1. Introduction

Over the last 30 years, many countries have adopted anti-money laundering regulations meeting common international standards, yet the effectiveness of these measures remains poorly understood. The Financial Action Task Force (FATF), established by the G7 in 1989, has driven this regulatory expansion by releasing recommendations detailing regulatory best practices and by harnessing international economic pressure and reputational concerns to push reluctant states to adopt regulations meeting the FATF’s standards (Simmons, Reference Simmons2001; Sharman, Reference Sharman2009; Morse, Reference Morse2019). These regulations are intended to prevent money laundering—the process by which criminals disguise and conceal funds obtained through crime within the broader economy—and aid law enforcement in criminal investigations. Substantial investment at the international level has produced major changes at the national level, as most countries today have incorporated the FATF’s recommendations into national law, including enlisting private sector actors like financial institutions in compliance activities.Footnote 1

Yet despite substantial investments by private sector, national, and international actors, empirical analysis of these regulations’ effectiveness remains limited. The FATF’s recommendations, which form the basis for most national regulations, were developed without clear metrics for assessing implementation effectiveness or efficiency (Levi et al., Reference Levi, Reuter and Halliday2018). And while the FATF’s recent evaluations have focused more explicitly on implementation and the effectiveness of countries’ anti-money laundering frameworks, these efforts have been hindered by a lack of reliable data on which to form assessments (Ferwerda and Reuter, Reference Ferwerda and Reuter2024). This empirical gap reflects broader challenges in systematic evaluation of anti-money laundering regulations arising from several key data limitations (Reuter, Reference Reuter2013; Levi et al., Reference Levi, Reuter and Halliday2018; Central Bank of the Bahamas, 2020).

First, unlike other areas of international finance—such as foreign investment, cross-border capital flows, or capital adequacy requirements—money laundering’s covert nature precludes reliable measurement of the underlying activity targeted by regulation. While scholars have attempted to estimate money laundering at the national level, these models rely on unverifiable assumptions and have not produced credible estimates (Reuter, Reference Reuter2013; Levi et al., Reference Levi, Reuter and Halliday2018). This measurement challenge has hindered efforts to evaluate regulatory effectiveness. Without baseline estimates of money laundering, researchers have been unable to evaluate the overall effectiveness of anti-money laundering laws at the international or national level or compare changes over time. Even conventional enforcement metrics—such as money laundering investigations, prosecutions, and convictions—offer limited insight without baseline estimates to contextualize the scope of these efforts relative to a country’s overall money laundering problem.

Second, while FATF-mandated reporting requirements could theoretically facilitate cross-national comparisons, varying reporting standards limit their utility. One such report is the Suspicious Activity Report, which financial institutions must file if they believe a customer may be involved in money laundering. While Swiss institutions file reports only after conducting a thorough investigation, U.S. institutions file reports far more liberally, often based only on a first impression (Ferwerda and Reuter, Reference Ferwerda and Reuter2019).Footnote 2 National Risk Assessments, another type of report recommended by the FATF, lack methodological consistency (Ferwerda and Reuter, Reference Ferwerda and Reuter2019). Even the FATF’s resource-intensive Mutual Evaluation Reports lack systematic data collection and analysis in their assessments of national anti-money laundering frameworks (Levi et al., Reference Levi, Reuter and Halliday2018; Ferwerda and Reuter, Reference Ferwerda and Reuter2024).

A third data challenge arises from the reluctance of private sector actors engaged in anti-money laundering enforcement to share data. Regulations require private sector actors known as intermediaries (i.e., actors who facilitate transactions between one or more parties) to screen their customers for money laundering risk, report suspicious activity to authorities, and maintain records of customer information. However, many intermediaries (including financial institutions and law firms) restrict access to transaction and compliance data to protect customer privacy and institutional reputations, limiting researchers’ ability to evaluate the effectiveness of these measures.Footnote 3

This paper addresses this gap in the scholarship by assessing the effectiveness of two design-based features of anti-money laundering laws through analysis of new regulations for the cryptocurrency sector. In 2019, the FATF issued recommendations establishing common regulatory standards for cryptocurrency exchanges—businesses that facilitate trades between cryptocurrencies and fiat (government-issued) currencies (FATF, 2019). These standards, which the FATF’s 37 member states committed to implementing within 1 year, impose two key obligations on exchanges: screening customers for transactions of 1,000 dollars/euros or greater and adopting a risk-based approach, which requires exchanges to assess the money laundering risks they face and develop customized systems to mitigate these risks. Under this approach, exchanges are supervised by national regulators, who can sanction exchanges for regulatory failures.

I develop predictions about how customers and exchanges will respond to these two features, which are common to anti-money laundering and other types of financial regulation more broadly. First, threshold-based screening enables strategic behavior by individuals, who may seek to avoid screening by adjusting their transaction size below the threshold. Accordingly, I predict that exchanges implementing threshold-based screening will show an abnormally high number of transactions below screening thresholds. Second, implementing a risk-based approach presents significant challenges, as it requires exchanges to exercise considerable discretion in developing and maintaining complex compliance systems. I predict that inadequate implementation of risk-based approaches will manifest in the persistence of an abnormally high number of transactions below screening thresholds over time—a pattern that exchanges implementing a risk-based approach should identify and address through enhanced screening measures.

The cryptocurrency sector provides a good case with which to study these regulatory features because of its unprecedented data accessibility. Unlike traditional financial intermediaries, cryptocurrency exchanges routinely share transaction information through public application programming interfaces (APIs). I leveraged these APIs using multiple remote servers to create a dataset of cryptocurrency-to-fiat transactions from virtually all exchanges offering these trades during a 2-month period in 2020. The dataset captures 150 million transactions across 66 exchanges in 12 countries, focusing on trades between major fiat currencies and the two highest-volume cryptocurrencies (Bitcoin and Ethereum). Each transaction record includes precise details about timing, quantity, price, and currency pairs. This granular data provides unprecedented insight into how both customers and exchanges respond to new regulatory requirements for the cryptocurrency sector—a level of detail typically unavailable in studies of traditional financial intermediaries.

I analyze this dataset using bunching estimation—an econometric strategy that uses the mass of a distribution to measure whether individuals responded strategically to an incentive at a threshold—to measure how customers and exchanges respond to the new regulations. The results reveal an abnormally high number of transactions (i.e., bunching) below screening thresholds in exchanges located in jurisdictions that require threshold-based screening. Importantly, this pattern does not appear in exchanges subject to comprehensive screening requirements or in FATF member jurisdictions that had not yet implemented the recommended anti-money laundering standards. This systematic variation in bunching behavior across regulatory regimes provides strong evidence that customers strategically adjust transaction sizes in response to threshold-based screening requirements, and the persistence of bunching over time shows that exchanges have not adequately addressed this behavior through application of a risk-based approach.

As a complementary analysis, I employ difference-in-differences estimation to measure how trading patterns in British Virgin Islands exchanges changed relative to unregulated exchanges following the introduction of threshold-based screening requirements. The results show significant increases in the proportion of trades conducted $50 and $10 below the screening threshold for both Bitcoin and Ethereum-to-dollar transactions in British Virgin Islands exchanges, with no corresponding changes in unregulated exchanges. Importantly, placebo tests show no similar bunching below other thresholds in British Virgin Islands exchanges, suggesting that this behavior reflects strategic responses to regulation rather than general patterns around round numbers.

This paper advances an understanding of regulatory effectiveness by examining how customers and intermediaries respond to specific design features of anti-money laundering regulation in cryptocurrency markets. The analysis shows that exchange customers strategically adjust their behavior to circumvent compliance requirements—specifically by manipulating transaction sizes to avoid threshold-based screening. The persistence of bunching over time, meanwhile, shows that exchanges have not adequately addressed this strategic behavior by implementing a risk-based approach, suggesting the need for enhanced regulatory guidance. Through novel transaction-level data, this paper provides insight into how both regulated entities and their customers respond to specific design features of regulation, contributing to broader debates about effective financial regulation in both the traditional financial and cryptocurrency sectors.

2. Cryptocurrency regulation

Cryptocurrency has rapidly emerged as a transformative financial technology since the introduction of Bitcoin in 2009. However, the high level of secrecy inherent to cryptocurrency transactions has attracted criminal actors. Specifically, cryptocurrency is transacted through pseudo-anonymous digital keys, eliminating the need to share information about one’s legal identity. This has given rise to a new ecosystem of cybercrime, as cryptocurrency directly enables certain illicit activities, such as thefts of cryptocurrency exchanges, and facilitates others at scale, like ransomware attacks and dark web markets. While the majority of cryptocurrency transactions are believed to be for legitimate purposes, the illicit uses of cryptocurrency reached an estimated $24.2 billion in 2023 (Chainalysis, 2024).

The accessibility of the blockchain, the decentralized public ledger that records all cryptocurrency transactions, has provided law enforcement with an avenue to trace criminal activity. However, effectively leveraging this data requires regulations that enable authorities to systematically match digital keys to real-world legal identities. Cryptocurrency exchanges have become a key focus for regulatory efforts, as they represent a critical juncture where cryptocurrency intersects with the broader financial system. This focus is particularly relevant for combating cryptocurrency-based crimes, as cryptocurrency has limited utility as a means of exchange, leading criminals to convert cryptocurrency into fiat currency to use it in the economy more widely. Indeed, research shows that the primary way criminals have made these conversions is through exchanges (Chainalysis, 2022, 11).Footnote 4

Regulating cryptocurrency exchanges poses several major challenges given the international environment in which both customers and exchanges operate. Specifically, these actors may seek to evade national oversight through regulatory arbitrage. This mirrors trends in the financial sector more broadly, where increasing global integration has led countries to establish common standards through intergovernmental bodies to combat regulatory arbitrage (Awrey and Judge, Reference Awrey and Judge2020). The Basel Committee on Banking Supervision’s (BCBS) capital adequacy requirements, now incorporated into over 100 countries’ national laws (CFI Team, N.d.), the International Organization of Securities Commissions’ (IOSCO) global securities regulation standards, and the FATF’s own recommendations exemplify this approach.Footnote 5

The risk of regulatory arbitrage is particularly acute in the cryptocurrency sector due to exchanges’ primarily digital operations and low fixed costs, lowering barriers to relocating. For example, Binance, one of the largest exchanges, successively claimed registration in China, Japan, Malta, Malaysia, and the Cayman Islands over the course of a few years, seemingly in response to new cryptocurrency regulations adopted by these countries (Roberts, Reference Roberts2021). The exchange’s chief executive officer even refused to disclose the location of its headquarters, claiming that the exchange is a new type of business that should not be subject to regulation (Baker, Reference BakerN.d.).

While the risk of regulatory arbitrage might suggest that money launderers might simply shift activity to exchanges in unregulated jurisdictions or more secretive alternatives like dark web peer-to-peer trading sites (Aguilar, Reference Aguilar2019; de Havilland, Reference de Havilland2019), several factors make regulated exchanges likely to remain the primary channel for crypto-to-fiat conversions. Dark web alternatives are both less convenient, requiring manual arrangement of trades, and riskier due to the absence of third-party guarantees—an important consideration in a sector plagued by scams, theft, and fund misappropriation (Deer, Reference Deer2022). More fundamentally, regulated exchanges possess a critical advantage through their access to correspondent banking relationships, which enable high-volume transactions between cryptocurrency and fiat currencies. While some high-volume exchanges operate in unregulated jurisdictions, their inability to access reliable banking networks typically prevents them from facilitating cryptocurrency-to-fiat trades at scale. Thus, the economic influence of FATF members—particularly the U.S., EU, and Japan—effectively controls access to key currencies through the international banking system (Bauerle Danzman et al., Reference Bauerle Danzman, Kindred Winecoff and Oatley2017), constraining unregulated exchanges’ ability to operate at scale and limiting cryptocurrency launderers’ viable alternatives.Footnote 6

Beyond regulatory arbitrage, countries face significant implementation challenges in developing and enforcing cryptocurrency regulations, yet these parallel existing challenges in anti-money laundering regulation where the FATF has proven instrumental. The FATF reduces legislative costs by providing detailed recommendations that serve as templates for national laws, while promoting regulatory consistency across jurisdictions (Simmons, Reference Simmons2001). Countries can thus leverage both their existing anti-money laundering frameworks and the FATF’s new cryptocurrency recommendations to regulate this emerging sector. And while implementation remains resource-intensive, the FATF’s track record suggests member states can effectively address these challenges. Below, I discuss two main design features of the FATF’s new directive—threshold-based screening and a risk-based approach—that are relevant to this analysis.

2.1. Threshold-based screening

First, the FATF’s directive stipulates that exchanges must screen customers for money laundering risk for transactions of 1,000 dollars/euros or greater. These screening requirements include collecting and verifying a customer’s identity and income information “using reliable, independent source documents, data or information” (FATF, 2003, 4–5). This documentation enables exchanges to assess customer risk profiles and report suspicious activity to national authorities, while also maintaining records for potential law enforcement investigations.

This threshold-based screening requirement creates opportunities for regulatory avoidance, as research consistently shows that actors respond strategically to threshold-based incentives in financial regulation. In the tax scholarship, research shows incomes clustered below thresholds that trigger higher tax rates (Bastani and Selin, Reference Bastani and Selin2014), particularly among self-employed individuals with greater control over reported incomes (Le Maire and Schjerning, Reference Le Maire and Schjerning2013; Zanoni et al., Reference Zanoni, Carrillo-Maldonado, Pantano and Chuquimarca2024). Similar behavioral responses emerge across other regulatory contexts, from small businesses avoiding revenue-based tax thresholds (Bettendorf et al., Reference Bettendorf, Lejour and van’t Riet2017) to companies maintaining market capitalization below thresholds that trigger enhanced regulatory actions (Dharmapala, Reference Dharmapala2016; Ewens et al., Reference Ewens, Xiao and Ting2024).Footnote 7

Unlike most threshold-based regulations where actors seek to minimize compliance costs, however, the direct costs to customers of undergoing screening are minimal. Customers face no financial costs and the process is straightforward—requiring only basic identification documents and personal information for a one-time verification that enables conducting future transactions of any amount without additional screening. However, anti-money laundering regulation must contend with another reason for regulatory avoidance: criminals’ desire to avoid detection by law enforcement.

This vulnerability of threshold-based requirements has precedent in anti-money laundering regulation. A notable example is the U.S. requirement that financial institutions report transactions exceeding $10,000, intended to aid “criminal, tax, or regulatory investigations or proceedings” (Welling Reference Welling(1989); quoted in Jensen et al. (Reference Jensen, Ferwerda and Wewer2023)). This threshold led to “structuring”—the practice of breaking larger transactions into smaller ones to avoid reporting requirements. Although subsequently criminalized, structuring remains difficult to detect (Welling, Reference Welling1989). Thus, the FATF’s threshold-based screening requirement may create similar vulnerabilities by signaling to potential money launderers precisely when screening will be applied.

Although the FATF directive notes a minimum standard of screening transactions above the 1,000 dollar/euro threshold, some countries chose to require screening of all customers regardless of transaction amount. Accordingly, these countries set a higher benchmark of regulatory scrutiny for exchanges operating in their jurisdictions.

2.2. Risk-based approach

The recommendation’s second requirement mandates that cryptocurrency exchanges implement a risk-based approach to money laundering prevention (FATF, 2019). Importantly, all FATF members adopted a risk-based approach to cryptocurrency regulation. Under this approach, “countries, competent authorities, and [intermediaries] identify, assess, and understand the money laundering and terrorist financing risk to which they are exposed, and take the appropriate mitigation measures in accordance with the level of risk” (FATF, N.d.). For cryptocurrency exchanges, this requires conducting comprehensive risk assessments and developing customized compliance systems that allocate resources toward mitigating the highest identified risks (FATF, 2015, 6, 8). Implementation typically involves developing internal expertise, engaging external consultants, and deploying specialized monitoring systems.

The risk-based approach has become central to the FATF’s recommendations across sectors since its introduction in 2003, with many countries mandating this approach in national regulations. This framework requires assessment and mitigation efforts at multiple levels—countries, regulators, and businesses—with the goal of allocating scarce resources toward the greatest money laundering risks (Ferwerda and Reuter, Reference Ferwerda and Reuter2024). However, both conceptual and practical challenges hinder effective implementation. The FATF’s guidance lacks clear articulation of how the components of risk (which it identifies as threat, vulnerability, and consequences) apply to money laundering contexts (Ferwerda and Reuter, Reference Ferwerda and Reuter2024). This conceptual ambiguity has led to problematic risk classifications, including on the basis of personal characteristics at the individual level and “impressionistic” judgments at the national level (Sharman, Reference Sharman2009; Halliday et al., Reference Halliday, Levi and Reuter2019). Further, the FATF’s guidance provides only minimal information for exchanges on the topic of identifying risks.Footnote 8

In practice, exchanges must make complex implementation decisions with limited regulatory guidance. They must identify risks, develop assessment metrics, prioritize mitigation efforts, and implement compliance systems—all within a rapidly evolving technological and criminal landscape (Black and Baldwin, Reference Black and Baldwin2012). One clear indicator of implementation effectiveness is exchanges’ response to transaction structuring below screening thresholds. Indeed, although the FATF’s guidance on implementing a risk-based approach in the cryptocurrency sector is limited, it explicitly identifies “irregular, unusual or uncommon” transaction patterns, including those structured to avoid reporting, as high-risk (FATF, 2021, 88). Accordingly, exchanges implementing a risk-based approach should identify an abnormally high number of transactions below screening thresholds as suspicious and take action to mitigate this risk, which may include additional screening below the threshold or setting a lower screening threshold (FATF, 2019). Thus, the persistence of an abnormally high number of transactions below screening thresholds over time would indicate a failure to adequately implement a risk-based approach.

2.3. Hypotheses

The response by FATF members to the FATF’s new guidelines for cryptocurrency fell into one of three categories: (1) countries with regulations that required comprehensive screening all customers and a risk-based approach, (2) countries with regulations that required screening customers above a transaction-threshold and a risk-based approach, and (3) countries that did not implement anti-money laundering regulations for the cryptocurrency sector by July 2020. Below, I detail several hypotheses that I test in Sections 4 and 5.

For exchanges operating in jurisdictions mandating comprehensive customer screening regardless of transaction size (Australia and the United States), I do not expect to observe bunching below FATF-specified thresholds, as there is no legal incentive for customers to adjust the size of their transactions below the threshold. Thus, I expect that exchanges will comply with the higher regulatory standards set by these countries, and consequently, no abnormal transaction activity will emerge.

• H1: Exchanges in countries that require screening of all customers will not show bunching below the 1,000 dollar/euro threshold.

For exchanges in jurisdictions with threshold-based screening requirements (Japan, EU countries, and the Bahamas), I predict observable bunching below screening thresholds as customers strategically adjust transaction sizes to avoid screening. Persistent bunching in exchanges over time also supports a secondary conclusion—exchanges have not mitigated this risk through a risk-based approach.

• H2: Exchanges in countries that require screening for transactions above the 1,000 dollar/euro will show bunching below the threshold.

Lastly, for exchanges in jurisdictions that had not yet implemented anti-money laundering regulations for the cryptocurrency sector by the agreed upon deadline (Turkey), I do not expect to observe bunching below the threshold specified in the FATF’s directive, though for a different reason than exchanges that implement comprehensive screening of all customers. The absence of a regulatory framework in this FATF member state means that exchanges faced no legal obligation to screen customers for transactions of any size, eliminating customers’ incentives to strategically adjust transaction values below a threshold.

• H3: Exchanges in countries that do not require any screening will not show bunching below the 1,000 dollar/euro threshold.

I test these hypotheses using two methods. First, I use bunching estimation to test for the presence (absence) of a statistically abnormal number of transactions in the range below the 1,000 dollar/euro threshold. Second, for one country (the British Virgin Islands) that implemented threshold-based screening during the data collection period, I use a difference-in-differences estimation strategy to test whether these exchanges showed an increase in the number of transactions below the threshold relative to placebo thresholds following implementation of the new regulations.

3. Data

Obtaining reliable data about cryptocurrency transactions presents a major challenge. While most studies use data from third-party aggregator sites, this data is often unreliable as many exchanges over-report their transaction volumes; this gives the illusion of higher liquidity, which can help exchanges attract new customers (Hougan et al., Reference Hougan, Kim and Lerner2019; Varshney, Reference Varshney2021; Chen et al., Reference Chen, Lin and Jiajing2022). In fact, one report estimates that as much as 95% of transactions reported to aggregator sites are fake (Bitwise Asset Management, 2019). To mitigate this risk, I circumvented third-party sites altogether by collecting real-time transaction data directly from exchanges using each exchange’s API. APIs are expected to provide more reliable data because customers can use APIs to execute trades.

Using APIs, I created a dataset of transactions from Bitcoin and Ethereum (the two highest-volume cryptocurrencies) to FATF member state fiat currencies for nearly all exchanges offering these trades between July 1, 2020 and September 3, 2020.Footnote 9 Major fiat currencies included in the dataset’s trading pairs are the US dollar, euro, Australian dollar, British pound, Indian rupee, Japanese yen, Korean won, Russian ruble, Turkish lira, and Brazilian real.Footnote 10 To collect this data, I set up remote servers to query each exchange’s API at intervals of 15–150 seconds, with specific intervals calibrated to each exchange’s trading volume and cache size. Each transaction record contains the timestamp, cryptocurrency quantity, and the crypto-to-fiat exchange rate at the time the trade was executed.Footnote 11 During data preprocessing, I excluded low-volume trading pairs to ensure data quality.Footnote 12

The final sample includes 45 trading pairs from 22 exchanges, spanning 7 regulated jurisdictions and at least 3 unregulated jurisdictions.Footnote 13 I classified each exchange’s country based on registration information from its official website as of July 2020. I then converted all transactions to the relevant regulatory currency—euros for EU exchanges, yen for Japanese exchanges, and dollars for all others—using hourly exchange rates (Dukascopy: Swiss Banking Group, N.d.). This sample presents a diverse cross-section of countries, including affluent industrialized countries (Australia, Japan, the Netherlands, South Korea, UK, US), a middle-upper income country (Estonia), several developing countries (India, Turkey), and an offshore financial center (British Virgin Islands). Further, the sample includes all seven jurisdictions that had implemented anti-money laundering regulations for cryptocurrency trading as of July 2020 (Australia, British Virgin Islands, Estonia, Japan, Netherlands, UK, and US).

This sample captures the majority of global crypto-to-fiat trading volume during the collection period, as it encompasses exchanges offering Bitcoin and Ethereum transactions across all major FATF member country currencies. These include the dominant global currencies—the U.S. dollar, euro, and yen—which facilitate the majority of both traditional financial and crypto-to-fiat transactions. According to Seth Reference Seth(2024), approximately 97.8% of crypto-to-fiat transactions in 2024 were conducted in currencies covered by the sample (U.S. dollar, yen, won, and euro). Moreover, the cryptocurrency market’s digital-native structure and limited physical infrastructure resulted in relatively homogeneous exchange services across jurisdictions during the data collection period, with regulation emerging as the primary source of cross-jurisdictional variation.

4. Bunching estimation

To measure how customers and exchanges have responded to new regulations, I leverage transaction-level data and exploit the specific threshold above which exchanges are mandated to screen their customers for money laundering risk. I build on pioneering work on bunching estimation—a method used to study phenomena involving avoidance or evasion (Saez, Reference Saez2010; Chetty et al., Reference Chetty, Friedman, Olsen and Pistaferri2011). While this approach has traditionally been employed with administrative data such as data from individual tax returns, I modify this method for application to cryptocurrency transactions.Footnote 14

I use bunching estimation to estimate the level of statistically abnormal transaction activity below the transaction thresholds at which exchanges must screen their customers for money laundering risk. While this method cannot attribute any individual transaction to criminal activity, the aggregate presence of excess mass (bunching) below the threshold presents a statistical anomaly. I argue this statistical anomaly is most plausibly explained by customers’ efforts to avoid screening under the new laws. Thus, this paper follows other forensic analyses aimed at revealing deceptive behavior or regulatory avoidance through the scrutiny of abnormal statistical trends consistent with legal incentives (Saez, Reference Saez2010; Deleanu, Reference Deleanu2017; Daniele and Dipoppa, Reference Daniele and Dipoppa2023; Ferwerda et al., Reference Ferwerda, Deleanu and Unger2019).

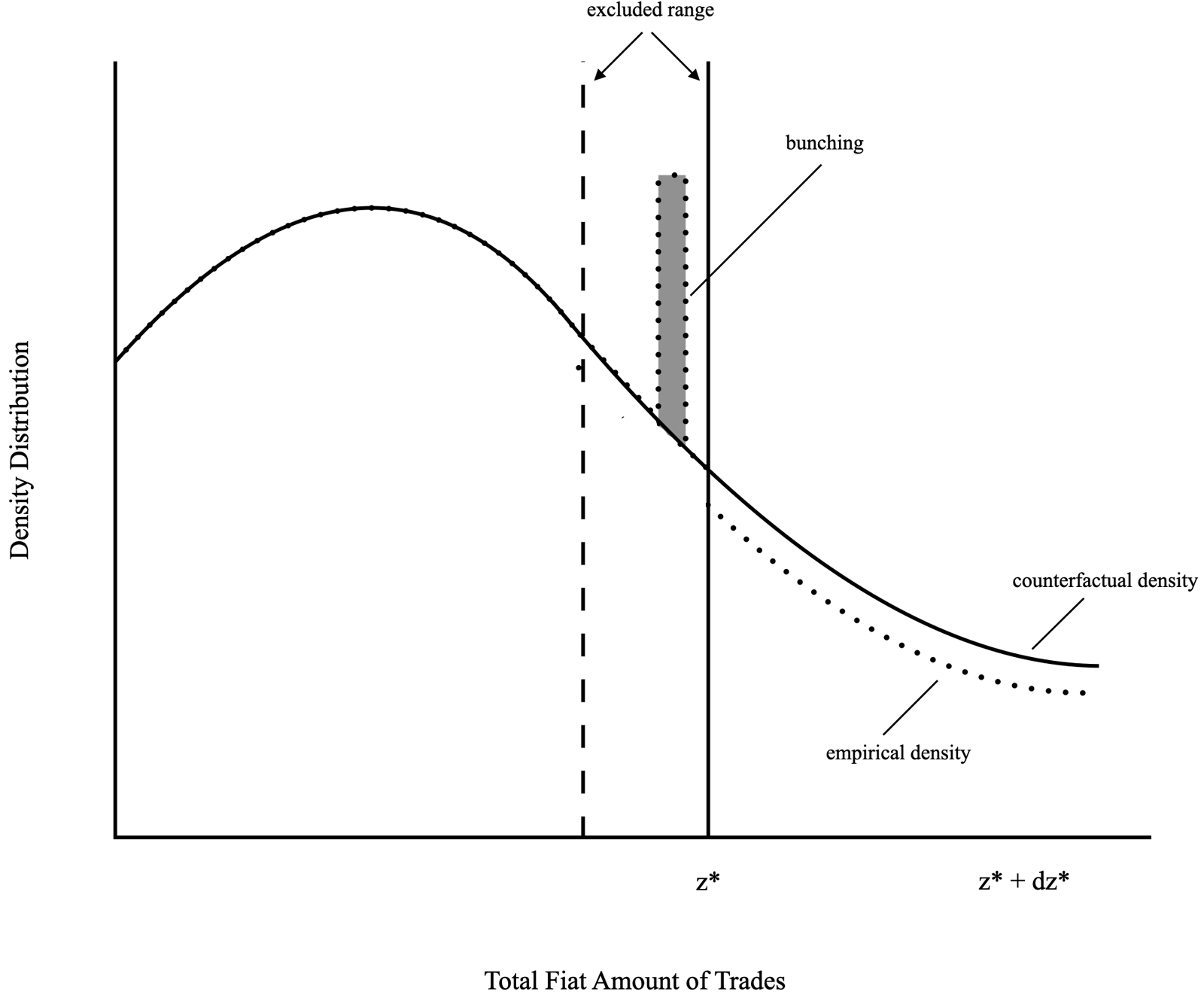

Bunching estimation uses the mass of a distribution to assess how individuals respond to a discontinuity in incentives occurring at a threshold. This method is applicable when individuals have the opportunity to shift something (e.g., a transaction) below a threshold, thereby achieving a different outcome. Applying this method to cryptocurrency transactions, the distribution of trades within a specific range is represented by a smooth density distribution denoted as h(z) across a continuous variable z, which represents the transaction size (Figure 1). The change in incentives, indicating whether a customer undergoes screening, is represented by ![]() $z^*$. If users strategically respond to

$z^*$. If users strategically respond to ![]() $z^*$, they will shift transactions that would have fallen in the range [

$z^*$, they will shift transactions that would have fallen in the range [![]() $z^*$,

$z^*$, ![]() $z^* + d(z)$] below

$z^* + d(z)$] below ![]() $z^*$, leading to bunching (excess mass) below the threshold and shifting the empirical distribution beyond

$z^*$, leading to bunching (excess mass) below the threshold and shifting the empirical distribution beyond ![]() $z^*$ downward. Because individuals may adjust the transactions to any amount below the threshold, bunching in cryptocurrency transactions may more closely resemble a hump than a spike. This is in contrast to more constrained settings—for example, self-reported taxable income—in which case individuals have a stronger incentive to report outcomes just below a threshold signifying a higher tax bracket.

$z^*$ downward. Because individuals may adjust the transactions to any amount below the threshold, bunching in cryptocurrency transactions may more closely resemble a hump than a spike. This is in contrast to more constrained settings—for example, self-reported taxable income—in which case individuals have a stronger incentive to report outcomes just below a threshold signifying a higher tax bracket.

Figure 1. Bunching illustration.

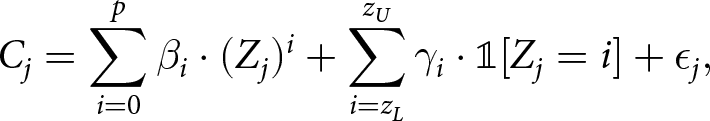

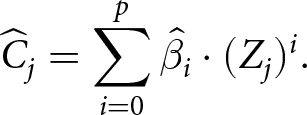

To measure bunching, I follow the procedure outline by Chetty et al. Reference Chetty, Friedman, Olsen and Pistaferri(2011) and summarized by Mavrokonstantis Reference Mavrokonstantis2019; this approach allows me to estimate excess mass relative to the predicted mass in a defined range below the threshold. Importantly, this method does not require knowledge of the overall distribution of trades, but rather, it relies on approximating the local distribution within a smaller bunching window (Kleven, Reference Kleven2016). Accordingly, I calculate the counterfactual distribution by fitting a polynomial to the distribution of binned data within the bunching window, excluding the contributions of bins close to the threshold to prevent introducing bias caused by bunching itself. The counterfactual distribution represents the expected distribution if no bunching occurred below the threshold and is expressed by the following equation:

\begin{equation}

C_j = \sum_{i=0}^{p} \beta_i \cdot (Z_j)^i + \sum_{i=z_L}^{z_U} \gamma_i \cdot \mathbb{1}[Z_j=i] + \epsilon_j,

\end{equation}

\begin{equation}

C_j = \sum_{i=0}^{p} \beta_i \cdot (Z_j)^i + \sum_{i=z_L}^{z_U} \gamma_i \cdot \mathbb{1}[Z_j=i] + \epsilon_j,

\end{equation} where cj represents the number of transactions in each bin j, Zj signifies the position of each bin relative to ![]() $z^*$ in 10-unit increments (

$z^*$ in 10-unit increments (![]() $Z_j = {-25, -24, \ldots, 25}$), p indicates the order of the polynomial, and zL and zU represent the lower and upper bounds of the excluded bunching area respectively. Consequently, the counterfactual distribution is derived from the predicted values of Equation 1, excluding the contribution of the dummies in the excluded range, formally:

$Z_j = {-25, -24, \ldots, 25}$), p indicates the order of the polynomial, and zL and zU represent the lower and upper bounds of the excluded bunching area respectively. Consequently, the counterfactual distribution is derived from the predicted values of Equation 1, excluding the contribution of the dummies in the excluded range, formally:

\begin{equation}

\widehat{C}_j = \sum^p_{i=0} \widehat{\beta}_i \cdot (Z_j)^i.

\end{equation}

\begin{equation}

\widehat{C}_j = \sum^p_{i=0} \widehat{\beta}_i \cdot (Z_j)^i.

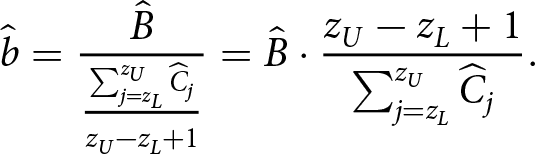

\end{equation} Next, I calculate the difference between the counterfactual and observed values in each bin within the bunching window ( $\widehat{B}_N = \sum^{z_U}_{j=z_L} C_j - \widehat{C}_j$) (Kleven, Reference Kleven2016). Finally, I estimate excess mass in the bunching region relative to the average height of the counterfactual distribution in the excluded range

$\widehat{B}_N = \sum^{z_U}_{j=z_L} C_j - \widehat{C}_j$) (Kleven, Reference Kleven2016). Finally, I estimate excess mass in the bunching region relative to the average height of the counterfactual distribution in the excluded range ![]() $[z_L, z_U]$, formally:Footnote 15

$[z_L, z_U]$, formally:Footnote 15

\begin{equation}

\widehat{b} = \frac{\widehat{B}}{\frac{\sum_{j={z_L}}^{z_U} \widehat{C}_j}{z_U - z_L + 1}} = \widehat{B} \cdot \frac{z_U - z_L + 1}{\sum_{j={z_L}}^{z_U} \widehat{C}_j}.

\end{equation}

\begin{equation}

\widehat{b} = \frac{\widehat{B}}{\frac{\sum_{j={z_L}}^{z_U} \widehat{C}_j}{z_U - z_L + 1}} = \widehat{B} \cdot \frac{z_U - z_L + 1}{\sum_{j={z_L}}^{z_U} \widehat{C}_j}.

\end{equation} Standard errors are calculated using nonparametric bootstrapping as outlined by Chetty et al. Reference Chetty, Friedman, Olsen and Pistaferri(2011). Nonparametric bootstrapping offers a method to estimate standard errors for bunching estimates without requiring the researcher to a priori assume the data’s distribution or use a known formula to calculate parameters of the distribution (Mooney et al., Reference Mooney, Mooney, Mooney, Duval and Duvall1993, 7–9). I draw 1,000 samples with replacement from the vector of errors (ϵi) in Equation 1. For each sample, I calculate a bunching estimate (![]() $\widehat{b}$) using the procedure described above. I then define the standard error of the original estimate as the standard deviation of the distribution of

$\widehat{b}$) using the procedure described above. I then define the standard error of the original estimate as the standard deviation of the distribution of ![]() $\widehat{b}^k$s (Chetty et al., Reference Chetty, Friedman, Olsen and Pistaferri2011). This process allows me to determine whether an estimate of bunching is statistically significant using a one-sided t-test.

$\widehat{b}^k$s (Chetty et al., Reference Chetty, Friedman, Olsen and Pistaferri2011). This process allows me to determine whether an estimate of bunching is statistically significant using a one-sided t-test.

Figure 2 illustrates this method using data from two exchanges: Binance US, located in the United States (4a), and Coinmetro, located in Estonia (4b). These graphs depict the number of transactions in each exchange within 10 dollar/euro bins between 750 and 1,250 dollars/euros with the graphs centered at the threshold. For each distribution, I fit a third-degree polynomial to the data (excluding the 100 units below the threshold where bunching may occur) to provide counterfactual estimates of the distributions. The counterfactual distribution roughly matches the empirical distribution for Binance US with no noticeable bunching below the threshold; this intuition is validated by a bunching estimate of ![]() $\widehat{b}$ = 0.04, which is not statistically significant (standard error = 1.96). In Coinmetro, by contrast, there are a large number of transactions below the threshold that diverge from the counterfactual fit line; accordingly, the bunching estimate (

$\widehat{b}$ = 0.04, which is not statistically significant (standard error = 1.96). In Coinmetro, by contrast, there are a large number of transactions below the threshold that diverge from the counterfactual fit line; accordingly, the bunching estimate (![]() $\widehat{b}$) of 58.80 is statistically significant, with a standard error of 8.36 (

$\widehat{b}$) of 58.80 is statistically significant, with a standard error of 8.36 (![]() $p \lt $ 0.00001). This indicates that there are nearly 59 times more transactions in the range below the threshold than predicted based on the rest of the distribution.

$p \lt $ 0.00001). This indicates that there are nearly 59 times more transactions in the range below the threshold than predicted based on the rest of the distribution.

In addition to measuring bunching below the regulatory threshold, I measure bunching below two placebo thresholds: 500 and 1,500 dollars/euros. These placebo thresholds hold no regulatory significance and were chosen because they are round numbers (like the regulatory threshold) within relatively close proximity. Accordingly, measuring activity below these placebo thresholds provides a counterfactual to the activity measured below the actual threshold, which I believe to be driven by a regulatory response rather than unaccounted for dynamics that might cause bunching below round values of fiat currency.

Figure 2. Bunching in two exchanges.

4.1. Threats to inference

While bunching estimation faces two potential threats to inference (Kleven, Reference Kleven2016), neither pose a significant problem for this research design. First, the presence of another policy that makes use of the same threshold could confound bunching estimates; however, there are no other national policies within the sampled countries that affect cryptocurrency transactions at the 1,000 dollar/euro threshold. Similarly, there are no exchange-based policies (including fee structures) that encourage customers to keep transactions below these thresholds.Footnote 16

Second, the threshold could serve as a natural reference point leading to bunching for another reason—a human affinity for the use of round numbers. Although the thresholds are natural reference points, this does not present a problem for this research design as I measure bunching below the threshold. Accordingly, bunching at the threshold actually introduces bias against finding bunching below the threshold, as a greater number of transactions outside the excluded range shifts the distribution upward and makes any bunching below the threshold seem less unusual when compared to the rest of the distribution.

Another potential concern is that bunching at round quantities of cryptocurrency could introduce bias. Although there is bunching at round quantities of cryptocurrency, this behavior alone is unlikely to explain bunching below the threshold because I analyze a diverse sample of crypto-to-fiat trades that include transactions from two different cryptocurrencies drawn from 27 exchanges over a 2-month period. Accordingly, the sample includes widely varying crypto-to-fiat prices because of persistent price discrepancies across exchanges (Pieters and Vivanco, Reference Pieters and Vivanco2017); prices also vary by the minute within exchanges as exchanges never officially close and trades are executed at all hours and days of the week. Thus, wide variation in crypto-to-fiat prices within the sample and analysis of transactions from two cryptocurrencies mitigates the risk that bunching below the threshold is driven by bunching at round quantities of cryptocurrency.

4.2. Results

Table 1 presents estimates of bunching in the range below the threshold for exchanges that implemented threshold-based screening. Columns 1–3 show estimates for Bitcoin-to-fiat transactions, and columns 4–6 show estimates for Ethereum-to-fiat transaction. Transactions are grouped according the threshold and currency used for screening, with screening performed at 1,000 dollars; 1,000 euros; and 100,000 yen. For each, I estimate bunching in the 100 units (10,000 yen) below the actual threshold, as well as two placebo thresholds at 500 dollars/euros (50,000 yen) and 1,500 dollars/euros (150,000 yen), which were chosen because they are round numbers in close proximity to the threshold.

Table 1. Bunching in threshold-screening exchanges

Notes: Bunching estimates for exchanges with threshold-based screening. N denotes count of transactions. Exchanges denotes count of exchanges. Pairs denotes count of trading pairs. Standard errors are in parentheses.

* Significance: p < 0.05; **p < 0.01; ***p < 0.001.

Estimates are positive and significant across transactions from Bitcoin and Ethereum into dollars and euros and in transactions from Bitcoin into yen. Estimates range in magnitude from between two and three times greater transactions in the range below the threshold than expected based on the rest of the distribution to eight times greater transactions in Bitcoin-to-yen transactions. Meanwhile, estimates of bunching below the two placebo thresholds are generally not significant. The exceptions are positive and significant bunching below the placebo thresholds in Ethereum-to-yen transactions, which also do not show bunching below the screening threshold. Unlike the other trading pairs, activity in Ethereum-to-yen trades appears to more closely resemble transaction patterns in unregulated and full-screening exchanges (discussed below).

Table 2 presents estimates of bunching below the counterfactual screening threshold and placebo thresholds in unregulated exchanges. Columns 1–2 show estimates for Bitcoin-to-fiat transactions, and columns 3–4 show estimates for Ethereum-to-fiat transactions. Once again, I group transactions according to the counterfactual threshold and currency used for screening (i.e., euros for European-based exchanges and dollars for all others) and estimate bunching below the 1,000 dollars/euro threshold and placebo thresholds (500 and 1,500 dollars/euros, respectively).

Table 2. Bunching in unregulated exchanges

Notes: Bunching estimates for unregulated exchanges. N denotes count of transactions. Exchanges denotes count of exchanges. Pairs denotes count of trading pairs. Standard errors are in parentheses.

* Significance: p < 0.05; ***p < 0.001.

Estimates are not significant below the counterfactual thresholds, consistent with the interpretation that bunching emerges because customers seek to avoid screening. While I find no significant bunching below the 1,500 dollar/euro placebo threshold, I do observe positive and significant bunching below the 500 dollar/euro placebo threshold in Bitcoin and Ethereum to dollar transactions. Although providing a definitive explanation of transaction behavior in unregulated exchanges lies beyond the scope of this analysis, distinct trading patterns appear to have emerged between regulated and unregulated exchanges. Specifically, unregulated exchanges show a greater volume of transactions at lower fiat values, contributing to the observed bunching below the 500 dollar/euro threshold in some specifications.

Lastly, Table 3 shows bunching estimates below 1,000 dollars and two placebo thresholds for transactions from Bitcoin and Ethereum to dollars in exchanges that have implemented full screening of all customers.Footnote 17 While there is no positive and significant bunching below counterfactual thresholds, there is negative and significant bunching for transactions from Ethereum. This finding is driven by bunching at 1,000 dollars, as customers whose transactions would otherwise have fallen in the range below the threshold choose to round their transaction upward to 1,000 dollars. There is no significant bunching below placebo thresholds for transactions from Ethereum or below the 1,500 dollar threshold in transactions from Bitcoin. However, there is bunching below 500 dollars in transactions from Bitcoin, mirroring results for unregulated exchanges. Similar to unregulated exchanges, exchanges with full screening show a greater volume of transactions at lower fiat amounts than exchanges that implement threshold-based screening, contributing to the emergence of bunching below 500 dollars. Section E in the Supplementary Materials details robustness tests.

Table 3. Bunching in full-screening exchanges

Notes: Bunching estimates for exchanges with full screening. N denotes count of transactions. Exchanges denotes count of exchanges. Pairs denotes count of trading pairs. Standard errors are in parentheses.

* Significance: p < 0.05.

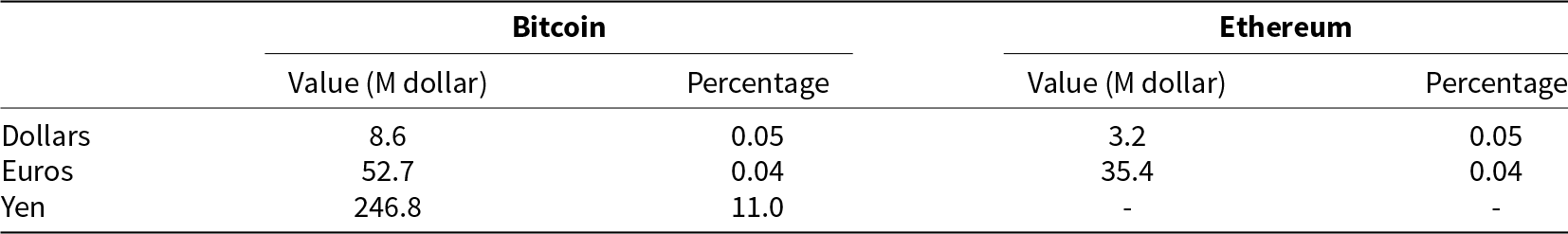

Table 4 shows the total dollar value of bunching below screening thresholds in exchanges that implement threshold-based screening by cryptocurrency and threshold currency pair during the data collection period.Footnote 18 Excess bunching accounted for between 8.6 and 246.8 million dollars in Bitcoin transactions and 3.2 and 35.4 million dollars in Ethereum transactions during the roughly 2-month period. The table also shows the percentage these dollar values represent of all trades in the 500 dollars/euros (or 50,000 yen) range around the threshold. The substantial dollar values of bunching below screening thresholds highlights the importance of addressing this behavior through increased regulatory scrutiny.

Table 4. Dollar value of excess bunching

Notes: Table shows excess bunching dollar amounts below the screening threshold. Percentages represent excess bunching value relative to all trades within 500 dollars/euros (or 50,000 yen) of the threshold.

To summarize, bunching estimates below the threshold are consistently positive and significant for trading pairs in exchanges with threshold-based screening and nonsignificant for trading pairs in unregulated exchanges or exchanges that screen all customers regardless of transaction size. Although some model specifications show positive and significant bunching below the first placebo threshold (500 dollars/euros or 50,000 yen), this finding appears to be driven by the natural concentration of smaller transactions in unregulated and full-screening exchanges rather than regulatory avoidance. Consequently, these results are consistent with the interpretation that customers in exchanges with threshold-based screening have sought to avoid screening by keeping their transactions below the threshold, and exchanges have not sufficiently mitigated this activity through a risk-based approach to anti-money laundering enforcement.

5. Regulatory changes in the British Virgin Islands

The British Virgin Islands, a small country with a large financial sector, provides an opportunity to study how trading in exchanges changed following the introduction of new regulations. On July 10, 2020, the country’s Financial Services Commission issued new regulatory guidance requiring cryptocurrency businesses to register with the country’s regulatory agency and comply with anti-money laundering laws, including screening customers for money laundering risk for transactions of $1,000 or greater (British Virgin Islands Financial Services Commission, 2020). These changes, which were later formalized in national law (Virgin Islands Cabinet, 2022), enable analysis of how transaction activity below the screening threshold changed following the introduction of these new requirements.

I employ a difference-in-differences estimation strategy to compare activity below the screening threshold in British Virgin Islands’ exchanges to activity in unregulated exchanges before and after the regulatory exchange. Unregulated exchanges serve as an appropriate control group, as British Virgin Islands exchanges were also unregulated prior to the new regulatory guidance. By comparing activity in British Virgin Islands’ exchanges to activity in unregulated exchanges, this estimation strategy can control for broader trends in the cryptocurrency-to-fiat markets that could influence trading in British Virgin Islands exchanges independently of the regulatory change.

While this approach provides valuable insight through its before-and-after comparison of transaction activity, several limitations warrant consideration. First, I do not have insight into how quickly British Virgin Islands’ exchanges implemented the new screening requirements, and the guidance did not specify a compliance timeline for these requirements.Footnote 19 Second, the limited availability of pre-regulation data constrains the ability to evaluate the parallel trends assumption for transaction activity in British Virgin Islands and unregulated exchanges before the regulatory change. Accordingly, the results of this analysis should not be understood as definitive, but rather, they present another piece of evidence that aligns with the findings from bunching estimation and helps provide a more comprehensive understanding of transaction activity in regulated and unregulated exchanges.

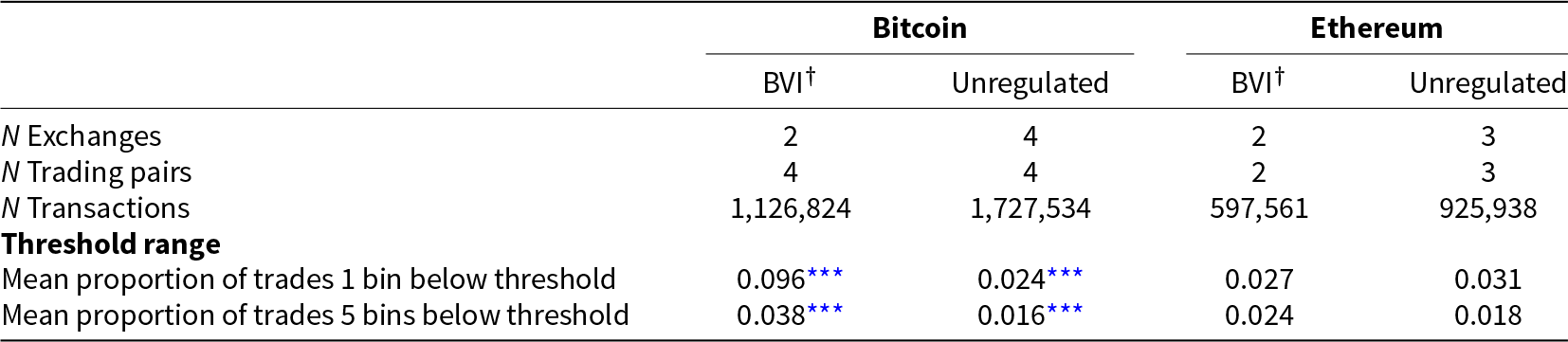

5.1. Estimation strategy

Table 5 presents descriptive statistics for transactions activity in British Virgin Islands and unregulated exchanges, including the average percentage of daily trades by bin below the threshold during the period before the regulatory change. There is a significant difference in the mean proportion of trades conducted 1 and 5 bins below the threshold between British Virgin Islands and unregulated exchanges before the regulatory change for Bitcoin transactions, with a higher proportion of transactions conducted below the threshold in British Virgin Islands exchanges. However, there is no significant difference between the average proportion of trades conducted 1 and 5 bins below the threshold between British Virgin Islands and unregulated exchanges for Ethereum transactions. Section F of the Supplementary Materials presents graphs of the pre-trends on the outcome variable (proportion of trades by bin below the threshold) for each treatment-control group.

Table 5. Descriptive statistics for British Virgin Islands and unregulated exchanges

† Notes: British Virgin Islands; *** < 0.001 (two-tailed tests).

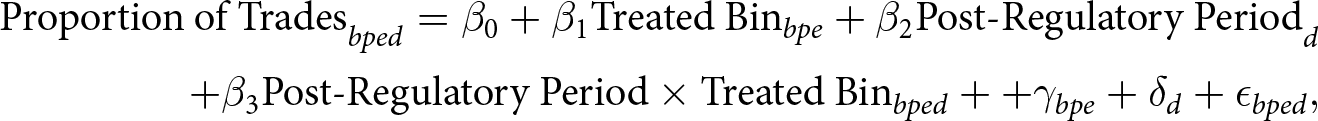

I estimate the following model:

\begin{equation}

\begin{aligned}

\textrm{Proportion of Trades}_{bped} = \beta_0 + \beta_1 \textrm{Treated Bin}_{bpe} +

\beta_2 \textrm{Post-Regulatory Period}_{d} \\

+ \beta_3 \textrm{Post-Regulatory Period} \times \textrm{Treated Bin}_{bped} +

+ \gamma_{bpe} + \delta_d + \epsilon_{bped},

\end{aligned}

\end{equation}

\begin{equation}

\begin{aligned}

\textrm{Proportion of Trades}_{bped} = \beta_0 + \beta_1 \textrm{Treated Bin}_{bpe} +

\beta_2 \textrm{Post-Regulatory Period}_{d} \\

+ \beta_3 \textrm{Post-Regulatory Period} \times \textrm{Treated Bin}_{bped} +

+ \gamma_{bpe} + \delta_d + \epsilon_{bped},

\end{aligned}

\end{equation}where b represents bin, p represents trading pair, e represents exchange, and d represents day. Post-Regulatory Period and Treated Bin are dummy variables indicating the period following the British Virgin Islands’ regulatory change and British Virgin Islands exchanges, respectively. The primary estimate of interest is β 3, which is the effect for treated bins during the post-regulatory period bins on the proportion of daily trades. The model includes fixed effects by bin-exchange-trading pair (γ) and by day (δ).

Proportion of Daily Trades is calculated as the proportion of daily trades by bin within the 500 dollars (i.e., 50 bins) around the threshold. I restrict estimates of trading volume within a range centered at the threshold because trading volume varies substantially across different dollar amounts, with relatively fewer transactions conducted at larger dollar amounts. Further, specifying the variable as a proportion enables analysis of relative changes in trading activity below the threshold. This approach reduces the influence of fluctuations in daily transaction volume, which vary significantly both within and across exchanges and trading pairs.

I employ two specifications of Treated Bins—5 bins and 1 bin below the threshold. This dual approach enables testing for both more targeted and wider spread adjustments of transaction size in response to the regulatory change. For each specification, I compare transaction activity below the threshold between British Virgin Islands and unregulated exchanges. All models are estimated using ordinary least squares regression with robust standard errors clustered at the exchange-trading pair level.

5.2. Results

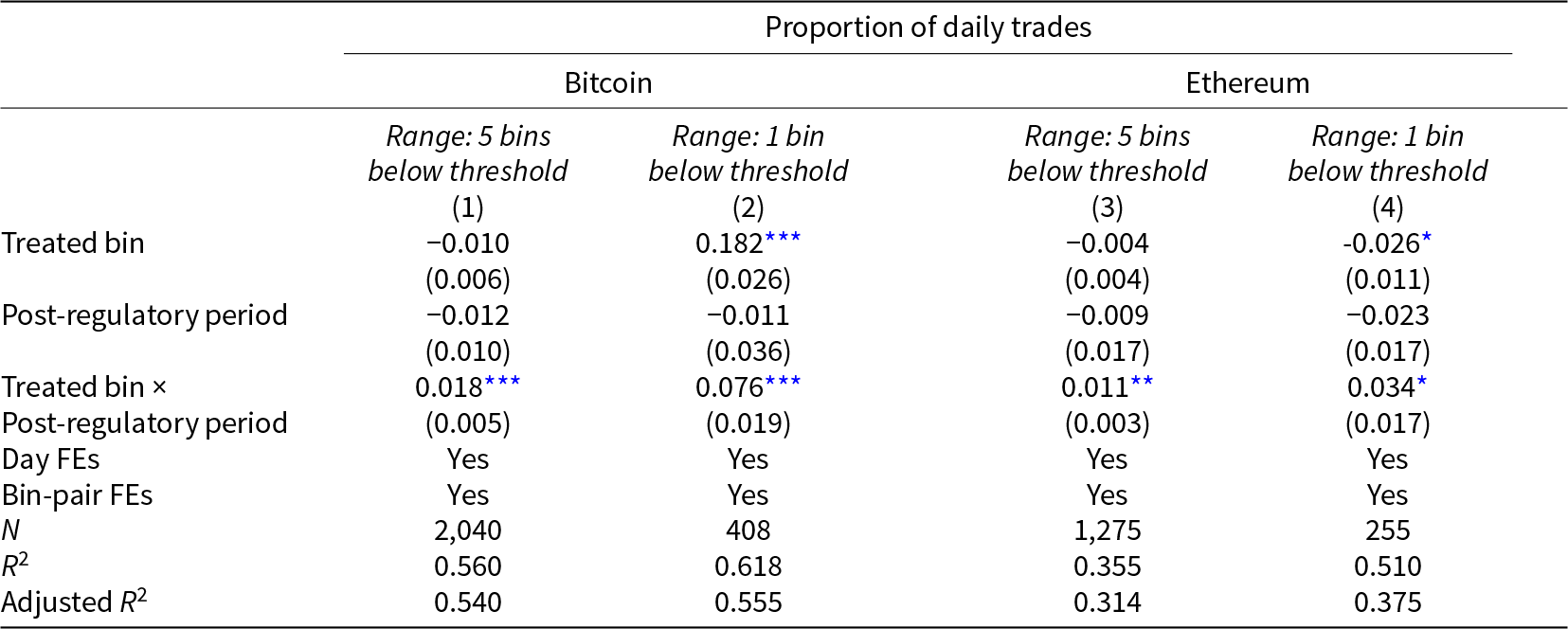

Table 6 presents estimates from Equation 4. The results show positive and significant coefficients for treated bins in the post-regulatory period across both cryptocurrency-to-fiat pairs and both treatment specifications. Bitcoin-to-dollar transactions in treated exchanges show increases of 7.6 and 1.8 percentage points in the proportion of daily trades $10 and $50 below the threshold relative to the increase for control bins, respectively. Similarly, Ethereum-to-dollar transactions in treated exchanges show increases of 3.4 and 1.1 percentage points in the proportion of daily trades $10 and $50 below the threshold, respectively. For both cryptocurrencies, the effect is larger $10 below the threshold than $50 below. These findings are also substantively meaningful, as each bin represents only 2% of the total dollar range around the threshold. Thus, the observed increases of 1.1–7.6 percentage points in the proportion of daily trades conducted in bins below the threshold indicate substantial shifts in trading activity.

Table 6. Difference-in-differences estimation of British Virgin Islands and unregulated exchanges

Notes: Table shows difference-in-differences estimates for daily trades below $1,000 in British Virgin Islands’ and unregulated exchanges. Models test two treatment specifications ($50 and $10 below threshold) for Bitcoin and Ethereum-to-fiat transactions. All models include day and bin-exchange-trading pair fixed effects. Robust standard errors clustered by exchange and trading pair (in parentheses).

* Significance levels: p < **p < 0.01; ***p < 0.001.

Tables 10 and 11 in the Supplementary Materials present estimates of Equation 4 for transactions below two placebo thresholds: $500 and $1,500.Footnote 20 Estimates for placebo thresholds do not reach statistical significance across any specification of the model—including transactions from both cryptocurrencies and both treatment specifications (i.e., $10 and $50 below the threshold). The absence of effects below round-number placebo thresholds highlights the distinctiveness of the main findings: the consistent, positive, and significant increases in trading activity below the screening threshold following the British Virgin Islands regulatory change. These placebo tests lend support to the interpretation that the observed increases in transaction activity below the screening threshold in British Virgin Islands exchanges reflect strategic behavioral responses to screening requirements rather than arbitrary clustering below round numbers.

I also estimate bunching below the threshold before and after the regulatory change and find results generally consistent with those obtained through difference-in-differences estimation. Table 12 in the Supplementary Materials shows no significant pre-regulation bunching for Ethereum transactions; Bitcoin transactions show positive and significant bunching, which may be driven by anticipation of the new regulations. Post regulation, transactions from both cryptocurrencies show significant bunching below the threshold, with over three times greater Bitcoin-to-dollar transactions and two and a half times greater Ethereum-to-dollar transactions. While there is no significant bunching below either placebo threshold post regulation, there is positive and significant bunching below the $500 placebo threshold for both cryptocurrencies before regulation (consistent with the findings for unregulated exchanges discussed in Section 4.2). These findings suggest that trading activity changes in several ways following the introduction of threshold-based screening, leading to both a higher proportion of trades conducted in the range below the threshold and higher average transaction value.

6. Discussion

This analysis reveals how two key features of anti-money laundering regulation—threshold-based screening and risk-based approaches—function in cryptocurrency markets. First, the results provide evidence of strategic customer behavior in response to threshold-based screening requirements. I document significant bunching below screening thresholds across most exchanges and cryptocurrency-to-fiat trading pairs, indicating deliberate transaction structuring to avoid enhanced scrutiny. Difference-in-differences estimation of British Virgin Islands exchanges corroborate this pattern, showing increased trading activity below screening thresholds following the country’s adoption of new regulatory guidelines. These patterns emerge consistently despite the complexity of the international regulatory landscape, including varying screening requirements and thresholds across jurisdictions, showing that customers consistently adapt their behavior to specific regulatory environments.

These findings contribute to the broader scholarship on strategic responses to threshold-based financial regulations (Kleven and Waseem, Reference Kleven and Waseem2013), extending this research to both anti-money laundering regulation and the cryptocurrency sector. These findings align with well-documented regulatory avoidance patterns in the financial sector more broadly, where innovations frequently emerge to circumvent regulatory frameworks (Awrey and Judge, Reference Awrey and Judge2020). In the anti-money laundering context, actors often respond to new regulations by shifting activities to less regulated sectors or developing new evasion techniques (Welling, Reference Welling1989). While such strategic responses are not surprising, they illustrate the iterative nature of anti-money laundering regulation: as authorities implement stricter controls, they increase the expertise and resources required for regulatory avoidance, reducing the number of actors capable of evasion.

These findings suggest that policymakers should carefully evaluate threshold-based screening mechanisms, which can reduce regulatory effectiveness by creating opportunities for avoidance. One potential solution is randomized screening conducted at different probabilities by transaction size—a solution that is both cheap and easy given modern computing capabilities. This approach would ensure that neither exchanges nor customers bear the costs of additional screening while making it harder for bad actors to avoid. Moreover, because money laundering operations typically involves large sums of illegally obtained funds, perpetrators would face a high cumulative probability of detection even if they successfully avoid screening on occasion.

These findings also reveal significant deficiencies in exchanges’ implementation of a risk-based approach. Under a risk-based approach, exchanges must monitor and mitigate money laundering risks specific to their business models, including transactions structured to avoid screening. Thus, the persistence of bunching indicates that exchanges have not adequately addressed this risk. This failure is particularly noteworthy because structuring represents one of the most straight-forward types of risk in this approach and is explicitly highlighted in FATF guidance.Footnote 21 Thus, exchanges’ inability to address bunching suggests fundamental weaknesses in their application of a risk-based approach.

This failure highlights fundamental tensions in the risk-based approach itself, which replaced earlier rules-based frameworks (Killick and Parody, Reference Killick and Parody2007; Bello and Harvey, Reference Bello and Harvey2017). This approach poses particular challenges in anti-money laundering enforcement, where significant uncertainties persist about both the scale of illicit activity and the effectiveness of preventive measures (Bello and Harvey, Reference Bello and Harvey2017).Footnote 22 Indeed, risk-based frameworks presume that risks can be identified, quantified, and managed—yet money laundering oversight often operates under conditions of uncertainty, where risks remain unknown and potentially unknowable (Bello and Harvey, Reference Bello and Harvey2017).Footnote 23 This misalignment between the knowledge required to implement a risk-based approach and fundamental uncertainties about money laundering creates a major implementation challenge.

More broadly, these findings demonstrate the effectiveness of international efforts to implement common financial regulations for the cryptocurrency sector. While further action is necessary to strengthen enforcement (especially risk-based measures), most FATF members have successfully implemented customer screening at the minimum threshold required by the new standards. Given the challenge of registering a new class of intermediaries with little physical presence (exchanges) and enforcing new standards, these results show meaningful progress. In turn, this highlights the success of the FATF, which was established as a temporary task force 35 years ago and today serves as a fulcrum for international anti-money laundering cooperation (Nance, Reference Nance2018). Furthermore, these developments reflect broader progress in implementing international financial regulations across sectors, which has been achieved through collaborative efforts by states, international institutions, and private sector actors (Simmons, Reference Simmons2001; Farrell and Newman, Reference Farrell and Newman2015).

Beyond regulatory implementation, this analysis reveals promising developments in cryptocurrency oversight capabilities. Private sector companies have proven both willing and able to assist law enforcement in tracing illegally obtained cryptocurrency, providing valuable skills and expertise that states can leverage to enhance anti-money laundering enforcement. Given this collaboration and the greater transparency of most cryptocurrency-related data,Footnote 24 the cryptocurrency sector appears better positioned than most for robust anti-money laundering enforcement. Yet an important question remains: will states continue investing the resources necessary to effectively regulate the sector?

7. Conclusion

This paper examines two design-based features of cryptocurrency sector regulations that are commonly featured in financial regulation. I document significant bunching below screening thresholds in exchanges with threshold-based screening requirements, while finding no comparable patterns in exchanges with comprehensive screening or no screening protocols. This pattern is further corroborated by evidence from British Virgin Islands exchanges, which show increased trading activity below the threshold following adoption of new regulations. These findings suggest that customers respond strategically to threshold-based screening by adjusting transaction sizes to fall below the threshold, and exchanges have not adequately addressed this activity through a risk-based approach. Although this paper focuses exclusively on cryptocurrency, I expect similar regulatory features for other sectors produce similar outcomes. Threshold-based screening in the banking sector, for example, will likely prompt an abnormally high activity below the threshold.

This paper makes several contributions through its analysis of transaction-level cryptocurrency data. First, it provides granular evidence of how both customers and exchanges respond to design features common to anti-money laundering regulations. Second, it offers insights into the broader effectiveness of cryptocurrency regulation. While regulatory arbitrage remains a significant concern in the cryptocurrency sector—especially the risk of exchanges relocating to unregulated jurisdictions—FATF member countries have made substantial progress toward regulating exchanges. The cryptocurrency sector’s unique characteristics, and especially the availability of data, position it as an important laboratory for studying regulatory effectiveness. These characteristics enable ongoing evaluation of regulatory implementation and evidence-based refinement of regulatory frameworks, potentially informing approaches to financial regulation more broadly.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/psrm.2025.10027. To obtain replication material for this article, https://doi.org/10.7910/DVN/JMURRG.

Acknowledgements

For helpful comments, I would like to thank Michael Becher, Robert Bridges, Matthew Collin, Hadi Elzayn, Julia C. Gray, David A. Hoffman, Michael Levi, Charles Littrell, Edward Mansfield, Daniel L. Nielson, Jacob N. Shapiro, Jason Sharman, Beth A. Simmons, Kevin Werbach, and participants of the Second International Research Conference on Empirical Approaches to AML.