1. Introduction

As befits the birthplace of the Industrial Revolution, British economic performance has long fascinated economic historians. Interest has naturally focused on why the Industrial Revolution was British in the first place, followed by extensive debate about how the country lost its leadership position in the late nineteenth century, why it experienced what many have described as an economic “malaise” or, more dramatically, a “climacteric.”Footnote 1 Recent revisions to Britain’s national income accounts add more statistical weight to impressions of “malaise”: The new data reveal “evidence of a long-term retardation in the UK productivity growth path beginning in the 1870s/1880s.”Footnote 2 Broad-brush approaches to understanding the persistent unease surrounding Britain’s economic performance at this time have proved unconvincing and too vague and imprecise to resolve the issue. Some wonder why Britain’s unparalleled capital markets channeled unprecedented resources overseas rather than into emerging technologies at home;Footnote 3 and others to pervasive but ill-defined “entrepreneurial failure.”Footnote 4 Nevertheless, the question remains: How did Britain lose its once-unsurpassed ability to recognize and implement critical emerging technological opportunities?

This paper seeks to sharpen understanding of Britain’s faltering growth performance in the decades before 1914 by detailed examination of the very early years of its electrical industry, the time when global patterns of the industry’s development—in terms of the emergence of leading electrical engineering firms and the style of electricity supply—were established. The importance of the early electrical industry is well established: it was the source of productivity growth and consumer amenities for the following century, a crucial general-purpose technology in the making.Footnote 5 From its inception in the early 1880s, the electrical industry has been made up of two distinct sectors: equipment manufacturers and electricity suppliers. Engineering concerns produce the increasingly sophisticated equipment needed for cheaper electricity and innovative applications. Supply undertakings (utilities) use that equipment to deliver electricity to growing numbers of varied users. This division of labor arose almost immediately upon the industry’s emergence. By 1912, within thirty years of the industry’s first emergence, the leading electrical engineering companies were among the world’s largest industrial firms, profitably satisfying the burgeoning electricity demand worldwide.Footnote 6 Moreover, because electrical engineering was the closest of the engineering disciplines to physics, men who were trained as electrical engineers were to play key roles in subsequent technological advances, not least semiconductors. Thus, in many ways, the electrical industry was central to the economic growth of the late nineteenth century and beyond. Yet to the surprise of many, electrification in Britain proceeded remarkably awkwardly and hesitantly compared with other countries.Footnote 7 As J.H. Clapham (Reference Clapham1932: p.109) noted: “it was agreed that Britain was not the pioneer” despite its wealth, its vast accessible capital markets, the depth of its science base (only Germany’s could compare), and its abundance of engineering talent.

To better understand how Britain’s unexpectedly faltering embrace of electrification came about, we examine British electrical company formation from 1880, when the commercialization of electricity first began, to 1888, when large-scale electricity supply finally began in Britain. A study of company formation reveals when, how, by whom, to what extent, and how successfully resources were assembled for British electrification. What emerges is that when British electrification finally began in earnest, it proceeded with supply companies assembling haphazardly the equipment they needed to generate electricity. They were not supported by competitively seasoned electrical engineering companies with a record of devising, improving, eliciting the myriad complementary innovations needed to apply electricity effectively, and vigorously marketing the equipment needed to expand applications. Such activity also lowered the cost of electricity supply, further encouraging the search for new applications. This process drove electrification in the United States and Germany, the countries that had pursued electrification most successfully.Footnote 8 The British lag was due, above all, to the self-induced implosion in 1882 of Britain’s most successful electrical engineering company of the time, which had secured, by international standards, unsurpassed funding to pursue electrification and was briskly installing lighting systems across the United Kingdom. The 1882 crash left the surviving electrical engineering companies suddenly bereft of financial markets access amid newly-found multifaceted skepticism as they attempted to market large-scale lighting installations and probe electrical possibilities.Footnote 9 What business they could conduct was now small-scale and unambitious. This inversion of the practice of the leaders of electrification severely handicapped British electrification: its electrical engineering companies were small, conspicuously lacking innovative flair and profitability. The only exception was C. A. Parsons and Co., established in 1889 to specialize in the manufacture of steam turbines rather than the whole range of electrical equipment. The firm had no recourse to public finance, being wholly owned by the well-born Charles Parsons. Britain’s early supply companies offered few applications beyond lighting, leaving the costs of electricity supply conspicuously high by the standards of the most advanced countries.Footnote 10 The paper also considers the extent to which government regulation affected British electrification. Because expanding electricity supply became increasingly complex with characteristics of a natural monopoly and pronounced economies of scale, the early decision to place regulation in the hands of local authorities created an impediment that remained unaddressed for decades.

This study is organized into ten sections. Following the Introduction, Section 2 sets out the sources and methods used. Section 3 employs Britain’s unparalleled financial data to examine the extraordinary amounts of capital amassed by British electrical companies in the period 1880–1882—no other country raised nearly as much in this foundational period. Section 4 examines the impact on electrical activity of the collapse of the share prices of lavishly funded electrical companies in late 1882. Section 5 considers the impact on British electrification of the unexpected death in November 1883 of Sir William Siemens. Section 6 considers the extent the Lighting Act of 1882 inhibited early British electrification, as often argued. Section 7 considers the experience of Liverpool Electricity Supply, one of the few companies established to supply electricity from a central station to the general public between 1882 and 1888, when the controversial 1882 Act was amended to encourage the formation of private electrical supply companies. Section 8 considers the development of electrical engineering firms in Britain between the end of the 1882 boom and 1888, focusing on Woodhouse and Rawson, the firm that raised the largest amount of public money for electrical equipment manufacture in that period. Section 9 contrasts Britain’s troubled path to electrification with that followed in the United States and Germany. Section 10 concludes.

2. Sources and Methods

Our sources allow us to replicate the information that investors of the period used, thereby framing the choices they made within the common knowledge of the time. We monitor the progress of British electrification by recording the amounts of capital raised by security issues for this purpose and the returns earned on those securities. Unless otherwise noted, all data on security issues and payments made to their holders are taken from Burdett’s Official Intelligence of Securities. Henry C. Burdett was Secretary of the Share and Loan Committee of the London Stock Exchange from 1880 to 1898 and published his Official Intelligence under the auspices of the Committee of the Stock Exchange. Upon Burdett’s retirement in 1898, the title of his publication became The Stock Exchange Official Intelligence. Burdett and his successors sought to make their publication a reliable source of information on company security issues and payments, taking the care necessary to do so. Investors relied on this information.

Unless noted otherwise, we take security price data from the Investor’s Monthly Manual (hereafter IMM) published by The Economist newspaper from October 1864 to June 1930, when it was supplanted by quotations reported daily in the financial press. The IMM holds a distinguished place in the evolution of the collection and dissemination of financial data that makes capital market efficiency possible.Footnote 11 We augment these sources by reports in specialist publications, notably The Electrical Review (hereafter ER, formerly The Telegraphic Journal and Electrical Review) and The Electrician, as well as more general publications reporting electrical activity, notably The Economist and The Times. The ER systematically covered the Annual General Meetings of electrical companies where management presented their financial results (usually audited) and submitted to shareholder questions, often adding their commentary and that of readers. For shareholders, it was probably the most reliable source of information about the electrical company’s accounts. These sources enable us to follow the progress of electrical companies in the same manner as investors of the time.

3. The Turbulent Start to British Electrification

With advances in previous decades, particularly linking the capacity of electricity to create light, first publicly demonstrated by Sir Humphrey Davy in 1808, to improvements in electricity generation arising from the discovery in 1866 of how electromagnets could create much stronger current flows than permanent magnets or batteries, entrepreneurs perceived opportunities. The first commercial application of electricity beyond telegraphy was arc-lighting to illuminate large spaces such as streets, rail stations, warehouses, and foundries. While arc lamps had been in limited use from the 1850s onwards, the pace picked up markedly when Paul Jablochkoff, a Russian telegraph engineer, created an international sensation in February 1878 by illuminating the streets around the Paris Opera with his powerful electric “candles.” A Jablochkoff demonstration along London’s Victoria Embankment soon followed. Concurrently, Charles Brush in the United States created similar sensations, demonstrating his arc-lighting system in his native Cleveland, Ohio, and in New York’s Times Square. In 1879, Brush established a pioneering central station to light the streets of central San Francisco cheaply with an unprecedented number of arc lights.Footnote 12 However, arc-lighting’s illumination was far too bright, harsh, and noisy (the carbon rods through which electricity passed when creating an illuminating arc were noisy as they burned away) for the confined spaces of individual rooms in the homes, offices, clubs, hotels, and restaurants where gas lighting was profitably used.Footnote 13 In the late 1870s, Thomas Edison in the United States and Joseph Swan in Britain, among others (notably Hiram Maxim and Edward Weston), independently demonstrated incandescent lamps (where electricity was passed through a thin filament in a sealed glass bulb rather than thick carbon rods) that could illuminate confined spaces.Footnote 14 By 1880, electric lighting in its various forms was ripe for large-scale commercial development.

This readiness found its greatest expression in London in 1882, where an unprecedented £2.2 million in cash was raised by the public issue of securities for thirty-nine separate electrical ventures, 49 percent of which were issued by Anglo-American Brush (A-AB) and the sixteen concessionaire companies that had purchased rights to its proprietary arc-lighting equipment.Footnote 15 Even larger amounts resided in the uncalled portions of the shares that investors in A-AB and its concessionaires had subscribed. Almost all electrical companies raising cash at this time issued a fraction (often a large one) of their shares only partially paid-up, shareholders being legally bound to pay the subscribed remainder when company directors “called” that money up. In 1880 A-AB had purchased the exclusive rights to deploy Charles Brush’s well-regarded proprietary arc-lighting system outside North America and had demonstrated it widely in Britain, replicating Charles Brush’s success in the United States. Robert Hammond, an early A-AB concessionaire, greatly aided this marketing effort by using A-AB’s arc-lighting equipment to illuminate several British foundries, workshops, and public spaces, skillfully publicizing the results. Hammond also astutely used his own home in London’s Highgate to showcase the advantages of incandescent lighting for domestic use.Footnote 16

The successful lighting demonstrations of A-AB and Hammond stimulated the sale of licenses for Brush’s system to thirteen other groups intending to establish, with A-AB’s support, the Brush system throughout the United Kingdom, Australia, Austria-Hungary, Spain, and South Africa. To place the scale of A-AB’s and its concessionaires’ security issues before 1883—£1.2 million—in perspective, Edison had raised only $1.8 million (£370,000) before 1886. In 1882, A-AB hastily purchased rights (but not the exclusive rights it carelessly assumed) to St. George Lane-Fox’s incandescent lamp, a competitor of Edison’s and Swan’s lamps. In this manner, A-AB and its concessionaires had by June 1882 the resources to sell electricity for lighting, both arc and incandescent, on a uniquely broad scale. However, while A-AB’s arc-lighting system was promising, it was not perfect, afflicted by the operating problems common to all new systems, as well as being relatively expensive to operate.Footnote 17 Moreover, its entrance into the much more lucrative incandescent-lighting market was untested and faced formidable competition from Edison and Swan.

However, rather than using its remarkable cash reserves and elevated share price to develop its lighting systems and other applications, in August 1882, A-AB’s directors paid all the concessionaire cash it had amassed to its shareholders as a special 100-percent dividend and to themselves as a bonus based on the dividends paid to shareholders. Worse, in December 1882, A-AB’s management announced calls on shareholders to repay previously undisclosed bank loans. These calls were totally unexpected, since to secure approval for its special dividend, management had assured shareholders the company held ample cash reserves, which turned out, to A-AB’s shareholders’ outrage, to be merely the nominal value of its concessionaires’ shares, whose market values had promptly collapsed in the wake of A-AB’s special dividend.Footnote 18 Moreover, A-AB’s unexpected calls fell on the unpaid portion (60 percent) of the amounts most A-AB shareholders had subscribed. A-AB’s directors were among the group that had founded the company in 1880 and had issued to themselves and their allies fully-paid £10 shares and thus were spared the calls that cash (outside) buyers faced.Footnote 19 The market price of A-AB’s shares, already falling from extreme heights before the unexpected calls, went into freefall after them, not bottoming out until early 1884 at £1 for the partially paid shares (£3.50 for the fully-paid) upon which £8 had been paid up, with £2 still to be called (which happened in 1889 when A-AB was re-organized into Brush Electrical Engineering). A-AB, even with new management, was not able to approach the London Stock Exchange for fresh funding until May 1887 when it offered five thousand shares at a written-down par of £5 (from £10), of which only 1,354 were taken up: the long-lasting distrust in this company gravely impeded its engineering ambitions. The failed rights issue was part of a floundering funding drive, which included a hire-purchase scheme aimed at those who wanted their own private electricity supply but were distrustful of A-AB’s reliability.Footnote 20 In 1882, a year of great electrical expectations for which, by international standards, extraordinary cash amounts had been raised and pledged in the United Kingdom, ended in electrical market disarray with the bursting of the short-lived “Brush bubble” and its attendant collateral damage.Footnote 21

4. Picking Up the Pieces

The depressed sentiment surrounding A-AB was even more manifest in the share prices of its concessionaires. The most important of these was Robert Hammond’s Hammond Electric Light and Power Supply Company (HELPS), which had been highly effective in demonstrating and marketing electricity using Brush equipment. At the end of 1882, its (partially-paid) share price was £3.00 and falling, a shadow of its June 1882 peak market price of £12.00. The share prices of A-AB’s other concessionaires fell more sharply on their way to liquidation or reorganization.Footnote 22

The reasons for this rout were obvious. The money A-AB’s concessionaires had paid for rights to use A-AB’s proprietary equipment had been squandered egregiously, leaving little for the support expected from A-AB as concessionaires attempted to roll out the Brush system widely.Footnote 23 Moreover, as they set about installing A-AB’s equipment, the need for technical support became clearer as the operational shortcomings of A-AB’s equipment and the limited electrical knowledge of concessionaire personnel emerged. A-AB’s standard generator powered too few arc lamps to produce light as cheaply as once expected.Footnote 24 A-AB’s competent engineer, William Mordey, addressed this problem. With thoroughly depleted resources, he finally introduced an improved generator in 1884 (dubbed “Victoria”), but by then Sebastian de Ferranti’s comparable generator had been financed and marketed by HELPS for seventeen months, winning favorable reviews.Footnote 25 Moreover, in its haste to acquire rights to Lane-Fox’s incandescent lamp, A-AB had failed to notice that St. George Lane-Fox had a year earlier already sold those rights to the British Electric Light Company, so A-AB could not confer upon its concessionaires the exclusive rights to the Lane-Fox lamps they had expected. Worse, Lane-Fox lamps soon proved markedly inferior to those of Swan and Edison.Footnote 26

This quickly led to well-publicized legal wrangling, further damaging the allure of electricity. Three concessionaires used A-AB’s failure to secure exclusivity (which the concessionaires had in turn promised verbatim in their prospectuses) as an opportunity to claw back the money they had paid to A-AB for various rights, on the grounds of A-AB’s false prospectus. This effort met with little success. While Robert Hammond offered a refund (£4,000 cash) to his concessionaires, A-AB successfully refused any refund to its concessionaires (including HELPS) on the grounds that, given the dormancy of British Electric Light, lack of exclusivity had no material impact on the value of the Lane-Fox rights A-AB had conveyed, but at the further cost to its already-damaged reputation for competence and honest dealing.Footnote 27

A-AB’s alienation of its concessionaires severely damaged its main channel for equipment sales: A-AB could not legally sell its own equipment in areas where it had previously sold its rights to the Brush and Lane-Fox technologies.Footnote 28 In 1885, to retrieve its rights, A-AB paid HELPS enough cash to help that company discharge all its debts to creditors and pay its shareholders in aggregate (including Robert Hammond himself) a cash liquidation amount of £7,500. Unlike some concessionaires, Hammond insisted on cash, refusing to accept A-AB shares for the surrender of the rights he had once purchased from A-AB. A-AB was further hampered by disgruntled concessionaires, often in the process of liquidation, dumping on second-hand markets at fire-sale prices the equipment they had bought in 1882 in anticipation of a continued surge of lighting installations that A-AB’s short-sighted special dividend ensured never came.Footnote 29 By the end of 1885, with only one exception (Australasian Brush), all A-AB’s concessionaires, including HELPS, had been liquidated with very little returned to shareholders (in aggregate, less than 10 percent of the cash they had originally paid).

Since Robert Hammond was arguably Britain’s most competent electrical engineer at the time, his company’s experience illuminates electrical demand in Britain after 1882. Hammond’s business was now confined to small installations, for example, the lighting of coal mine shafts at Wigan, woolen factories at Bradford and Huddersfield, and the rail station at Brighton.Footnote 30 He was not able to repeat his previous year’s successes of spawning small public electricity supply companies in Hastings, Eastbourne, and Brighton. Demand for electric lighting persisted, but, given the very public collapse in the market value of electrical companies (especially A-AB’s), demonstrations now faced more skeptical, cautious consumers, who bought less readily while stipulating deferred payment until increasingly demanding warranties had been satisfied. After 1882, Hammond used Ferranti’s generators exclusively, in direct competition with A-AB’s equipment. Although the technical press regarded Ferranti’s generators favorably, Ferranti often delivered them late due to his urge to improve each one, which strained HELPS’ now-slender finances.Footnote 31 With only the money he had raised in 1882 and retained from operations, with no prospect of raising more by share issue and banks leery of lending money to the crisis-prone electrical industry, Hammond gambled by starting a factory to produce incandescent lamps using mechanical glass-blowing machinery rather than specialist glass-blowing labor, betting that he would be able to sell enough lamps to justify the investment.Footnote 32 He could not. In 1885, unable to secure more funding—everyone he had approached now regarded electricity too risky to justify investment—he wound up HELPS in an orderly manner.Footnote 33 The liquidation of HELPS ended Hammond’s engineering ambitions but undoubtedly enhanced his reputation as he embarked on a successful career as a consulting engineer to supply companies.

After the 1882 crash, the need for electrical innovation in Britain remained as important as ever, but existing electrical companies were unable to raise new money and had to manage with their remnants from the 1882 debacle. A-AB didn’t try to raise new funds until 1887, with disappointing results. When the Maxim-Weston Electric Company tried in 1883, it had to issue shares at a 75-percent discount, raising only £6,075 rather than the £24,300 sought. In 1881, the year of its flotation, the directors of this company had astutely bought for £54,000 (at least £41,500 in cash, the remainder in fully-paid shares), the British rights to Maxim-Weston’s effective generator and a viable incandescent lamp robust to Edison’s patents. Unfortunately, the directors proved patently incapable of sustaining their investment. When Hiram Maxim traveled from America to visit the company’s London offices and its shockingly decrepit workshops, he was offered the company’s managing directorship at the derisory fee of one guinea per year—the directors evidently deciding they had paid enough for his rights.Footnote 34 He immediately resolved to have nothing more to do with the company, instead turning his creative mind to devising an effective machine gun, for which, as a naturalized British subject, he was knighted in 1901. The Maxim-Weston Electric Company staggered on until 1889, when it quietly entered liquidation, after having paid £6,925 in dividends and a liquidation payment of £16,175Footnote 35 on the cash of £131,575 it had raised by share issue since 1881. Its only concessionaire, Lancashire Maxim-Weston, had entered liquidation in 1884 amidst acrimony over funding.

The merger of Swan United Electric Light Company and Edison Electric Light Company in June 1883—the resulting company entitled Edison and Swan United Electric Light Company (popularly known as Ediswan)—sought only a small fund-raising of £44,630 to top up the combined resources of the two merging companies. Ediswan sought no further Stock Exchange funding before it was acquired in 1928 by Associated Electrical Industries, the successor by merger to two American-based companies (British Thomson-Houston and British Westinghouse) that had created British subsidiaries before 1914. While Ediswan and the foreign operations of Swan United (which competed with Edison in Europe and the United States but not in the United Kingdom) were by far the most successful of the early British electrical companies, they did little to advance British electrification. Swan United’s business was the sale of its relatively reliable incandescent lamps both in the United Kingdom and abroad. While Swan recognized that the creation of central-generating stations could greatly increase the number of customers for his lamps, his company did not have the engineering capacity to establish such central stations and did not actively attempt to do so, restricting its limited efforts to cautious collaboration on small-scale installations with the engineer R.E.B. Crompton, with limited success. As in New York, Edison did actively pursue a central-station strategy and accordingly established a showcase station at London’s Holborn Viaduct in March 1882, which attracted much attention and generally favorable comment.Footnote 36 However, Edison himself did not devote his attention to his London prototype station, being fully engaged, with many twenty-hour days, removing all the remaining “bugs” infesting a similar station in New York City’s financial district before deeming it ready on 4 September 1882, for its well-publicized switch-throwing inauguration in J.P. Morgan’s offices.Footnote 37 Subsequently, he remained fully occupied in Manhattan, maintaining the reliability of his electricity supply company as he added customers to his central station and met the growing demand from affluent individuals for his isolated-plant equipment.Footnote 38 Once his English company had merged with Swan’s, he devoted no more effort to establishing central stations in Britain. Even without the demand central stations could have created for incandescent lamps, Ediswan did a brisk business selling them to the residences of wealthy individuals, to the restaurants where they dined, and to the hotels, promenades, and theatres they frequented, all the places, especially in London, that could bear the cost of servicing small groups of affluent clients.Footnote 39 As William Siemens had discovered in Godalming in 1881, electric incandescent lighting was a “light of luxury,” its cleanliness, convenience, safety, and clarity making it, for those who could afford it, clearly preferred to the gas lighting of the time.Footnote 40 The shareholders of gas companies recognized this too, dumping their holdings upon even the rumor of electric lighting.Footnote 41 The collapse of A-AB in late 1882 offered the British gas industry a reprieve from electrical competition, but more perceptive gas engineers, notably those at London’s Gas Light & Coke Company, immediately saw the need to find new uses for gas in cooking and heating.Footnote 42 The introduction of the improved Welsbach gas mantle in 1892 aided this endeavor. The key innovation in expanding gas markets after 1880 was the invention of the coin-in-the-slot gas meter in the 1870s.Footnote 43 These meters enabled gas suppliers to sell gas without also extending credit, opening up a large market of less credit-worthy consumers: between 1890 and 1914, the number of Britain’s gas customers tripled while gas sales had only doubled.

Ediswan also found a ready market for its lamps in the ships of the Royal Navy and on luxury ocean liners.Footnote 44 While such business proved to be profitable, it utilized the equipment readily available in the early 1880s, without needing the improved generators, fuses, meters, switchgear, and other equipment needed for large-scale central stations serving thousands of customers, the hallmark of electrification in earnest, as Edison had anticipated. Such highly profitable early niche lighting markets serving well-heeled customers had few linkages to broader British electrical development.

The other nineteen electrical companies launched in Britain before 1883 had generally short, dismal existences. For example, Electric “Sun” Lamps & Power Company, which had raised £20,200 by share issue in 1882, boasted socially prominent directors who arranged the lighting of the South Kensington Museum while flaunting their ignorance of electricity. One of them, Lord Brabourne, distinguished himself by declaring an inability to discuss the difference between series and parallel wiring.Footnote 45 The company entered liquidation early in 1884, leaving shareholders with a total loss, directors opportunistically attributing their failure to restrictions unexpectedly imposed by the Board of Trade rather than incompetence. A more viable, but hardly successful, company among the nineteen was Edison’s Manchester & District Edison Electric Light Company (not included in the merger that created Ediswan), which lost money for the first five years of its existence. After raising more money in 1894, it became modestly profitable and was taken over by Ediswan in a share swap in 1896, by which time Ediswan’s once-robust dividend stream was fading as the expiration of the Swan-Edison patents heralded greatly intensified competition in incandescent lamps. Edison’s Indian & Colonial Electric company, launched in London in 1882 with £30,000 in funding, was failing when it was taken over in 1886 by Australasian Brush, the only surviving Brush concessionaire, itself faring only marginally better until it became part of Brush Electrical Engineering following a share swap in 1889 during the restructuring of the ill-fated A-AB.

Gülcher Light & Power Company possessed a once-promising generator, for the development of which it raised, through two funding rounds, £138,900. Gülcher entered its final liquidation in 1894 with nothing noted as paid to shareholders. Among the electrical companies floated in 1882 were three that specialized in batteries—Fauré Electric Accumulator, Electrical Power Storage Co. (EPS), and Indian & Oriental Electrical Storage & Works Co., which among themselves raised a total of £159,000 cash. Of these, EPS, organized as a patent pooling organization embracing the notable battery makers of the day (Fauré, Sellon, Swan, and Volckmar) initially raised no cash but was the only one to pay off for shareholders, returning £171,600 cash when EPS merged with two other companies in 1889 to create Electric Construction Corporation.Footnote 46 In summary, the companies floated in 1880-1882 accomplished very little with the remarkable amounts of money they had been able to raise.

5. The Unfulfilled Role of Siemens Brothers in Britain

Not all the electrical companies noted in Burdett’s before 1882 were new creations. Siemens Brothers & Company, the shares of which were closely held within the sprawling Siemens family, sought a listing in Burdett’s to mark its emergence in 1880 as a British limited company. The purpose of Siemens Brothers’ conversion to a limited company was not to raise money from the public but to facilitate access to short-term credit markets to accommodate the completion of “lumpy” contracts spawned by its growing British operations. Siemens Brothers’ listing in Burdett’s, supported by years of strong earnings in the late 1870s, cemented the company’s stellar creditworthiness.Footnote 47 Neither the company’s ordinary shares nor its debentures were ever quoted in Britain before 1914, but dividend and interest payments were duly recorded as Burdett’s fulfilled its self-appointed function as a provider of financial information in the world’s premier capital markets. Siemens Brothers’ entry in the first issue of Burdett’s, in February 1882, was a large one of £350,000. The company’s 10-percent dividend signified the undoubted profitability of its operations both in undersea telegraphy and its growing involvement in electrical applications. William Siemens (later, Sir William; born in 1823, Carl Wilhelm, in Lenthe, then Kingdom of Hanover, Germany), the representative of the House of Siemens in Britain since 1843, had wide interests in many technical fields, including applications of electricity. In 1866, his engineering skills had aided his elder brother, Werner, in designing electromagnets to greatly enhance generator output, a signal advance in electrical technology that cemented Siemens and Halske’s leading position as a manufacturer of electrical equipment.Footnote 48 In 1881, he established a central power station in the village of Godalming, Surrey, using water power to provide arc lighting, with the possibility of adding incandescent lighting. More importantly, in October 1883, Sir William (as he was then) had, to great acclaim, completed an ambitious electric railway project linking the harbor at Portrush on the north coast of Ireland with the Bushmills’ whiskey distillery six miles inland.Footnote 49 As in Godalming, Sir William used hydropower for the generator, exploiting electricity’s capacity to transmit power cheaply over distances and anticipating later developments at Lauffen in Bavaria and Niagara in the US. The Portrush-Bushmills electric rail line was, at the time, the longest outside Berlin, where Werner had, in 1879, for the Berlin industrial exhibition of that year, built at Gross-Lichterfelde an electric tramline using a third rail for power transmission, as Sir William did at Portrush. While obstacles remained—third rails were too hazardous to use in crowded urban areas where demand was greatest but where current-carrying rails were exposed to pedestrian and horse traffic—the Siemens brothers, at the time of the completion of the Portrush-Bushmills line, were systematically exploring electricity’s first significant power application. Werner, in 1882, as part of a project to apply electricity to his Russian copper mining operations, had constructed an electric mine railway using an overhead conductor.Footnote 50 Within a decade, power applications in their many guises had become the fastest-growing use of electricity and the prime source of improved productivity in manufacturing. But Sir William’s unexpectedly early death in November 1883 disrupted Britain’s involvement in this promising development of electrical power, as well as ending Godalming’s supply initiative. Control of Sir William’s businesses passed to the older (by nearly seven years) Werner in Berlin. Werner, increasingly cautious as he aged, decreed that the family’s London operations, without his brother’s capable guidance, should concentrate on its long-established and highly profitable undersea-telegraph cable business, effectively abandoning the family’s electrical engineering projects to Berlin. Thus, the promising work done by London-based Siemens Brothers on traction, lighting, and related electrical projects ended abruptly. It would not be until well after Werner died in 1892 that Siemens Brothers would once again actively engage in British electrical engineering, although then directed (not very successfully) from Berlin. Imagine how Britain’s electrical industry might have evolved had Sir William’s elder brother died first, with the locus of the Siemens family’s multifaceted operations shifting to London from Berlin.

Ironically, the considerable wealth Sir William bequeathed to his brother was used to fund the Physikalische–Technische Reichsanstalt (Imperial Physical-Technical Establishment) in Berlin when that legacy presented Werner with the means finally to get his cherished but long-delayed project approved by the Reichstag, further bolstering Germany’s pre-eminent position in physics research. While Sir William’s widow, upon her death in 1902, left money to King’s College London for the education of students in electrical science, this amount, while not negligible, was small relative to that left by her husband to Werner.Footnote 51

6. Did Government Regulation Undermine British Electrification?

Sir William’s premature death, occurring as the rest of Britain’s nascent electrical industry sank into a period of low regard and the limited ambitions imposed by want of cash, ensured that only meager development would occur in Britain for the foreseeable future. Many have argued that flawed British legislation also played an important role in inducing this post-1882 electrical lethargy with no counterpart in the United States or Germany.Footnote 52 After all, the Lighting Act of 1882, devised after three years of Parliamentary deliberation, was regarded by some aspiring electrical entrepreneurs from the outset as excessively restrictive.Footnote 53 To prevent the monopolistic exploitation that gas companies had long practiced, a key premise of the 1882 Act was that electricity would ultimately be provided by local authorities. However, Parliament had correctly anticipated local authorities’ innate reluctance to venture ratepayers’ money on this little-understood technology. Hence, the Act permitted private companies to supply electricity if their local authorities failed to do so. However, where private companies had gained permission to supply electricity, the Act gave local authorities the right (not the obligation) to buy private supply companies after only twenty-one years of operation on very favorable terms: no allowance need be made for any profitability the companies established during their twenty-one-year tenure, only the second-hand value of assets in place (derisively dubbed a “scrap metal” valuation). Experience soon revealed that the Act gave local authorities too much obstructive power without any counterbalancing power compelling them to provide electricity themselves when they refused the applications of private companies. This invited inaction. The wave of stock market flotations of private supply companies that began in 1887 upon the anticipated revision of the 1882 Act, which lengthened to forty-two years the period of secure tenure that private companies could enjoy while reducing the scope for local authority obstruction, exposed the restrictive nature of the 1882 Act. Indeed, many of the supply companies that issued shares only after the amendment of the 1882 Act had been waiting for just that opportunity.Footnote 54 Britain was unfortunate its 1882 Lighting Act was intended to apply to the entire county whereas the United States and Germany were both federal systems where the regulation of electricity was left to local authorities, allowing much experimentation to reveal the electricity supply systems worth emulating, as Hammond had briefly shown on England’s south coast in early 1882Footnote 55, as EdisonFootnote 56 and ThomsonFootnote 57 showed in the United States and as Emil Rathenau would later show in Berlin.Footnote 58 However, the impact of Britain’s premature attempt to regulate electricity was felt throughout the country, illustrating the hazards of regulating an emerging technology before it was well understood.

There is little doubt that the 1882 Act’s presumption that local authorities would shape electrification created obstacles for private companies while risk-averse local authorities passively waited to see how electrical technology evolved.Footnote 59 Additionally, the Brush bubble’s bursting badly tarnished the nascent industry’s prospects. In April 1883, a delegation from the Edison and Swan companies called upon the Board of Trade to protest the debilitating deposits demanded of them by local authorities in London before receiving the requisite permission to begin work supplying electricity in their jurisdictions. Joseph Chamberlain, then President of the Board of Trade, explained to the protesters that the deposits were necessary to deter mere “speculators” who had “no knowledge, no ability, and no means” to supply the electricity they promised.Footnote 60 Thus, Chamberlain reasoned, only companies that had the means and confidence to supply electricity would pay the deposits. In November 1884, Chamberlain received a larger delegation from electrical companies requesting that the Board of Trade curb local-authority obstructionism and, in recognition of the fact that electrical construction would surely be delayed by administrative procedures, grant companies freedom from compulsory purchase for forty-two years. Moreover, if local authorities’ right of compulsory purchase were exercised, the delegation insisted that companies should be paid the value of their assets as going concerns rather than simply the second-hand value of assets in place. Given that no electricity was being provided in 1884 under the terms of the 1882 Act, Chamberlain set in motion the legislation that addressed the companies’ concerns. Parliament’s slow-moving legislative machinery amended the 1882 Lighting Act four years later, in August 1888. A wave of stock market flotations of electricity supply companies promptly followed.

While the 1882 Act undeniably inhibited British electrification, its malign influence must not be exaggerated. The Act could be sidestepped by those enterprising enough to do so, either by gaining local authority support or by stringing wires over roofs to eager consumers while avoiding public thoroughfares, the basis of local authorities’ powers under the Act. Already in 1882, Robert Hammond’s successful demonstrations of effective lighting in three neighboring towns on England’s south coast led influential citizens in those towns to establish companies to buy his installations and commence a public supply without reference to either the 1882 Act or the Board of Trade. Hammond’s company owned the power station in Brighton, which was bought as a going concern by the newly formed Brighton Electric Light Company in December 1885. (See Table 1 for the value of the companies bought out by their local authorities.) Brighton’s local authority had obtained authorization in 1883, but, like many local authorities, refused to use it. Thus, Brighton’s situation was an odd one in which Brighton Electric, a private company, was actually supplying electricity in the town without official sanction, while the local authority possessed the authority to supply electricity but refused to do so. Footnote 61 Moreover, Brighton Corporation refused to cede its authorization to Brighton Electric but instead, when the Board of Trade threatened to revoke the Corporation’s authorization if it remained dormant, set up a municipal electricity supply in competition with the Company, a costly rivalry which persisted for more than three years before the Company agreed in 1894 to sell to the Corporation, netting a small (14 percent) premium to the issue price of its shares.

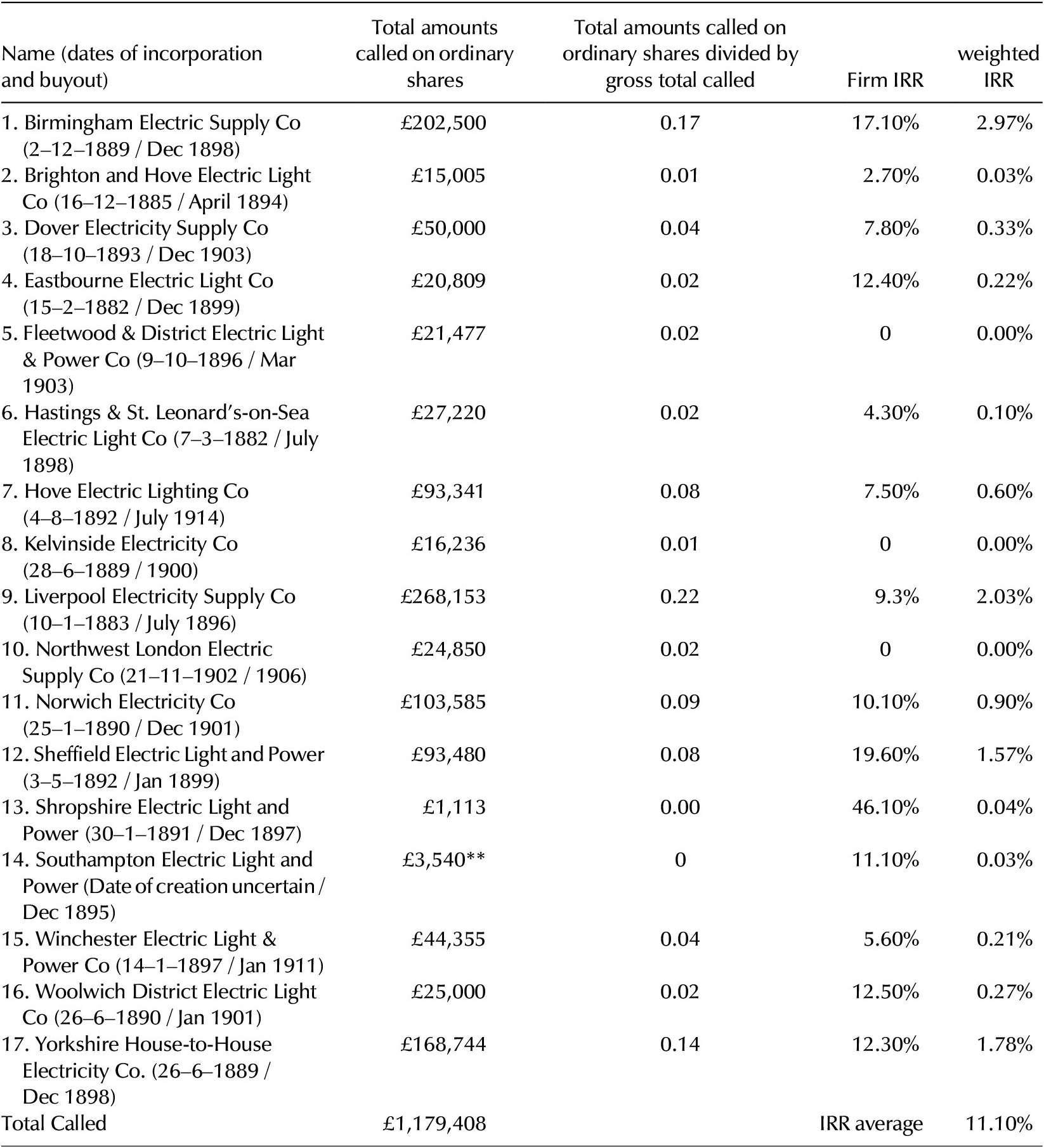

Table 1. Profitability (measured by the internal rate of return, IRR) of companies bought by local authorities

IRR weights are calculated as a company’s called amount as a proportion of the amounts called on all companies.

** Limited information

Despite unusually acrimonious relations with its local authority, Brighton’s private electricity supply company nevertheless secured a positive (albeit small) return on its investment. Brighton Electric Company’s experience was unusual only in the paltry return it had earned when acquired by the local authority. Table 1 shows that the Internal Rate of Return (IRR) earned by the fourteen private electricity supply companies possessing minimal competence (i.e., not acquired during liquidation) taken over by their local authorities was generally high, with an average IRR (weighted by investment) of 11.1 percent. Winchester Electric Light & Power Company, which achieved at least a respectable IRR of 5.6 percent over its lifetime as a private company, was the only one of the 17 companies taken over compulsorily by its local authority before 1914. By the 1890s, a reliable electricity supplier was clearly a valuable asset. If a municipality were to take over a supplier, which it was not compelled to do, it was sensible to do it on good terms to secure a reliable income stream for ratepayers. Hence, fears expressed so volubly in the early 1880s regarding compulsory municipal purchase were badly misguided. Establishing a reliable electricity supplier turned out to be well rewarded. The experience of the Liverpool Electric Supply Company illustrates this clearly.

7. Liverpool Electric Supply Company

While the experience of the three central stations that Hammond set up in 1882 shows what initiative and a modicum of electrical competence could achieve in the early 1880s, the biggest success was that achieved in Liverpool by the partnership of Arthur Holmes and John Clough Vaudrey, locally-based consulting civil engineers attracted by the commercial possibilities of electric lighting.Footnote 62 They established their Liverpool company with a nominal capital of £10,000 in January 1883, after the passage in August of the 1882 Lighting Act. Like the Hammond companies, Liverpool Electric Supply dispensed with the complexities of the 1882 Act by not seeking the approval of the Corporation of Liverpool (the local authority). Instead, it simply strung the cables from its dynamo to its customers over roofs rather than under the Corporation’s streets. Holmes and Vaudrey had the benefit of observing the pioneering efforts in Liverpool of the ill-fated Lancashire Maxim-Weston Company, a short-lived subsidiary of the floundering Maxim-Weston Electric Company. By January 1882, eight months before the passage of the contentious 1882 Act, the nineteen-year-old Henry Royce (later partner in the auto company Rolls-Royce), then the chief electrician at Lancashire Maxim-Weston, was providing electricity in Liverpool for the illumination of several theatres and a market. It might be noted here that Royce was not the only automobile pioneer who possessed an electrical background, foreshadowing the role that electricity would later play in the automobile industry. Henry Ford, before turning to vehicle manufacture, had been chief engineer at Detroit Edison. Ford’s great rival, GM, was managed by Alfred Sloan in a variety of increasingly senior roles from 1916 (CEO, 1923–1937). Sloan had studied electrical engineering at MIT, graduating in 1895.

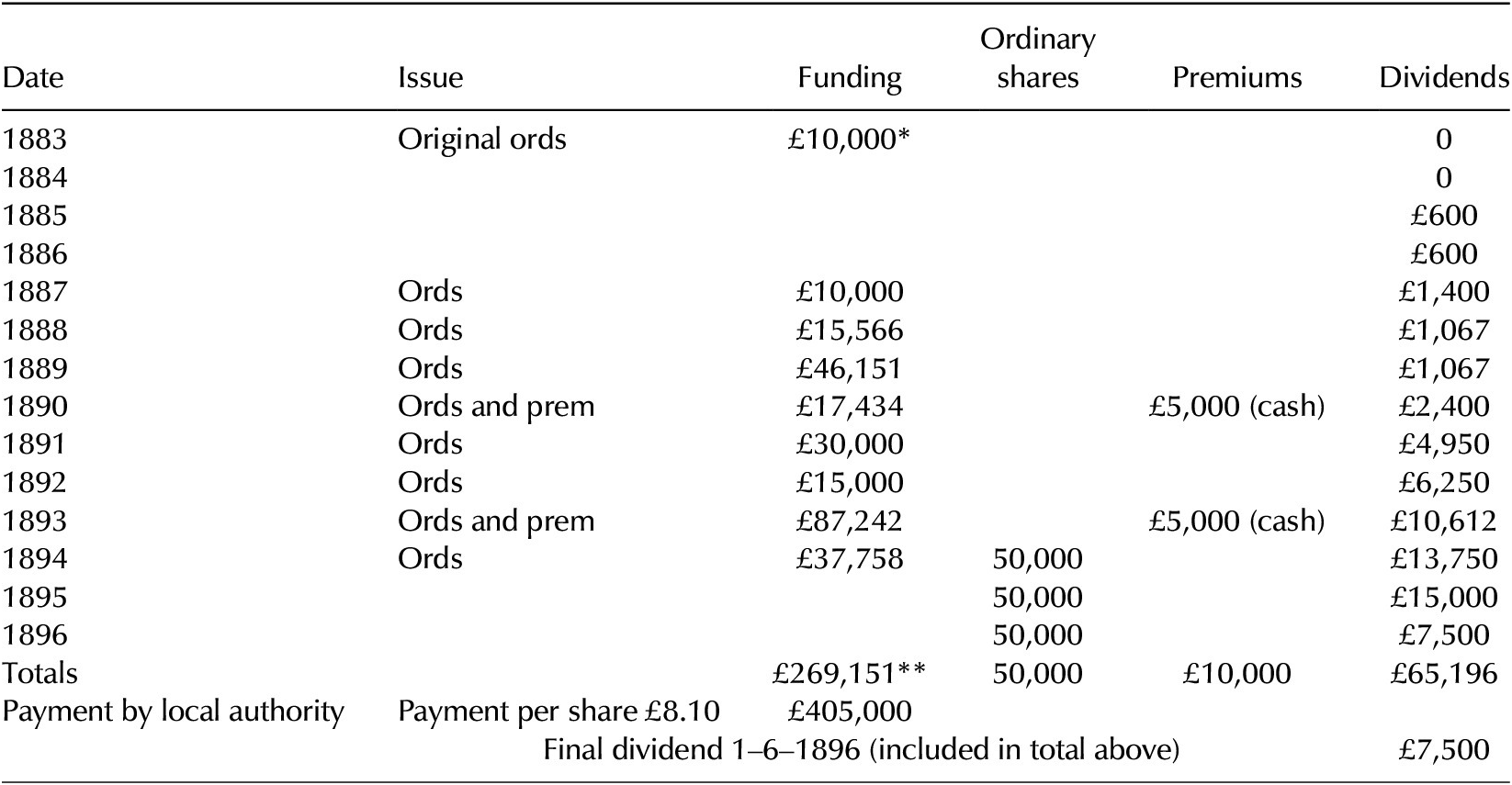

Holmes and Vaudrey executed Royce’s strategy with greater resources and drive, enabling them to establish a central station in the city center delivering direct-current electricity at 110 V to a growing range of hotels, restaurants, theatres, residences, and other users. In response to growing demand, in 1887, before the passage of an amended Lighting Act made the private provision of electricity supply more attractive, the company doubled its capital. Indeed, the company increased its capital every year from 1887 through 1893, its share issues first commanding a market premium to par in 1889. With this money, a larger generating station was built in 1888 to address the rapidly growing Liverpool market, followed by another the next year. See Table 2 .

Table 2. Funding for Liverpool Electric Supply Company

* Vendors’ valuation. ** Includes £10,000 at Vendors’ valuation. All other share issues were for cash.

In 1888, following the relaxation of the 1882 Lighting Act, Liverpool Electric Supply sought official sanction for its operations, obtaining a Board of Trade license to lay cables under public streets, followed in 1889 by more comprehensive permission. However, still favoring municipal control, the Board of Trade imposed the condition on this permission that Liverpool Electric grant the Corporation of Liverpool the right to purchase the Company as a going concern (thereby acknowledging its profitability at the time of purchase) in twenty-one rather than forty-two years. In 1891, when the Company sought more liberal terms, the Corporation objected, wanting earlier control of the flourishing business. After extended negotiations, it was agreed that the municipality could purchase the company as a going concern on 30 June 1900 or on any subsequent 30 June.Footnote 63 However, the municipality became progressively more impatient as the Company grew, finally agreeing to pay in June 1896 £405,000 for the Company’s nominal capital of £250,000 (market value of £406,250) on 30 June 1896, yielding an IRR of 9.3 percent on shareholders’ invested capital, plus a final dividend of £7,500 paid to shareholders, this transaction closing on 1 July 1896.

8. The Development of Electrical Engineering in Britain, 1880-1888

Unsurprisingly, the lassitude that enveloped the Britain electrical industry after the 1882 Brush bubble thwarted the development of an electrical engineering industry. For six years after 1882, electrical equipment was overwhelmingly provided either by companies created in 1882 or earlier, most notably Anglo-American Brush (still struggling to recover from its 1882 collapse), Ediswan and Swan United (manufacturing carbon-filament lamps soon to be rendered obsolete by metal filaments), Siemens Brothers (after 1883 poorly managed from Berlin), and Maxim-Weston Light Company (floundering towards liquidation in 1889). A few existing mechanical engineering partnerships established an electrical engineering department focused on lighting. The most important of these was R. E. Crompton & Co. of Chelmsford, Joseph Swan’s closest collaborator in establishing individual (isolated) incandescent lighting installations (as opposed to central stations serving many users).Footnote 64 In 1884, Crompton installed, for the time, a well-regarded but unambitious direct-current lighting system for the Ring Theatre in Vienna, relying upon batteries for reliable service, a strategy Edison had considered very early in designing his central stations but ruled out as expensive and hopelessly cumbersome.Footnote 65 Crompton did not create a limited engineering company to seek public money to operate on a larger scale until 1888, when he launched an engineering company. He did this to extend the direct-current electricity supply he had for his own home in Kensington to the surrounding area. He powered his larger dynamos with the high-speed steam engines originally designed for naval launches produced by the partnership of Willans & Robinson.Footnote 66 Although Crompton found some initial demand for his dynamos beyond his own supply company, they were often soon replaced by the more advanced equipment of other manufacturers, some of which were German.Footnote 67 Mather & Platt, the prominent and prosperous manufacturer of textile machinery (which remained a private, unlisted company until 1899), established an electrical department focused first on electric traction, but did not pursue this work after the disappointing performance of its pioneering City & Suburban London underground line.Footnote 68 Subsequently, it confined itself to small-scale factory electrification projects, never becoming an important electrical manufacturer.Footnote 69

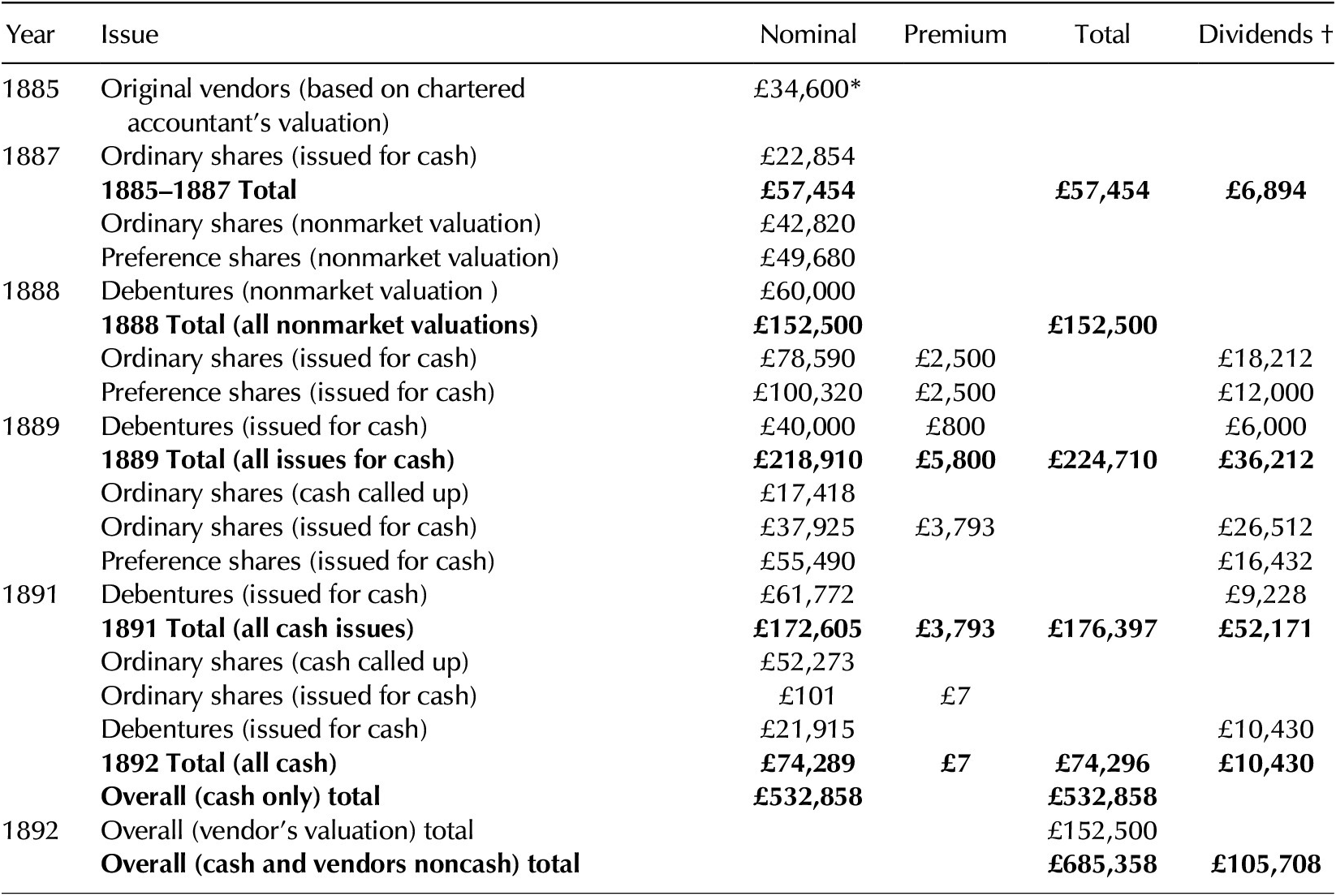

In contrast to the rush of initial public offerings of electrical companies in 1882, in 1883 only three small, short-lived electrical engineering companies, and no supply companies, sought public money through the London Stock Exchange, for which they raised a total of £34,500, returning derisory dividends totaling £207. In 1884, the year after the merger of the Edison and Swan companies, Ediswan, untarnished by A-AB’s troubles, easily raised £44,600. In 1885, Woodhouse and Rawson secured a chartered accountant’s valuation of £34,600 for its electrical manufacturing assets.Footnote 70 Two engineering companies were floated in 1886, raising a total of £6,000, which soon disappeared, returning nothing to shareholders. There were only two public flotations in 1887: (1) Schanschieff Electric Battery Syndicate, which raised £5,000 and soon vanished; and (2) Woodhouse and Rawson (W&R), which raised £22,900. Of these seven electrical engineering companies floated after 1882, W&R was by far the biggest.

This company began in 1881 as a partnership between Otway Edward Woodhouse and Frederick Lawrence Rawson, making a variety of simple electrical lighting accessories (such as lamp holders and ceiling roses). Woodhouse (1855–1887) had received a good education at Marlborough College, followed by study at King’s College London, before serving an apprenticeship at Hunter & English, a well-regarded general mechanical engineering partnership.Footnote 71 In 1880–1882, he also enjoyed competitive success in lawn tennis tournaments at Wimbledon and New York City. Frederick Lawrence Rawson (1859–1923) was born in South Africa, son of the British colonial secretary in the Cape of Good Hope, traveling to London in the late 1870s to embark on a career as a consulting engineer. In January 1885 the partnership, by this time manufacturing a wider range of small electrical items (such as switchboards for low-voltage direct-current circuits and wiring junction boxes) and, with some success, incandescent lamps (albeit under constant threat from Ediswan for patent infringement) became a private limited (unquoted) company entitled Woodhouse and Rawson Ltd. The company’s issue of ordinary shares at this time, supported by an auditor’s valuation, may have enabled Woodhouse to move to Cannes in an ultimately unsuccessful effort to recover his health. Woodhouse’s obituary suggested that his health had been broken by overwork (“he being too often found in his office far into the night”). He never returned to work with the firm that bore his name, dying two years later in July 1887 aged thirty-two. In the mid-1880s, Woodhouse and Rawson were serious competitors of Edison and Swan in the British incandescent lamp market until losing patent infringement suits to them.Footnote 72 With electrical activity in Britain from the mid-1880s gradually picking up, the company began raising increasingly large amounts of cash from the public even though Ediswan patent infringement suits in 1886 compelled it to cease making and selling incandescent lamps.Footnote 73 (See Table 3). In 1888, it issued securities with a nominal value of £152,500 in noncash merger transactions. That noncash issuance, usually a warning signal to outside (cash) investors, did not prevent it, now a public limited company entitled Woodhouse & Rawson United Ltd., from raising £532,858 in cash (including premiums) over the next four years. By 1892, it had issued securities amounting to £685,358 including premiums paid on cash share issues as well as shares issued in noncash transactions.

Table 3. Woodhouse and Rawson funding

* Treated as cash equivalent; † Excludes Directors’ fees of £17,000

However, Woodhouse & Rawson United’s funding achieved nothing. In 1892, at its Annual General Meeting, management admitted that it had suffered losses of £129,765 arising from: (1) the failure of a scheme to illuminate a wealthy area of Paris; (2) opening sales offices in the British colonies that generated expenses without revenues; (3) losses on the fulfillment of ill-judged and mismanaged electrical contracts in Britain; and (4) under threat of another aggressive Ediswan patent infringement action, the abrupt and costly abandonment of the recently lucrative sale and manufacture of incandescent-lamps in Britain.Footnote 74 All this suggested that the company had suffered from the early death of Otway Woodhouse, the more highly-trained and experienced partner. Shareholders responded to the shock of the 1892 losses by securing a winding-up order on 17 May 1893. The rush to liquidation triggered by this setback was prompted by the sudden end of the company’s modest stream of dividends –some £80,050 in total. These dividends had been guaranteed by a curious trust arrangement put in place in July 1889 to stimulate cash share issue, subtly implying that the company’s prospects alone were not sufficient inducement to invest. While the Official Receiver’s preliminary report suggested that the company’s assets were sufficient to pay off the debentures in full and distribute some £29,000 to other claimants, liquidation actually produced only enough cash to cover 12 percent of the debentures, leaving nothing for the holders of the ordinary and preference shares.Footnote 75 The liquidator’s preliminary over-valuation may have been due to difficulties in establishing accurate valuations of W&R’s minority shareholdings in a clutch of obscure unquoted foreign companies.Footnote 76 In all, notwithstanding a promising start and considerable success in raising cash, Woodhouse and Rawson United did not advance British electrification, but only enhanced the industry’s reputation as a waste of capital.

In 1888, two companies which had often worked together as partnerships were established: Crompton & Co., Ltd. and Willis and Robinson. As discussed earlier in this section, although these two companies enjoyed some success in the 1890s, they failed to stay abreast of evolving technology. By 1914, their shares were nearly worthless.

9. Britain’s Flawed Path to Electrification

Britain’s electrification began in 1882, as it did in the United States and Germany, with an engineering firm demonstrating convincingly the possibilities of the new technology: Anglo-American Brush in Britain (A-AB); the Edison Electric Light Company in the United States; and Emil Rathenau’s German Edison Company for Applied Electricity in Germany. Of these three, A-AB had by far the most readily available money to further develop the technology it was demonstrating. However, the funds A-AB had secured were squandered in an egregiously self-serving special dividend and attendant managerial bonuses. The subsequent plunge of electrical company share prices, especially those of A-AB and its concessionaires, combined with the very public acrimony unleashed by A-AB’s extraordinary dividend at concessionaire’s expense, immediately burdened the reputation of the industry. In the words of Joseph Chamberlain, the nascent industry’s regulator, the electrical industry was the preserve of “speculators,” who had “no knowledge, no ability, and no means” to develop it.Footnote 77 Consequently, the extensive experimentation that had characterized Britain before 1883 abruptly slowed. Those still trying to manufacture electrical equipment in Britain now faced a flood of second-hand equipment from A-AB’s disgruntled concessionaires while having little money for equipment development and marketing demonstrations as they faced now-skeptical, if not hostile, audiences, not least among local authorities considering whether and how to embrace the new technology.Footnote 78 Britain’s electrical manufacturers, suddenly in a hostile marketing environment and unable to raise more capital, had few resources advancing electrification.

While the macroeconomic environment after 1882 moved against would-be electrical entrepreneurs, this movement was notably milder than historians had once believed.Footnote 79 The most recent income measures of GDP are considerably less volatile than Charles Feinstein’s 1972 estimates. The new estimates record a fall of Gross Domestic Product Index (GDPI), the most accurate measure, by some 3.5 percent between 1882 and 1885 before steadily recovering to stand 6.4 percent above the 1882 level in 1888. Moreover, the incomes of those in receipt of salaries and rent—among the groups most likely to buy shares and whose incomes comprised approximately a quarter of GDPI in the 1880s—experienced no decline after 1882 but rose steadily throughout the 1880s. It was not the macroeconomic environment that obstructed funds to electrical projects, but the nascent industry’s own badly tarnished reputation.

A different path was followed in the United States and Germany. There, Edison and Rathenau concentrated on making their flagship lighting companies—Edison’s in New York, Rathenau’s in Berlin—successful, financially rewarding, and worthy of emulation. The progress of Edison and Rathenau quickly attracted other entrepreneurs, notably Elihu Thomson and George Westinghouse in the United States and Johann Sigmund Schuckert in Germany. Siemens & Halske sold Rathenau the reliable equipment he needed to expand his fledgling business on a slender capital base. Moreover, engineering entrepreneurs in the United States and Germany realized, more quickly than Edison, that if they wanted a larger market for electricity, they needed new uses for it to spread the costs of expensive equipment over more hours of the day (“building load” as this strategy was called). Success here would make electricity more accessible to a wider group of users, further lowering the cost of electricity in a virtuous circle of expansion powerfully aided by the intrinsic economies of scale in generation.Footnote 80 This logic led American and German electrical engineering firms to press more aggressively than either Thomas Edison, well aware of the possibilities of electric traction, or the aging Werner Siemens, himself a pioneer in electric traction, the development of the technology needed to replace horse transport in urban areas. Once a robust, safe system using overhead electrical cables was demonstrated, electric traction became an area of explosive growth globally. The urban-traction system the American Frank Sprague (a former employee of Edison) put into operation in Richmond, Virginia in the spring of 1888 was the first operationally successful one (quickly licensed for Germany by Rathenau’s AEG). Because others, notably both Thomson-Houston and Westinghouse Electric, were already working to develop their own urban traction systems, competing systems quickly emerged, which quickly drove further improvements in electrical power applications.Footnote 81 Edison General Electric, the collection of engineering companies Thomas Edison assembled to equip the various direct-current plant (central and isolated) his backers were establishing, acquired Sprague’s traction company to avoid being further left behind in the race to “build load.” Only later did a much–diminished A-AB attempt to master this rapidly developing new technology, albeit with little success as it still struggled to raise fresh funds in the wake of its 1882 collapse.

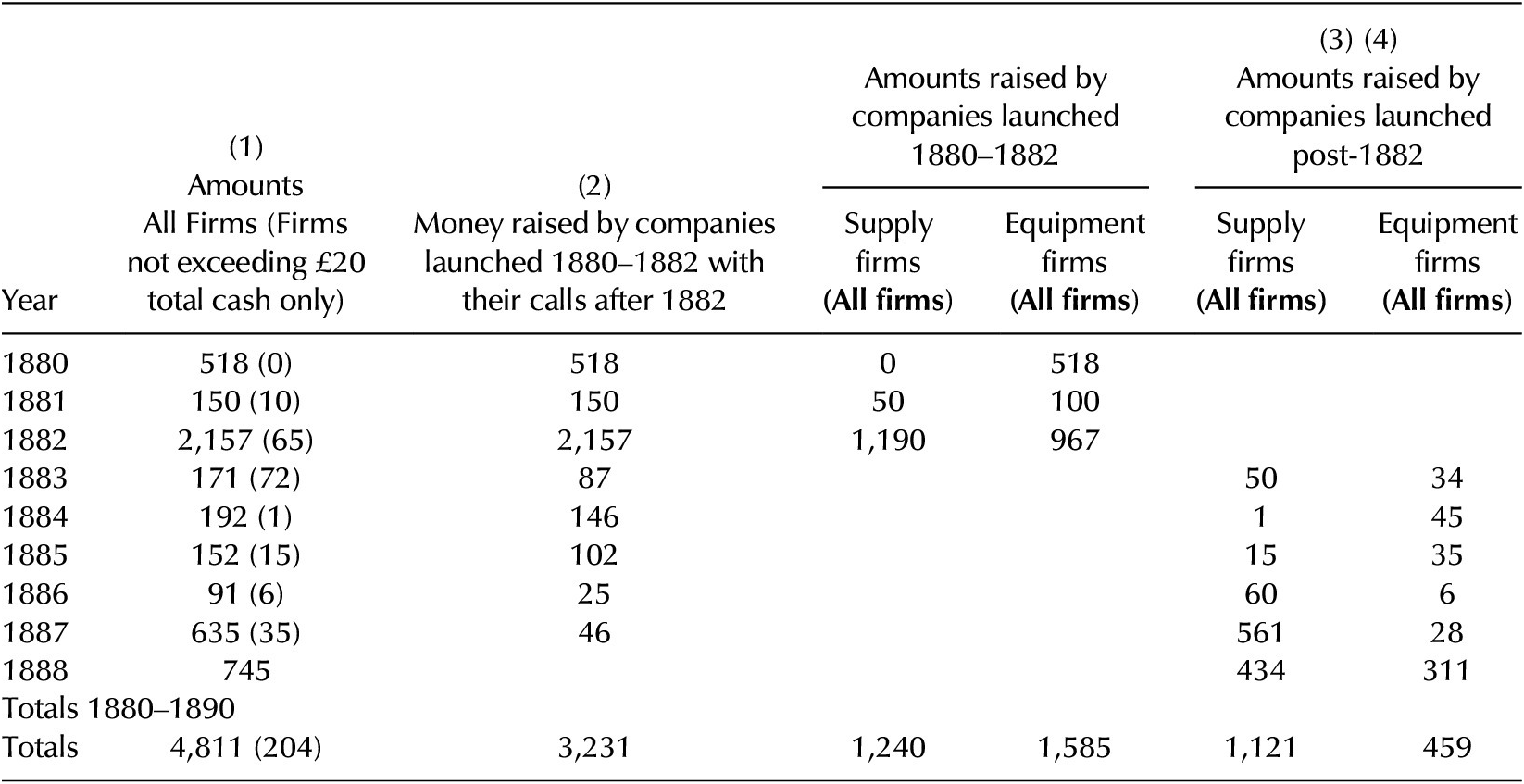

In Britain, in the listlessness following the turmoil of 1882, the surviving electrical engineering companies focused not on developing the technologies necessary to “build load” and lower the cost of electricity, but simply to sell enough relatively simple equipment for small isolated-lighting installations to stay in business.Footnote 82 Moreover, once the 1882 Lighting Act was amended in 1888, reducing obstruction by local authorities while granting private electricity supply companies a secure forty-two-year tenure before a forced sale to their local authorities as a going concern, the rush of supply companies formed were overwhelmingly those in wealthy areas of London directed almost exclusively on the “light of luxury.” With the important exception of preciously-pioneering London Electricity Supply, this resulted in reliable, but generally unambitious, high-cost systems usually dependent upon batteries to maintain uninterrupted supply rather than robust generation capacity. Provincial supply companies appeared soon after 1888, but even the most capable of them, Newcastle Electricity Supply Company (NESCo), grew only slowly for its first decade, heavily reliant on foreign electrical equipment manufacturers, not least America’s Thomson-Houston (T-H), with whom the founders of NESCo had a close relationship through their early, perceptive investment in Laing, Wharton & Down Construction Syndicate, a partnership distributing T-H equipment in Britain.Footnote 83 Most critically, once large-scale electrification in Britain began at last in 1887–1888, it was not, as in the United States and Germany, driven by engineering companies in a competitive environment intently engaged in expanding their technological capabilities. Instead, in Britain, private supply companies and local authorities largely designed and arranged the manufacture of their own unambitious lighting systems, with notably haphazard results.Footnote 84 Table 4 indicates the disparity in Britain of the finance supply companies raised in 1880–1888 by security issue compared with that raised by the few electrical engineering companies attempting to operate at scale at that time. Moreover, as discussed in Section 6 above, the few specialist British electrical engineering companies attempting to meet the demand created by the new wave of supply company launches were notably weak. Thus, unlike the United States or Germany, electrification in Britain proceeded after 1888 virtually without domestic electrical engineering companies of any serious capability. This was emphatically not an environment conducive either to technological advance (notably alternating current) or the realization of economies of scale and scope in equipment manufacture. Hence Britain’s belated electrification proceeded with an electrical engineering base that in 1888, by the international standards of the time, was marked by limited experience and extreme technological conservatism, if not outright backwardness, condemning British electricity users to high prices, poor service, and limited applications while surrendering a growth industry to foreign manufacturers.Footnote 85

Table 4. Amounts raised by electrical companies 1880–1888 (‘000 £)

Source: Table 2 (Kennedy & Delargy, Reference Kennedy and Delargy2020), modified with additional data from various issues of Burdett’s Official Intelligence and Investor’s Monthly Manual.

10. Why the State of the British Electrical Industry in 1888 Matters

Understanding Britain’s faltering electrification must focus on the electrical engineering industry, for it was there that the equipment needed for electricity usage was constructed, demonstrated, deployed, and advanced. This paper has shown how self-inflicted harm had gravely weakened Britain’s electrical engineering capacity by 1888. After the financial debacle of 1882, in sharp contrast to previous years, only feeble electrical experimentation occurred. Electrical engineering capacity dissipated. Thus, in 1888, when legal conditions became less restrictive, the early supply companies essentially assembled by themselves as best they could the equipment they needed for unambitious lighting schemes in affluent districts, given their limited knowledge and the meagre electrical engineering resources available. The interaction of a financial debacle with premature, unreflective regulation crippled Britain’s process of electrification, leaving a legacy of high-cost electricity supply with limited applications. By international standards, this combination produced a technologically backward electrical engineering sector unable to stimulate the complementary innovations, often mechanical in nature, needed for effective electricity usage, a serious impediment as the opportunities for factory electrification expanded. In Britain in the 1880s, the high cost of electricity and absence of demonstrations of successful applications offered little incentive to explore electricity’s myriad possibilities beyond what Edison and Swan had demonstrated in 1882. This backwardness also meant limited demand for advanced education and research in electrical theory, resulting in a slow expansion of higher-level education at the intersection of electrical engineering and physics. This left Britain severely handicapped in exploring new electrical applications, notably in motor design and alternating current applications.Footnote 86 Britain’s higher technical education institutions conspicuously lacked the eager backing of electrical engineering companies (Siemens in Berlin-Charlottenburg and Darmstadt; General Electric and Westinghouse together at the Massachusetts Institute of Technology (MIT)) keen to employ their graduates and reap the fruits of their research.

One might ask whether the weak exploration of electricity in Britain after 1882 was a case of entrepreneurial or market failure (or both)? Certainly, the technology of electrification was daunting, but that did not stop a remarkable flood of money in the early 1880s from coursing through London’s stock market to exploit the technology. The 1882 Lighting Act added legal hurdles to be navigated, but as Crompton, Ferranti, and the Lindsay family in London, Hammond on England’s south coast, and Holmes and Vaudrey in Liverpool had shown, those hurdles could be sidestepped. The question remains: why were there not more entrepreneurs like them, who, convinced of the promise of electric lighting, simply installed a generator in a central position and began selling electricity without the authorization of either central or local government? Why, given his successful central station launches in 1882, was Robert Hammond unable to secure finance after A-AB collapsed? His partnership with Ferranti in September 1882 showed clearly he was not shackled to A-AB’s tarnished technology, yet, regardless of his efforts, market indifference forced his electrical engineering company into an orderly liquidation as he prepared for a much less capital-intensive career as a consulting engineer. It is hard to suppress the suspicion that entrepreneurial timidity and market fickleness conspired to shunt British electrification into an unpromising configuration whereby, when electrification finally got underway in 1888, supply rather than engineering companies steered the process.

In this context, the state’s inhibiting role in British electrification has been widely misunderstood. The literature (excepting Hannah’s Electricity before Nationalisation and Byatt’s British Electrical Industry) has focused on the 1882 Lighting Act’s twenty-one-year limitation of secure private tenure imposed on government-authorized companies (never a binding constraint to those clever and bold enough to circumvent it). The fundamental obstacle was the presumption that local authorities, with their innate caution in committing ratepayers’ funds to ventures of which they knew little, would regulate electricity supply.Footnote 87 Thus, even Liverpool, where a flourishing supply company had been created, the 1882 Lighting Act notwithstanding, succumbed eventually to providing electricity constrained by municipal boundaries, foregoing the economies of scale (and cheap electricity) inherent in alternating current. Only an exceptional combination of circumstances found in Britain’s heavily industrialized Newcastle alone enabled a region to escape the deadening stranglehold of municipal control of electricity supply. Newcastle was uniquely fortunate to have firms involving powerful municipal and industrial interests united by close family ties with shared interests in cheap electricity possessing wide applications (notably three-phase alternating current, the mainstay of factory electrification), all guided by unusually gifted electrical engineers within the same family network.Footnote 88 Moreover, when the state finally did move to relax the constraints on private electricity supply with the 1888 amended Lighting Act, it did so oblivious to the advent of viable alternating current systems. Indeed, in 1889, a state-appointed regulatory body, the Marindin Committee, with astonishing unawareness of trends in electrical engineering, imposed highly debilitating restrictions on Ferranti’s visionary plans, which clearly foresaw the potential of alternating current to provide cheap current over a wide area of London and beyond.Footnote 89

The British state responded with little imagination or curiosity about the possibilities of electricity. At best, when sufficiently prodded, it grudgingly relaxed at a glacial pace the most obvious constraints, as with the 1888 amendment of the 1882 Lighting Act. But it never managed to articulate a coherent view of how electricity supply should be provided and supported. Only in the 1920s, when Britain’s lag behind international best practice, painfully exposed during the War, had become too conspicuous to be ignored, did the state stir itself finally to create a national grid. The long period of high-cost electricity and limited applications also left the skill base stunted, especially relating to the melding of electrical and mechanical skills that were central to eliciting the complementary innovations needed to make the most of electric powerFootnote 90. In short, lavish, precocious funding, promptly squandered, combined with government indifference, contrived to bequeath Britain a remarkably poor electrical inheritance in the twentieth century.

Acknowledgments

We wish to acknowledge the support extended by the Leverhulme Trust (Grant F4BB) and the LSE’s Pump Priming Scheme for making this research possible. We would also like to thank the Universities of Galway and Essex for library and computing facilities; the Santry Book Repository, Trinity College Dublin, for access to its collection of periodicals; and Roy Bailey, Leslie Hannah, and Kate Rockett for helpful comments on earlier versions of this paper. We alone are responsible for any remaining errors or omissions.

Disclosure/Conflict of Interest Statement

There are no conflicts of interest for either author.