1. Introduction

Like many other countries, the US has experienced a resurgence in inflation in recent years, not seen in nearly 40 years. The initial rise in measured inflation can be partly attributed to the breakdown of the global supply chain following the COVID pandemic and the rise in energy prices, influenced by geopolitical disruptions such as the war in Ukraine and the countervailing sanctions on Russia’s export of oil and natural gas. However, the overtly expansionary monetary policy, through quantitative easing and the policy interest rate kept near the zero lower bound for a while, also bears some responsibility, especially for the increase in core (trend) inflation.

It has long been thought that the quantity of money in circulation has a direct bearing on an economy’s general price level (e.g., Fisher, Reference Fisher1911; Friedman, Reference Friedman and Friedman1956), implying that an increase in nominal money supply beyond a rise in real money demand leads to a higher price level, thus being a key determinant to core inflation. Yet, central banks’ emphasis on the short-term policy interest rate in the conduct of monetary policy, as well as its predominant use as a modelling tool by researchers and central banks, has relegated the importance of money in monetary policy to the background, possibly overlooking it by leaving it in a blind spot.

Empirically, following Bernanke and Mihov (Reference Bernanke and Mihov1998) and Christiano et al. (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999), a significant strand of the literature using structural vector autoregressive (VAR) models has found that shocks to the Fed Funds rate appeared to capture impulse response functions (IRFs) that are consistent with the expected economic intuition for their dynamic impact on interest rates, output, some narrow or somewhat broader money aggregates, and sometimes on inflation or the price level.Footnote 1 It became widely accepted that a central bank’s stance on monetary policy can be accurately represented, or extracted, from the policy interest rate, i.e., the Fed Funds rate for the US. However, the evidence was not entirely free from empirical puzzles regarding prices and output, which vary depending on the sample and variables in the model. In particular, the occurrence of a so-called price puzzle happens when what is identified as a restrictive monetary policy is followed by a counterintuitive empirical rise in prices.

When bringing up measures of money supply, the literature typically referred to conventional simple-sum aggregates, which impose that all components of an aggregate are perfectly substitutable. However, Barnett (Reference Barnett1980) effectively showed that, contrary to simple aggregates, the demand for Divisia money services has firm microfoundations that are consistent with welfare-maximizing households. Therefore, a more appropriate measure to represent the amount of medium of exchange in circulation, such as a Divisia index, could be relevant to assess its ability to better capture the state of monetary policy.

Recently, notable papers (such as Keating et al. Reference Keating, Kelly, Smith and Valcarcel2019, Belongia and Ireland, Reference Belongia and Ireland2019, Chen and Valcarcel, Reference Chen and Valcarcel2021, Reference Chen and Valcarcel2025) have found that Divisia money empirically matters, has informational content, but has been neglected in mainstream studies on the empirical role of money. Some papers have used time-invariant models, while others have used time-varying parameter (TVP) models.Footnote 2 In particular, Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019), using quarterly data up to 2015, and Chen and Valcarcel (Reference Chen and Valcarcel2021), using monthly data for the 1988–2020 period, find that, unlike Fed Funds rate-based shocks, structural monetary policy shocks estimated with Divisia measures of money do not exhibit a counterintuitive rise in the price level in response to restrictive monetary policy.

It might be argued that the Fed Funds rate’s inadequacy in representing monetary policy post-2008 is not surprising, given the Fed’s use of unconventional tools. Still, tracking the central bank’s instruments is different from understanding the overall stance of monetary policy, especially when considering its effects on output and prices.

One might question whether this result is robust and why it has remained barely known or acknowledged. The recent COVID episode, with its inflationary and disinflationary spells, offers a “natural experiment,” given the scale of the latest QE interventions, as inflation did not materialize in previous QE episodes following the 2007–2009 Great Financial Crisis.Footnote 3

Using samples of quarterly data from 1967Q1 to 2023Q4, this paper builds on earlier work. It takes advantage of recent episodes characterized by an important expansionary monetary policy from quantitative easing in response to the pandemic, followed by a rise in inflation, and then a renewed focus on getting inflation back around the 2% target. Combining new data with both traditional and new econometric tools, we assess the stability of the sign and size of key macroeconomic variables’ responses to monetary shocks throughout a period marked by many disturbances. Using block-recursive identifying restrictions, we apply two estimation methods to extract structural monetary policy shocks from alternative indicators.

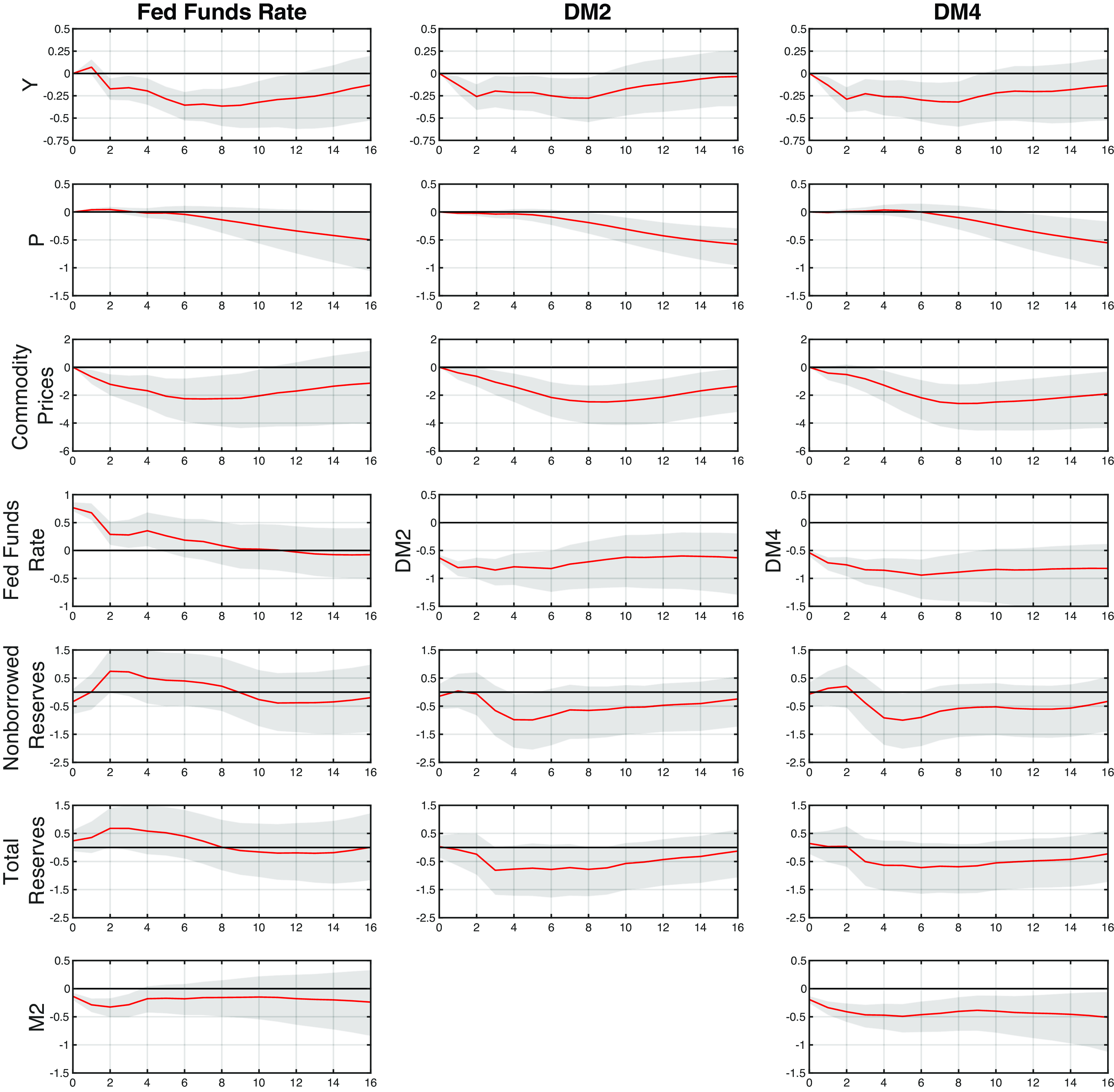

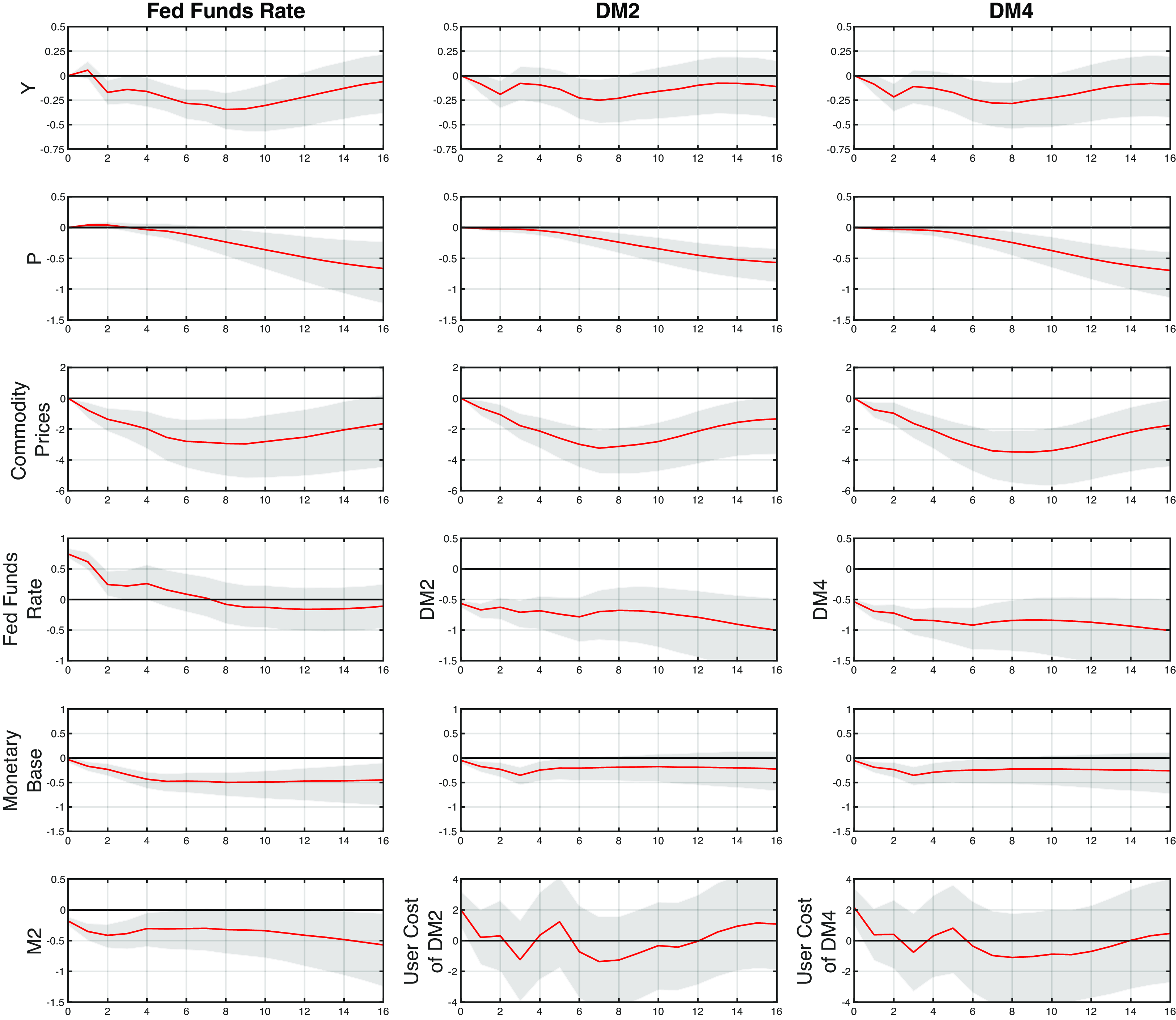

Time-invariant structural VAR (SVAR) models are first used to revisit the typical identification restrictions (such as in Christiano et al. Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999, Christiano et al. Reference Christiano, Trabandt, Walentin, Christiano, Trabandt and Walentin2010, and Keating et al. Reference Keating, Kelly, Smith and Valcarcel2019), comparing models that include either the Fed Funds rate, a Wu and Xia’s (Reference Wu and Xia2016) shadow rate with conventional or Divisia monetary aggregates.Footnote 4 Time-invariant impulse response functions (IRFs) for key macroeconomic variables are generated from these fixed-coefficient VARs, and their robustness is evaluated across different subsamples and variable sets.

We then use Goulet Coulombe’s (Reference Goulet Coulombe2025) 2-step ridge regression estimator to derive time-varying IRFs from TVP-VARs to assess whether these macroeconomic variables’ responses have been consistent throughout the years, notwithstanding the various developments in the US economy and in the conduct of monetary policy. This alternative estimator, recently developed, offers advantages that could be beneficial for addressing the empirical relevance of money. In particular, except for the estimation of one hyperparameter, in contrast to the Bayesian estimation of TVP models, it does not face the challenges of handling numerous hyperparameters and the requirement for an initial training sample that omits many observations.

Empirical evidence proves to be relevant for accurately capturing the dynamics of key macroeconomic variables since the late 1960s. Evaluating the forecasting ability and information content of Divisia measures confirms their usefulness and supports the superiority of models that include them for studying monetary policy transmission. Interest rates fail to produce dynamic responses free from empirical puzzles or consistent with expected intuition, for both earlier and extended sample periods past the early 2000s. When considering different subsamples, Divisia measures produce impulse response functions that better align with expected economic intuition and are less prone to empirical puzzles compared to interest rates or simple-sum aggregates, both in terms of size and duration of the impact. TVP-VAR evidence is particularly revealing and strongly supports our conclusion that the theoretically superior Divisia indices for monetary aggregates yield puzzle-free estimated IRFs for both output and prices throughout the 1967–2023 period. Furthermore, key macroeconomic variables are generally quicker to react to Divisia monetary policy shocks and the responses are often more important compared to alternative policy indicators.

Taking into account the latest inflation spell and using recent econometric developments, our results reinforce the idea that money, especially Divisia money, is important and has an explicit role in modelling and understanding monetary policy. Consequently, the long-held presumption in macroeconomics that the shocks to the central bank policy rate are the sole and central signal of monetary policy can be misleading or at least incomplete in characterizing the monetary policy stance and its impact, especially on prices.

The paper is structured as follows. Section 2 discusses how money has taken a back seat in monetary policy for more than three decades. Section 3 summarizes the concepts and the motivation for preferring Divisia monetary aggregates indices over traditional simple-sum monetary aggregates. Section 4 presents the econometric approach. Next, Section 5 presents and discusses the empirical results, while Section 6 provides concluding remarks and suggests possible extensions.

2. Monetary policy and inflation: money vs. the policy interest rate

Measured inflation (the percentage change in the price level between two periods) may involve both transitory and trend components. Supply shocks, such as a surge in energy prices or disruptions in the global supply chain, lead to a temporary increase in measured inflation. In the presence of nominal rigidities, the gradual adjustment of prices of some goods and services can be recorded in the overall price level over several quarters.Footnote 5

Assuming that all money in circulation is willingly held, the equilibrium between money supply and demand implies that the difference between the growth rates of the supply in the nominal quantity of money and the real demand for money must equate to the percentage change in the price level. This holds true despite nominal rigidities and the short-term non-neutrality of money, notwithstanding the operational modalities underlying the implementation of monetary policy.

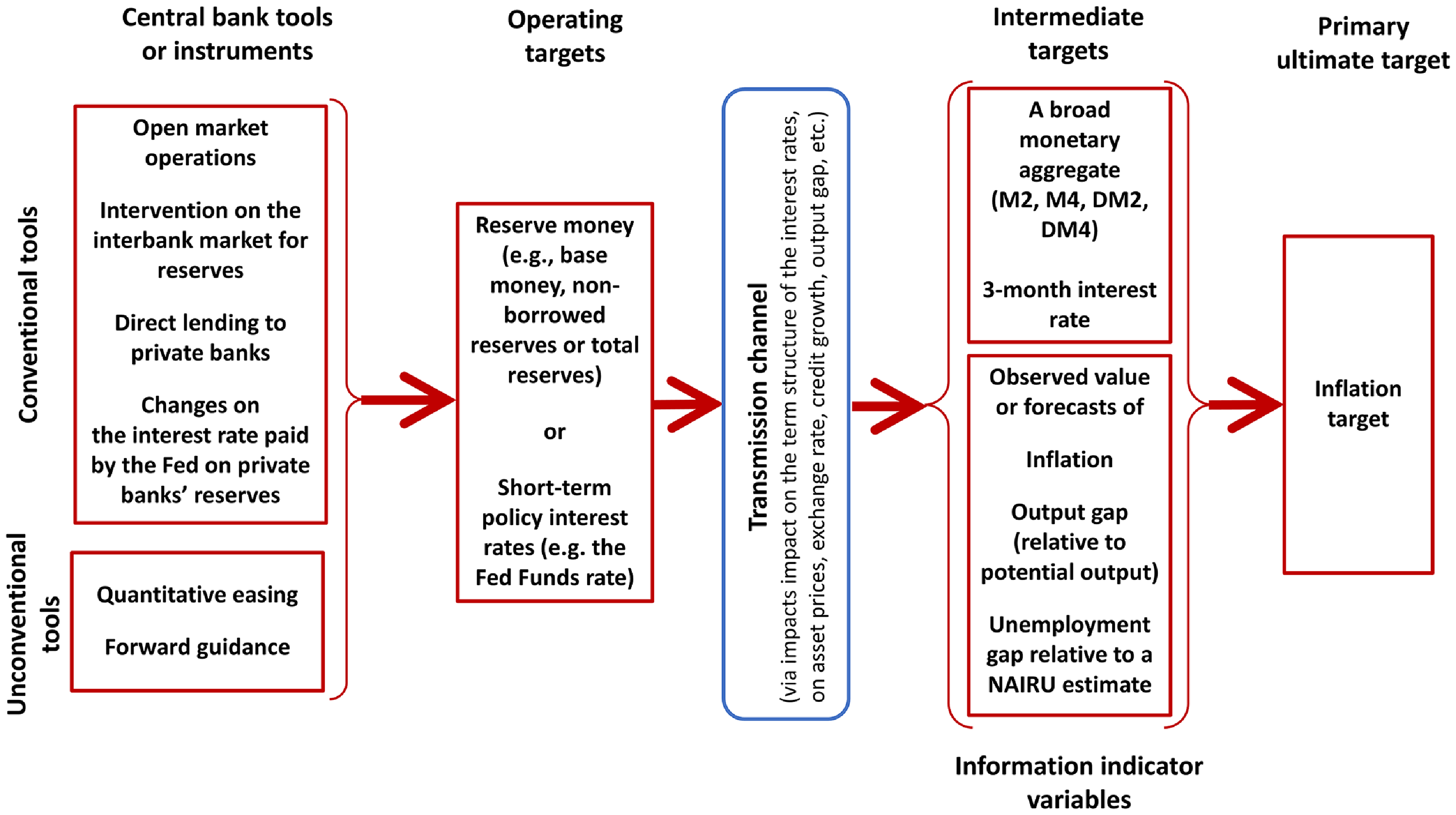

Monetary policy implementation is a chain process, starting from a central bank’s use of tools to reach operating targets, which then impact intermediate targets or information indicator variables, ultimately achieving the monetary authority’s primary target, as illustrated in Figure 1.

Figure 1. Alternative monetary policy chains.

In the US, once the effects of the temporary non-neutrality of money have subsided, the Federal Reserve’s ultimate target can be thought of as a 2% value for core inflation. The central bank can use conventional tools like open market operations and interest rate adjustments, and unconventional tools like quantitative easing and/or forward guidance. The operating targets can be some reserve money or short-term interest rates, which impact various financial and economic variables, such as the term structure of the interest rates, asset prices, exchange rates, credit growth, output gap, etc. This leads to changes in intermediate targets (e.g., the 3-month or a higher maturity interest rate, or some measures of broad money) or information-indicator variables (e.g., the forecasts of some variables thought to be informative, such as future inflation, an output gap relative to potential output, or an unemployment gap relative to some value of a Non-Accelerating Inflation Rate of Unemployment), aiming at achieving the monetary policy goal.

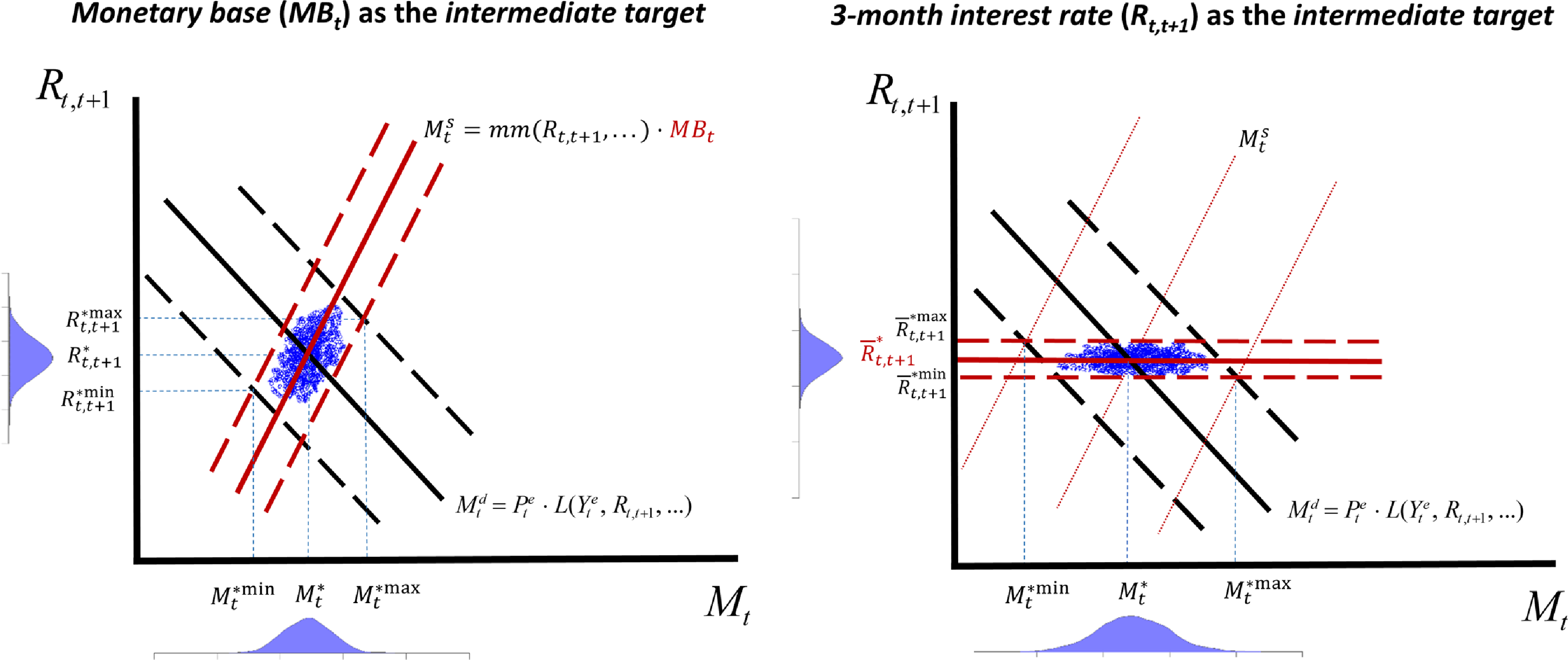

In accordance with McCallum’s (Reference McCallum1989) graphic and schematic presentation, which we adapt in Figure 2, monetary policy can be understood, broadly speaking, in two alternative ways to achieve that the resulting growth path of some adequate and relevant monetary aggregate aligns with the inflation objective, for a given expected growth rate of real money demand and a given money multiplier.

Figure 2. A schematic representation of alternative intermediate targets for monetary policy: the monetary base versus the 3-month interest rate.

The dashed lines represent the “extreme” positions of the money demand and money supply curves due to the central bank’s imperfect controls of the intermediate target and the existence of uncertainty on either or both money demand and supply. Associated probability mass functions for the quantity of money and the short term interest rates respectively are represented below the horizontal axis and to the left axis of the graphs associated with the alternative targets. Under a short-term interest rate intermediate target, the position of the underlying money supply function is endogenously determined.

On one hand, if the operating target were considered to be the monetary base or a specific measure of private banks’ reserves, the central bank could chart its course so that the resulting path of broad money aligns with the inflation target. In particular, expected changes in either real money demand or the money multiplier would lead to adjustments in the operating target.

On the other hand, with the Fed Funds rate as the operating target, a central bank must adjust its very short-term one-day policy interest rate for a sufficient period to influence the specific higher-maturity nominal interest rate along the yield curve that enters the real money demand function. Thereby, monetary policy must be conducted in such a way that the resulting path of broad money growth aligns with the ultimate inflation target. Similarly, expected changes in real money demand, due to movements in the expected growth rate of real economic activity and the cost of financial intermediation, will also necessitate adjustments to the operating target.

However, empirical, theoretical, and central bank models have generally abstracted, for a long time, from the role of money supply in analyzing monetary policy. This de-emphasis is also evident in the conduct and discussion of monetary policy by central banks. Due to presumed instability in money demand and supply, central banks became disenchanted with using base money or broader money aggregates as instruments, intermediary targets, or indicators for monetary policy. This remained true even with the use of quantitative easing during the 2007–2009 Financial Crisis and the 2020 pandemic. For instance, while the Fed Funds rate was near zero, quantitative easing in the US led to massive expansions of the Federal Reserve’s balance sheet, with large purchases of either government or private bonds on the asset side and increases in financial intermediaries’ reserves and/or the US Treasury General Account on the liability side. Yet, monetary policy discussions continued to focus mainly on the policy rate.

Moreover, Taylor’s (Reference Taylor1993) and various extensions, e.g., Clarida et al. (Reference Clarida, Galí and Gertler2000), showed that monetary policy could be represented by an interest-rate rule or reaction function. This ties the evolution of the Fed Funds rate

![]() $_{ff}\bar {R}_{t}$

, to the quarterly average lagged value of the Fed Funds rate

$_{ff}\bar {R}_{t}$

, to the quarterly average lagged value of the Fed Funds rate

![]() $_{ff}{R}_{t-1}$

, the Wicksellian real natural rate

$_{ff}{R}_{t-1}$

, the Wicksellian real natural rate

![]() $ r^{N*}_t$

(also called the neutral real rate), the inflation gap relative to the inflation target

$ r^{N*}_t$

(also called the neutral real rate), the inflation gap relative to the inflation target

![]() $\pi ^\oplus$

, and a proxy for the output gap

$\pi ^\oplus$

, and a proxy for the output gap

![]() $\tilde {y}_{t}$

relative to potential real output.

$\tilde {y}_{t}$

relative to potential real output.

Hence, a generalized version of the Taylor rule describing the dynamics of the Fed Funds rate,

![]() $_{ff}\bar {R}_{t}$

, could be written as follows:

$_{ff}\bar {R}_{t}$

, could be written as follows:

The parameters of the monetary policy rule are interpreted as follows. The interest rate smoothing parameter

![]() $ 0\lt \rho _m\lt 1$

captures the central bank’s desire to avoid abrupt movements in the Fed Funds rate. The parameter

$ 0\lt \rho _m\lt 1$

captures the central bank’s desire to avoid abrupt movements in the Fed Funds rate. The parameter

![]() $\phi _\pi \gt 0$

indicates the central bank’s willingness to raise (lower) the policy rate when inflation exceeds (is less than) its target, adhering to the Taylor principle that it needs to move more than one-for-one with inflation. The output gap parameter

$\phi _\pi \gt 0$

indicates the central bank’s willingness to raise (lower) the policy rate when inflation exceeds (is less than) its target, adhering to the Taylor principle that it needs to move more than one-for-one with inflation. The output gap parameter

![]() $\phi _{y} \gt 0$

reflects the central bank’s intent to increase (decrease) the Fed Funds rate when real output exceeds (is below) trend output. Additionally, a non-systematic discretionary component

$\phi _{y} \gt 0$

reflects the central bank’s intent to increase (decrease) the Fed Funds rate when real output exceeds (is below) trend output. Additionally, a non-systematic discretionary component

![]() $\epsilon _t$

can be included to account for deviations from the systematic component due to other factors or changes in the usual weights given to inflation and output gaps, possibly in accordance with particular sensitivities expressed by the Federal Open Market Committee meetings’ participants.

$\epsilon _t$

can be included to account for deviations from the systematic component due to other factors or changes in the usual weights given to inflation and output gaps, possibly in accordance with particular sensitivities expressed by the Federal Open Market Committee meetings’ participants.

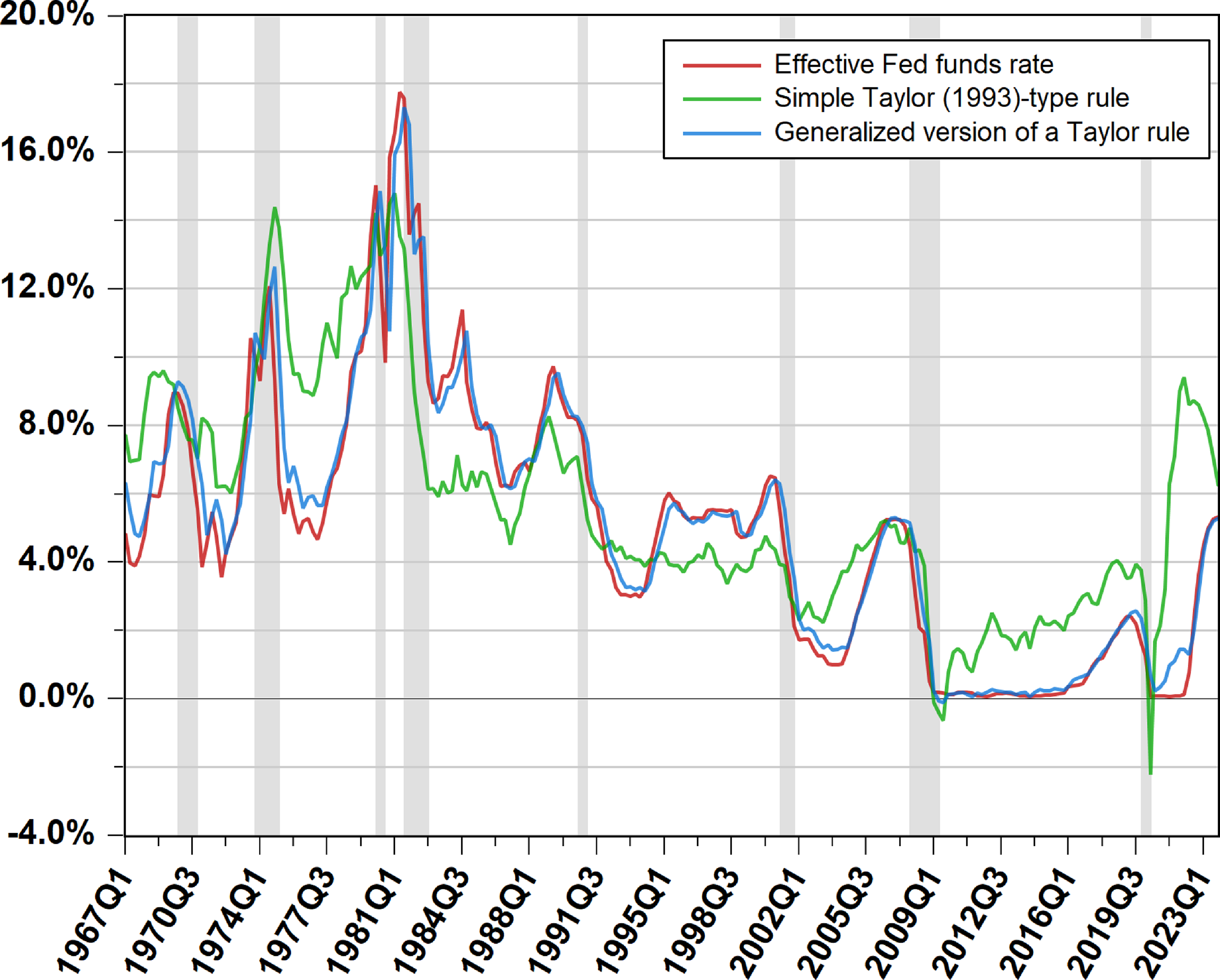

Using the Atlanta Fed’s Taylor Rule Utility with representative parameter values allows for the calibration of a generalized Taylor rule.Footnote 6 Figure 3 shows, almost astonishingly, that the resulting path of the ‘prescribed’ Fed Funds rate follows very closely the course of the observed Fed Funds rate from 1967Q1 to 2023Q4 (with a correlation of 0.974). Of course, no one would reasonably argue that the Federal Reserve was either pursuing a 2% inflation rate target in the late 1960s or in the 1970s, or that its sensitivity to inflation was necessarily as high as the one used in our simulation. Nonetheless, this suggests that tracking of the central bank’s generally preferred instrument may be a different thing than keeping track of the monetary policy stance.

Figure 3. Actual effective fed funds rate and Taylor rule’s prescriptions from 1967Q1 to 2023Q4.

The Taylor-rule prescribed values were generated using the Taylor Rule Utility made available by the Center for Quantitative Economic Research from the Federal Reserve Bank of Atlanta website (https://www.atlantafed.org/research/taylor-rule), with

![]() $r^{N*}_t=r^{N*} = 2\%$

, and a 2% inflation target,

$r^{N*}_t=r^{N*} = 2\%$

, and a 2% inflation target,

![]() $\phi _\pi = 0.5$

, and

$\phi _\pi = 0.5$

, and

![]() $\phi _{y} =0.5$

, for the Simple Taylor-type rule. For the generalized version, Laubach and Williams’s (Reference Laubach and Williams2003) time-varying 1-sided estimate of the natural real interest rate and an interest rate smoothing parameter

$\phi _{y} =0.5$

, for the Simple Taylor-type rule. For the generalized version, Laubach and Williams’s (Reference Laubach and Williams2003) time-varying 1-sided estimate of the natural real interest rate and an interest rate smoothing parameter

![]() $\rho _m = 0.85$

were used, while keeping a 2% inflation target,

$\rho _m = 0.85$

were used, while keeping a 2% inflation target,

![]() $\phi _\pi = 0.5$

, and

$\phi _\pi = 0.5$

, and

![]() $\phi _{y} =0.5$

.

$\phi _{y} =0.5$

.

Following Taylor’s (Reference Taylor1993) description of monetary policy by an interest-rate rule and its spin-offs, Woodford (Reference Woodford2003) then put forward some foundations suggesting that the policy interest rate may suffice to describe the monetary policy stance, while the quantity of money is adjusting endogenously.

In that vein, empirical literature, surveyed by Ramey (Reference Ramey and Ramey2016), used various econometric techniques to identify monetary policy shocks from movements in the Fed Funds rate. For example, Romer and Romer (Reference Romer and Romer1989, Reference Romer and Romer1994, Reference Romer and Romer1997) used archival Federal Reserve documents to pinpoint episodes of deliberate counter-inflationary policy decisions. Structural vector autoregressive models by Sims (Reference Sims1980, Reference Sims1986), Bernanke and Mihov (Reference Bernanke and Mihov1998), and Christiano et al. (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999, Reference Christiano, Trabandt, Walentin, Christiano, Trabandt and Walentin2010) estimate monetary policy shocks and their macroeconomic impacts by imposing identification restrictions. Additionally, high-frequency data studies, such as Nakamura and Steinsson (Reference Nakamura and Steinsson2018a, Reference Nakamura and Steinssonb), extract unexpected components of Fed Funds rate movements to measure exogenous monetary policy shocks.

The aforementioned empirical research and the central banks’ preference for the short-term policy interest rate as its instrument, along with Woodford’s (Reference Woodford2003) work, have made Taylor-type reaction functions prevalent in dynamic stochastic general equilibrium (DSGE) models to describe interest rate dynamics, typically excluding the quantity of money. In line with Woodford (Reference Woodford2003), it is assumed that there is no need to explicitly include a quantity of money variable, as the policy interest rate determines, in turn, the quantity of money along an implicit money demand curve, without explicitly modelling money demand and supply functions.

Accordingly, in typical New Keynesian DSGE models, monetary policy is captured by a Taylor-type rule, assuming no need for an explicit measure of the “quantity of money.” It is hypothesized that the nominal interest rate from the Taylor reaction function, up to a stochastic factor, will lead to an endogenous adjustment of an implicit “monetary aggregate” consistent with what is otherwise observed.

Consequently, a first issue pertains to whether abstracting from an explicit consideration of the role of money may have been misleading, at least to some extent, and even more so for some periods. The second issue we now turn to is the most appropriate concept of money.

3. On the theoretical and empirical relevance of Divisia monetary aggregates

3.1 Issues with traditional measures of money

The concept of a medium of exchange implies that its use as a generally accepted means of payment reduces the time, effort, and resources costs involved in trading goods and services. Undoubtedly, financial and goods-and-service innovations have transformed the form of “money” and its use over the last 40 years. Yet, notwithstanding what now constitutes the medium of exchange compared to what it was in the past, this does not change the idea that the general price level must also be compatible with an equilibrium in the market for money, with short-run nominal rigidities and long-run wage and price flexibility.

The theoretical foundation of core inflation being a monetary phenomenon stems from the equilibrium between money supply and demand, where economic agents freely hold the outstanding quantity of money. This equilibrium condition does not rely on some particular model of functioning of the labor market and/or the market for goods and services, holds regardless of the existence or not of nominal rigidities, and does not require the short-term and long-term money demands to be identical. Hence, trend inflation being driven by monetary considerations is not due to a Keynesian nature of the economy or a question pertaining to a school of thought.

Various issues have been invoked by central banks to turn away from the traditional monetary aggregates as guides to the conduct of monetary policy. In part, this was motivated by a somewhat vast empirical literature documenting the existence of instability in the demand for money aggregates, in the wake of Goldfeld (Reference Goldfeld1976) and the case for the missing money. Referring to traditional money aggregates, this instability has been mostly linked to instability in the short-term dynamics of money demand, and less so in the long-run money demand. Moreover, it appeared to be tied to post-1973 periods of significant financial innovations and changes in the components that can be counted as medium of exchange. For instance, Lucas and Nicolini (Reference Lucas and Nicolini2015) showed how the changes in the regulation of the banking sector in the 1980s had led to evidence of instability in the demand for M1, and they argued in favor of redefining “monetary aggregates by the functions they have in the payments system rather than by the institutions whose liabilities they are.” Furthermore, as discussed in Cukierman (Reference Cukierman and Cukierman2018), Noizet, Reference Noizet2018), and Ryan and Whelan (Reference Ryan and Whelan2023), the US conventional M2 money multiplier to the monetary base sharply fell, especially around 2008. This coincided with the financial crisis, which decreased the financial system’s readiness to lend in a more uncertain environment. Additionally, the nominal interest rate was near zero, and in October 2008, the US Federal Reserve Bank began paying interest on reserves held by financial institutions.Footnote 7

A non-trivial task is to link the theoretical concept of money to an empirical concept that is satisfactory and sufficiently broad, which Lucas (Reference Lucas1977) was alluding to in his own words:

“ in the ‘long run,’ general price movements arise primarily from changes in the quantity of money. Moreover, cyclical movements in money are large enough to be quantitatively interesting. [

![]() $\ldots$

] The direct evidence on short-term correlations between money, output, and prices is much more difficult to read. [

$\ldots$

] The direct evidence on short-term correlations between money, output, and prices is much more difficult to read. [

![]() $\ldots$

] In general, however, the link between money and these and other variables is agreed to be subject, in Friedman’s terms, to ‘long and variable lags.’ [

$\ldots$

] In general, however, the link between money and these and other variables is agreed to be subject, in Friedman’s terms, to ‘long and variable lags.’ [

![]() $\ldots$

] These remarks do not, of course, explain why monetary effects work with long and variable lags. On this question little is known. It seems likely that the answer lies in the observation that a monetary expansion can occur in a variety of ways, depending on the way the money is ‘injected’ into the system, with different price response implications depending on which way is selected. This would suggest that one should describe the monetary ‘state’ of the economy as being determined by some unobservable monetary aggregate, loosely related to observed aggregates over short periods but closely related secularly.”

$\ldots$

] These remarks do not, of course, explain why monetary effects work with long and variable lags. On this question little is known. It seems likely that the answer lies in the observation that a monetary expansion can occur in a variety of ways, depending on the way the money is ‘injected’ into the system, with different price response implications depending on which way is selected. This would suggest that one should describe the monetary ‘state’ of the economy as being determined by some unobservable monetary aggregate, loosely related to observed aggregates over short periods but closely related secularly.”

This quote could thus be seen as an invitation to link the concept of money to a suitable and encompassing empirical counterpart.

3.2 The conceptual and theoretical case for Divisia measures of money

Typically, much of the literature has used conventional measures of monetary aggregates, defined as simple arithmetic sums of their components, to measure the medium-of-exchange volume in circulation. By construction, the reference to a traditional monetary aggregate implicitly assumes that all its components are perfectly substitutable, by implying that the services derived from holding and using each component are perfectly equivalent in providing the services of a medium of exchange. For instance, banknotes and demand deposits, whose holding yields a higher return, have the same unitary weight in the simple-sum aggregate. At the same time, traditional broader aggregates, such as M3 and M4, tend to overweight shadow bank services, while narrower aggregates exclude financial bonds from the financial markets on which companies finance themselves for maturities of less than one year. So, while a one-hundred-dollar bill and a one-hundred-dollar Treasury bill are considered perfect substitutes in a conventional broad monetary aggregate like M4, Treasury bills are surely less liquid. Besides, different monetary asset components may have a different impact on production, inflation, or other macroeconomic variables.

Furthermore, as shown by Barnett (Reference Barnett1980) and many subsequent contributions, a simple-sum monetary aggregate is incompatible with and internally inconsistent with microeconomic consumer demand theory. Therefore, the Barnett critique implies that a traditional monetary aggregate is unlikely to accurately measure the true flows of money services demanded by households.

Instead, William A. Barnett and various researchersFootnote 8 have proposed constructing and preferring the use of a Divisia index of monetary aggregation to measure the quantity of money.Footnote 9 Intuitively, the idea is to measure the flow of money services received in each period by households and firms from their holdings of monetary assets. In particular, in a calibrated New Keynesian DSGE model, Belongia and Ireland (Reference Belongia and Ireland2014) showed that, contrary to a theoretically flawed simple-sum aggregate, a Divisia monetary index is theoretically coherent for measuring monetary services and produces intuitively sensible impulse responses to various real and monetary shocks.

The Divisia measures are grounded in firm microfoundations aligned with households maximizing their welfare, making them theoretically superior to simple-sum aggregates for measuring the money supply. They take into account the varying levels of liquidity of different assets, and weight each component of the monetary aggregate by their degree of moneyness or their quality of money, represented by its user cost. Thus, the weight of each component varies inversely with their respective associated interest rates. For instance, nonbank money and demand deposits would have a higher liquidity value than term deposits.Footnote 10

3.3 The empirical case for Divisia measures of money

Simple-sum measures of money have also been known to be distorted on empirical grounds. Looking at evidence for seven industrialized countries, Chrystal and MacDonald (Reference Chrystal and MacDonald1994) found that Divisia indices generally fared better. This was especially the case for US broader aggregates when major financial innovations occurred in the 1980s. Moreover, several empirical papers have revealed the relevance of Divisia money aggregates in several dimensions that are consistent with economic intuition.

Serletis and Gogas (Reference Serletis and Gogas2014) empirically studied the demand for long-term real money in the United States over the period from the first quarter of 1967 to the third quarter of 2011. While the use of simple-sum monetary aggregates does not reveal a long-term relationship over the entire period between real cash, real private Gross National Income, and the yield on 3-month Treasury bills, the empirical evidence is very favorable to the theory of real money demand when money is defined as Divisia measures. The authors cannot reject a unit elasticity of demand for real money with respect to output, nor a negative value of the semi-elasticity of demand for the opportunity cost of holding money. Belongia and Ireland (Reference Belongia and Ireland2019) also identified and estimated a stable US money demand function for the entire 1967Q1–2019Q1 period with US Divisia M2 and MZM aggregates, i.e., even including episodes marked by financial innovations in the 1980s, and the Great Financial Crisis. More recently, Barnett et al. (Reference Barnett, Ghosh and Adil2022) also found that the inference of instability in money demand stems from the use of simple-sum aggregates, while the stability of the long-run broad Divisia money demand is strong, with quarterly data for the European Monetary Union, India, Israel, Poland, the UK, and the US.Footnote 11

Furthermore, using various measures of Divisia monetary aggregates over the 1967Q1–2014Q1 sample, for the United States, Serletis and Koustas (Reference Serletis and Koustas2019) found evidence of short-run non-neutrality, while they cannot reject long-run monetary neutrality. Their results are also robust to different identification hypotheses.

In addition, studying dynamic correlations using the cyclical components of US data from 1967Q1 to 2013Q4 extracted by applying the Baxter and King (Reference Baxter and King1999) filter, Belongia and Ireland (Reference Belongia and Ireland2016) found that the current cyclical component of real GDP tends to be positively correlated with the respective cyclical component of the 1- to 8-quarter lagged values of Divisia money aggregates. Their results also show that there is a stronger positive dynamic correlation between the current cyclical component of the price level and the 8- to 16-quarters lagged values of the cyclical component of the Divisia money. Their statistical correlations turned out to be stronger with Divisia indices than with conventional simple-sum money aggregates, as well as when considering subsamples of their data.

Recently, Belongia and Ireland (Reference Belongia and Ireland2016, Reference Belongia and Ireland2018, Reference Belongia and Ireland2019, Reference Belongia and Ireland2024), Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019) and Chen and Valcarcel (Reference Chen and Valcarcel2021) also empirically support the consideration of Divisia measures of monetary services, especially as the combination of conventional and unconventional monetary policy measures in the wake of the Great Financial Crisis has made questionable the use of the effective federal funds rate to assess the effects of monetary policy.

3.4 A comparison of the time paths and dynamics of simple-sum and Divisia money aggregates

Let us consider

![]() $n$

assets that are held by economic agents and that possess some moneyness characteristics as a medium of exchange within a given level of aggregation that we want to consider. For each

$n$

assets that are held by economic agents and that possess some moneyness characteristics as a medium of exchange within a given level of aggregation that we want to consider. For each

![]() $i=1, \ldots, n$

, let

$i=1, \ldots, n$

, let

![]() $m_{i,t}$

be the observed quantity of asset

$m_{i,t}$

be the observed quantity of asset

![]() $i$

held at date

$i$

held at date

![]() $t$

, and

$t$

, and

![]() $r_{i,t}$

being the expected nominal return on monetary asset

$r_{i,t}$

being the expected nominal return on monetary asset

![]() $i$

. Finally, let

$i$

. Finally, let

![]() $R_t$

be the maximum expected one-period return on a non-monetary asset (bond). Thus, the user cost of asset

$R_t$

be the maximum expected one-period return on a non-monetary asset (bond). Thus, the user cost of asset

![]() $i$

at date

$i$

at date

![]() $t$

is reckoned with the following formula:

$t$

is reckoned with the following formula:

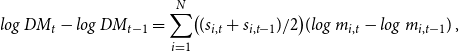

and the growth rate of the Törnqvist-Theil Divisia index is defined as

\begin{equation} log \ DM_t - log \ DM_{t-1} = \sum _{i=1}^N \bigl ({(s_{i,t}+s_{i,t-1})}/{2}\bigr) (log \ m_{i,t} - log \ m_{i,t-1}) \,, \end{equation}

\begin{equation} log \ DM_t - log \ DM_{t-1} = \sum _{i=1}^N \bigl ({(s_{i,t}+s_{i,t-1})}/{2}\bigr) (log \ m_{i,t} - log \ m_{i,t-1}) \,, \end{equation}

where the share of asset

![]() $i$

in the Divisia index is given by

$i$

in the Divisia index is given by

Therefore, other things being equal, the more liquid a money-component asset is, the lower its return and the higher its user cost. Consequently, this asset contributes more significantly to the growth of the Divisia index.

The

![]() $DM_t$

Divisia index can be derived by compounding the growth rates from some initial normalized value. Then, correspondingly, the aggregate user cost associated with the Divisia aggregate is given by:

$DM_t$

Divisia index can be derived by compounding the growth rates from some initial normalized value. Then, correspondingly, the aggregate user cost associated with the Divisia aggregate is given by:

Notice that in contrast to the Divisia index

![]() $DM_t$

, a traditional simple-sum aggregate is defined as

$DM_t$

, a traditional simple-sum aggregate is defined as

![]() $M_t = {\sum _{k=1}^N m_{k,t}}$

.

$M_t = {\sum _{k=1}^N m_{k,t}}$

.

The Center for Financial Stability (https://centerforfinancialstability.org/) calculates and publishes various Divisia indices for the United States for varying degrees of aggregation. In this paper, we use Divisia M2 (DM2) and Divisia M4 (DM4). DM2 includes currency, checking accounts, small certificates of deposit, and retail money market mutual funds. DM4 adds institutional money market funds, large negotiable certificates of deposit, overnight and term repurchase agreements, commercial paper, and US Treasury bills. These latter two assets were crucial during the Federal Reserve’s quantitative easing, highlighting the importance of using the broadest aggregate in recent empirical analyses. As supported by Kelly et al. (Reference Kelly, Barnett and Keating2011) and Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019), DM4 aggregate reflects informative content for monetary policy and monetary services from assets that were excluded from the narrower DM2. Commercial paper and US Treasury bills are still rather highly liquid and fairly safe assets used by large institutions, especially with the disintermediation of banks and the development of shadow banking.

Figure 4 shows the log-scale time paths of M2 and Divisia M2 (DM2), and those of M4 and Divisia M4 (DM4) from 1967Q1 up to 2023Q4. A visual comparison of the data reveals that despite all these series displaying long-run positive trends, their slopes, which convey their growth rates, have differed markedly in some subperiods, which suggests different characterizations of their underlying movements.

Figure 4. The time-paths of various monetary aggregates (in log) from 1967 to 2023.

For instance, when inflation in the early 1980s was high, the Federal Reserve under Chairman Volker is thought of as having implemented a tight monetary policy to fight inflation. Interestingly, the picture conveyed by Figure 4 differs whether the focus is on the index associated with the simple-sum aggregate or on the Divisia index. Indeed, the growth rates of M2 and M4 were strongly positive at the outset, during and after the 1981 recession, thus suggesting that, despite what was claimed and believed, the monetary policy looked expansionary. Yet, the Divisia-index counterparts for both DM2 and DM4 exhibit negative or at most flat growths preceding the recession.

In the early 1990s, both the Divisia and simple-sum indices began moving together as the Federal Reserve began targeting inflation, while interest rates were decreasing. This led to a decrease in the yield spread for all components of the money supply, causing both indices to be more in tune. What is observed, especially for M4 vs. DM4, is that as the policy interest rate was settling at lower values, the growth rate of the simple-sum aggregate slowed down, while this did not happen with DM4. This is another illustration of the difference in the information conveyed by the Divisia index versus that of the simple-sum aggregate.

During the 2008 Financial Crisis, the Federal Reserve implemented quantitative easing (QE) that increased the monetary base to increase the money supply and stimulate the economy. Surprisingly, both the Divisia and simple-sum indices did not tend to increase significantly during this period, and even decreased. This reflects the break in the money multiplier discussed earlier.

Finally, in the midst and in the aftermath of the COVID pandemic and the Great Lockdown, both the Divisia and simple-sum indices significantly increased as the Federal Reserve injected trillions of dollars into the economy with its 2020 QE program to buffer the effects of the COVID-19 pandemic. This time, the increase in the monetary base or the Fed’s balance sheet effectively affected the money supply.

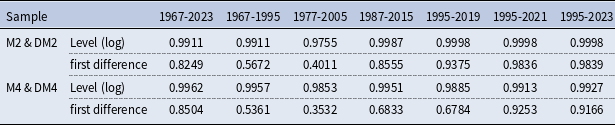

Another way to compare the relative behavior of both the levels and the growth rate of simple-sum and Divisia aggregates is to compute the contemporaneous correlations between their corresponding measures. As shown in Table 1, the M2–DM2 pair and the M4–DM4 pair in levels are highly correlated, as both simple-sum and Divisia indices share a common trend. However, the strength of the correlation, while often high and positive, is smaller with growth rates than with levels and varies across different subperiods. In particular, for the 1967–1995 subperiod, the growth rates for both the M2–DM2 pair and the M4–DM4 pair were less correlated, which corresponds to both measures seemingly signalling a different monetary policy stance. As subperiods beginning post-1987 and extending beyond 2005, the growth rates of simple-sum and Divisia indices were higher, coinciding with a period of lower interest rates and QEs. Finally, in the subperiod encompassing the onset of the pandemic and the period that followed, between 2020 and 2023, the low interest rates and the high growth of the money base led to the growth rates of both the simple-sum aggregates and the Divisia index being more highly correlated. This is consistent with Mattson and Valcarcel’s (Reference Mattson and Valcarcel2016) statistical finding that, in a period when the interest rates on all components of the aggregates are somewhat close to zero, the user cost of all components tends to fall near the same value. Since their weights in the Divisia index growth rates are very close, the evolution of the simple-sum aggregates and their Divisia index counterparts becomes somewhat more similar.

Table 1. Correlations between simple-sum aggregates and their Divisia counterpart for various subsamples from 1967Q1 to 2023Q4

Barnett (Reference Barnett1980) and subsequent work in the literature have established that the Divisia indices are theoretically and conceptually superior to simple-sum aggregates. Furthermore, the difference in the information content of alternative monetary-aggregate measures and the monetary policy interest rate can have important implications for the interpretation of the monetary policy stance and its effect on the economy. To better understand the dynamics and effects of monetary policy, it seems unjustified to ignore de facto the relevance of money, as has been customary for more than three decades. Divisia measures can help deepen this relationship and provide a more accurate indication of the stance of monetary policy and the impact of the quantity of money on inflation. We now turn to a rigorous empirical evaluation of our conjecture.

4. The data and the econometric approach

4.1 The data

The dataset combines various monetary and macroeconomic variables.Footnote

12

Standard macroeconomic data, such as real GDP (

![]() $Y_t$

), the GDP deflator (

$Y_t$

), the GDP deflator (

![]() $P_t$

), the effective Fed Funds rate (

$P_t$

), the effective Fed Funds rate (

![]() $FF_t$

), total reserves (

$FF_t$

), total reserves (

![]() $TTR_t$

), non-borrowed reserves (

$TTR_t$

), non-borrowed reserves (

![]() $NBR_t$

), the money base (

$NBR_t$

), the money base (

![]() $MB_t$

) and the M2 aggregate (

$MB_t$

) and the M2 aggregate (

![]() $M2_t$

), were sourced from the St. Louis Fed’s website (FRED). Divisia M2 (

$M2_t$

), were sourced from the St. Louis Fed’s website (FRED). Divisia M2 (

![]() $DM2_t$

), Divisia M4 (

$DM2_t$

), Divisia M4 (

![]() $DM4_t$

), and their respective user costs (

$DM4_t$

), and their respective user costs (

![]() $UCD_t$

) were obtained from the Center for Financial Stability (CFS) website. Commodity price data (

$UCD_t$

) were obtained from the Center for Financial Stability (CFS) website. Commodity price data (

![]() $PCOM_t$

) from 1967 to 2001 came from the CRB, and from 1972 onwards, from the Bank of Canada.Footnote

13

$PCOM_t$

) from 1967 to 2001 came from the CRB, and from 1972 onwards, from the Bank of Canada.Footnote

13

The extended sample includes periods when the effective interest rate approached the zero lower bound, prompting the Federal Reserve to use unconventional tools like quantitative easing, forward guidance, and term funding facilities. Wu and Xia’s (Reference Wu and Xia2016) shadow (Fed) Funds rate (

![]() $SR_t$

), which can fall below 0 percent, has been proposed to better represent monetary policy during these times. Retrieved from the Atlanta Fed’s website, the shadow rate closely tracked the Fed Funds rate until 2007, but diverged significantly between 2008Q4 and 2015Q3, and between 2020Q2 and 2022Q1.

$SR_t$

), which can fall below 0 percent, has been proposed to better represent monetary policy during these times. Retrieved from the Atlanta Fed’s website, the shadow rate closely tracked the Fed Funds rate until 2007, but diverged significantly between 2008Q4 and 2015Q3, and between 2020Q2 and 2022Q1.

4.2 VAR modelling and estimation

4.2.1 The time-invariant-parameter VAR

A typical vector autoregressive representation consists of jointly modelling each variable of a system of equations as a linear function of lagged values of all the variables to capture their intrinsic built-in dynamics. It is written as

where

![]() $\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [z_{1,t}, \ldots, z_{Q,t}]^{\prime}$

is the vector of variables and

$\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [z_{1,t}, \ldots, z_{Q,t}]^{\prime}$

is the vector of variables and

![]() $\boldsymbol{\epsilon}_{\boldsymbol{{t}}} = [\epsilon_{1,t}, \ldots, \epsilon_{Q,t}]^{\prime}$

is a vector white noise process, i.e.,

$\boldsymbol{\epsilon}_{\boldsymbol{{t}}} = [\epsilon_{1,t}, \ldots, \epsilon_{Q,t}]^{\prime}$

is a vector white noise process, i.e.,

![]() $E(\boldsymbol{\epsilon} _{\boldsymbol{{t}}}) = \boldsymbol{0}, \, E(\boldsymbol{\epsilon _{\boldsymbol{{t}}} \, \epsilon _t^{\prime}}) = \boldsymbol{\Omega_\epsilon}, \text{ and } E(\boldsymbol{\epsilon} _{\boldsymbol{{t}}}\, \boldsymbol{\epsilon} _{\boldsymbol{{s}}}^{\prime}) = \boldsymbol{0}$

for any

$E(\boldsymbol{\epsilon} _{\boldsymbol{{t}}}) = \boldsymbol{0}, \, E(\boldsymbol{\epsilon _{\boldsymbol{{t}}} \, \epsilon _t^{\prime}}) = \boldsymbol{\Omega_\epsilon}, \text{ and } E(\boldsymbol{\epsilon} _{\boldsymbol{{t}}}\, \boldsymbol{\epsilon} _{\boldsymbol{{s}}}^{\prime}) = \boldsymbol{0}$

for any

![]() $t \neq s$

. The parameters making up the matrices in the K-order lag-matrix polynomials in

$t \neq s$

. The parameters making up the matrices in the K-order lag-matrix polynomials in

![]() $\boldsymbol{\Phi} (\boldsymbol{{L}})$

are assumed to be time invariant.

$\boldsymbol{\Phi} (\boldsymbol{{L}})$

are assumed to be time invariant.

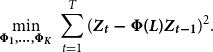

Once the order of the VAR system is established on empirical ground, with the absence of serial correlation in its residuals, the VAR’s time-invariant parameters can be estimated consistently and efficiently by maximum likelihood, which is equivalent to the application of OLS applied separately to each equation, in the situation when all the system’s equations share the same regressors, which amounts to solve

\begin{eqnarray} \underset {\boldsymbol{\Phi_{1},\ldots,\Phi _{\boldsymbol{{K}}}}}{\textrm {min}}\, \sum_{t=1}^T (\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} - \Phi (\boldsymbol{{L}}) \boldsymbol{{Z}}_{\boldsymbol{{t}}-1}})^{2}. \end{eqnarray}

\begin{eqnarray} \underset {\boldsymbol{\Phi_{1},\ldots,\Phi _{\boldsymbol{{K}}}}}{\textrm {min}}\, \sum_{t=1}^T (\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} - \Phi (\boldsymbol{{L}}) \boldsymbol{{Z}}_{\boldsymbol{{t}}-1}})^{2}. \end{eqnarray}

As commonly used in the literature and explained in section 4.3, the VAR model also amounts to the reduced form of an underlying structural model that can be recovered once one imposes a required number of reasonable identifying restrictions.

4.2.2 The time-varying-parameter VAR

Changes in the economic environment and various financial innovations over the years that have led to the creation and use of new assets, as well as changes in monetary transmission, may well have impacted the dynamics between macroeconomic variables. To account for the possibility that the underlying dynamic relationships may have changed across variables in a model and may have evolved over time, a logical extension to model structural changes in economics is to consider a time-varying-parameter vector autoregressive (TVP-VAR) representation explicitly, such as:

where

![]() $\boldsymbol{\Phi_{\boldsymbol{{t}}}(\boldsymbol{{L}})}$

is a

$\boldsymbol{\Phi_{\boldsymbol{{t}}}(\boldsymbol{{L}})}$

is a

![]() $K^{th}$

-order matrixlag polynomial, whose sequence of matrix coefficients are given by

$K^{th}$

-order matrixlag polynomial, whose sequence of matrix coefficients are given by

![]() $\boldsymbol{\Phi _{1,\boldsymbol{{t}}},\ldots,\Phi _{\boldsymbol{{K}},\boldsymbol{{t}}}}$

.

$\boldsymbol{\Phi _{1,\boldsymbol{{t}}},\ldots,\Phi _{\boldsymbol{{K}},\boldsymbol{{t}}}}$

.

As shown by Primiceri (Reference Primiceri2005), a model akin to that above, assuming amultivariate stochastic volatility, can be estimated using Bayesianestimation. Essentially, the procedure starts with conditional priordistributions for the unknown parameters associated with the vectorsin

![]() $\boldsymbol{\Phi_{\boldsymbol{{t}}}(\boldsymbol{{L}})}$

and their covariance matrices

$\boldsymbol{\Phi_{\boldsymbol{{t}}}(\boldsymbol{{L}})}$

and their covariance matrices

![]() $\boldsymbol{\Omega _{\epsilon _{\boldsymbol{{t}}}}}$

. By combining the likelihood function with some informative prior distributions based on initial beliefs, Bayes’ theorem updates these priors with new data to form the posterior density distribution, reflecting updated beliefs. The parameters of the prior distributions, called hyperparameters, control the shape and scale of the priors and can influence the model’s flexibility and robustness. The TVP-BVAR employs Markov Chain Monte Carlo (MCMC) techniques on an expanding window of data. The Gibbs sampler is utilized to generate multivariate posterior distributions of the model parameters.

$\boldsymbol{\Omega _{\epsilon _{\boldsymbol{{t}}}}}$

. By combining the likelihood function with some informative prior distributions based on initial beliefs, Bayes’ theorem updates these priors with new data to form the posterior density distribution, reflecting updated beliefs. The parameters of the prior distributions, called hyperparameters, control the shape and scale of the priors and can influence the model’s flexibility and robustness. The TVP-BVAR employs Markov Chain Monte Carlo (MCMC) techniques on an expanding window of data. The Gibbs sampler is utilized to generate multivariate posterior distributions of the model parameters.

As argued by Goulet Coulombe (Reference Goulet Coulombe2025), one difficulty that arises in the estimation of a TVP-VAR relates to “tuning the crucial amount of time variation” in the elements of the

![]() $\boldsymbol{\Phi _{i,\boldsymbol{{t}}}}$

matrices, for

$\boldsymbol{\Phi _{i,\boldsymbol{{t}}}}$

matrices, for

![]() $i=1, \ldots, K$

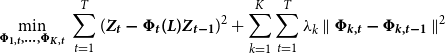

. Alternatively, he showed that multivariate random walk TVPs such as the system defined by equation (8) and (9) give rise to a multivariate TVP-ridge problem, which is particularly useful to obtain point estimates, on which we will focus. Accordingly, he showed how to carry the estimation of the empirical model by multivariate Two-Step Ridge Regression (2SRR) that amounts to solving

$i=1, \ldots, K$

. Alternatively, he showed that multivariate random walk TVPs such as the system defined by equation (8) and (9) give rise to a multivariate TVP-ridge problem, which is particularly useful to obtain point estimates, on which we will focus. Accordingly, he showed how to carry the estimation of the empirical model by multivariate Two-Step Ridge Regression (2SRR) that amounts to solving

\begin{eqnarray} \underset {\boldsymbol{\Phi _{1,\boldsymbol{{t}}},\ldots,\Phi _{\boldsymbol{{K}},\boldsymbol{{t}}}}}{\min } \, \sum _{t=1}^T (\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} - \Phi _{\boldsymbol{{t}}}(\boldsymbol{{L}}) \boldsymbol{{Z}}_{\boldsymbol{{t}}-1}})^2 + \sum _{k=1}^K \sum _{t=1}^T \lambda _k \parallel \boldsymbol{\Phi _{\boldsymbol{{k}},\boldsymbol{{t}}} - \Phi _{\boldsymbol{{k}},\boldsymbol{{t}}-1}}\parallel ^2 \end{eqnarray}

\begin{eqnarray} \underset {\boldsymbol{\Phi _{1,\boldsymbol{{t}}},\ldots,\Phi _{\boldsymbol{{K}},\boldsymbol{{t}}}}}{\min } \, \sum _{t=1}^T (\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} - \Phi _{\boldsymbol{{t}}}(\boldsymbol{{L}}) \boldsymbol{{Z}}_{\boldsymbol{{t}}-1}})^2 + \sum _{k=1}^K \sum _{t=1}^T \lambda _k \parallel \boldsymbol{\Phi _{\boldsymbol{{k}},\boldsymbol{{t}}} - \Phi _{\boldsymbol{{k}},\boldsymbol{{t}}-1}}\parallel ^2 \end{eqnarray}

and

![]() $ \boldsymbol{{Z}}_{\boldsymbol{{t}}}$

is the

$ \boldsymbol{{Z}}_{\boldsymbol{{t}}}$

is the

![]() $Q \times 1$

vector of variables.

$Q \times 1$

vector of variables.

The required computations are carried out via a closed-form solution in the form of data-augmented ridge regression. Throughout the estimation process, the 2SRR method carefully considers key aspects to ensure robustness and mitigate overfitting.

In the 2SRR framework, the smoothing

![]() $\lambda _k$

-hyperparameters drive the amount of time variation in the VARs coefficients and aim at optimally balancing bias and variance, as they are functions of the ratio of the variances of

$\lambda _k$

-hyperparameters drive the amount of time variation in the VARs coefficients and aim at optimally balancing bias and variance, as they are functions of the ratio of the variances of

![]() $\boldsymbol{\epsilon _{\boldsymbol{{t}}}}$

and

$\boldsymbol{\epsilon _{\boldsymbol{{t}}}}$

and

![]() $\boldsymbol{\boldsymbol{{e}}_{\boldsymbol{{t}}}}$

. Goulet Coulombe (Reference Goulet Coulombe2025) proposed a data-driven choice for the

$\boldsymbol{\boldsymbol{{e}}_{\boldsymbol{{t}}}}$

. Goulet Coulombe (Reference Goulet Coulombe2025) proposed a data-driven choice for the

![]() $\lambda _k$

’s values based on blocked 5-fold cross-validations for quarterly data, which accounts for time dependence between data points and avoids overfitting issues. The selected block size of 10 quarters strikes a balance between capturing relevant time information and preventing excessive dimensionality.

$\lambda _k$

’s values based on blocked 5-fold cross-validations for quarterly data, which accounts for time dependence between data points and avoids overfitting issues. The selected block size of 10 quarters strikes a balance between capturing relevant time information and preventing excessive dimensionality.

Moreover, his comparisons for different scenarios characterized by distinct patterns of time-varying parameters and varying proportions within the total parameter space confirmed that the performance of 2SRR in accurately capturing the dynamic path of true parameters closely aligned with that of the standard Bayesian TVP-VAR with stochastic volatility.

In a manner akin to that used with time-invariant VARs, identifying restrictions will make it possible to retrieve structural shocks and their implied dynamic impacts on the empirical model’s variables, albeit accounting for time variation in both the sizes of shocks and the variables’ responses.

4.2.3 Contrasting Bayesian and 2SRR estimators for TVP-VAR models

Until now, the empirical literature has employed Bayesian inference to estimate TVP-VAR models (TVP-BVAR), while this paper makes use of the 2SRR estimator recently proposed by Goulet Coulombe (Reference Goulet Coulombe2025), who found that both methods yield comparable effectiveness in estimating the dynamics of the variables, albeit each has distinct features in their application with a given sample.

TVP-BVAR estimation allows the integration of prior beliefs or information, which can be valuable when data is sparse and noisy, but it tends to be computationally intensive. However, their results may be sensitive to the choice of priors and may lead to misleading inferences. TVP-BVAR estimation using MCMC requires setting values of key hyperparameters, which often leads practitioners to use values somewhat consistent with those in Primiceri (Reference Primiceri2005) or Giannone et al. (Reference Giannone, Lenza and Primiceri2015).Footnote 14 Moreover, TVP-BVAR requires a lengthy enough “initial training sample period” to initialize the specifications in order to reliably estimate the time-varying parameters and their evolution. Hence, estimates obtained from TVP-BVAR are contingent on data that predates the results for a reported sample.Footnote 15 Finally, conducting the Bayesian estimation with MCMC requires building a Markov chain that has a joint stationary distribution from which the parameter estimates can be sampled. To ensure the convergence of the distribution, this can be done by discarding a sufficient number of initial samples to let the simulated distribution stabilize.Footnote 16

By contrast, the 2SRR estimation of TVP-VAR does not involve burdensome MCMC simulations. It only needs to determine the time-smoothing

![]() $\lambda _k$

-hyperparameters, which define the extent of time variation without the initialization and convergence issues pertaining to Bayesian TVP-VARs. These practical considerations, linked to the treatment of numerous hyperparameters and the loss of observations inherent to the Bayesian estimation, confer advantages that motivate the use of the newest 2SRR estimator to account for time-varying parameters in the VAR models.

$\lambda _k$

-hyperparameters, which define the extent of time variation without the initialization and convergence issues pertaining to Bayesian TVP-VARs. These practical considerations, linked to the treatment of numerous hyperparameters and the loss of observations inherent to the Bayesian estimation, confer advantages that motivate the use of the newest 2SRR estimator to account for time-varying parameters in the VAR models.

4.3 Structural VAR and identification

The basic time-invariant VAR in equation (6) for the vector of endogenous variables

![]() $\boldsymbol{\boldsymbol{{Z}}}_t$

can be thought of as the reduced form of an underlying structural model such as:

$\boldsymbol{\boldsymbol{{Z}}}_t$

can be thought of as the reduced form of an underlying structural model such as:

where the

![]() $\boldsymbol{\boldsymbol{{A}}_0}$

matrix captures the contemporaneous endogeneity between the variables in

$\boldsymbol{\boldsymbol{{A}}_0}$

matrix captures the contemporaneous endogeneity between the variables in

![]() $\boldsymbol{\boldsymbol{{Z}}}_t$

, while the

$\boldsymbol{\boldsymbol{{Z}}}_t$

, while the

![]() $p$

-order lag-matrix polynomial in

$p$

-order lag-matrix polynomial in

![]() $\boldsymbol{\boldsymbol{{B}}(\boldsymbol{{L}})}$

represents the intrinsic dynamics built-in for the endogenous variables of the system, and

$\boldsymbol{\boldsymbol{{B}}(\boldsymbol{{L}})}$

represents the intrinsic dynamics built-in for the endogenous variables of the system, and

![]() $\boldsymbol{\boldsymbol{{u}}}_t$

is the vector of (orthogonal) structural shocks driving the endogenous variables.

$\boldsymbol{\boldsymbol{{u}}}_t$

is the vector of (orthogonal) structural shocks driving the endogenous variables.

Accordingly, the VAR or reduced form of the system in equation (11) is given by:

with the vector of reduced-form residuals

![]() $\boldsymbol{\varepsilon _{\boldsymbol{{t}}} = \boldsymbol{{A}}_0^{-1} \, \boldsymbol{{u}}_{\boldsymbol{{t}}}}$

, and which admits the following equivalent VMA(

$\boldsymbol{\varepsilon _{\boldsymbol{{t}}} = \boldsymbol{{A}}_0^{-1} \, \boldsymbol{{u}}_{\boldsymbol{{t}}}}$

, and which admits the following equivalent VMA(

![]() $\infty$

) representation:

$\infty$

) representation:

Since

![]() $\boldsymbol{\boldsymbol{{u}}_{\boldsymbol{{t}}} = \boldsymbol{{A}}_0 \, \varepsilon _{\boldsymbol{{t}}}}$

, therefore:

$\boldsymbol{\boldsymbol{{u}}_{\boldsymbol{{t}}} = \boldsymbol{{A}}_0 \, \varepsilon _{\boldsymbol{{t}}}}$

, therefore:

By imposing enough identification restrictions on the matrix equation above, it is possible to recover the

![]() $\boldsymbol{\boldsymbol{{A}}_0}$

matrix. Then, the proper elements of the

$\boldsymbol{\boldsymbol{{A}}_0}$

matrix. Then, the proper elements of the

![]() $\boldsymbol{\Psi (\boldsymbol{{L}})}$

matrix polynomial can be used to plot the dynamic or impulse responses of the structural shocks in

$\boldsymbol{\Psi (\boldsymbol{{L}})}$

matrix polynomial can be used to plot the dynamic or impulse responses of the structural shocks in

![]() $\boldsymbol{\boldsymbol{{u}}_{\boldsymbol{{t}}}}$

, and to calculate their contribution to the variance of different variables at different horizons.

$\boldsymbol{\boldsymbol{{u}}_{\boldsymbol{{t}}}}$

, and to calculate their contribution to the variance of different variables at different horizons.

Given a particular and reasonable set of identification restrictions, the structural VAR approach provides an interpretation of the impulse response functions (IRFs) for the model with, for instance, the dynamic response of the variables to a one-time structural shock to the monetary-policy signalling variable.Footnote 17 Finally, even within the class of short-run identifying restrictions, it is necessary to make the case for the transmission channel of the shocks of interest.

In a manner akin to that used for the time-invariant VAR, imposing identifying restrictions on the estimated TVP-VARs by 2SRR yields estimates of time-varying impulse response functions.Footnote 18

Once we have settled on a relevant and reasonable set of identification restrictions, the IRFs can be used to evaluate the effectiveness of different monetary policy strategies and to inform policymakers about the potential impact of their decisions on the economy. Because of the alternative and possibly unresolved debate about which variable is empirically the most appropriate indicator to extract the stance of monetary policy, we will compare results for multiple monetary policy indicator variables, and assess their ability and reasonableness in capturing the dynamics of macroeconomic variables.

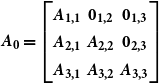

One popular method for identifying the structural shocks in a SVAR model consists of imposing restrictions on the short-term coefficient matrix with a block recursive identification approach, such as in the seminal paper by Christiano et al. (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999). In this paper, the authors use a three-block variable SVAR model to study the effects of a monetary policy shock on output, inflation, and other economic variables. The block recursive identification approach, which is akin to the Cholesky decomposition, involves partitioning the variables in the model into blocks, based on economic theory or prior knowledge of the relationships between the variables. The variables within each block are ordered based on their causal relationships, and the shocks are identified recursively by imposing restrictions on the lower-triangular covariance matrix of the error terms in the model.

The block-recursive restrictions amount to the following structural specification of the matrix associated with the contemporaneous relationships between the model’s variables:

\begin{eqnarray} \boldsymbol{\boldsymbol{{A}}_0 = \begin{bmatrix} \boldsymbol{\boldsymbol{{A}}_{1,1}} & \boldsymbol{0_{1,2}} & \boldsymbol{0_{1,3}} \\ \boldsymbol{\boldsymbol{{A}}_{2,1}} & \boldsymbol{\boldsymbol{{A}}_{2,2}} & \boldsymbol{0_{2,3}} \\ \boldsymbol{\boldsymbol{{A}}_{3,1}} & \boldsymbol{\boldsymbol{{A}}_{3,2}} & \boldsymbol{\boldsymbol{{A}}_{3,3}} \\ \end{bmatrix}} \end{eqnarray}

\begin{eqnarray} \boldsymbol{\boldsymbol{{A}}_0 = \begin{bmatrix} \boldsymbol{\boldsymbol{{A}}_{1,1}} & \boldsymbol{0_{1,2}} & \boldsymbol{0_{1,3}} \\ \boldsymbol{\boldsymbol{{A}}_{2,1}} & \boldsymbol{\boldsymbol{{A}}_{2,2}} & \boldsymbol{0_{2,3}} \\ \boldsymbol{\boldsymbol{{A}}_{3,1}} & \boldsymbol{\boldsymbol{{A}}_{3,2}} & \boldsymbol{\boldsymbol{{A}}_{3,3}} \\ \end{bmatrix}} \end{eqnarray}

with the matrix of variables being partitioned as

![]() $\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [ \ \boldsymbol{{X}}_{1,\boldsymbol{{t}}}^{\prime} \ \ \boldsymbol{{S}}_{\boldsymbol{{t}}}^{\prime} \ \ \boldsymbol{{X}}_{2,\boldsymbol{{t}}}^{\prime}\ {]}^{\prime}}$

.

$\boldsymbol{\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [ \ \boldsymbol{{X}}_{1,\boldsymbol{{t}}}^{\prime} \ \ \boldsymbol{{S}}_{\boldsymbol{{t}}}^{\prime} \ \ \boldsymbol{{X}}_{2,\boldsymbol{{t}}}^{\prime}\ {]}^{\prime}}$

.

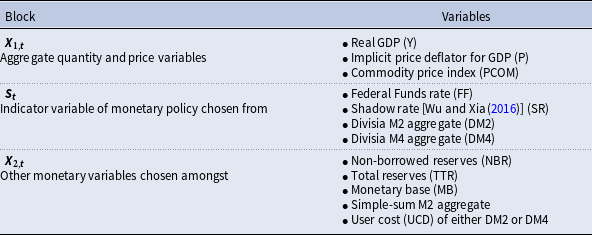

The first block includes macroeconomic variables that respond to a monetary policy shock with a one-lag delay, such as real GDP, the implicit GDP deflator index, and the commodity price index. The second block comprises the monetary policy variable indicator, such as an interest rate or a monetary aggregate. The third block contains money market variables that immediately react to the monetary policy shock, such as reserves, the monetary base, or a monetary aggregate.

In the empirical literature, the Fed Funds rate has, by and large, mostly been favored as the signalling variable to extract a monetary shock indicating the direction of monetary policy. This is also consistent with that variable being generally preferred by the Federal Reserve to communicate its intent and decision regarding monetary policy.

Using monthly and quarterly data from 1965M1 to 1995M6, Christiano et al.’s (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999) preferred VAR specification defined the matrix of variables and its identifying restriction ordering according to

![]() $\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [Y_t, P_t, PCOM_t, S_t, NBR_t, TTR_t, M2_t]$

. They found the federal funds rate to be the superior indicator variable, showing a strong negative response of GDP and an eventual reduction in the price level following a restrictive monetary policy shock, with fewer empirical puzzles compared to some reserve money or a money aggregate.

$\boldsymbol{{Z}}_{\boldsymbol{{t}}} = [Y_t, P_t, PCOM_t, S_t, NBR_t, TTR_t, M2_t]$

. They found the federal funds rate to be the superior indicator variable, showing a strong negative response of GDP and an eventual reduction in the price level following a restrictive monetary policy shock, with fewer empirical puzzles compared to some reserve money or a money aggregate.

In Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019), the non-borrowed reserves and total reserves were replaced by the monetary base because NBR went negative during the Great Recession. Moreover, their ordering used for identification is

![]() $ \boldsymbol{{Z}}_{\boldsymbol{{t}}} = [Y_t, P_t, PCOM_t, S_t, MB_t, \varnothing \ {or} \ M2_t \ {or} \ UCD_t]$

. In a sample from 1967Q1 to 2015Q4, they found that a Divisia index is a superior monetary policy indicator compared to the Fed Funds rate or a shadow rate, especially before and after the use of quantitative easing during the 2008 Great Recession. Following a monetary policy shock, their dynamic responses do not show empirical puzzles regarding price, output, or the interest rate. Chen and Valcarcel (Reference Chen and Valcarcel2021) reported similar findings over the 1988M10-2020M2 sample.

$ \boldsymbol{{Z}}_{\boldsymbol{{t}}} = [Y_t, P_t, PCOM_t, S_t, MB_t, \varnothing \ {or} \ M2_t \ {or} \ UCD_t]$

. In a sample from 1967Q1 to 2015Q4, they found that a Divisia index is a superior monetary policy indicator compared to the Fed Funds rate or a shadow rate, especially before and after the use of quantitative easing during the 2008 Great Recession. Following a monetary policy shock, their dynamic responses do not show empirical puzzles regarding price, output, or the interest rate. Chen and Valcarcel (Reference Chen and Valcarcel2021) reported similar findings over the 1988M10-2020M2 sample.

Except for one comparison with Christiano et al. (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999) over the 1967Q1–1995Q2 period, we use the same ordering as in Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019) for identifying structural monetary policy shocks, with quarterly data for a full sample, as well as subsamples, up to 2023Q4. This sample includes data from the recent “natural experiment” episode, marked by expansionary monetary policy during the pandemic, followed by inflation and a policy shift to bring inflation back to 2%. Table 2 lists the variables in their original form in our SVAR model.

Table 2. Variables used in the empirical VAR models

Note: Except for interest rates, all variables are expressed in log.

4.4 Assessment of out-of-sample point forecasts and implications for competing models

Since we will be comparing the IRFs of structural models that include either the Fed Funds rate, a shadow rate, a conventional monetary aggregate or its Divisia counterpart, it is worth discussing the extent to which the forecasting capacity of various models may be relevant to judge the reasonability and relevance of the IRFs under consideration. Indeed, the information content of a monetary policy indicator hinges on its consistent usefulness and contribution in out-of-sample (OOS) forecasting.

In econometric modelling, impulse response functions trace the dynamic effects on key variables following a structural shock to a given variable, similar to a conditional forecast. As such, they serve as valuable tools for understanding the system’s response to shocks. Their construction relies upon the assumption that the model is able to capture the dynamics of the underlying data generating process (DGP).

The robustness of estimated IRFs depends on the model’s economic foundations, grounded in a thoughtful selection of variables, its specification and identifying restrictions aligned with the true underlying DGP. At the same time, factual accuracy of IRFs must translate into good forecasting performance. Hence, a model’s empirical reliability should rest on predictive accuracy that complements a sound understanding of the economic mechanisms it seeks to capture. This can enhance the overall relevance of the model’s implications, as the IRFs could provide a useful depiction of the underlying economic reality, even though a good forecasting model without a good understanding of the underlying economic mechanisms would not guarantee the dependability of the IRFs.

Thus, when comparing two models with variables deemed to represent the same policy context and characteristics, using similar identifying restrictions/ordering, a reduction in the dispersion of the OOS forecast errors may be interpreted as reflecting a closer alignment of the empirical model to the actual underlying DGP. This is the motivation for gauging and contrasting the predictive accuracy of our different specifications with alternative monetary policy indicators.

Thereby, we proceed to pseudo-OOS point forecasts analyses from 1- to 8-quarters ahead, spanning the period from the first quarter of 2011 to the fourth quarter of 2023, and from the first quarter of 2020 to the fourth quarter of 2023 for the variables.Footnote

19

The recursive estimation and tuning of the models at each stage is used to construct the predicted value of the variables, using an expanding window estimated from the first quarter of 1967. The Root Mean Square Prediction Error (RMSPE), which is a standard metric in the literature, was used to assess the degree of forecast accuracy. Accordingly, for the OOS forecasted values at time

![]() $t$

of variable

$t$

of variable

![]() $v$

made

$v$

made

![]() $h$

-steps ahead from model

$h$

-steps ahead from model

![]() $j$

, i.e.,

$j$

, i.e.,

![]() $\hat {y}{}_{t}^{v,h,j}$

, the relevant quantities are computed as

$\hat {y}{}_{t}^{v,h,j}$

, the relevant quantities are computed as

\begin{eqnarray} RMSPE_{v,h,j} = \sqrt {\frac {1}{\#OOS} \sum _{t \, \epsilon \, OOS} {(y_{t+h}^v - \hat {y}{}_{t}^{v,h,j})}^2} \,. \end{eqnarray}

\begin{eqnarray} RMSPE_{v,h,j} = \sqrt {\frac {1}{\#OOS} \sum _{t \, \epsilon \, OOS} {(y_{t+h}^v - \hat {y}{}_{t}^{v,h,j})}^2} \,. \end{eqnarray}

Each variable, step-ahead forecast, and model specification combination yields a unique RMSPE value. Then, the values of the RMSPE for a given

![]() $\hat {y}_{t}^{v,h,j}$

are expressed in relative terms by calculating the ratio of the RMSPE for a particular forecasting model

$\hat {y}_{t}^{v,h,j}$

are expressed in relative terms by calculating the ratio of the RMSPE for a particular forecasting model

![]() $j$

to that of some reference model. For all variables, we will use the RMSPE of forecasts from an AR(2) as the reference model, as this simple univariate model is often considered as producing good forecasts for various macroeconomic variables (e.g., see Goulet Coulombe (Reference Goulet Coulombe2025), amongst others). The normalization of the RMSPE scores for each model against those of a benchmark model, for each variable and every forecasting horizon, facilitates relative comparisons across specifications with alternate monetary policy indicators. A value below 1 indicates that a model surpasses the benchmark for that specific variable and

$j$

to that of some reference model. For all variables, we will use the RMSPE of forecasts from an AR(2) as the reference model, as this simple univariate model is often considered as producing good forecasts for various macroeconomic variables (e.g., see Goulet Coulombe (Reference Goulet Coulombe2025), amongst others). The normalization of the RMSPE scores for each model against those of a benchmark model, for each variable and every forecasting horizon, facilitates relative comparisons across specifications with alternate monetary policy indicators. A value below 1 indicates that a model surpasses the benchmark for that specific variable and

![]() $h$

-steps-ahead forecasting horizon. However, regardless of a specific value, the forecasting accuracy of different models can still be compared with one another.Footnote

20

$h$

-steps-ahead forecasting horizon. However, regardless of a specific value, the forecasting accuracy of different models can still be compared with one another.Footnote

20

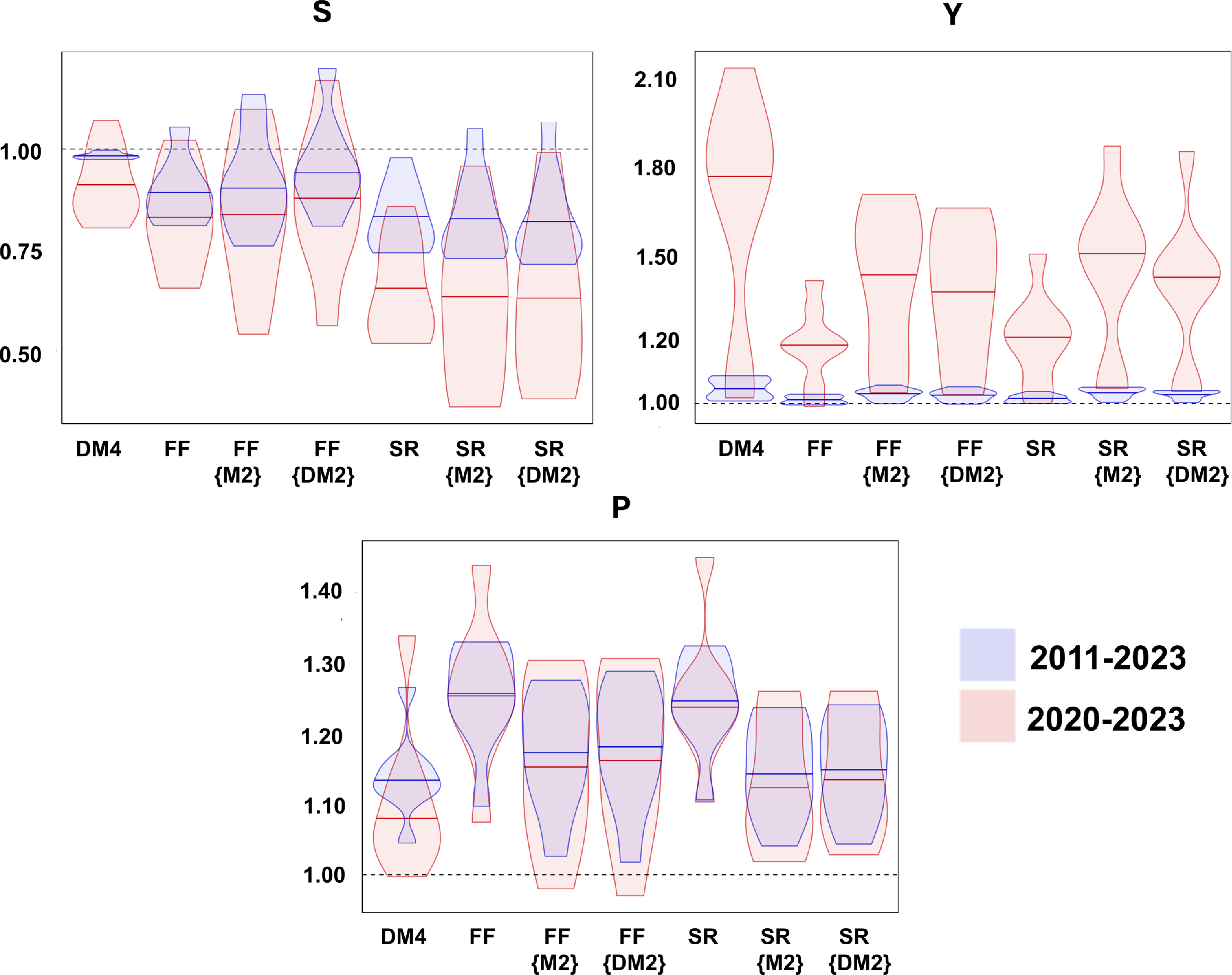

Finally, the pseudo-OOS analysis is conducted using violin plots to represent the density of the normalized distribution of the RMSPEs. These are drawn after applying a kernel density estimator to the normalized values of the RMSPEs. These plots facilitate the visualization of the degree of each model’s forecasting accuracy by showing whether the RMSPEs are clustered in the same region or whether they exhibit a wide dispersion.

5. The empirical results

5.1 The out-of-sample forecast assessment of time-invariant VAR specifications

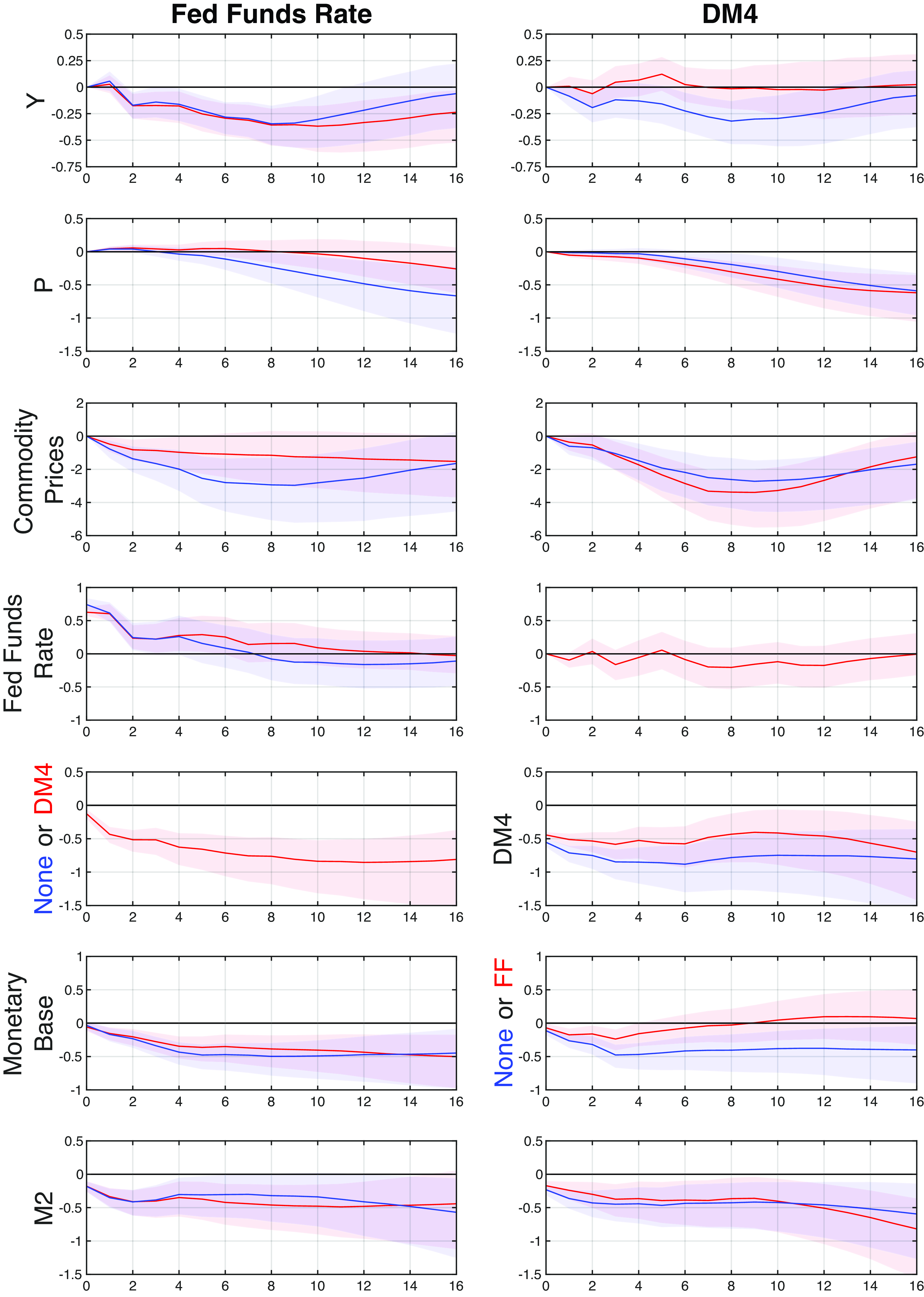

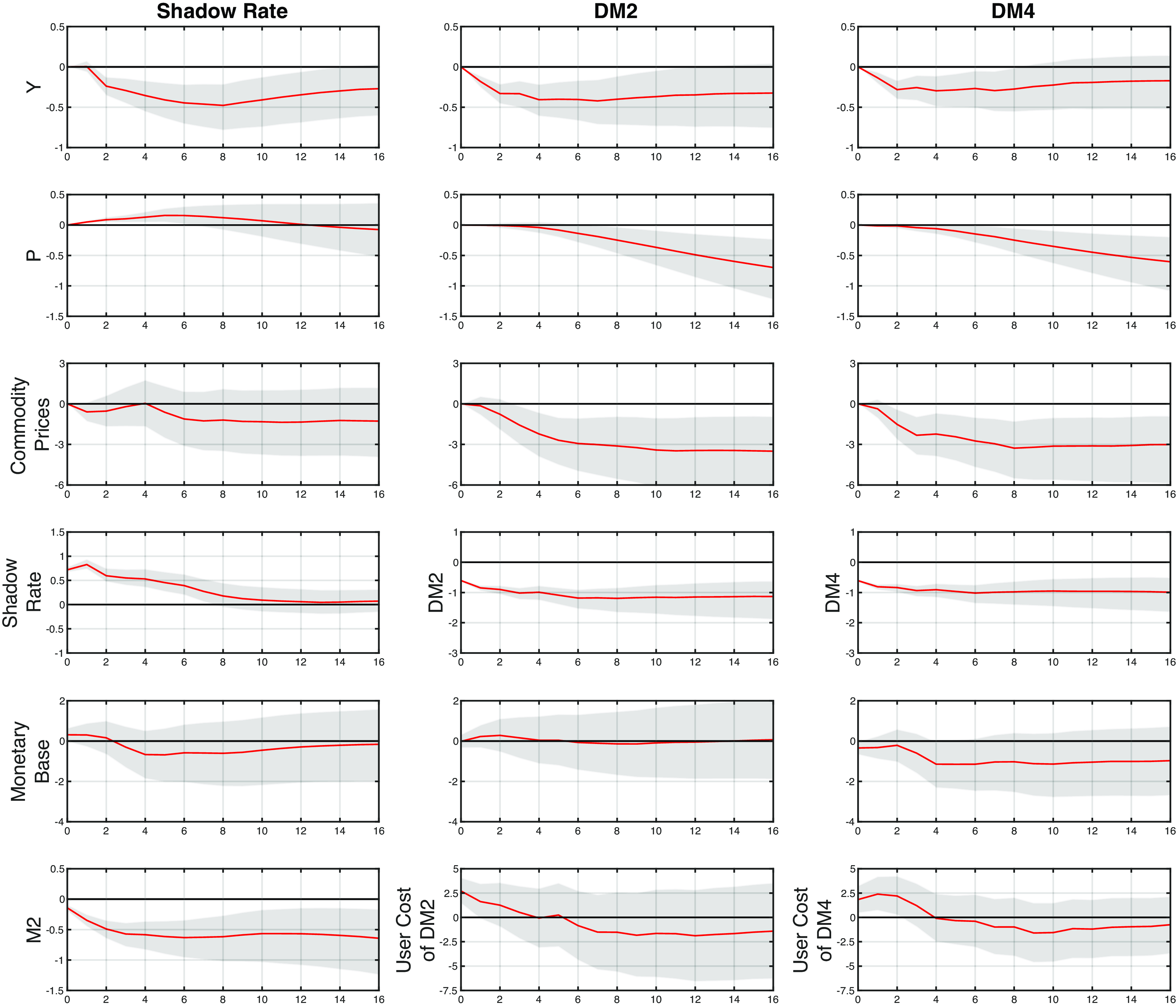

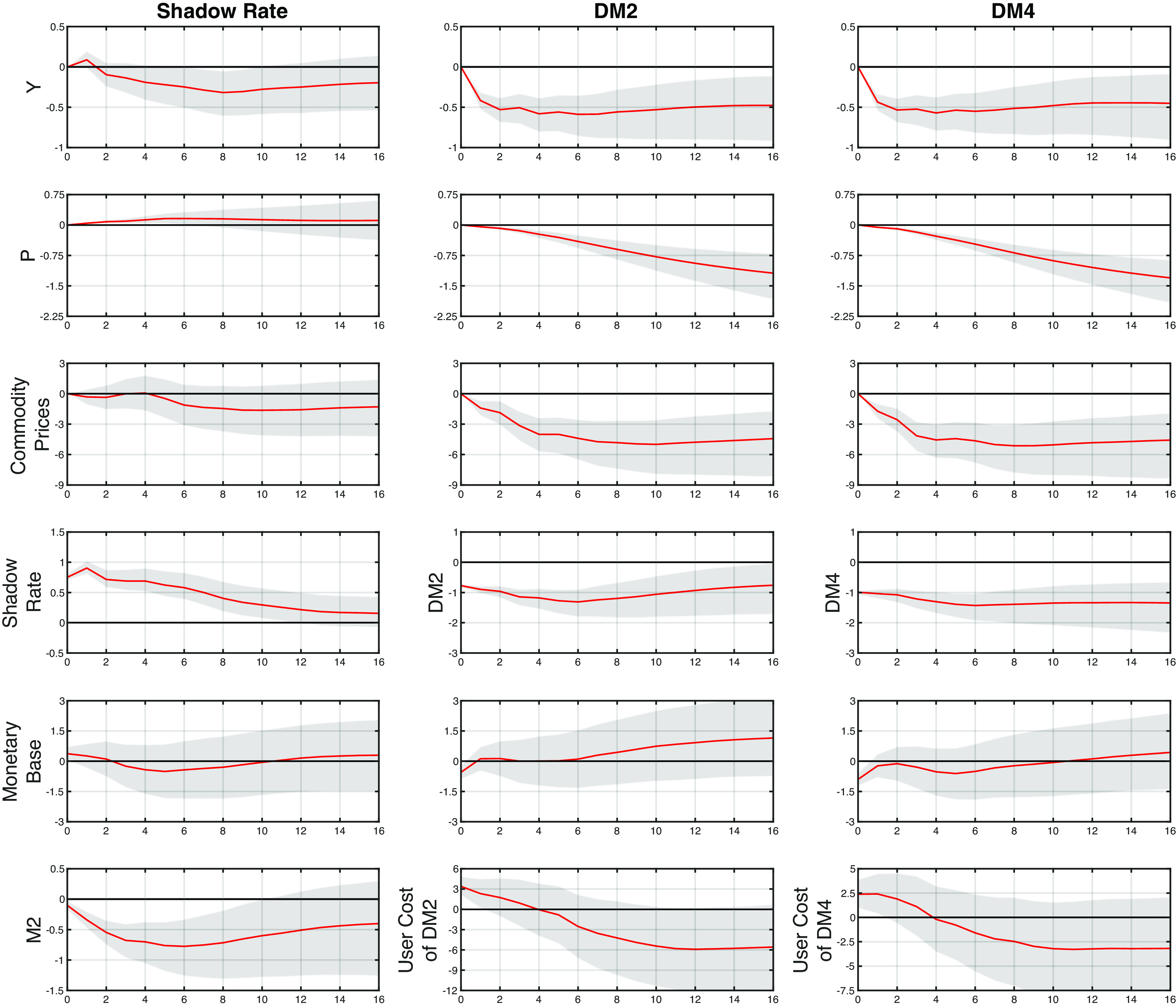

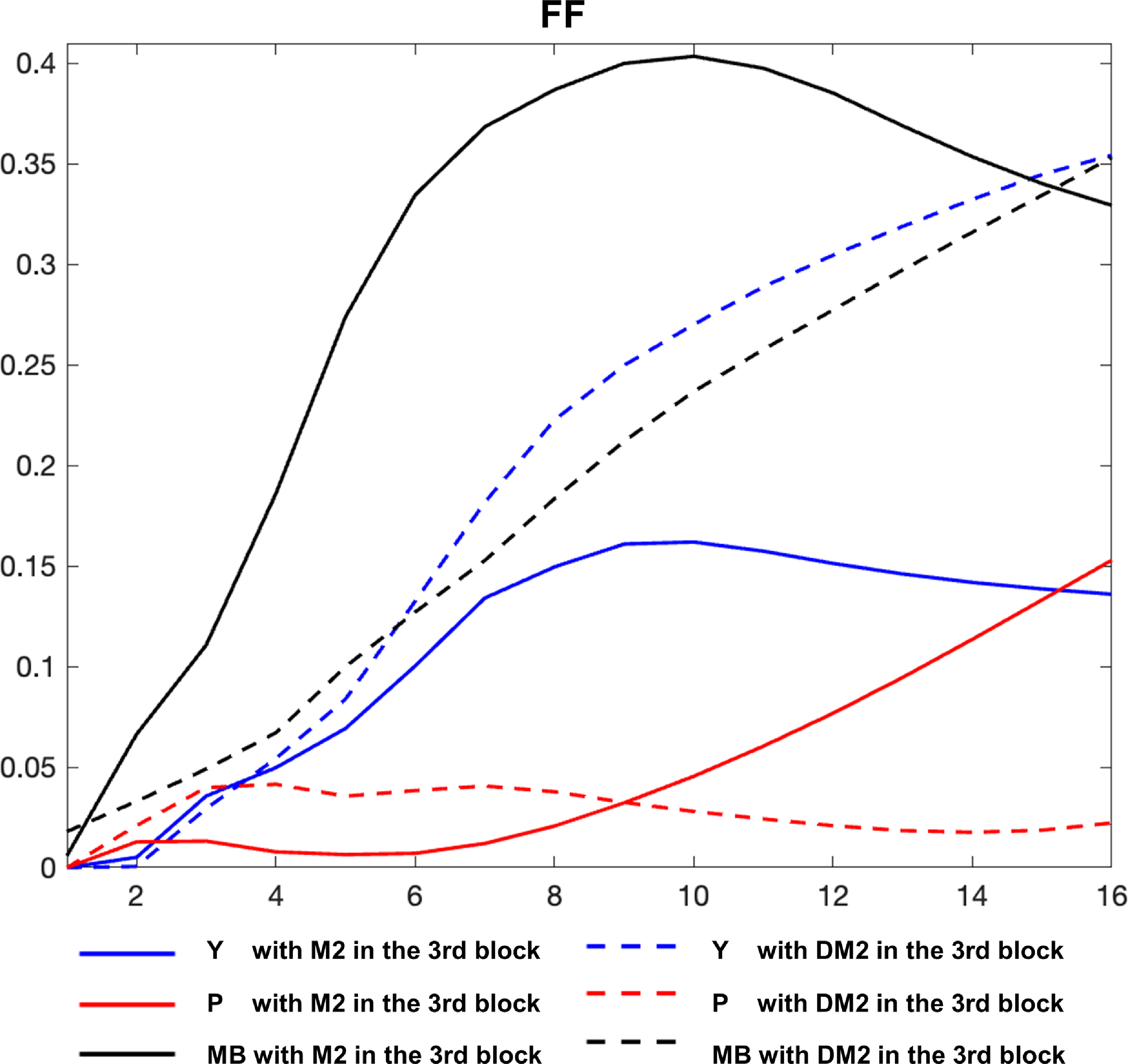

Based on the Akaike Information Criterion (AIC) and the Bayesian Information Criterion (BIC) for the whole sample and the various subsamples considered, as well as on unit root tests, stationary considerations, and tests for no autocorrelation, we selected a 5-quarter lag length for our VARs. That is the same number of lags as in Keating et al. (Reference Keating, Kelly, Smith and Valcarcel2019), and one more lag than in Christiano et al. (Reference Christiano, Eichenbaum, Evans, Christiano, Eichenbaum and Evans1999).Footnote 21 Except for the interest rates, the variables are in logs and first-differenced for stationarity when data past 2008 were in the sample. This is in accordance with the requirement that the eigenvalues of the companion matrix associated with the VAR coefficients lie within the unit circle, and with augmented Dickey-Fuller tests.Footnote 22