andrés et al., Reference Maestre‐Andrés, Drews and van den Bergh2019; Mildenberger et al., Reference Mildenberger, Lachapelle, Harrison and Stadelmann‐Steffen2022).

This paper explores the political economy of carbon taxation with a focus on how perceptions of costs and fairness might be affected by the selective provision of information on its distributive implications. In particular, we focus on information about the income distribution of carbon footprints and costs related to carbon taxation. We argue that the individuals' material positions, in terms of their place in the household income distribution, are important in shaping these perceptions and beliefs. As a result, poorer and richer individuals respond differently to information about carbon inequality, subsequently shaping their support for carbon taxation.

We provide empirical evidence on this issue using original survey data for the case of Germany. We conducted a survey experiment where we provided information about the actual distribution of household CO

![]() $_2$ emissions by income. This allows us to identify the causal effect of this information on the individuals' overall support for carbon taxation, based upon their position in the income distribution. Our key finding is that individuals at the bottom of the income distribution, who are initially more skeptical about carbon taxation, increase their support when they receive the information that the main burden would fall on high‐income individuals. Exploring mechanisms related to individuals' cost perceptions of taxation and their general aversion to inequality, we find that the main effect is more likely to be driven by the former rather than the latter, that is individuals update their policy preferences based on perceived costs of carbon taxation. Further supporting the individual cost mechanism, we find that support is independent of our information treatments and income for those who believe they would lose income from the carbon tax.

$_2$ emissions by income. This allows us to identify the causal effect of this information on the individuals' overall support for carbon taxation, based upon their position in the income distribution. Our key finding is that individuals at the bottom of the income distribution, who are initially more skeptical about carbon taxation, increase their support when they receive the information that the main burden would fall on high‐income individuals. Exploring mechanisms related to individuals' cost perceptions of taxation and their general aversion to inequality, we find that the main effect is more likely to be driven by the former rather than the latter, that is individuals update their policy preferences based on perceived costs of carbon taxation. Further supporting the individual cost mechanism, we find that support is independent of our information treatments and income for those who believe they would lose income from the carbon tax.

This paper contributes to several strands in the literature on environmental politics and redistributive preferences more generally. First, it speaks to a broad literature in political science, and environmental politics specifically, on how individuals' beliefs affect policy support (e.g. Brulle et al., Reference Brulle, Carmichael and Jenkins2012; Mildenberger & Tingley, Reference Mildenberger and Tingley2019; Norgaard, Reference Norgaard2011; Tranter, Reference Tranter2011). Second, it adds to a growing body of research that is concerned with understanding the importance of income inequality in causing climate change and its relation to policy responses (e.g. Carley & Konisky, Reference Carley and Konisky2020; Jorgenson et al., Reference Jorgenson, Schor and Huang2017). Third, it provides new evidence on public opinion towards carbon taxation, by focusing on ex ante distributive considerations (e.g. Umit & Schaffer, Reference Umit and Schaffer2020) that feed into discussions of responsibility for mitigating climate change, rather than ex post redistributive outcomes (e.g. Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauer2019; Dolšak et al., Reference Dolšak, Adolph and Prakash2020; Jagers et al., Reference Jagers, Martinsson and Matti2019; Maestre‐Andrés et al., Reference Maestre‐Andrés, Drews and van den Bergh2019). Fourth, and finally, our paper also contributes to an emerging discussion about the relationship between environmental and social policies (e.g. Armingeon & Bürgisser, Reference Armingeon and Bürgisser2021; Busemeyer & Beiser‐McGrath, Reference Busemeyer and Beiser‐McGrathn.d.; Fritz & Koch, Reference Fritz and Koch2019; Gough, Reference Gough2010).

The paper proceeds as follows. First, we discuss the relation between carbon inequality, in the form of household CO

![]() $_2$ emissions, and the distributional consequences of carbon taxation. In doing so, we outline the role of individuals' perceptions about carbon inequality and support for carbon taxation, which can be driven by mechanisms related to individuals' costs and inequality aversion. Second, we outline our research design, providing information about our original survey data, the design of survey items and the survey experiment. Third, we present the results of our empirical analysis, which is guided by our theoretical discussion. The final section offers concluding thoughts.

$_2$ emissions, and the distributional consequences of carbon taxation. In doing so, we outline the role of individuals' perceptions about carbon inequality and support for carbon taxation, which can be driven by mechanisms related to individuals' costs and inequality aversion. Second, we outline our research design, providing information about our original survey data, the design of survey items and the survey experiment. Third, we present the results of our empirical analysis, which is guided by our theoretical discussion. The final section offers concluding thoughts.

Household emissions and the cost of carbon pricing

Carbon pricing aims to reduce greenhouse gas (GHG) emissions by internalising the externalities of individuals' consumption of carbon‐intensive goods through higher costs. The distribution of CO

![]() $_2$ consumption by income is, therefore, crucial to understand the perceived and actual impact of carbon taxation for individuals. As exemplified by Sager (Reference Sager2019), the relationship between individual income and GHG emissions is complex. The distinction between absolute and relative emissions, therefore, helps us understand how carbon inequality and individuals' incomes translate into policy preferences.

$_2$ consumption by income is, therefore, crucial to understand the perceived and actual impact of carbon taxation for individuals. As exemplified by Sager (Reference Sager2019), the relationship between individual income and GHG emissions is complex. The distinction between absolute and relative emissions, therefore, helps us understand how carbon inequality and individuals' incomes translate into policy preferences.

Broadly speaking, GHG emissions are increasing in household income. A growing body of research quantifies the relationship between household income and CO

![]() $_2$ emissions, finding that richer households have a larger carbon footprint (Davis & Caldeira, Reference Davis and Caldeira2010; Lenzen et al., Reference Lenzen, Wier, Cohen, Hayami, Pachauri and Schaeffer2006; Papathanasopoulou & Jackson, Reference Papathanasopoulou and Jackson2009; Weber & Matthews, Reference Weber and Matthews2008). While there is evidence that the carbon intensity of consumption (i.e. relative emissions) is lower for richer households (Büchs & Schnepf, Reference Büchs and Schnepf2013; Liu et al., Reference Liu, Spaargaren, Heerink, Mol and Wang2013), the higher overall volume of consumption by richer individuals overwhelms this effect when considering absolute emissions. However, poorer households spend more on GHG‐intensive goods as a proportion of their income. Low‐income households spend significantly more on utilities as a proportion of their income, which tend to be carbon intensive, compared to richer households (Carley & Konisky, Reference Carley and Konisky2020). Moreover, energy efficiency incentives are disproportionately adopted by higher income individuals (Jacobsen, Reference Jacobsen2019).

$_2$ emissions, finding that richer households have a larger carbon footprint (Davis & Caldeira, Reference Davis and Caldeira2010; Lenzen et al., Reference Lenzen, Wier, Cohen, Hayami, Pachauri and Schaeffer2006; Papathanasopoulou & Jackson, Reference Papathanasopoulou and Jackson2009; Weber & Matthews, Reference Weber and Matthews2008). While there is evidence that the carbon intensity of consumption (i.e. relative emissions) is lower for richer households (Büchs & Schnepf, Reference Büchs and Schnepf2013; Liu et al., Reference Liu, Spaargaren, Heerink, Mol and Wang2013), the higher overall volume of consumption by richer individuals overwhelms this effect when considering absolute emissions. However, poorer households spend more on GHG‐intensive goods as a proportion of their income. Low‐income households spend significantly more on utilities as a proportion of their income, which tend to be carbon intensive, compared to richer households (Carley & Konisky, Reference Carley and Konisky2020). Moreover, energy efficiency incentives are disproportionately adopted by higher income individuals (Jacobsen, Reference Jacobsen2019).

The complexity of this association may explain why in the case of GHG emissions, individual perceptions about the distribution of these emissions –and hence the distributional implications of costs related to carbon taxation – might be biased or simply wrong. High‐income households pursuing a climate‐conscious lifestyle might underestimate the absolute emissions they actually produce. Vice versa, low‐income households focusing on GHG‐intensive goods in their consumption profiles (e.g. fuel for cars) might overestimate their absolute emissions – and, therefore, their vulnerability to carbon taxation.

If perceptions indeed matter and are potentially biased, the selective provision of information about carbon inequality should change individuals' support for carbon taxation, given the strong link between the economic consequences of carbon taxation and individuals' income. As illustrated in other economic areas, such as trade (Rho & Tomz, Reference Rho and Tomz2017), providing information about the nature of the problem, can impact individuals' policy preferences. In the case of redistributive policies, research has shown that providing individuals with information about the actual position in the ranking of household incomes (rather than their self‐perceived position) can enhance support for redistribution (e.g. Kuziemko et al., Reference Kuziemko, Norton, Saez and Stantcheva2015). While other research in the area of carbon taxation has explored income effects (e.g. Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauern.d.; Mildenberger et al., Reference Mildenberger, Lachapelle, Harrison and Stadelmann‐Steffen2022), an examination of the importance of distributional consequences and the related cost sensitivity to carbon pricing has not yet been undertaken.

To do so, we focus on two types of information: (i) information about individuals' expected carbon footprints, relative to the country average, given their place in the income distribution and (ii) information about the societal distribution of carbon footprints based upon household incomes.

First, we expect that receiving information about their carbon footprints, relative to the average carbon footprint, will change individuals' support for carbon taxation. Analogous to pocketbook models of voting (e.g. Healy & Malhotra, Reference Healy and Malhotra2013; Tilley et al., Reference Tilley, Neundorf and Hobolt2018) and economic voting more generally (e.g. Lewis‐Beck & Stegmaier, Reference Lewis‐Beck and Stegmaier2000; Reference Lewis‐Beck, Stegmaier, Dalton and Klingemann2007; Meltzer & Richard, Reference Meltzer and Richard1981; Powell & Whitten, Reference Powell and Whitten1993), research suggests that individuals' policy preferences are often formed by individuals' perceptions about the extent to which they are burdened (e.g. Armingeon & Bürgisser, Reference Armingeon and Bürgisser2021; Compton & Lipsmeyer, Reference Compton and Lipsmeyer2019). According to this logic, which is essentially based on material self‐interest, individuals with a larger carbon footprint will expect to face a higher burden from the adoption of carbon taxation and thus be less supportive of this policy instrument. However, individuals themselves might not be immediately aware of the size of their footprints. Therefore, providing selective information on this issue should affect their policy preferences. More specifically, we expect that poorer individuals who learn that they have lower‐than‐average carbon footprints will become more supportive of carbon taxation, while richer individuals will decrease support upon learning that they have higher‐than‐average carbon footprints.

Second, beyond the individual footprints, the overall distribution of carbon footprints by household income, that is carbon inequality, might also be relevant for understanding individuals' support for carbon taxation. A large literature examines the role of sociotropic concerns in individuals' policy preferences (e.g. Lü & Scheve, Reference Lü and Scheve2016; Mansfield & Mutz, Reference Mansfield and Mutz2009; Schaffer & Spilker, Reference Schaffer and Spilker2019). This research finds that individuals' policy preferences and political behaviour are driven by evaluations of the societal impact of policy. That is, even if a policy may have positive (or negative) impacts upon an individual herself, she may, nevertheless, be supportive of the policy due to its broader societal impact. In the context of carbon inequality and carbon taxation, information about the larger carbon footprints of rich households when compared to poorer households can lead to increasing support for carbon taxation given the implications in terms of tax burdens. As we will discuss in subsequent sections, we expect this effect to be stronger for those individuals who are less accepting of economic inequality and thus will be more inclined towards a policy where the burden is placed on richer individuals who have more carbon‐intensive lifestyles. Or put differently: Support for carbon taxation might be boosted among those who are averse to inequality once they realise that this policy instrument has redistributive implications.

Finally, we consider the joint impact of these two types of information, individual and distributional, in combination with one another. Combining this information leads to individuals both learning about their own individual footprints but also how this compares to the carbon footprints of the richest and poorest households. This allows for a potential magnification of the individual and distributional information effects (Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauern.d.). For example, poorer individuals may become even more supportive of carbon taxation when learning that they not only have lower carbon footprints but also that richer households have significantly higher footprints. In this example, the individual effect is amplified by knowing that they have a relatively lower burden compared to richer households, potentially due to fairness motivations and/or concerns about relative gains/losses.

In summary, this leads to the following testable hypotheses:

-

H1a: Information about an individual's expected household CO

$_2$ emissions relative to the average causes poorer (richer) individuals to increase (decrease) support for carbon taxation.

$_2$ emissions relative to the average causes poorer (richer) individuals to increase (decrease) support for carbon taxation. -

H1b: Information about the distribution of household CO

$_2$ emissions by income causes poorer (richer) individuals to increase (decrease) support for carbon taxation.

$_2$ emissions by income causes poorer (richer) individuals to increase (decrease) support for carbon taxation. -

H1c: Combining these two sources of information increases the positive (negative) effect of information for poorer (richer) individuals.

Mechanisms

While information about carbon inequality can shape preferences towards carbon taxes, we also examine two possible mechanisms that generate this relationship. In particular, we focus on (i) individuals' perceptions of the costs associated with carbon taxation and (ii) their attitudes towards inequality more broadly.

The first mechanism focuses on individuals' perceptions about the cost they face from carbon taxes. Upon learning about the distribution of household CO

![]() $_2$ emissions, individuals will update their beliefs about their personal cost associated with taxation. Poorer individuals should decrease their belief that carbon taxation will have a negative effect on their incomes. In contrast, richer individuals upon learning that they are likely to be higher emitters, on average, will increase their belief that they shoulder a larger burden from carbon taxation.

$_2$ emissions, individuals will update their beliefs about their personal cost associated with taxation. Poorer individuals should decrease their belief that carbon taxation will have a negative effect on their incomes. In contrast, richer individuals upon learning that they are likely to be higher emitters, on average, will increase their belief that they shoulder a larger burden from carbon taxation.

-

H2a: Information about the distribution of household carbon footprints will cause poorer individuals to decrease their belief that a carbon tax will reduce their income.

-

H2b: Information about the distribution of household carbon footprints will cause richer individuals to increase their belief that a carbon tax will reduce their income.

These beliefs about the burden faced from carbon taxation should subsequently affect policy support. For individuals who still believe that a carbon tax would reduce their incomes, we expect that the effect of the treatments is similar across all income groups. In this case, any distributional concerns from the policy are ultimately overridden by material self‐interest. In contrast, for those who do not believe that a carbon tax will reduce their income, they will be more attuned to its distributional component. Therefore, their support will again fall along income lines, with support being dependent upon how those in a similar economic situation are affected. This leads to the following testable hypotheses:

-

H3a: Poorer and richer individuals will decrease support for the carbon tax, regardless of information about the distribution of household carbon footprints, when they believe that they will lose income from the tax.

H3b: Poorer (richer) individuals who believe that they will not lose income from the tax, will increase (decrease) support for the carbon tax when provided information about the distribution of household carbon footprints.

Second, individuals may process information about carbon inequality and its implications for carbon taxation, in terms of their attitudes towards inequality. Previous research finds that the values about equality are important for understanding individuals' policy and redistributive preferences (e.g. Alesina & Angeletos, Reference Alesina and Angeletos2005; Cavaillé & Trump, Reference Cavaillé and Trump2015; Dimick et al., Reference Dimick, Rueda and Stegmueller2017; Fong, Reference Fong2001).

Applying this to the case of carbon taxation, we expect information that richer households have larger carbon footprints and thus face a larger burden from a carbon tax in absolute terms, which may lead to increasing support amongst those who are inequality‐averse, regardless of income position. In contrast, those who are not opposed to unequal economic outcomes will be driven more by individual material concerns. As a result, we expect a negative income gradient amongst those who received the information treatment, as poorer individuals become more supportive and richer individuals become less supportive. This leads to the following testable hypotheses:

-

H4a: Poorer and richer individuals who are inequality averse, will decrease support for the carbon tax when provided information about the distribution of household carbon footprints.

-

H4b: Poorer (richer) individuals who are accepting of inequality, will increase (decrease) support for the carbon tax when provided information about the distribution of household carbon footprints.

Research design

Sample

To examine the empirical implications of our theoretical discussion, we created an original module included as a part of a survey fielded in September 2020 by Kantar, utilising an online panel of respondents in Germany. The survey recruitment was designed to be representative of the German adult resident population in terms of age, education, gender and NUTS2 region. Of the 6411 respondents interviewed, 203 responses were removed by Kantar for either being flagged as speeders, failing to respond to questions (

![]() $>20$ per cent), being classified as straightliners or failing plausibility checks based upon item responses and response behaviours. Individuals from this sample of 6208 respondents were randomly assigned to our carbon inequality (household CO

$>20$ per cent), being classified as straightliners or failing plausibility checks based upon item responses and response behaviours. Individuals from this sample of 6208 respondents were randomly assigned to our carbon inequality (household CO

![]() $_2$) experiment.Footnote 2 This resulted in a final sample of 3167 respondents, that is analysed here.

$_2$) experiment.Footnote 2 This resulted in a final sample of 3167 respondents, that is analysed here.

Survey module design

The survey module on carbon inequality and support for carbon taxation consisted of five parts that allow us to assess the empirical evidence for the empirical implications derived:

-

1. Items on individuals' inequality acceptance.

-

2. Individuals' household income.

-

3. A survey experiment randomly assigning information about household CO

$_2$ emissions by income.

$_2$ emissions by income. -

4. An item measuring individuals about how carbon taxation would affect their disposable income.

-

5. An item measuring support for carbon taxation.

First, we asked individuals about their attitudes towards economic inequality. This item asks whether income differences between people are acceptable because they are a result of whether individuals have taken advantage of the opportunities available to them (translated from German). Responses took the form of a seven‐point Likert scale (1 = completely disagree,

![]() $\dots$, 5 = completely agree), which we recode to three categories of not accepting (1,2,3), indifferent to (4) and accepting (5,6,7) inequality to ensure enough observations per sub‐group. This item allows us to measure the inequality aversion mechanism linking information about household CO

$\dots$, 5 = completely agree), which we recode to three categories of not accepting (1,2,3), indifferent to (4) and accepting (5,6,7) inequality to ensure enough observations per sub‐group. This item allows us to measure the inequality aversion mechanism linking information about household CO

![]() $_2$ emissions to support for carbon taxation.

$_2$ emissions to support for carbon taxation.

Second, we measure individuals' household income. Our measurement strategy is designed to ensure the lowest level of non‐response possible. To do so, we first ask individuals to state their household post‐tax income. For those who do not answer this question, we then ask them to choose their household post‐tax income from 10 categories representing the income deciles. From this, we are able to assign individuals to income quintiles and deciles which we use for our empirical analysis.Footnote 3

Third, we conducted a survey experiment providing information about (i) individuals' expected household emissions given their household income relative to average household emissions and/or (ii) inequality in household emissions. Individuals' expected household emissions are based upon their stated household income, using estimates from Hardadi et al. (Reference Hardadi, Buchholz and Pauliuk2021), and are presented in comparison to the national average of household emissions. Information about inequality in household emissions presents information on how the top 20 per cent of the income distribution emits significantly more CO

![]() $_2$ than the bottom 20 per cent of the income distribution in Germany. Individual household CO

$_2$ than the bottom 20 per cent of the income distribution in Germany. Individual household CO

![]() $_2$ emissions are presented by income quintiles.

$_2$ emissions are presented by income quintiles.

All individuals read the following introductory text (translated from German):

Carbon dioxide emissions (i.e., CO

![]() $_2$emissions) resulting from the burning of coal, oil, gas, gasoline, diesel and other fossil fuels are considered to be one of the main causes of global warming, that is, climate change.

$_2$emissions) resulting from the burning of coal, oil, gas, gasoline, diesel and other fossil fuels are considered to be one of the main causes of global warming, that is, climate change.

One of the most important measures considered is a CO

![]() $_2$tax, also known as a carbon tax. Fossil fuel producers and distributors would have to pay a tax levy. This would increase the price of fossil fuels. How much this will affect your household will likely depend on your income level.

$_2$tax, also known as a carbon tax. Fossil fuel producers and distributors would have to pay a tax levy. This would increase the price of fossil fuels. How much this will affect your household will likely depend on your income level.

Following this, individuals receive one of the randomly assigned treatment conditions. The text of the three treatment conditions, and control, are as follows (translated from German):

-

T0 Control:<NO ADDITIONAL TEXT>

T1 Own: Your expected CO

$_2$ consumption based on your income is <ESTIMATE> tons per year. In comparison, the expected CO

$_2$ consumption based on your income is <ESTIMATE> tons per year. In comparison, the expected CO

$_2$ consumption of the average household in Germany is 9.1 tons per year.

$_2$ consumption of the average household in Germany is 9.1 tons per year.-

T2 Distribution: Richer households consume more CO

$_2$ than poorer households. Households in the top 20 per cent of the income distribution consume an average of 10.8 tons of CO

$_2$ than poorer households. Households in the top 20 per cent of the income distribution consume an average of 10.8 tons of CO

$_2$ per year. Households in the bottom 20 per cent of the income distribution consume only 6.2 tons on average. This means that the richest 20 per cent of households consume 75 per cent more CO

$_2$ per year. Households in the bottom 20 per cent of the income distribution consume only 6.2 tons on average. This means that the richest 20 per cent of households consume 75 per cent more CO

$_2$ than the poorest 20 per cent.

$_2$ than the poorest 20 per cent. T3 Own + Distribution: Your expected CO

$_2$ consumption based on your income is <ESTIMATE> tons per year. In comparison, the expected CO

$_2$ consumption based on your income is <ESTIMATE> tons per year. In comparison, the expected CO

$_2$ consumption of the average household in Germany is 9.1 tons per year.

$_2$ consumption of the average household in Germany is 9.1 tons per year.Richer households consume more CO

$_2$ than poorer households. Households in the top 20 per cent of the income distribution consume an average of 10.8 tons of CO

$_2$ than poorer households. Households in the top 20 per cent of the income distribution consume an average of 10.8 tons of CO

$_2$ per year. Households in the bottom 20 per cent of the income distribution consume only 6.2 tons on average. This means that the richest 20 per cent of households consume 75 per cent more CO

$_2$ per year. Households in the bottom 20 per cent of the income distribution consume only 6.2 tons on average. This means that the richest 20 per cent of households consume 75 per cent more CO

$_2$ than the poorest 20 per cent.

$_2$ than the poorest 20 per cent.

Fourth, after receiving the information from their treatment condition, individuals are then asked about their beliefs about how carbon taxation affects their disposable income. Individuals could choose between three responses, indicating that they believe their disposable income would decrease, stay the same or increase. This item allows us to examine the personal cost mechanism linking information about household CO

![]() $_2$ emissions to support for carbon taxation.

$_2$ emissions to support for carbon taxation.

Finally, we measure individuals' support for carbon taxation. Specifically, individuals are asked the extent to which they support or oppose increasing the cost of CO

![]() $_2$ consumption through a CO

$_2$ consumption through a CO

![]() $_2$ tax. Responses are measured on a five‐point Likert scale, ranging from strongly oppose (1) to strongly support (5).

$_2$ tax. Responses are measured on a five‐point Likert scale, ranging from strongly oppose (1) to strongly support (5).

Estimation

For all our statistical analyses, we use ordinary least squares regression with robust standard errors. In our analyses, we also show that our results are robust for adjusting for key characteristics that are measured before the survey module. These are age, education, gender and party identification.

As our key empirical implications involve examining how treatment effects vary by income, we estimate both linear and non‐linear interaction effects. To ease interpretation when presenting regression coefficients, we standardise the income variable to have a mean zero. For non‐linear interaction effects, we use the binning estimator developed by Hainmueller et al. (Reference Hainmueller, Mummolo and Xu2019). This involves partitioning the moderator variable, in our application income deciles, into three bins and estimating treatment effects within these bins. We also assess the robustness of our main results when accounting for a full set of covariate interactions and other non‐linearities in the appendix (Beiser‐McGrath & Beiser‐McGrath, Reference Beiser‐McGrath and Beiser‐McGrath2020; Reference Beiser‐McGrath and Beiser‐McGrath2023; Blackwell & Olson, Reference Blackwell and Olson2022).

Results

Support for carbon pricing

We first examine how individuals' support for carbon taxation depends upon their income. To do so, we examine whether the provision of information about the distribution of household CO

![]() $_2$ emissions changes individuals' support for carbon taxation, via our survey experiment.

$_2$ emissions changes individuals' support for carbon taxation, via our survey experiment.

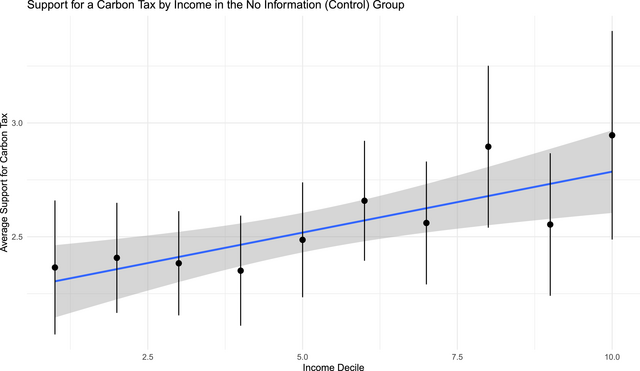

Before doing so, we estimate the relationship between income and support for carbon taxation, absent information. As displayed in Figure 1, we find that richer individuals are more supportive of carbon taxation, echoing previous research on carbon taxes and climate policy more broadly (e.g. Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauern.d.; Fairbrother, Reference Fairbrother2012; Franzen & Meyer, Reference Franzen and Meyer2009; Kotchen et al., Reference Kotchen, Turk and Leiserowitz2017).

Figure 1. Support for carbon taxation is associated with income. The regression line of support for carbon taxes on income is displayed, with 95 per cent confidence intervals. Points are the expected level of carbon tax support for each income decile with 95 per cent confidence intervals.

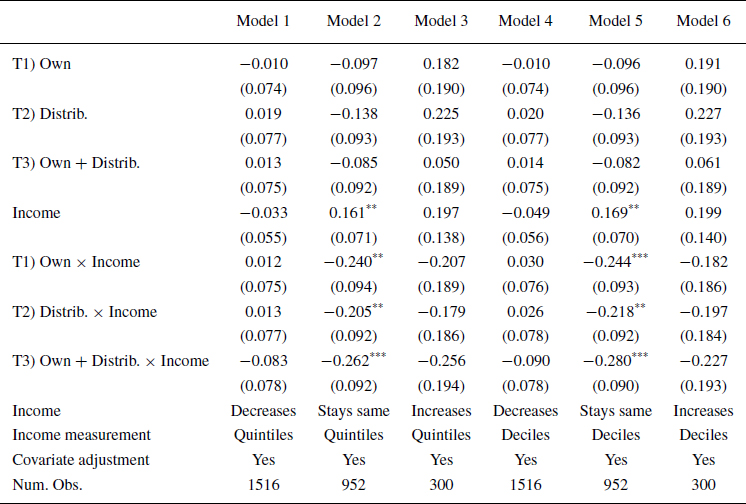

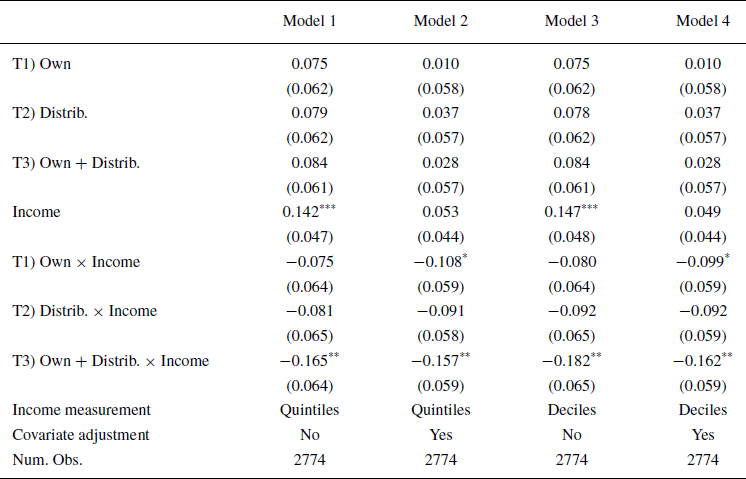

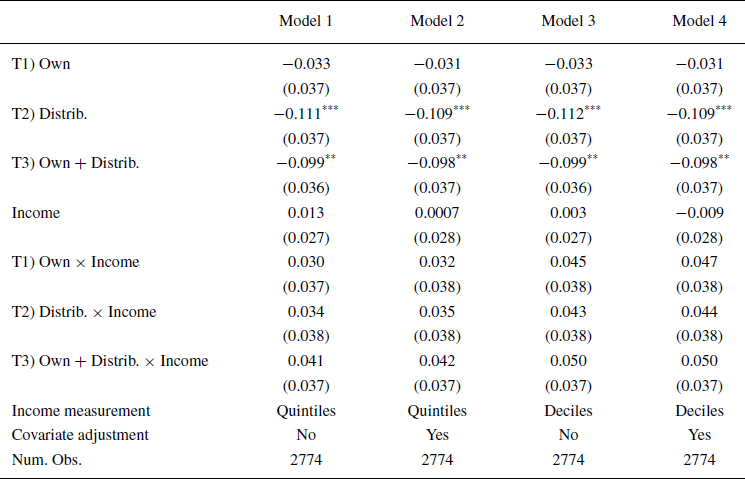

We now examine how support for carbon taxation varies due to the effect of information about household CO

![]() $_2$ emissions conditional upon respondents' household income. Table 1 displays the treatment effects, conditional upon individuals' household income. Across all model specifications, we find that the causal effect of information about household CO

$_2$ emissions conditional upon respondents' household income. Table 1 displays the treatment effects, conditional upon individuals' household income. Across all model specifications, we find that the causal effect of information about household CO

![]() $_2$ consumption depends upon individuals' household income. We find that richer (poorer) individuals significantly decrease (increase) their support for carbon taxation when assigned to the third information treatment (T3) that combines information about an individual's expected CO

$_2$ consumption depends upon individuals' household income. We find that richer (poorer) individuals significantly decrease (increase) their support for carbon taxation when assigned to the third information treatment (T3) that combines information about an individual's expected CO

![]() $_2$ consumption, given their household income, with information about the emissions of the top and bottom 20 per cent of households by income. This is also the case for individuals who received only information about their own expected CO

$_2$ consumption, given their household income, with information about the emissions of the top and bottom 20 per cent of households by income. This is also the case for individuals who received only information about their own expected CO

![]() $_2$ consumption (T1) when adjusting for other covariates; however, this is only significant at the

$_2$ consumption (T1) when adjusting for other covariates; however, this is only significant at the

![]() $p<0.1$ level. This provides some initial evidence that while changing support for carbon taxation is driven more by individual, egotropic, concerns than broader distributional concerns, these egotropic effects are acocentuated when contextualised with distributional information.Footnote 4

$p<0.1$ level. This provides some initial evidence that while changing support for carbon taxation is driven more by individual, egotropic, concerns than broader distributional concerns, these egotropic effects are acocentuated when contextualised with distributional information.Footnote 4

Table 1. Effect of treatments on support for carbon taxation

*p

![]() $<$ 0.1, **p

$<$ 0.1, **p

![]() $<$ 0.05, ***p

$<$ 0.05, ***p

![]() $<$ 0.005.

$<$ 0.005.

As the income variable is rescaled to have a mean of zero, the coefficient estimates for the treatment constitutive terms represent the treatment effect for an average household income. For all treatments and model specifications, these effects are not statistically significant, implying that average levels of support are not moved by the treatments but rather that the significant changes in support for carbon taxes are driven by the richest and poorest respondents (interaction effect between individual respondent income and treatment conditions). Additionally, while income is positively associated with support for carbon taxation in the control group, this relationship is no longer statistically significant when adjusting for other covariates.

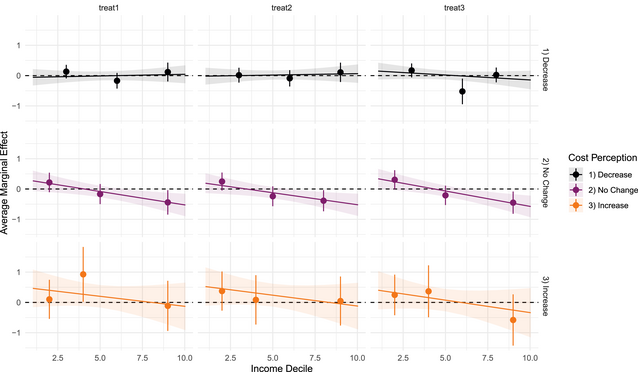

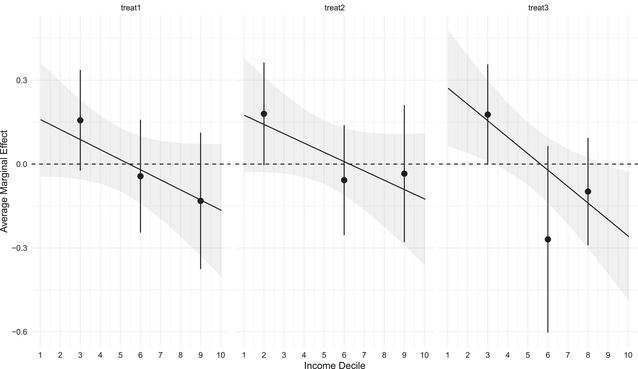

Figure 2 provides a different perspective on our results, displaying marginal effect plots for the results presented above. We can see that the linear marginal effect displays the expected effect, with information about carbon footprints reducing support for carbon taxation as income increases. The estimated non‐linear interaction effects suggest that this is primarily driven by the poorer individuals in the sample, who see an increase in support of approximately 0.2 (statistically significant for T2 and T3), while the richest individuals only significantly reduce support in the linear interaction model for T3. Therefore, our initial evidence suggests that information about differential contributions to CO

![]() $_2$ emissions by richer and poorer individuals can flatten the income gradient found in observational research.

$_2$ emissions by richer and poorer individuals can flatten the income gradient found in observational research.

Figure 2. Treatment effects depend upon individuals' income. The lines with shaded area display linear marginal effect estimates with 95 per cent confidence intervals. The points display non‐linear marginal effects using the binning estimator proposed by Hainmueller et al. (Reference Hainmueller, Mummolo and Xu2019).

Counterfactual of support versus opposition to carbon taxation by treatment and income

Based upon these results, we also engage in a counterfactual assessment of the German population's support versus opposition to carbon taxes, estimating this for counterfactual scenarios where all respondents received a particular treatment or not. Examined by Beiser‐McGrath and Bernauer (Reference Beiser‐McGrath and Bernauer2019) we focus on the proportion of individuals supporting a carbon tax when compared to the number of respondents either opposing or supporting the carbon tax.Footnote 5 Therefore, we estimate a regression replicating the specification of Model 4 from Table 1, while incorporating survey weights provided by the survey company that match the German population.Footnote 6 From there we create counterfactual predictions, estimating support for the carbon tax if all respondents hypothetically received each of the treatments or control.

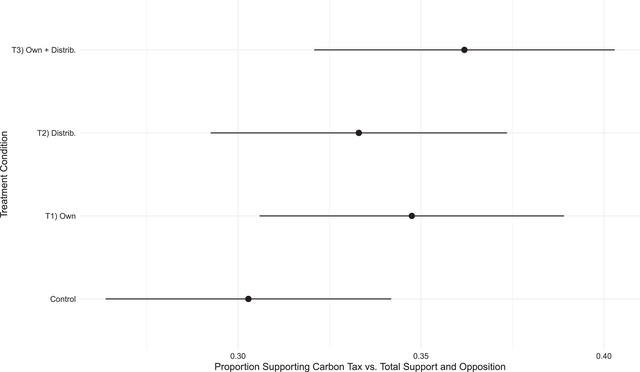

We first examine the overall impact of the treatments for the general population, ignoring individuals' incomes. Figure 3 displays the results. In doing so, we find that while our treatments lead to a projected population‐level increase in support for carbon taxation, this does not cross the 0.5 threshold where a larger number of individuals would support rather than oppose the carbon tax. This echoes the results from Beiser‐McGrath and Bernauer (Reference Beiser‐McGrath and Bernauer2019) who find a similar proportion of support for carbon taxation, with no level of the carbon tax achieving majority support.

Figure 3. Counterfactual population estimates for carbon tax support by treatment condition. Points indicate the proportion of individuals supporting the carbon tax compared to total support and opposition. Lines indicate 95 per cent confidence intervals.

Nevertheless, when estimating the difference between the combined information treatment (T3) to the no information control, we find a statistically significant 5.9 percentage point increase in population support for carbon taxation (95 per cent confidence interval: 0.2–11.6 percentage points), which corresponds to a 20 per cent relative increase compared to the control baseline. Therefore, the strongest treatment leads to a statistically significant substantive increase in support for carbon taxation.

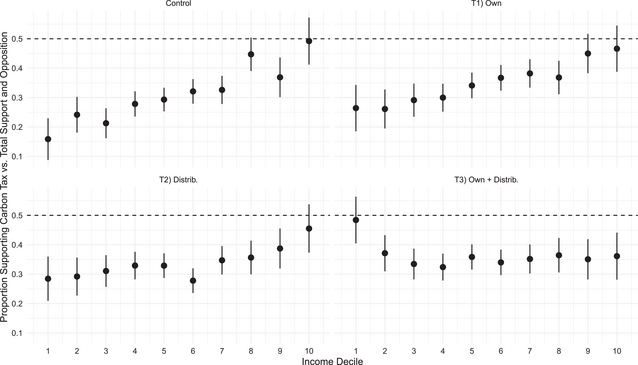

To understand how the treatments change the distribution of support in the population by income group, we repeat the same exercise calculating estimates by each income decile. Figure 4 shows these population projections for each income decile by treatment condition. Focusing again on the strongest treatment (T3), we find that this information treatment results in a flattening of the income gradient in support for carbon taxation. Notably, however, the first decile does not follow this flattened gradient, as those in this group have approximately equal levels of support and opposition. This contrasts with the control group, where there is a very strong income gradient with the 10th decile having approximately equal levels of support and taxation.

Figure 4. Counterfactual population estimates for carbon tax support by treatment condition and income decile. Points indicate the proportion of individuals supporting the carbon tax compared to total support and opposition. Lines indicate 95 per cent confidence intervals.

In summary, the results suggest that full information about carbon inequality leads to an overall rise in support for carbon taxation. This, however, is a result of large increases in support for those in low‐income deciles, which is partially offset by a smaller decline in support from those in the top‐income deciles. Thus the overall increase in support generated by this treatment (T3) leads to a flattening of the income gradient in support for carbon taxation (apart from the lowest income decile). This again echoes our main insight that the distributional implications of carbon taxation shape support along distributional lines. Information about carbon inequality changes to support for carbon taxation from an area where support is concentrated amongst higher income groups, where there is a more equal share of support across the income distribution and a high concentration of support in the lowest income decile.

Mechanisms

We now turn to examining potential mechanisms identified in our theoretical section, to understand what drives these changes in support. We do so by examining how this information changes cost perceptions of a carbon tax, which subsequently affects support for the carbon tax, and how inequality aversion conditions the effect of this information.

Before we do, we first examine the association between these two factors (cost perceptions and inequality aversion) and support for carbon taxation in the control group. This allows us to examine their influence upon support for carbon taxes absent information provision and related mechanisms we are primarily interested in.

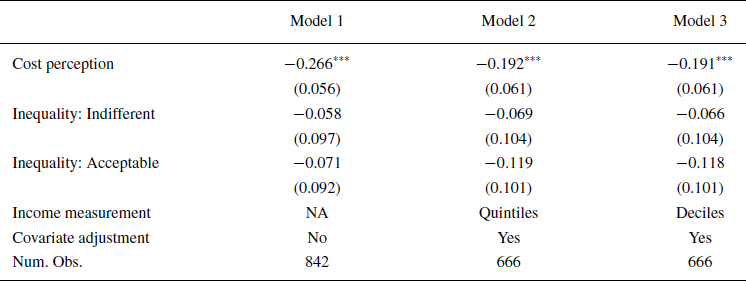

Table 2 displays how cost perceptions and inequality aversion are associated with support for carbon taxation in the control group. We find that individuals with higher carbon tax cost perceptions are significantly less likely to support a carbon tax, which is a clear indication that material self‐interest matters for support for carbon taxation. In contrast, we do not see significant associations between generalised attitudes towards inequality and support for carbon taxation. This is to some extent at odds with our hypotheses from above as we assumed that general attitudes towards inequality (and implicitly redistribution) would also matter with regard to individuals' support for carbon taxation. As we will show in the subsequent section, distributional implications of taxation still matter though, even though they seem to be more related to self‐interest rather than normative considerations.

Table 2. Association between cost perceptions, inequality acceptance and support for carbon taxation

* p

![]() $<$ 0.1, ** p

$<$ 0.1, ** p

![]() $<$ 0.05, *** p

$<$ 0.05, *** p

![]() $<$ 0.005.

$<$ 0.005.

Individual costs

First, we examine how the treatments affect individuals' assessments about the impact a carbon tax would have on their own incomes. Table 3 displays these estimated treatment effects when adjusting for additional covariates. We find that those treatments presenting information about the distribution of CO

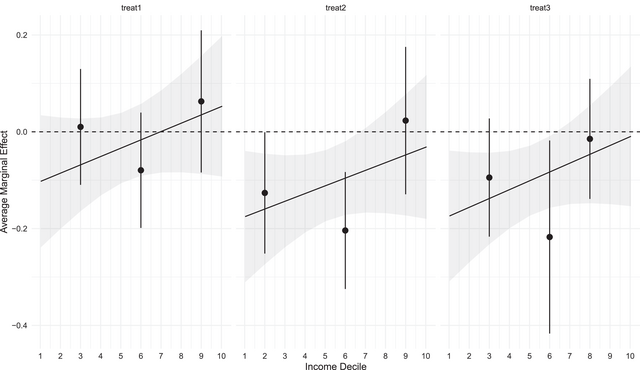

![]() $_2$ emissions (T2 and T3) cause significant decreases in individuals' perceptions that carbon taxes will decrease their income, on average. However, when examining the coefficients for the interaction terms we do not find strong evidence of these effects being linearly moderated by individuals' incomes. However, as displayed in Figure 5, this is not because income does not moderate the treatment effects, but rather the interaction is non‐linear in nature.

$_2$ emissions (T2 and T3) cause significant decreases in individuals' perceptions that carbon taxes will decrease their income, on average. However, when examining the coefficients for the interaction terms we do not find strong evidence of these effects being linearly moderated by individuals' incomes. However, as displayed in Figure 5, this is not because income does not moderate the treatment effects, but rather the interaction is non‐linear in nature.

Table 3. Effect of treatments on perceived costs of carbon taxation

* p

![]() $<$ 0.1, ** p

$<$ 0.1, ** p

![]() $<$ 0.05, *** p

$<$ 0.05, *** p

![]() $<$ 0.005.

$<$ 0.005.

Figure 5. Information about the distribution of CO

![]() $_2$ emissions changes perceived costs of carbon taxation. The lines with shaded area display linear marginal effect estimates with 95 per cent confidence intervals. The points display non‐linear marginal effects using the binning estimator proposed by (Hainmueller et al., Reference Hainmueller, Mummolo and Xu2019).

$_2$ emissions changes perceived costs of carbon taxation. The lines with shaded area display linear marginal effect estimates with 95 per cent confidence intervals. The points display non‐linear marginal effects using the binning estimator proposed by (Hainmueller et al., Reference Hainmueller, Mummolo and Xu2019).

Figure 5 displays these linear interaction effects, as well as the estimated non‐linear interaction effects. We find that the treatments emphasising the distribution of household CO

![]() $_2$ emissions by income (T2 and T3) cause large significant changes in individuals' assessments, in the lowest and middle income tercile, of the cost of carbon taxation. In contrast, we see no meaningful changes amongst those in the highest income quintile. Thus, our results find that individuals' household income moderates the effect of our treatments on cost perceptions, in line with our analyses above.

$_2$ emissions by income (T2 and T3) cause large significant changes in individuals' assessments, in the lowest and middle income tercile, of the cost of carbon taxation. In contrast, we see no meaningful changes amongst those in the highest income quintile. Thus, our results find that individuals' household income moderates the effect of our treatments on cost perceptions, in line with our analyses above.

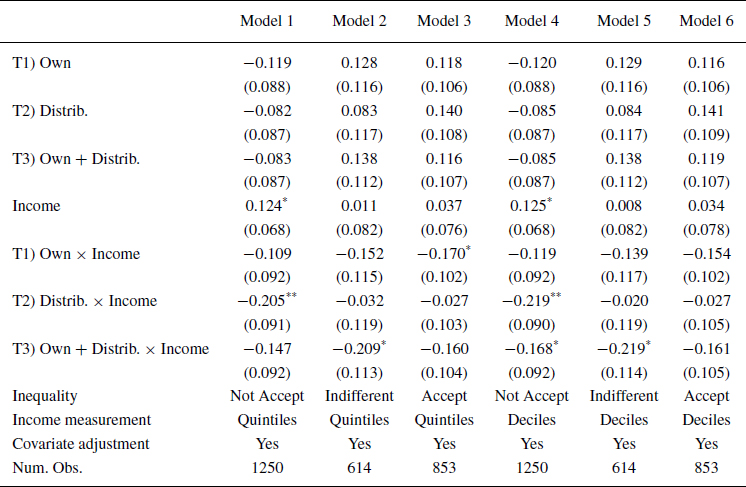

We now examine how cost perceptions moderate the income gradient of our information treatments. Table 4 shows that the increase in support for carbon taxation for poorer individuals caused by the information treatments primarily occurs amongst those who do not believe a carbon tax would decrease their income. Likewise, the decrease in support for carbon taxation for richer individuals caused by the information treatments primarily occurs amongst those who do not believe a carbon tax would decrease their income. For those who believe a carbon tax would not change their income, we see evidence that information about carbon inequality causes support for carbon taxes to increase (decrease) for poorer (richer) individuals.Footnote 7 In contrast, we see no meaningful effects of both the information treatments and income amongst those who believe their income would reduce as a result of carbon taxation. This suggests that individuals' material economic concerns overwhelm these information and income effects when considering support for carbon taxation.

Table 4. Effect of treatments by income and cost perceptions

* p

![]() $<$ 0.1, ** p

$<$ 0.1, ** p

![]() $<$ 0.05, *** p

$<$ 0.05, *** p

![]() $<$ 0.01.

$<$ 0.01.

Figure 6 displays marginal effect plots for these results. When considering those individuals who believe their income would be unaffected, we see that the information treatment causes a significant increase in support from poorer individuals and a significant decrease in support from richer individuals. This is consistent across both linear and non‐linear marginal effect estimates. The results thus suggest that material concerns can override distributional concerns, amongst those who perceive that a carbon tax would reduce their income. Or put differently: Negative subjective perceptions of the costs of taxation could be so strong as to overwhelm the actual (beneficial) effects of such taxation for the poor.

Figure 6. Treatment effects depend upon individuals' income and perceived cost of carbon taxation. The lines with shaded area display linear marginal effect estimates with 95 per cent confidence intervals. The points display non‐linear marginal effects using the binning estimator proposed by Hainmueller et al. (Reference Hainmueller, Mummolo and Xu2019). Rows indicate perceived cost of carbon taxation, while columns indicate the information treatment conditions.

Inequality aversion

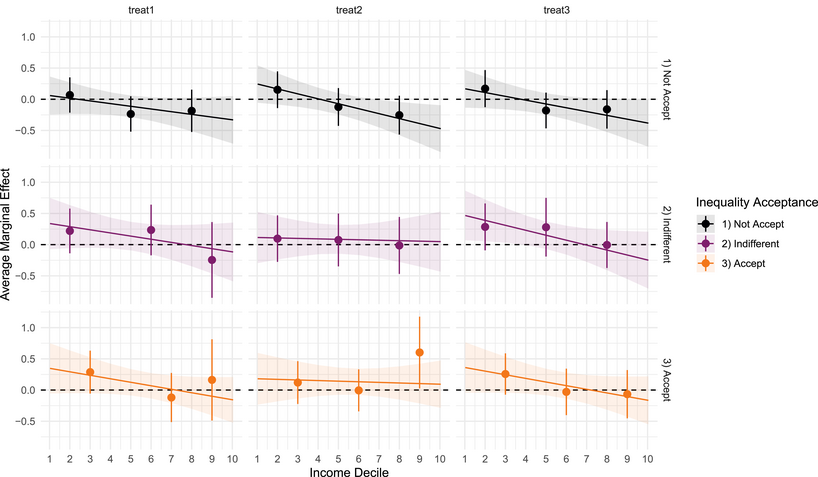

Next, we examine how individuals' inequality preferences affect support for carbon taxation. Table 5 displays how the effect of the treatment varies by income, depending upon individuals' acceptance of economic inequality. In general, the results do not provide strong evidence that inequality preferences moderate these effects. While there are differences in statistical significance across sub‐groups, substantive effects are broadly similar. This is also in line with the above finding that general perceptions of inequality are only weakly related to support for carbon taxation in the first place.

Table 5. Effect of treatments by income and inequality acceptance

* p

![]() $<$ 0.1, ** p

$<$ 0.1, ** p

![]() $<$ 0.05, *** p

$<$ 0.05, *** p

![]() $<$ 0.01.

$<$ 0.01.

This is further demonstrated by Figure 7, which displays the relevant marginal effects plots. Looking at those who are inequality‐averse, we see a consistent negative interaction effect for the treatments in line with our main results. This is similar for those who are not inequality‐averse when receiving treatments that provide information about individuals' expected CO

![]() $_2$ emissions relative to the average household (T1 and T3). The main exception, however, is the treatment that only presents information about the distribution of CO

$_2$ emissions relative to the average household (T1 and T3). The main exception, however, is the treatment that only presents information about the distribution of CO

![]() $_2$ emissions between those in the top and bottom income quintiles (T2). In this case, we broadly see a flat income gradient, although the non‐linear interaction effect estimate suggests that there is a significant increase in support amongst rich individuals who are inequality accepting. This result suggests that a portion of these rich individuals who are inequality accepting may misperceive their place in the income distribution, and thus their expected CO

$_2$ emissions between those in the top and bottom income quintiles (T2). In this case, we broadly see a flat income gradient, although the non‐linear interaction effect estimate suggests that there is a significant increase in support amongst rich individuals who are inequality accepting. This result suggests that a portion of these rich individuals who are inequality accepting may misperceive their place in the income distribution, and thus their expected CO

![]() $_2$ emissions, given that this effect disappears when the same information is combined with information about an individual's own emissions.

$_2$ emissions, given that this effect disappears when the same information is combined with information about an individual's own emissions.

Figure 7. Treatment effects depend upon individuals' income and inequality preferences. The lines with shaded area display linear marginal effect estimates with 95 per cent confidence intervals. The points display non‐linear marginal effects using the binning estimator proposed by Hainmueller et al. (Reference Hainmueller, Mummolo and Xu2019). Rows indicate individuals' acceptance of inequality, while columns indicate the information treatment conditions.

Summary

In summary, we find that information about carbon inequality, in combination with individuals' positions in the income distribution, is relevant for explaining support for carbon taxation. Providing information about the actual distribution of household CO

![]() $_2$ emissions by income significantly increases support for carbon taxes amongst the lower part of the income distribution. Exploring the cost and inequality‐aversion mechanisms, we generally find that this is likely driven by poorer individuals updating their beliefs on the costs of taxation, that is finding out that they are less likely to be burdened by such taxation. Further supporting the individual cost mechanism, we find that support is independent of our information treatments and income for those who believe they would lose income from the carbon tax.

$_2$ emissions by income significantly increases support for carbon taxes amongst the lower part of the income distribution. Exploring the cost and inequality‐aversion mechanisms, we generally find that this is likely driven by poorer individuals updating their beliefs on the costs of taxation, that is finding out that they are less likely to be burdened by such taxation. Further supporting the individual cost mechanism, we find that support is independent of our information treatments and income for those who believe they would lose income from the carbon tax.

Conclusion

Transitioning to a green economy requires costly policy choices in order to mitigate climate change. Yet individuals differ in terms of their contribution to climate change, in relation to their household's carbon footprint. A growing body of research highlights the importance of carbon inequality for understanding these distributional costs. Richer households have significantly larger carbon footprints than poorer households, yet they are better prepared to adapt to higher costs from carbon pricing due to their lower relative dependence upon carbon‐intensive goods and their resources to more easily transition to greener alternatives.

In this paper, we examine how information about carbon inequality, in terms of individual perceptions about the contribution of poorer and richer households to CO

![]() $_2$ emissions, affects support for carbon taxation. Using original survey data, and an embedded information experiment from Germany, we find that individuals' material positions are crucial for understanding beliefs and support for costly climate policies. Individuals' perceptions about the distribution of CO

$_2$ emissions, affects support for carbon taxation. Using original survey data, and an embedded information experiment from Germany, we find that individuals' material positions are crucial for understanding beliefs and support for costly climate policies. Individuals' perceptions about the distribution of CO

![]() $_2$ emissions by income inform their assessment of the costliness of the green transition for their own incomes. Providing information about the actual distribution of CO

$_2$ emissions by income inform their assessment of the costliness of the green transition for their own incomes. Providing information about the actual distribution of CO

![]() $_2$ emissions thus has the potential for individuals to reassess the costliness of carbon taxation for themselves, based upon their position in the income distribution, and ultimately their support for carbon taxation. We also find that the link between redistributive and environmental policies largely works via material self‐interest in this case. Individuals are more likely to support carbon taxation once they find out that they are less affected by it. Their general attitudes towards inequality (and redistribution) matter less in this case.

$_2$ emissions thus has the potential for individuals to reassess the costliness of carbon taxation for themselves, based upon their position in the income distribution, and ultimately their support for carbon taxation. We also find that the link between redistributive and environmental policies largely works via material self‐interest in this case. Individuals are more likely to support carbon taxation once they find out that they are less affected by it. Their general attitudes towards inequality (and redistribution) matter less in this case.

This research helps our understanding of how the green transition relates to existing inequalities within societies. Making carbon consumption costly is one of the most important policy options for facilitating meaningful climate change mitigation. Yet the contribution of individuals to the problem, and their ability to shoulder the costs of transition, are unequally distributed. As the consequences of meaningful climate policy become more immediate and directly related to individuals' material positions, individuals' beliefs and policy preferences will likely change. Our results suggest that the existing composition of climate policy supporters is not necessarily stable and may start to mirror the broader context of income inequality within society in the future. In particular, the existing income gradient in support for climate policy, with higher support amongst higher incomes, may change as the discussion of climate change and climate inequality focuses on the high absolute emissions of richer individuals. Therefore, future research that explicitly focuses on how costly climate policy is connected to broader economic and social reforms (e.g. Bergquist et al., Reference Bergquist, Mildenberger and Stokes2020; Busemeyer & Beiser‐McGrath, Reference Busemeyer and Beiser‐McGrathn.d.) can help better understand the emerging political cleavages surrounding climate change.

Our findings that the link between carbon inequality and support for carbon taxation is primarily driven by individuals' personal cost perceptions (i.e. from material self‐interest) also suggest potential future avenues for research. From a policy perspective, individuals' beliefs about the material burdens they would face from carbon taxation, and other ambitious costly climate policy, are a key input for political feasibility. Therefore, policy designs which are able to offset or diffuse these costs, for example, through revenue recycling and rebate schemes (e.g. Jagers et al., Reference Jagers, Martinsson and Matti2019; Maestre‐Andrés et al., Reference Maestre‐Andrés, Drews and van den Bergh2019; Dolšak et al., Reference Dolšak, Adolph and Prakash2020; Mildenberger et al., Reference Mildenberger, Lachapelle, Harrison and Stadelmann‐Steffen2022; Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauern.d.; Beiser‐McGrath et al., Reference Beiser‐McGrath, Bernauer and Prakash2023; Beiser‐McGrath & Bernauer, Reference Beiser‐McGrath and Bernauer2019) continue to offer an avenue to increasing climate ambition. Additionally, from a research perspective, delving deeper into the mental models used by individuals to form these beliefs will help further understand these political components of climate policy. For example, future research could examine how differences between income groups in terms of the costs of climate policy have differential impacts when considering absolute versus relative costs and individuals' sensitivity to economic pressures in supporting climate policy (e.g. Beiser‐McGrath, Reference Beiser‐McGrath2022; Büchs & Schnepf, Reference Büchs and Schnepf2013; Carley & Konisky, Reference Carley and Konisky2020; Davis & Caldeira, Reference Davis and Caldeira2010; Lenzen et al., Reference Lenzen, Wier, Cohen, Hayami, Pachauri and Schaeffer2006; Liu et al., Reference Liu, Spaargaren, Heerink, Mol and Wang2013; Papathanasopoulou & Jackson, Reference Papathanasopoulou and Jackson2009; Weber & Matthews, Reference Weber and Matthews2008) potentially lead to a multitude of cost comparisons and perceptions that individuals may form. Systematically exploring which forms of costs individuals focus on, drawing on insights from behavioural economics and public policy (e.g. Oliver, Reference Oliver2017; Reference Oliver2023) and research on the formation of environmental beliefs (e.g. Beiser‐McGrath, Reference Beiser‐McGrath2023) could, therefore, help further our understanding of preference formation and its political consequences in the course of the green transition.

The broader political and policy implications of our findings point to two important issues: policy design and communication. Regarding policy design, our findings suggest that a careful design of carbon pricing schemes that takes the redistributive implications of such pricing into account could potentially increase overall levels of public support for climate change policies as well as contribute to mitigating inequalities. Secondly, our analysis also implies that political communication might matter: The provision of information about the real effects of carbon taxation on inequality can affect individual preferences and perceptions, overall increasing support for carbon pricing. However, vice versa, politically motivated biased information provision could also have the opposite effect. In particular, selective reporting of emissions and tax incidences with differing benchmarks (e.g. absolute vs. relative emissions/incidence) could impact public support for carbon taxation. Hence, future research could further explore the extent to which information provision can actually make a difference in moving preferences.

Acknowledgements

Thanks to Janina Beiser‐McGrath, Thomas Bernauer, Alexander Sayer Gard‐Murray, Chris Hanretty, Oliver Heath, Cesar B. Martinez‐Alvarez, Cassilde Schwartz, Kaat Smets and Gabriele Spilker for comments and suggestions. This research was funded through the ‘Politics of Inequality’ Excellence Cluster at Universität Konstanz as part of the German Excellence Initiative (DFG EXC‐2035/1).

Online Appendix

Additional supporting information may be found in the Online Appendix section at the end of the article:

Table A1: Effect of Treatments on Support for Carbon Taxation Accounting for Additional Interactions.

Figure A1: Replication of Figure 2 from the main text, following the covariate adjustment advice of Beiser‐McGrath and Beiser‐McGrath (2023) for non‐linear interaction effects.

Figure A2: Replication of Figure 5 from the main text, following the covariate adjustment advice of Beiser‐McGrath and Beiser‐McGrath (2023) for non‐linear interaction effects.

Figure A3: Replication of Figure 6 from the main text, following the covariate adjustment advice of Beiser‐McGrath and Beiser‐McGrath (2023) for non‐linear interaction effects.

Figure A4: Replication of Figure 7 from the main text, following the covariate adjustment advice of Beiser‐McGrath and Beiser‐McGrath (2023) for non‐linear interaction effects.

2

2