Introduction

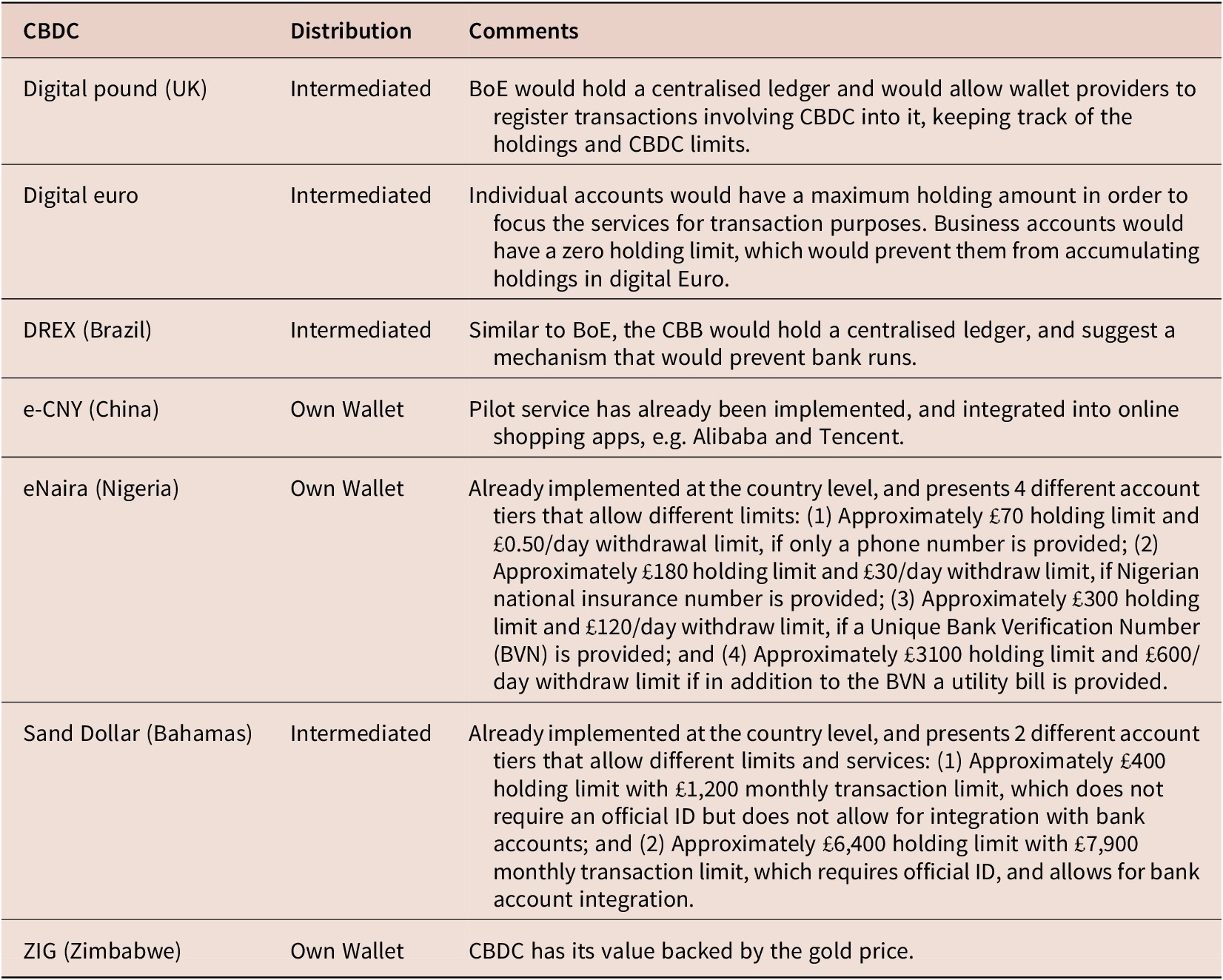

According to the latest Payment Survey by the British Retail Consortium, the share of total UK transactions paid in cash fell from over 38% in 2018 to less than 19% in 2022Footnote 1. In light of these trends, many central banks are working towards the development of a digital version of their fiat money (Boar and Wehrli, Reference Boar and Wehrli2021), and the literature is trying to understand the potential impact of such implementation. Table 1 presents some of the design decisions already made for CBDC in advanced stages of development or already issued.

Table 1. CBDC designs are already disclaimed and potential functionalities

Notes: For Intermediated CBDC, central banks rely on retail partners to provide wallet and transaction services to users (wallet providers).

The information presented here is based on the CBDC Tracker (Available at https://cbdctracker.org/ [Accessed March 2024]) website and central banks’ own documentation.

Holding and transaction limits converted to British Pounds using April 1st, 2024 quotes.

The CBDC implementation can bring efficiency in payments by the introduction of features not yet possible with money, and that are similar to bank deposits but improved by the use of blockchain technology. In this paper, we motivate the use of CBDC by basing ourselves on these efficiency improvements in a series of use cases explored in the BIS’s Project Rosalind (BIS, 2023) and Central Bank of Brazil (CBB) LIFT challenge (CBB, 2023).

We then turn our attention to two important questions not yet fully covered by the literature: (1) how payments from traditional bank accounts into CBDC should be cleared, and (2) how these wallet providers should be remunerated for their services.

With respect to the first topic, we argue that there are two possible options for clearing and settlement mechanisms. The first one follows a similar process to traditional interbank clearing, where reserves from the paying end (a bank) are transferred to the recipient end (a CBDC wallet). The main drawback of this option is the possibility of instantaneous bank runs if no limitations are imposed on the CBDC wallets. The second option is based on the work by Brunnermeier and Niepelt (Reference Brunnermeier and Niepelt2019). Once an order is sent to a bank for payment into a CBDC wallet, the central bank credits the wallet with the resources at the same time that it fills the gap in the balance sheet of the bank caused by the withdrawal of deposits. This automatic lending short-circuits the outflow of reserves that would otherwise be triggered by the withdrawal of deposits. The main drawback of this second option is that central banks become more exposed to commercial banks’ financial health.

With respect to the wallet operator’s remuneration, we base our analysis on two possible frameworks. The first one bases the remuneration of the wallet operator as a spread between the two sides of the CBDC (retail and wholesale), whilst in the second the operator charges a fee over transactions using CBDC. The latter framework is the one that stands closest to the current options being evaluated by central banks (see CBB (2023) for the Brazilian case and BoE (2023) for the UK case).

Regardless of the remuneration framework chosen, we analyse operator decisions with a basic moral hazard model where the wallet operator is required to exert some effort in order to properly screen for “good” CBDC customers in line with Anti-Money Laundry (AML) and Know Your Customer (KYC) practices. Our model shows that the cost of fraud has two opposing effects: (1) higher fraud cost increases the return of monitoring, and (2) tightens the solvency constraint of the operator. Our model also shows that both remuneration frameworks would generate similar results in terms of effort level.

We also argue that, depending on the clearing scheme chosen for the settlement of reserves, the use of CBDC can have slightly different functions for the final user. When banks are more exposed to bank runs in the first clearing model, final users might opt to hold more digital currency than bank deposits, making the CBDC more of a store of value token than a medium of exchange. This can affect the return on monitoring and the optimal level of effort.

There is limited data on the extent of payment fraud in the UK, but the available data does suggest that this is not a trivial problem. In a recent Payment Systems Regulator report, the share of chargeback transactions for a sample of UK retailers for the period 2016–2018 was 0.03% of all transactions.Footnote 2 According to a survey by payment services firm Justt, 78% of UK consumers have used chargebacks in 2023, with particularly high rates of chargebacks for gaming and travel transactions.Footnote 3 German payments company Wirecard enabled fraudulent practices by their retail clients and ultimately committed one of the largest accounting frauds in European history.

The literature on CBDC is fast growing and largely boosted by the aforementioned reduction in the use of cash-based transactions in the economy. With this in mind, this paper aims to contribute to the literature on CBDC by focusing specifically on the wallet operator and its optimal decisions. Our paper can then be related to the works of Agur et al. (Reference Agur, Ari and Dell’Ariccia2022) and Chiu et al. (Reference Chiu and Davoodalhosseini2021), which look at how remuneration decisions affect CBDC implementation and its consequences in the deposit market. While the former focuses on the optimal CBDC design welfare trade-off regarding bank intermediation and diversity in the means of payments, the latter shows that a deposit-like CBDC can crowd out banking and take a relevant stake in the deposit market. Barrdear and Kumhof (Reference Barrdear and Kumhof2022), instead, argue that a rule-based remuneration for CBDC deposits can help counteract business-cycle fluctuations. Minesso et al. (Reference Minesso, Mehl and Stracca2022), on the other hand, expose that, under an open-economy setup, CBDC remuneration can cause welfare loss for the foreign economy (not an issuer of CBDC).

We can also relate our paper to the work of Andolfatto (Reference Andolfatto2021), Hemingway (Reference Hemingway2023) and Fernández-Villaverde et al. (Reference Fernández-Villaverde, Sanches, Schilling and Uhlig2021). The first shows that CBDC has the potential to promote bank lending by increasing deposit funding, whilst the second shows that the introduction of CBDC can increase the costs associated with deposits. In the long run, the banking sector can become more concentrated, which dampens the effect of deposit rates by the introduction of CBDC. Finally, the former shows that in periods of panic, the central bank can arise as the sole monopolist of deposits, endangering the financial sector’s stability.

The rest of this paper is organised as follows. Section 1 presents the use cases for retail CBDC. Section 2 presents the revenue model for wallet providers. Section 3 discusses clearing methods into wallets. Section 4 formalises the wallet operator’s problem and section 5 concludes.

1. Retail CBDC use cases

The actual use of CBDC in the economy is still something under thorough discussion. Project Rosalind (BIS, 2023), a joint experiment between the BIS and the Bank of England, and the LIFT challenge (CBB, 2023), organised by the Central Bank of Brazil (CBB) are useful references to highlight what could be the main use of CBDC as means of payments.

There are potentially two broad categories that the use of CBDC by final users could be grouped by: information sharing and smart/automated payments.

1.1. Stylised Use Case 1: Payments plus metadata and information sharing

Traditional bank payments typically only carry a small amount of metadata, including for example a reference code and sender and receiver identifiers. A CBDC protocol that supported the attachment of additional metadata to payments, and potentially allowed for that data to be shared or accessed by permitted third parties, would enable a wide range of specific use cases.

Project Rosalind describes three potential use cases for CBDC that emphasise the ability of the technology to both couple payments with metadata and for the associated metadata to be accessible in part or whole by a third party (BIS, 2023). These examples include (1) a use case where governments would have access to payment metadata relating to energy bills, and could use that metadata to provide targeted advice and support to households based on need; (2) a use case where companies could offer reward points for specific payments made with CBDC, based on the associated metadata, and that those points could, in turn, be redeemed by the customer, for example in the form of charitable donations from the company providing the reward programme; (3) a use case where a parent could monitor and guide their child’s spending, with access both to their transaction records but also specific metadata relating to the goods and services purchased: for example, the parent would not just see that the child had spent 10 pounds at a supermarket, but also that the child had bought a specific type of food or drink.

Beyond the examples listed by Project Rosalind, we can envisage further potential specific use cases for this type of information sharing. For example, some health insurance companies offer discounts or rewards to customers in turn for purchasing healthy food or attending a gym. Typically, this involves specific retail partners and bespoke data-sharing arrangements; CBDC could facilitate a more standardised approach, potentially allowing smaller insurers to offer similar rewards without the need for their own bespoke data-sharing arrangements with specific partners. It could also support smaller health clubs and retailers to be able to compete with larger retailers who may have more established relationships with larger insurers.

A second, and perhaps more straightforward use case, would be to support the attachment of receipt metadata, including VAT information, to payments. This would make it much easier for firms to automate expense tracking and tax compliance.

1.2. Stylised Use Case 2: Contingent and smart payments

Project Rosalind and the LIFT Challenge also laid the ground for the discussion on the use of smart payments using CBDC (BIS, 2023; CBB, 2023). Smart contracts are automatically enforced clauses implemented in blockchain that do not need the intervention or mediation of a third party (Zheng et al., Reference Zheng, Xie, Dai, Chen, Chen, Weng and Imran2020). This can increase significantly the efficiency of business and the benefits of using CBDC.

The main use cases that could leverage the smart contract use of CBDC are: (1)use case with automated refunds for purchases, e.g. train tickets and delayed claims for customers, which would make the process visible to all, also potentially avoiding frauds; (2) a use case that improves the efficiency of payments to delivery-based contracts (e.g. itinerant or “gig economy”), where payments could be agreed upon between employer and employee and programmed to be paid after completion of certain stages of the work; (3) use case where after the purchase of a good, CBDC is reserved in the buyer account and then released to the seller upon receipt of delivery. This specifically also demonstrates how CBDC could interact with “traditional” commercial bank money; (4) use case of a prototype showcasing a trade finance scenario illustrated the potential of utilizing a secure three-party escrow system. This system allows importers to reserve the entire payment for a delivery, which is then automatically released upon the goods’ receipt. Additionally, the prototype demonstrated the accessibility of a marketplace featuring locked CBDC receivables for potential investors; (5) use case that leverages micro-payment solutions, e.g.micro-payments that support corporate sustainability strategy or payment of time-based services like parking permits; (6) use case of tokenization of asset ownership titles which helps to improve transactions via the DVP method; (7) Smart finance solution earmarked for rural financing.

Having motivated the use of CBDC by the final user, we move to discuss how the wallet layer could function both in terms of clearing mechanism between the traditional banking sector and CBDC wallets and in terms of remuneration of these wallet providers.

2. Revenue models

For any CBDC to be successful, the CBDC must offer a service that is sustainably desirable for a large number of end users, and in addition, provides sufficient income for wallet providers to participate. Ultimately, these two requirements go hand in hand, therefore we frame the demand side of CBDC in terms of the permissible business models of CBDC wallet providers.

The business model of CBDC wallet providers, we argue, is central to the financial stability implications of the introduction of CBDC. Some models are likely to provoke cyclical flows between CBDC and retail bank deposits, potentially increasing bank financial risks, while other models introduce cyclical solvency and liquidity risks to CBDC wallet providers themselves, who would operate more like shadow banks.

2.1. Revenue Model 1: Interest-bearing CBDC

Under the current UK monetary policy system – “The Sterling Monetary Framework” or “The Red-Book” – excess commercial bank reserves (over and above target) deposited at the Bank of England are remunerated at the Bank rate less 0.5 percent per annum (BoE, 2015). The remuneration of excess reserves, alongside repurchase lending facilities offered at the Bank rate plus 0.5%, helps to ensure that the market interbank lending rate stays close to the Bank rate, providing the Bank of England with more control over market rates and enhancing the efficacy of the Bank rate in affecting market interest rates and ultimately broader economic conditions.

Our first Revenue Model for CBDC wallet providers would be to offer them remuneration on wholesale CBDC held against retail CBDC claims offered to end users, with those wholesale CBDC earning remuneration at an interest rate based on the Bank rate.

One perceived benefit of interest-bearing wholesale CBDC is a form of neutrality between CBDC and retail bank deposits, which could potentially stabilise the relative demand of CBDC and retail bank deposits. At the margin, an inflow of retail CBDC into a wallet provider generates the same remuneration for that provider from the Bank of England as an equivalent inflow of deposits into a commercial bank, given that the marginal use of those funds for the commercial bank is to hold the associated reserves as excess reserves.

This model can have three likely implications for CBDC. (1) On a micro-level, part of the earnings from wholesale CBDC interest could be passed on to final customers, either as a form of interest in their balance or as other services developed by the providers; (2) retail CBDC could become more (less) desirable relative to bank deposits depending on the Bank rate being high (low); and (3) the earnings of the wallet operator could be high (low) when the Bank rate is high (low).

2.2. Revenue Model 2: Transaction fees

Transaction fees can be levied either on the merchants or on users. In the case of merchant fees, these would pay a fee to CBDC intermediaries for processing transactions. These fees, in turn, could be passed on in part to customers either as cashback, interest on retail CBDC holdings, or in the form of other services.

This model, however, poses a difficulty in enforcing that merchants must accept CBDC but cannot pass on fees to customers. In traditional banking merchant transaction fees could potentially, under appropriate regulation or competition, be driven very close to zero. There is also evidence of welfare costs of the implementation of fees in the economy. See Huynh et al. (Reference Huynh, Nicholls and Shcherbakov2022) for estimates of these costs in Canada (as well as the references therein for other countries).

Policymakers have generally stated that CBDC transactions will be free for end users, with any transaction fees being paid by retailers (see BoE (2023)). For some applications, user transaction fees may be more appropriate. In particular, rich receipts and metadata attached to payments may be valuable to end users and could be used to support new business models. For example, business expense cards with receipts and VAT information attached to the transaction could simplify tax compliance. In this case, it may be appropriate to charge end users for these features and to pass on some of this revenue to CBDC wallet providers, and to retailers to support the required IT and data management costs. Other users, without the requirement for rich receipt and payment metadata information, could potentially opt for low or zero-fee CBDC accounts without these features.

Also, see Huynh et al. (Reference Huynh, Nicholls and Shcherbakov2022) and references therein for a discussion of the economic inefficiency resulting from limited passthrough of Point of Sale (POS) fees to consumers when merchants can only choose whether to accept or not accept a particular payment method while consumers choose the amount of use.

2.3. Revenue Model 3: CBDC product bundles

A final revenue option arises as a substitute for when neither CBDC yields interest, nor fees are levied. In this option, while basic wallet functionality might be free of charge, the operator could offer product bundles for more premium services. These services can range from basic budgeting tools to more complex ones such as dev interface for smart contracts, if these are also implemented in the CBDC ecosystem.

This revenue model could be the one chosen by most of the central banks, given it generates less financial instability (will not compete with deposit rates), is easier for the central bank to monitor and poses less burden on the users.

3. Managing payments into CBDC

With the widespread use of CBDC, individuals would have a fast, easy way to instantly transfer retail commercial bank deposits into CBDC, potentially triggering liquidity crunches for banks. In past bank runs, household retail deposit outflows have been somewhat slowed by end-of-day clearing, physical cash supply constraints, physical queues, and the fact that many individuals do not hold multiple bank accounts across multiple banks, and therefore cannot instantly transfer funds electronically out of a potentially troubled bank. Widespread use of CBDC, alongside bank deposits, would provide an easier way for retail bank depositors to withdraw bank deposits, and could therefore hasten or amplify bank runs.

In this Section, we describe two different models of payment clearing between bank deposit accounts and CBDC. Our first model is a traditional model, where deposit outflows are coupled with bank reserve outflows. This traditional model could potentially amplify bank run risks, especially if settlements occur in real time. Our second model shortcircuits these risks by automatically replacing retail deposit outflows with central bank deposits against the commercial bank, which are then cleared at a later time. This second model separates deposit outflows from reserve outflows, potentially reducing bank run risks. It does however introduce operating risks faced by the central bank, as it resembles an automatic lender-of-first-resort mechanism.

The choice of clearing model, we argue, is important for the functions of CBDC as a form of money. The clearing model has implications for the stability of commercial banks, and therefore the relative desirability of CBDC as a store of value rather than as just a means of exchange. Ultimately, the use of CBDC as a store of value, or as a means of exchange, will affect the velocity of CBDC and the incentives faced by wallet operators under different revenue models.

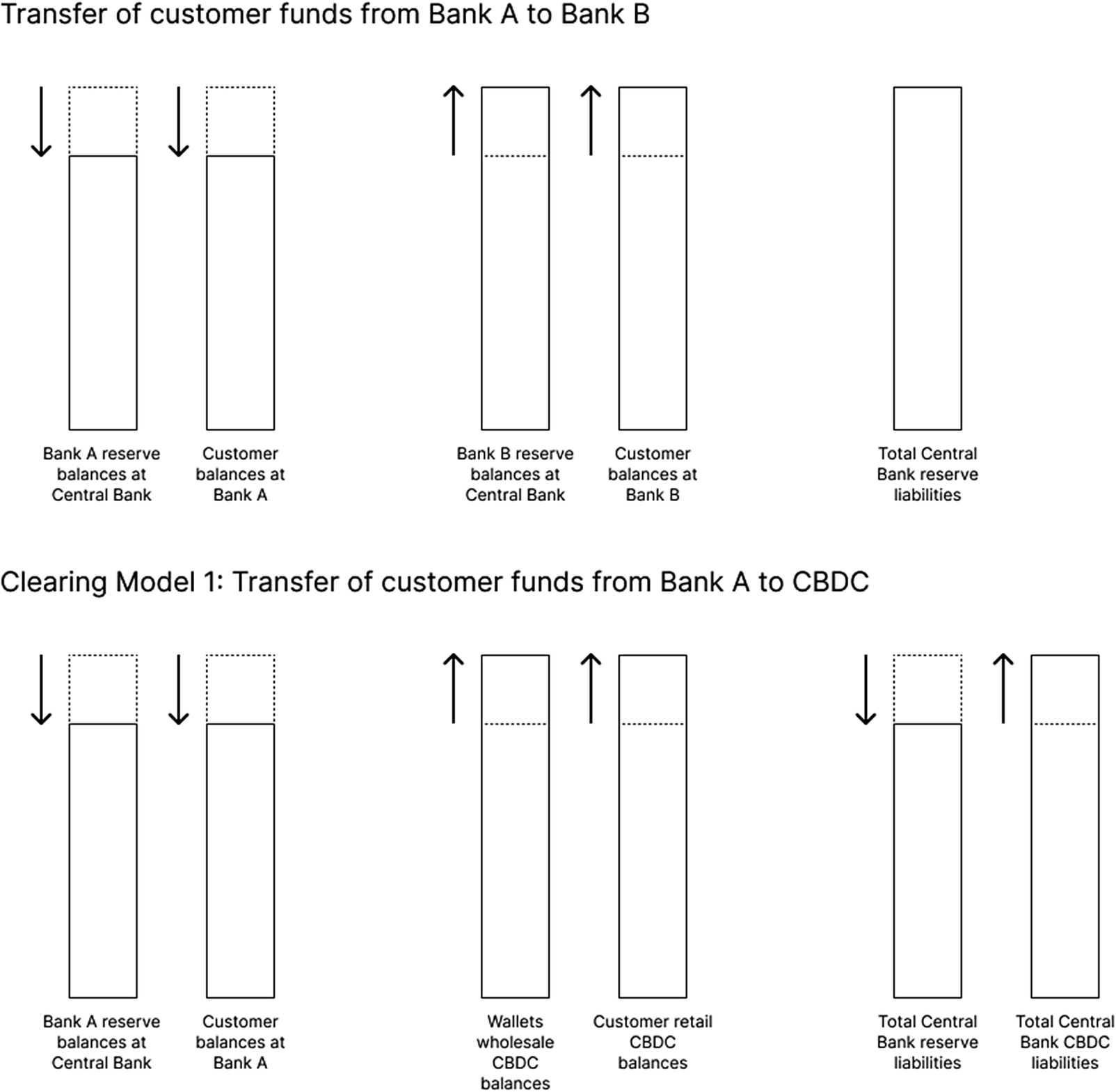

3.1. Clearing Model 1: Reserve destruction and CBDC creation

3.1.1. Traditional interbank payment clearing

Under the traditional interbank payment system, a customer sends a payment order to their bank, which in turn transfers the funds to the recipient bank. The receiving bank then credits the receiving account with the reserves, and the overall level of bank reserve in the central bank balance sheet is not affected. The settlement between banks can occur instantly in a gross settlement manner or in batches in a net settlement manner.

3.1.2. Translation to CBDC clearing

Clearing Model 1 is based closely on the traditional interbank payment clearing model. When a customer sends instructions to transfer funds from a bank deposit account to a CBDC wallet, there is an outflow of reserves from the bank’s reserve account at the central bank, corresponding to a decrease in customer deposit balances. New wholesale CBDC balances are created, and there is a corresponding inflow of CBDC into the customer’s wallet. The narrow money supply remains constant.

Clearing Model 1: Transfer of customer funds from Bank A to CBDC.

The concern with this clearing model is that Bank A can, in theory, lose all their reserves instantly. If CBDC accounts are held widely by the public, then it would be easier for bank depositors to withdraw their bank deposits than under the current system. They would no longer be slowed down by queues, ATM cash limits, barriers to opening new bank accounts, and so on.

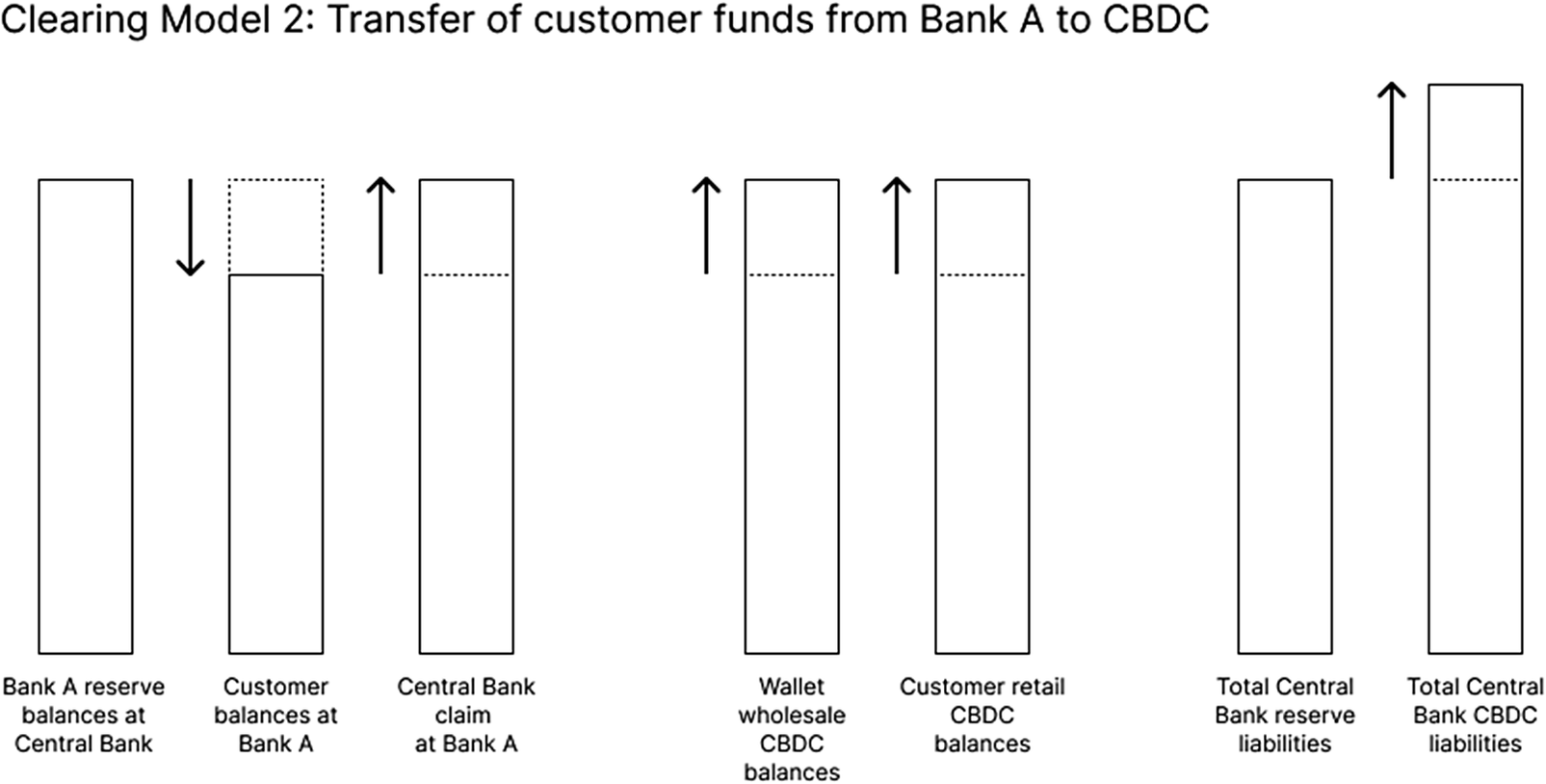

3.2. Clearing Model 2: Reserve conservation and CBDC creation

This model, in broad terms, is built upon the pass-through mechanism described by Brunnermeier and Niepelt (Reference Brunnermeier and Niepelt2019) and it works as follows.

The customer instructs bank A to transfer funds to the CBDC wallet intermediated by a wallet operator. The central bank is automatically credited with equivalent deposits at bank A and creates CBDC in B’s intermediated wallet.

Under this clearing model, at the moment of the transaction, there is no outflow of reserves from Bank A. The central bank has an additional asset (a credit against Bank A) and an additional liability (the CBDC in B’s wallet). The total narrow money supply increases by the amount of the transaction. If the central bank deposits at Bank A were remunerated at a penalty rate, then there would be an incentive for Bank A to repay the central bank’s deposit with reserves at the next clearing period.

In normal times, the central bank deposits at commercial banks would typically be cleared at the end of the day. During a bank run into CBDC, the central bank would effectively extend an automatic loan to the bank in question, which would short-circuit the outflow of reserves resulting from the run, and dampened liquidity pressures.

Real-world example. Some banks, including Monzo in the United Kingdom, offer their customers a very similar service to the model described above. Upon receiving the instruction of a payment to a Monzo account holder, Monzo will credit that payee’s account, before receiving the transfer of reserves from the payer’s bank. In doing so, Monzo is subject to settlement risk from the payer’s bank.

How this solves the bank run problem. Under this model, bank A cannot lose all its reserves and deposits, at least not instantly. Any outflow of deposits is matched with an inflow of central bank debits, surging up the bank’s reserves. This in a way is an automated version of the current system, where the central bank provides liquidity to banks in times of stress.

The problem. The concern with Clearing Model 2 is that central banks and ultimately the governments are now particularly exposed to the financial soundness of each and all commercial banks. This clearing model builds in automatic bailouts and the resulting moral hazard. The bank resolution framework would also need to be adapted in the scenario that at the time of resolution the central bank is a major depositor at the bank in question.

Clearing Model 2: Transfer of customer funds from Bank A to CBDC

We now move to formalise the wallet operators’ problem, keeping in mind the two revenue models discussed above. We also explore how the clearing method can affect the key parameters and predictions when there is an increase in the perceived risk of bank runs.

4. The wallet problem

We can formalise the wallet operator’s problem considering the revenue models described above as well as make conjectures about how the clearing of funds would affect this. In an economy where there is CBDC the wallet operator would be responsible for:

-

• Providing a high-quality user interface for retail CBDC.

-

• Providing recourse services following fraudulent transactions, mistaken transactions, or theft.

-

• Providing AML/KYC services to ensure the integrity of CBDC payments.

In turn, CBDC wallet providers can earn interest on wholesale CBDC balances held at the central bank, while Retail CBDC balances are not remunerated. CBDC businesses face risks relating to fraud and recourse demands, relating to their interface and accessibility, and relating to their ability to reduce risks relating to payment integrity. Managing the accounts and reducing these risks requires effort and investment.

They are owned by a member of a household and are exposed to a fraud risk that generates a financial cost

![]() $ \theta $

.

$ \theta $

.

5. Interest-based remuneration

We impose a (regulatory) solvency constraint that the wallet must be able to cover this cost in all states of the world. For this to happen, we require the following solvency constraint,

where

![]() $ N $

could be wallet reserves to be used in eventual recourse or reversal demands, assumed to be held in wholesale CBDC, while fraud losses are proportional to retail CBDC balances

$ N $

could be wallet reserves to be used in eventual recourse or reversal demands, assumed to be held in wholesale CBDC, while fraud losses are proportional to retail CBDC balances

![]() $ D $

and

$ D $

and

![]() $ R $

are the interest rate spread between retail and wholesale CBDC. We can re-write the solvency constraint as follows:

$ R $

are the interest rate spread between retail and wholesale CBDC. We can re-write the solvency constraint as follows:

The wallet provider exerts effort

![]() $ \varepsilon $

to reduce risk, and its ex-ante reward can be written as

$ \varepsilon $

to reduce risk, and its ex-ante reward can be written as

$$ {\displaystyle \begin{array}{l}\lambda \left\{\left(N+D\right)R-D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\Rightarrow \\ {}\lambda \left\{\Big( NR+\left(R-1\right)D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\end{array}} $$

$$ {\displaystyle \begin{array}{l}\lambda \left\{\left(N+D\right)R-D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\Rightarrow \\ {}\lambda \left\{\Big( NR+\left(R-1\right)D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\end{array}} $$

where

![]() $ NR $

is the total return to inside wealth,

$ NR $

is the total return to inside wealth,

![]() $ \left(R-1\right)D $

is the net interest margin charged against retail CBDC, and

$ \left(R-1\right)D $

is the net interest margin charged against retail CBDC, and

![]() $ \left(1-p\left(\varepsilon \right)\right)\theta D $

is the expected cost of fraud. The parameter

$ \left(1-p\left(\varepsilon \right)\right)\theta D $

is the expected cost of fraud. The parameter

![]() $ \lambda $

denotes the marginal value of consumption for the household that owns the wallet operator and

$ \lambda $

denotes the marginal value of consumption for the household that owns the wallet operator and

![]() $ c $

is the marginal cost of effort.

$ c $

is the marginal cost of effort.

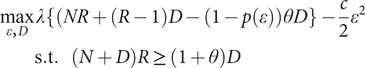

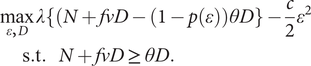

From (1), we can consider the optimization problem for the wallet operator as

$$ {\displaystyle \begin{array}{l}\underset{\varepsilon, D}{\max}\lambda \left\{\Big( NR+\left(R-1\right)D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\\ {}\hskip3em \mathrm{s}.\mathrm{t}.\hskip1em \left(N+D\right)R\ge \left(1+\theta \right)D\end{array}} $$

$$ {\displaystyle \begin{array}{l}\underset{\varepsilon, D}{\max}\lambda \left\{\Big( NR+\left(R-1\right)D-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\\ {}\hskip3em \mathrm{s}.\mathrm{t}.\hskip1em \left(N+D\right)R\ge \left(1+\theta \right)D\end{array}} $$

The first-order conditions are

where

![]() $ \mu $

is the Lagrange multiplier on the regulatory solvency constraint.

$ \mu $

is the Lagrange multiplier on the regulatory solvency constraint.

Solving the system above gives the optimal effort levelFootnote 4,

6. Fee-based revenue model

If instead of being remunerated by a spread between retail and wholesale CBDC, the wallet operator were remunerated by a fee for every transaction made, we can adjust the previous model in accordance. The solvency constraint becomes

where fraud losses are proportional to retail CBDC balances

![]() $ D $

. The fees charged by the wallets for transactions are denoted

$ D $

. The fees charged by the wallets for transactions are denoted

![]() $ f $

and

$ f $

and

![]() $ v $

is equivalent to the velocity that CBDC deposits are used in the economy.

$ v $

is equivalent to the velocity that CBDC deposits are used in the economy.

Rewriting the solvency constraint

the wallet’s problem becomes

$$ {\displaystyle \begin{array}{l}\underset{\varepsilon, D}{\max}\lambda \left\{\Big(N+ fvD-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\\ {}\hskip2em \mathrm{s}.\mathrm{t}.\hskip1em N+ fvD\ge \theta D.\end{array}} $$

$$ {\displaystyle \begin{array}{l}\underset{\varepsilon, D}{\max}\lambda \left\{\Big(N+ fvD-\left(1-p\left(\varepsilon \right)\right)\theta D\right\}-\frac{c}{2}{\varepsilon}^2\\ {}\hskip2em \mathrm{s}.\mathrm{t}.\hskip1em N+ fvD\ge \theta D.\end{array}} $$

The first order of necessary conditions are

Solving the system above gives the optimal effort level, we find

which is analogous to the interest-based remuneration model.

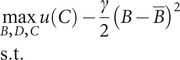

7. The household

The household enjoys consumption

![]() $ C $

according to increasing concave utility function

$ C $

according to increasing concave utility function

![]() $ u(C) $

. Some of the household’s spending is more conveniently paid from bank deposits

$ u(C) $

. Some of the household’s spending is more conveniently paid from bank deposits

![]() $ B $

while the rest of their spending is more conveniently paid from CBDC holdings

$ B $

while the rest of their spending is more conveniently paid from CBDC holdings

![]() $ D $

.

$ D $

.

The household’s problem is

$$ {\displaystyle \begin{array}{l}\underset{B,D,C}{\max }u(C)-\frac{\gamma }{2}{\left(B-\overline{B}\right)}^2\\ {}\mathrm{s}.\mathrm{t}.\end{array}} $$

$$ {\displaystyle \begin{array}{l}\underset{B,D,C}{\max }u(C)-\frac{\gamma }{2}{\left(B-\overline{B}\right)}^2\\ {}\mathrm{s}.\mathrm{t}.\end{array}} $$

The resulting optimality condition is

where

![]() $ {v}^{\prime }(W) $

is the marginal value of wealth. Ultimately, this generates a downward-sloping demand curve for CBDC balances in the

$ {v}^{\prime }(W) $

is the marginal value of wealth. Ultimately, this generates a downward-sloping demand curve for CBDC balances in the

![]() $ D,R $

space. A decrease in

$ D,R $

space. A decrease in

![]() $ \overline{B} $

shifts the demand curve outwards.

$ \overline{B} $

shifts the demand curve outwards.

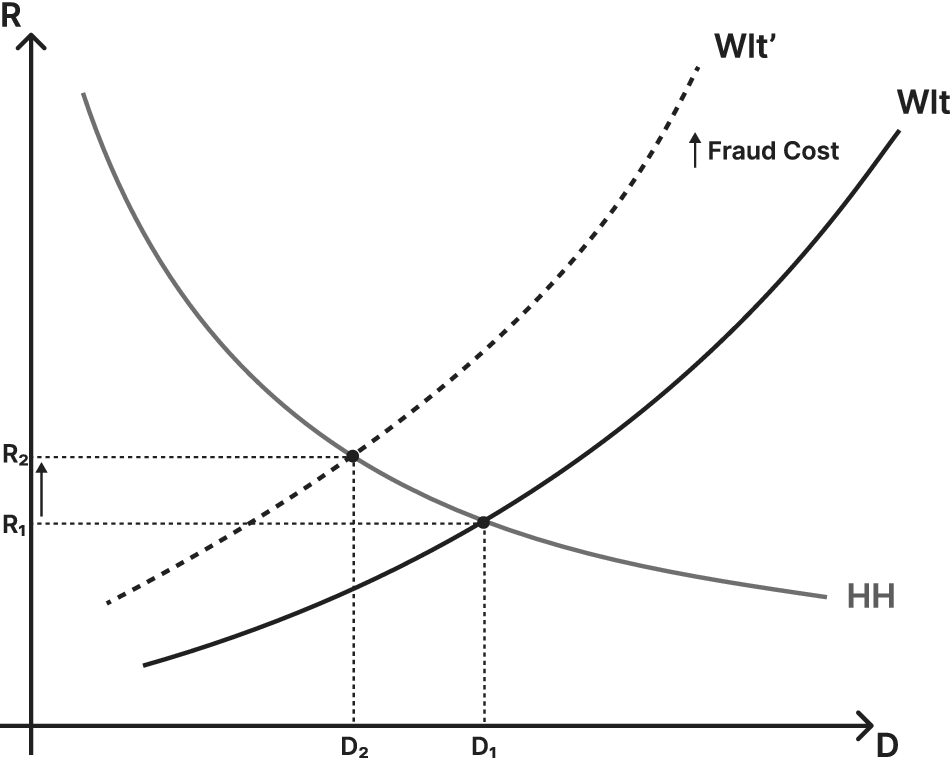

7.1. An increase in the fraud cost θ

An increase in the fraud cost

![]() $ \theta $

has two counteracting effects on the optimal effort level for both models. Holding deposits constant, the increase in fraud costs increases the return to monitoring efforts. However, the increase in fraud costs also tightens the solvency constraint, reducing the amount of deposit CBDC that can be attracted by the wallet operator, and this reduction in deposits reduces the return to monitoring effort. In sum, as characterised by (6), the optimal monitoring effort level is decreasing in the fraud cost

$ \theta $

has two counteracting effects on the optimal effort level for both models. Holding deposits constant, the increase in fraud costs increases the return to monitoring efforts. However, the increase in fraud costs also tightens the solvency constraint, reducing the amount of deposit CBDC that can be attracted by the wallet operator, and this reduction in deposits reduces the return to monitoring effort. In sum, as characterised by (6), the optimal monitoring effort level is decreasing in the fraud cost

![]() $ \theta $

as shown in Figure 1.

$ \theta $

as shown in Figure 1.

Figure 1. Impact of an Increase in the Fraud Cost

![]() $ \theta $

.

$ \theta $

.

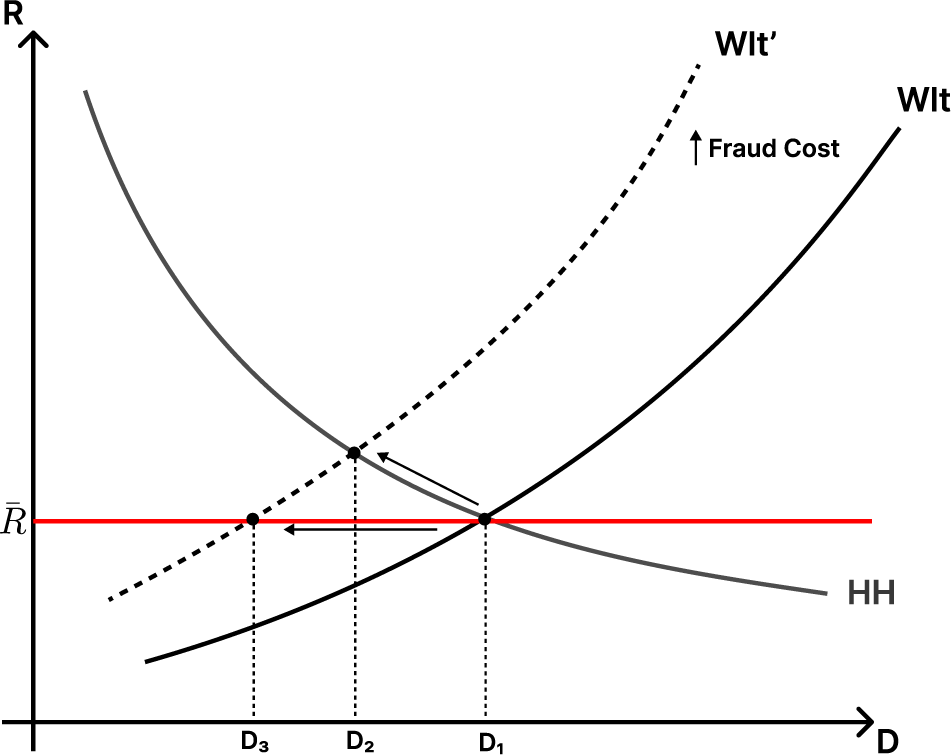

If, by regulatory decision, the spread

![]() $ R $

is capped at

$ R $

is capped at

![]() $ \overline{R} $

, an increase in fraud cost can further reduce the amount of CBDC deposits taken by the wallet. Everything else held constant, this would further decrease monitoring and increase the probability of a bad scenario as shown in Figure 2.

$ \overline{R} $

, an increase in fraud cost can further reduce the amount of CBDC deposits taken by the wallet. Everything else held constant, this would further decrease monitoring and increase the probability of a bad scenario as shown in Figure 2.

Figure 2. Impact of an Increase in the Fraud Cost

![]() $ \theta $

and Fixed Spread.

$ \theta $

and Fixed Spread.

7.2. Settlement risk and use of CBDC

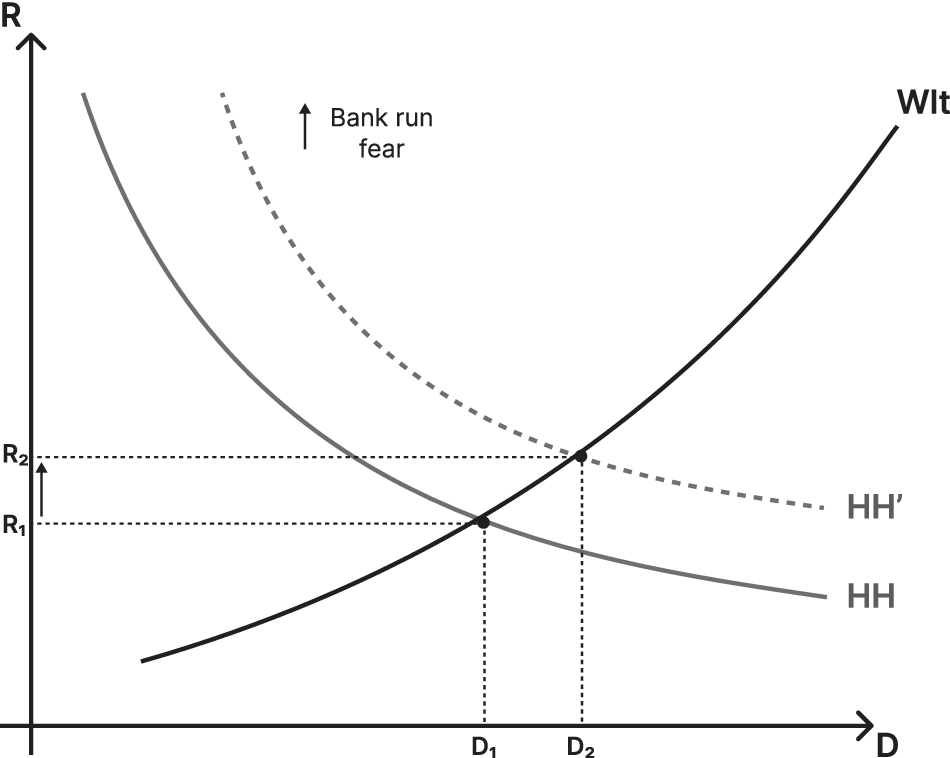

In light of the clearing models presented above, we argue that, depending on the selected option for settling funds between agents, the use of CBDC can be driven by different demands. If the clearing model followed a similar format as traditional banks, the potential risk of instant bank runs would create a store of value function for CBDCs. At any time, households could easily transfer their funds to their wallets and be safeguarded. We can reason this movement by saying that an increase in the fear of bank runs is equivalent to the number of payments being more conveniently paid by traditional deposits (

![]() $ \overline{B} $

) reducing. This would drive CBDC deposit demand up, everything else held constant as shown in Figure 3. This higher demand creates an incentive for the wallet provider to increase effort and monitoring. This effect, however, could be damped if limitations in CBDC are in place, e.g. maximum holds in the accounts or daily limit of transfers.

$ \overline{B} $

) reducing. This would drive CBDC deposit demand up, everything else held constant as shown in Figure 3. This higher demand creates an incentive for the wallet provider to increase effort and monitoring. This effect, however, could be damped if limitations in CBDC are in place, e.g. maximum holds in the accounts or daily limit of transfers.

Figure 3. Impact of an Increase in the Fear of Bank Runs.

If, however, the pass-through option is chosen, the automatic loans from the central bank to the bank would dampen any fear of bank runs, and no such change in the deviation cost would happen. CBDC accounts would be focused mostly as a medium of exchange.

8. Discussion

As Central Banks globally have studied, tested, and implemented CBDCs, a range of use cases have been identified, some of which could potentially be very valuable to consumers, and would be difficult to replicate in the traditional banking system. There remain important questions relating to the design of CBDCs, which will determine their ultimate success, as well as their impact on financial stability more broadly. In this paper, we have focused on two important design questions. First, how CBDC intermediaries should be compensated for their services. Second, how payments from traditional banks into CBDC wallets should be cleared.

While there are no options without risks or drawbacks, some of the main concerns about CBDC can be resolved with appropriate design choices. The question is whether these choices will limit the utility of CBDC, or create additional risks.