Introduction

The advent of large language models (LLMs) built using vast datasets raises questions about intellectual property (IP) rights and enforcement in the digital domain. These models often ingest copyrighted content without explicit permissions, leading to substantial IP concerns, for instance, with lawsuits against OpenAI, the largest LLM company, including against leading actors, like Sarah Silverman, and news outlets, like the New York Times. Although there is some evidence from a recent court ruling that the output of generative artificial intelligence (AI) models does not violate the rights of copyright holders whose works were used in training the LLM, courts have still not addressed the underlying question whether ‘tech companies’ unauthorized use of material scraped from the internet to train AI infringes copyrights on a massive scale’ (Brittain, Reference Brittain2024).Footnote 1

The lawsuits against OpenAI, and other tech providers, argue that LLMs are competing with the same outlets that they train their data on, thereby diverting web traffic away from the newspaper and copyright holders who depend on advertising revenue to continue producing creative content (e.g., journalism). OpenAI, and other providers, respond that ‘training AI models using publicly available internet materials is fair use’ (O’Brien, Reference O’Brien2024). While there is a fundamental disagreement over the definition of fair use and how contributors to digital content should be remunerated, the problem is exacerbated by ongoing disagreement about how digital intermediaries remunerate content creators, namely the price of the data that they take, ‘securitize,’ and sell to advertisers (Makridis and Thayer, Reference Makridis and Thayer2024). In this sense, any legal resolution is likely going to be temporary unless it addresses the underlying absence of property rights in the digital landscape, which began at least with the

internet before LLMs became ubiquitous. This paper proposes a new institutional approach to IP enforcement by integrating polycentric governance with blockchain-based licensing, offering a novel framework rather than serving as a traditional literature review or policy paper.

AI, and more specifically LLMs, are systems trained on vast datasets to generate human-like text. These models rely on deep learning techniques and neural networks to predict and construct responses based on training data. This creates a ‘tragedy of the commons’ whereby many organizations continue to draw on content to train their models, but the incentive to create quality content and validate it deteriorates absent a remuneration mechanism for content providers. Meanwhile, blockchain technology, a decentralized digital ledger, allows for secure and transparent verification of digital transactions. Smart contracts – self-executing agreements stored on the blockchain – enable automation of digital rights management. Non-Fungible Tokens (NFTs) are unique digital assets on blockchains that can represent ownership of a digital or physical asset. By suggesting a complementarity of these technologies, our paper envisions a future consisting of an automated, decentralized framework for managing and enforcing IP rights.

Our primary contribution is to apply institutional economics to these growing concerns about IP rights and argues that a polycentric approach anchored in the blockchain provides a holistic and systems-level solution. After examining potential approaches to governing and enforcing IP rights over digital content to train machine learning systems, balancing the interests of diverse stakeholders ranging from content creators to platform providers and end-users, we argue that blockchain, and more specifically NFTs on the blockchain, offer the means to operationalize these rights by providing a record of ownership and automating licensing and royalty distribution through smart contracts – solving the tension for all sides (Makridis and Liao, Reference Makridis and Liao2023).Footnote 2 However, we point out that one of the major gaps in the current use of NFTs and practical application of the blockchain at scale is enforcement. Consequently, we argue that a polycentric governance model (Ostrom, Reference Ostrom1990), which encourages stakeholder collaboration and enables context-specific solutions, provides promise for enforcing IP rights in the decentralized digital ecosystem, but we recognize that there are many barriers to adoption that must be overcome.

Successfully governing digital IP in the age of AI requires a framework that is both clear about rights and adaptable to rapid technological change. We contend that a polycentric governance approach, drawing from Ostrom’s principles for managing common resources, provides the necessary structure. This approach emphasizes clearly defined rights and rules developed through multi-stakeholder collaboration, allowing for context-specific solutions and ongoing adaptation – features essential for the dynamic digital ecosystem. Within this governance model, technologies like NFTs offer a practical mechanism for establishing clear ownership boundaries and automating licensing agreements via smart contracts, thereby potentially resolving ambiguities and reducing transaction costs. The specific application of polycentric principles (such as defining boundaries, ensuring participation, and establishing enforcement mechanisms) and the operationalization of rights using NFTs will be explored in detail in Sections 4 and 5, respectively.

Blanket bans on deploying systems lacking intuitive interpretability could stifle promising applications that could promote economic and social flourishing. For instance, some universities, whereas others have embraced it.Footnote 3 More granular oversight negotiated through inclusive multi-stakeholder processes may better balance risks versus benefits. Representatives from impacted groups can specify properties like transparency necessary through smart contracts rather than distant policymakers taking a blanket one-size-fits-all approach. Already, at least from patenting rates, AI and blockchain could serve complementary roles in the digital economy (Makridis et al., Reference Makridis, Bates, Barnes and Glasgow-George2024a).

Polycentric AI governance combining strong local participation with higher-order governmental supervision is only exercised judiciously to address major externalities or rights violations. This limits preemptive restrictions on community authority and expertise in regulating close technologies. Appropriately structured, such decentralization encourages tailored innovation aligned with user needs. Crucially, NFTs could provide the mechanism to track individual contributions and publicly signal ideas, claims, and stakes on assets because they tokenize ideas at their most granular level, providing rivalry and exclusivity where none may have otherwise existed. Building on recent work in institutional economics (Alston et al., Reference Alston, Law, Murtazashvili and Weiss2022; Alston, Reference Alston2022), we also argue that the concept of polycentric governance already lends itself well to the existing model of staking tokens to secure the blockchain provides, at least for blockchains that use proof-of-stake (PoS) consensus mechanisms, and may provide an enforcement mechanism for IP rights on the blockchain implemented through NFTs – or at least other tokens that share those properties.

Community-based monitoring of member behavior is essential within Ostrom’s framework. The open-source nature of blockchain ensures that civil society groups representing marginalized communities can oversee algorithmic systems to gauge impacts and highlight areas for improvement. Having visibility lets them document concerns around issues like unfair bias or lack of due process. Technical experts and independent auditors may assess more complex properties like security vulnerabilities, while an everyday system user is better positioned to judge intelligibility in context. Multiple complementary forms of community-driven monitoring provide needed visibility into AI systems hosted on online platforms. That is not to say that coordination problems do not arise, as Alston (Reference Alston2022) points out, but credible protocol design processes mitigate these challenges.

Ostrom also suggests graduated sanctions to discipline rule violators. For AI systems, this suggests corrective mechanisms should escalate based on the severity and persistence of harm. Civil or common law courts allow these enforcement mechanisms to emerge through an evolving system of tort cases. Binding arbitration systems tailored to AI could enable independent panels. Private courts could fill this gap, especially if a mechanism like NFTs exists to channel the majority of compensation situations. Without NFTs, courts would be overwhelmed with grievances, driving up the costs of arbitration.

Finally, multi-tiered oversight balances flexibility for innovation with higher-order cohesion. Tightly centralized governance often cannot respond adaptively to progress in context, and in many cases, markets for governance would be superior (Hadfield, Reference Hadfield2022). Without central coordination, failures cascade across fragmented systems, requiring massive correction after substantial preventable damage. Decentralized organizational bodies may coordinate and disseminate best practices to AI producers (Makridis et al., Reference Makridis, Borkowski and Alterovitz2024b), and other international bodies may supplement this work (Ho et al., Reference Ho, Barnhart, Trager, Bengio, Brundage, Carnegie, Chowdhury, Dafoe, Hadfield, Levi and Snidal2023). Nested governance structuring also maps to the deployment pipeline, with inward-facing developer controls complemented by user feedback loops and societal-level impact monitoring informing ongoing optimization in context. Markets in AI governance incorporate feedback from democratic systems to understand the values that citizens seek but delegate regulatory expertise to those who have proven within a dynamic and competitive marketplace that they understand and can adequately meet targets set by democratic systems while allowing for innovation (Hadfield and Clark, Reference Hadfield and Clark2023). Granular governance complements system-wide oversight and both play an important role within polycentric governance.

The remainder of this paper is organized as follows. Section 2 provides an overview of the literature. Section 3 explains the IP rights challenges with LLMs. Section 4 shows how polycentric governance can enhance the enforcement of IP law. Section 5 demonstrates how to operationalize intellectual property rights concerns within NFTs. Section 6 discusses areas of concern and opportunities for further research. Section 7 presents a case study of our theory with the Kleros blockchain, although we recognize that there are others too. Finally, in Section 8, we conclude.

Relevant literature

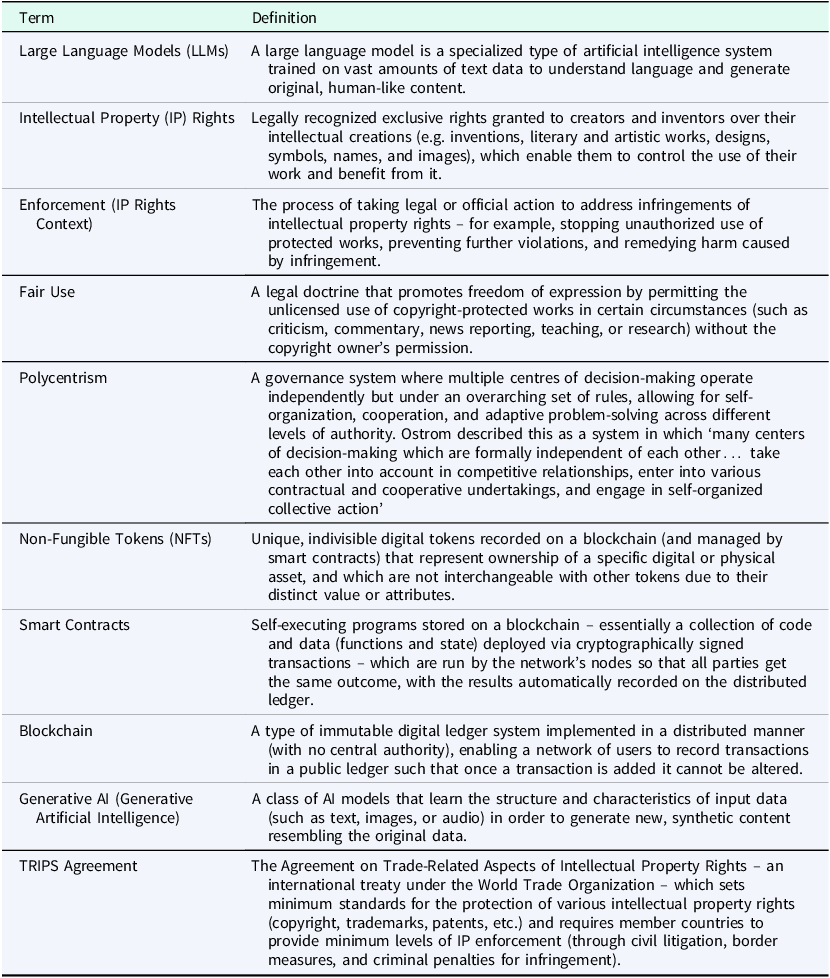

All definitions and terms are summarized in Online Appendix and in Table 1 Footnote 4 . The emergence of cryptocurrencies and blockchain technology has prompted significant scholarly interest across academic disciplines. Legal research focuses on how blockchain-based smart contracts can enable automated enforcement of agreements, while noting the limitations in handling complex disputes (Howell and Potgieter, Reference Howell and Potgieter2021; Arruñada, Reference Arrun˜ada2019). Concurrently, computer science studies examine the vulnerability of blockchain networks to attacks like double-spending, highlighting that scale-free topologies are particularly prone to such threats (Rohde et al., Reference Rohde, Mohan, Davidson, Berg, Allen, Brennen and Potts2021; Zhang et al., Reference Zhang, Xu and Houser2021). Economists have explored the microeconomic drivers behind cryptocurrency adoption and pricing, providing valuable insights into this evolving landscape (Halaburda et al., Reference Halaburda, Haeringer, Gans and Gandal2022).

Table 1. Common Terms

The role of blockchain in enabling institutional experiments is another area of interest, particularly in domains like intellectual property rights, where tailored, bottom-up governance may complement centralized regimes (Harper, Reference Harper, Pyka and Foster2015, Reference Harper2014). For instance, Allen et al. (Reference Allen, Berg, Davidson and Potts2021) argue that blockchains industrialize trust, thereby reducing associated capital costs. Similarly, Davidson (Reference Davidson2023) relates blockchain’s ability to generate price information to von Mises’ economic calculation problem. Furthermore, blockchains facilitate new institutional possibilities such as quadratic voting for preference aggregation (Allen et al., Reference Allen, Berg, Markey-Towler, Novak and Potts2020; Berg et al., Reference Berg, Berg and Novak2020), and they characterize proof-of-work mining as a three-sided market that produces trust. Some have also thought of blockchains as knowledge commons governed by polycentric arrangements that balance open access and sustainability (Murtazashvili and Weiss, Reference Murtazashvili, Weiss, Tran, Thai and Krishnamachari2022). Researchers have applied Ostrom’s framework for governing common pool resources to permissioned blockchains (Spithoven, Reference Spithoven2019; Murtazashvili et al., Reference Murtazashvili, Murtazashvili, Weiss and Madison2022). This hybrid governance approach often combines on-chain enforcement through code and off-chain legal oversight (Frolov, Reference Frolov2021).

The impact of blockchain on organizational and industry structures is another focal point in the literature. For example, MacDonald et al. (Reference MacDonald, Allen, Potts, Tasca, Aste, Pelizzon and Perony2016) predict that blockchain technology could shift organizational structures from hierarchical firms to decentralized markets. Similarly, other scholars suggest that blockchain could reduce the need for countervailing government intervention by enabling dehierarchicalization, thereby fostering more decentralized and autonomous organizational forms (Berg et al., Reference Berg, Davidson and Potts2019).

National development factors influencing cryptocurrency adoption across countries have also been examined, pointing to a positive correlation between crypto adoption and both educational attainment and the human development index, but a negative correlation with economic freedom (Bhimani et al., Reference Bhimani, Hausken and Arif2022). Apart from the adoption of cryptocurrency, however, has been an emerging interest in blockchain for organizations, often through ‘permissioned blockchains.’ Central banks, for instance, are looking at the adoption of blockchain for the development of central bank digital currencies (CBDCs). In parallel to public sector interests in blockchain has been the interest in AI and the design of trustworthy AI systems in compliance with recent federal guidance (Makridis et al., Reference Makridis, Borkowski and Alterovitz2024b). However, knowledge gaps exist even among managers (Cu´ellar et al., Reference Cu´ellar, Larsen, Lee and Webb2022), and remedying them will likely take more than just exposure to information.

Institutional analyses also examine collective choice dynamics for governing AI development in alignment with shared values. Multi-stakeholder arrangements are crucial, as they recognize the diverse incentives among private firms, academic researchers, and policymakers (Mikhaylov et al., Reference Mikhaylov, Esteve and Campion2018). Contributions from technical computer science are vital in this context, as applying cybernetic control theory helps analyze the risks posed by autonomous goal-directed systems lacking human oversight (Helbing et al., Reference Helbing, Frey, Gigerenzer, Hafen, Hagner, Hofstetter, van den Hoven, Zicari, Zwitter and Helbing2019). If smart contracts on the blockchain were to automate more decision-making within organizations, how would employees and other stakeholders react? Some nascent experimental and behavioral economics literature suggests diminished cooperation and fairness compared to interactions solely with humans (Dvorak et al., Reference Dvorak, Stumpf, Fehrler and Fischbacher2024), but further research is needed to develop transparency and accountability policies that could manage the resulting risks that could ensue with AI systems making decisions at scale.

However, the literature lacks a direct link between the IP rights challenges posed by LLMs and technical solutions that empower individuals to utilize burgeoning AI technology. Effective and adaptable solutions must embrace principles of polycentricity and decentralization. Given that AI is still in its infancy, top-down regulations risk either stifling the technology or failing to keep pace with emerging challenges. This paper posits that NFTs provide a novel and fitting solution to this problem, aligning well with the required principles of governance and adaptability.

Intellectual property rights and large language models

Traditional IP frameworks rely on centralized authorities and legal arbitration (e.g., the US Patent and Trademark Office), making enforcement costly and slow. Moreover, they struggle with tracking attribution and enforcing compensation in digital settings. Generative AI amplifies these challenges, necessitating new mechanisms such as blockchain registries and automated licensing via smart contracts.

AI systems by design, and more specifically LLMs, process extensive data collection, which can include copyrighted material without explicit permissions or mechanisms for compensation. Indiscriminate use raises IP rights infringement concerns, highlighting the limitations of traditional enforcement mechanisms in the digital domain. Part of the challenge lies in the difficulty of tracking the origin and ownership of digital content used in training these models and the subsequent challenge in enforcing IP rights against a backdrop of global and decentralized digital content distribution.

The rise of LLMs trained on vast troves of digitized text and data raises pressing intellectual property (IP) rights concerns. As Gu¨rpinar (Reference Gu¨rpinar2016) discusses, the indiscriminate use of copyrighted material to develop AI systems makes enforcing traditional IP protections difficult, especially given the decentralized and global digital content distribution today. This tension between technological innovation and copyright protection is not new; as Goldstein (Reference Goldstein2003) observes, copyright law has continually evolved to address challenges posed by emerging technologies, from the printing press to digital media, often struggling to balance creator rights with public access. Simply maximizing IP monopoly rights can also impede innovation, as evidenced by the marginalization of open sharing and reciprocal knowledge development (O¨zeveren and Gurpinar, Reference O¨zeveren and Gurpinar2023). Frischmann (Reference Frischmann2007) critiques the notion popular in IP law scholarship that internalizing externalities via extensive private property rights over knowledge goods inevitably maximizes creative investment; this assumption does not withstand empirical scrutiny. Indeed, tightly controlling access to knowledge inputs can inhibit cumulative innovation that builds on prior ideas (Goodman and Lehto, Reference Goodman and Lehto2023). Mikhaylov et al. (Reference Mikhaylov, Esteve and Campion2018) also discuss the ownership and usage permissions challenges regarding copyrighted data used to train AI models.

What do all these challenges have in common? We believe that a leading challenge facing LLMs stems from the transaction costs associated with identifying ownership and ensuring the proper remuneration of the IP (Coase, Reference Coase1960). In particular, AI models are generally designed by training on a vast amount of data, and often without strong exante expectations over what data will necessarily be most valuable in generating a reliable predictive model. Moreover, these factors and the relative weights on different variables can change. In this sense, attribution is at least partially a function of transaction costs because AI developers could argue that it is prohibitively costly to identify all the relevant owners of each piece of content and negotiate with them directly.

NFTs can provide a solution by creating a common taxonomy for classifying IP, making it publicly accessible on the blockchain, and allowing meta-data to be easily searchable. If every piece of uploaded data was issued via an NFT, then AI developers could procure NFTs that reflect partial ownership over the data and use it to train their models. Moreover, NFTs allow the creators to clarify the ownership rights over created content – big or small, eliminating the ambiguity of ownership and usage rights through the public recognition of a verifiable owner. For instance, a buyer could buy the NFT for exclusive and complete access or simply the right to use it in training models. In other words, NFTs could enable automated licensing, streamlining the process of obtaining permissions and distributing royalties.Footnote 5 This reduction in transaction costs could facilitate more efficient and fair remuneration for content creators. Blockchain reduces transaction costs by automating rights verification, eliminating intermediaries in licensing, and providing transparent, tamper-proof records of ownership. Smart contracts streamline royalty distribution, reducing administrative overhead.

A key benefit of recording ownership on a blockchain is having an immutable, transparent record that does not require trusting a central authority (Arruñada, Reference Arrun˜ada2019). Smart contracts can programmatically enforce licensing terms specified in an NFT (Davidson et al., Reference Davidson, Filippi and Potts2018). But as Howell and Potgieter (Reference Howell and Potgieter2021) note, the deterministic and incomplete nature of smart contracts makes them poorly suited for flexible, nuanced dispute resolution. Coase’s theory on transaction costs suggests that the effectiveness of NFTs in IP enforcement will depend on how well these new technologies reduce the costs associated with defining and enforcing property rights. The development of hybrid governance mechanisms, such as the Kleros system for arbitrating blockchain disputes, reflects a Coasean approach to minimizing transaction costs through institutional innovation.

And yet, even with the best technology and intentions, a recurring challenge is in the enforcement and maintenance of the blockchain. In particular, what happens if one content creator issues an NFT that is nearly identical to another content creator’s, perhaps out of ignorance rather than malicious intent? Drawing from Ostrom’s principles of collective management and polycentric governance (Ostrom, Reference Ostrom1990), we argue that collective action is required among the various stakeholders in digital content ecosystems, ranging from content creators to companies developing AI models to federal authorities (e.g., the judicial system). We explore these ideas next.

Polycentric governance for enhanced enforcement

To our knowledge, there have been few practical solutions towards the enforcement of IP on the blockchain. Existing platforms, such as OpenSea and Rarible, are unable to vet for scams and their resources have been stretched thin by malicious users who often impersonate them on social media, like Discord. The bulk of the writing, largely in the popular press, focuses on how the blockchain can be used in IP law, e.g. through writing smart contracts on the blockchain, but almost none is focused on how such IP would be maintained and enforced. We argue that polycentric governance, characterized by multiple, overlapping decision-making centers, offers a nuanced approach to enforcing IP rights in the digital ecosystem. This model acknowledges the diversity of stakeholders involved – from content creators and technology firms to policymakers and consumers – and their varied interests and capacities in IP protection.

Polycentric governance encourages collaboration among stakeholders, which could enable the development of shared standards and protocols that reflect a consensus on IP rights management. In particular, this collaboration can lead to innovative enforcement mechanisms tailored to the digital environment. Polycentric governance advocates collaborative approaches that unite diverse stakeholders to jointly develop institutional mechanisms tailored to digital contexts (Oxley, Reference Oxley1999). Such multi-stakeholder cooperation can lead to shared norms and protocols governing IP rights and enforcement attuned to the complex realities of decentralized creation and distribution of digital content (Gu¨rpinar, Reference Gu¨rpinar2016). These governance arrangements recognize the varied interests at play – from commercial entities to individual creators and user communities – and provide avenues for consensus-building around access, sharing, and incentives.

In knowledge-sharing contexts like open-source software and mining industries, collaborative governance arrangements already enable innovation while avoiding over-privatization of knowledge resources (Schweik, Reference Schweik, Frischmann, Madison and Strandburg2014; Lin et al., Reference Lin, Wang and Yuan2023). The success of such arrangements highlights the potential for similar multi-stakeholder cooperation in developing enforcement protocols for digital IP rights. Online creation communities that pool effort and co-produce common resources also employ collaborative governance combining formal rules and shared norms (Morell, Reference Morell, Frischmann, Madison and Strandburg2014). To that end, NFTs can be a tool for signaling public contributions towards common goods and/or sharing or receiving ownership for individual or team contributions. NFTs provide a mechanism to establish provenance and ownership of digital content, creating unique digital certificates.

In practice, collaborative governance has shown promise in various knowledge-sharing contexts, such as open-source software development and fisheries. These fields have successfully implemented governance structures that promote innovation while avoiding the pitfalls of over-privatization of knowledge resources. For instance, the cooperative frameworks used in open-source communities highlight the potential for similar multistakeholder arrangements in digital IP rights enforcement. These communities thrive on a combination of formal rules and shared norms, which ensure that collective efforts are coordinated and that the fruits of collaboration are equitably shared.

Additionally, online creation communities, which pool resources and co-produce common goods, offer valuable insights into the design of distributed IP rights management systems. By drawing on these insights, policymakers and stakeholders can develop institutional designs that support effective and fair IP rights management in the digital age. NFTs, when integrated into these governance structures, can further enhance transparency, accountability, and efficiency in managing digital IP rights, ensuring that content creators receive fair compensation while fostering an environment of innovation.

By involving stakeholders in governance, polycentric systems can adapt legal frameworks to the realities of digital content creation and distribution. This adaptability is crucial for developing laws and regulations that can effectively address the nuances of IP rights in the context of LLMs and other digital technologies. Flexible legal frameworks that can adapt to emerging digital technologies like LLMs are crucial, as rigid regulations often fail to effectively address the nuances and realities of systems like generative AI and decentralized networks (De Filippi et al., Reference De Filippi, Mannan and Reijers2020). Issues like bias, transparency, and misinformation exist with LLMs (Dvorak et al., Reference Dvorak, Stumpf, Fehrler and Fischbacher2024; Vergho et al., Reference Vergho, Godbout, Rabbany and Pelrine2024) that static laws may not cover. Decentralized and polycentric governance models tie into balancing international incentives and tradeoffs regarding intellectual property rights protections (Scotchmer, Reference Scotchmer2004). Regulatory ambiguity can also deter entrepreneurial innovation, indicating the demand for clearer and more flexible legal ecosystems (Luther, Reference Luther2022).

Ostrom’s concept of polycentric governance, characterized by multiple, overlapping decision-making centers, is particularly relevant for developing adaptive legal frameworks. Involving diverse stakeholders – such as content creators, technology firms, policymakers, and consumers – in the governance process ensures that the legal structures are responsive to the nuances of digital content creation. This collaborative approach can lead to the development of shared norms and protocols that reflect the collective interests of all parties involved (Markey-Towler, Reference Markey-Towler2019; Cowen, Reference Cowen2019; Jia et al., Reference Jia, Lam, Mai, Hancock and Bernstein2024).

Polycentric governance supports decentralized enforcement mechanisms, leveraging technology and community norms alongside formal legal systems. This approach allows for more effective monitoring and enforcement of IP rights across different jurisdictions and digital platforms. Emerging blockchain networks allow decentralized enforcement of rules and agreements through distributed protocols and community norms alongside more traditional legal systems. As Reijers et al. (Reference Reijers, Wuisman, Mannan, De Filippi, Wray, Rae-Looi, Cubillos V´elez and Orgad2021) discuss, tensions can arise between strictly on-chain decentralized governance enforcing agreements via code and traditional off-chain legal governance. This tension reflects Coase’s insights on transaction costs where the friction between different governance mechanisms can impact the efficiency of enforcement. Reducing these transaction costs through integrated decentralized and centralized systems can enhance enforcement efficiency.

Ostrom’s polycentric governance principles further illuminate the benefits of combining decentralized algorithmic enforcement with formal legal mechanisms. As Frolov (Reference Frolov2021) notes, blockchain institutions combine decentralized algorithmic enforcement elements with formal legal mechanisms. According to Tarko (Reference Tarko, Boettke and Martin2020), open-source software communities demonstrate how social norms and technology can facilitate enforcement without relying solely on centralized legal institutions. This example underscores Ostrom’s findings on the efficacy of community norms and self-governance. By allowing stakeholders to develop and enforce their own rules, these communities reduce reliance on external legal systems, thus lowering enforcement costs and improving compliance.

Polycentric systems integrating decentralized blockchain protocols and traditional governance may support more effective monitoring and enforcement across jurisdictions. Geographical indications provide a decentralized intellectual property rights framework spanning international borders, as Maz´e (Reference Maz´e2023) describes. Similarly, as outlined in Alston et al. (Reference Alston, Law, Murtazashvili and Weiss2022), public blockchain projects like Bitcoin and Ethereum feature decentralized rule-enforcement, enabling autonomous transactions without centralized oversight. Beyond payments, Davidson et al. (Reference Davidson, Filippi and Potts2018) suggest blockchains could also provide decentralized contractual enforcement. Using blockchain for contract enforcement, stakeholders can reduce reliance on centralized authorities, lower enforcement costs, and increase trust among parties. Murtazashvili et al. (Reference Murtazashvili, Murtazashvili, Weiss and Madison2022) institutional analysis of blockchain governance examines the range of mechanisms influencing rule compliance.

IP rights are frequently framed in a polarized conflict between private interests and public access. However, polycentric systems provide an alternative model where diverse stakeholders can be brought into alignment (Berg et al., Reference Berg, Berg and Novak2020). As Ostrom and Hess (Reference Ostrom and Hess2006) describe, knowledge commons require governance systems that balance open access with restrictions that ensure the resources are sustained. Spithoven (Reference Spithoven2019) applies Ostrom’s framework for governing the commons to analyze permissioned blockchain systems, which incorporate oversight from trusted parties into the decentralized network. These permissioned systems attempt to balance the private incentives needed for innovation with public interests in transparency and accountability. Nevertheless, new technologies always make it difficult to balance competing incentives around IP rights at the beginning. For example, Mikhaylov et al. (Reference Mikhaylov, Esteve and Campion2018) examine efforts to implement AI systems in public services, which requires collaboration across private sector developers, university researchers, and government agencies. Each stakeholder has different incentives, expectations, and norms around data sharing and privacy. By recognizing these varied viewpoints, polycentric governance provides a model through which innovations can be tailored to public values rather than maximize purely private returns.

Operationalizing IP rights with NFTs

NFTs offer a technological means to operationalize IP rights, providing a secure and immutable record of ownership and licensing terms on a blockchain. However, the efficacy of NFTs in enforcing IP rights hinges on their acceptance and integration into digital platforms, as well as the development of legal frameworks that recognize and support their use through the use of polycentric governance. Moreover, NFTs can span a range of assets, including digital or physical real estate (Yencha, Reference Yencha2023).

New governance mechanisms like the Kleros system have emerged to arbitrate blockchain disputes, but greater integration with legal frameworks is still needed. Until jurisprudence develops around enforcing rights recorded on a blockchain, uncertainties will dampen firms’ willingness to rely solely on NFTs for digital rights management. This highlights the need for ongoing adaptation and learning, as emphasized by Ostrom’s principles of polycentric governance. Hybrid approaches that leverage NFTs where they excel while retaining offline options for adjudication and enforcement may also prove effective. Vatiero (Reference Vatiero2022) suggests evaluating governance solutions not based on an absolutist smart contract versus traditional contracts dichotomy, but in terms of how well they support the continual adaptation necessary in real-world transactions. NFTs lower barriers to asserting rights, but various online and offline institutions must evolve in parallel to fully realize their potential. Advances on political, social, and technological dimensions are all required to transition towards increasingly sophisticated and reliable web3 systems. A hybrid governance model could integrate blockchain’s transparency with legal oversight. Smart contracts could register copyright claims on-chain while allowing off-chain adjudication for disputed cases. Decentralized arbitration platforms could play a key role in validating claims, ensuring compliance with both digital and legal frameworks.

Through smart contracts, NFTs can automate the distribution of royalties, ensuring that content creators are compensated for using their work. Bamakan et al. (Reference Bamakan, Nezhadsistani, Bodaghi and Qu2022) explain that one of the most significant advantages of NFTs in the context of IP is the ability to automate royalty collection. By minting patents as NFTs and combining them into commercial IP portfolios, inventors can ensure that they receive their fair share of royalties whenever their innovation is licensed. This is made possible by the automatic royalty collecting methods embedded within the NFTs. For example, when a patent is minted as an NFT and joined with others to form a compound NFT representing an IP portfolio, each inventor will automatically receive their portion of the royalties generated from licensing revenue. This eliminates the need to track down individual inventors and ensures that they are fairly compensated for their work.

Chalmers et al. (Reference Chalmers, Fisch, Matthews, Quinn and Recker2022) explain that NFTs, as blockchain-enabled cryptographic assets, represent proof-of-ownership for digital objects. This unique property of NFTs has been pioneered by creative industry entrepreneurs seeking new revenue streams and modes of stakeholder engagement. The ability to prove ownership and transfer rights through NFTs opens up the possibility of automating royalty payments to creators, like artists (Makridis and Hanneke, Reference Makridis, Hanneke and Themistocleous2025). This application aligns with Ostrom’s principles by ensuring that the rules of ownership and compensation are transparent and enforced consistently, thereby fostering a more collaborative and fair ecosystem for creators. NFT ownership does not inherently grant legal copyright over a work – it only confers ownership of the token itself. This distinction has been the subject of extensive legal debate. In response, emerging governance models aim to embed licensing terms within NFT smart contracts to specify the rights conferred to holders, creating clearer legal interoperability.

Interoperability across platforms and jurisdictions must be achieved for NFTs to effectively enforce IP rights. However, a key challenge will be facilitating the development of appropriate standards. Berg et al. (Reference Berg, Davidson, Potts and Wagner2018) characterize blockchains as constitutional orders that offer a unique economic environment for institutional discovery. This suggests that polycentric governance emerging through groups coordinating on blockchain platforms could promote standards tailored to those communities. Since blockchain allows for decentralized governance across global stakeholders (Reinsberg, Reference Reinsberg2021), platform-specific governance combined with cross-platform coordination resembles a type of polycentric governance that can potentially address technological interoperability issues. This approach aligns with Ostrom’s principles by ensuring that governance structures are flexible and adaptive, capable of evolving in response to new challenges and information.

There are some policy challenges. Allen et al. (Reference Allen, Berg, Davidson, Novak and Potts2019) discuss the need for regulatory recognition and compatibility for adopting blockchain technologies at scale across supply chains spanning jurisdictions. That may require integrating polycentric governance with policy frameworks to achieve interoperability. De Filippi et al. (Reference De Filippi, Mannan and Reijers2020) also explore blockchain governance challenges, including developing legal and constitutional structures suited for this technology. For NFTs to see widespread compatible use for IP rights enforcement via interoperable platforms and protocols, a governance model that bridges policy and community-led standards provides a path forward. Polycentric structures with cooperation between niche governance bodies facilitate the discovery and diffusion of effective solutions. While open-source frameworks aim to ensure content remains freely accessible, blockchain-based IP enforcement seeks to balance creator compensation with accessibility by enabling micropayments and automated licensing agreements.

Polycentricity, with its emphasis on stakeholder collaboration and decentralized enforcement, can address the challenges of enforcing IP rights in a global and digital context, while NFTs provide the technological means to assert and manage these rights securely. Together, these elements offer a path forward in reconciling the demands of IP protection with the imperatives of innovation and access in the digital economy.

Barriers to adoption

While we have referenced several challenges in this vision of connecting blockchain and AI, we explore a more detailed discussion of them here: (1) transaction costs that make it difficult to adopt and maintain such a system, (2) technical and feasibility issues that require further research, and (3) the limited adoption of blockchain.

First, AI firms currently face high operational costs due to compute-intensive training. However, emerging decentralized solutions such as Salad’s distributed computing network have demonstrated cost reductions of up to 90%. With computing costs declining, licensing fees for training data become more feasible. Moreover, cost-sharing models, such as per-use micropayments and subscription-based licensing, spread costs across multiple users, making compensation for content creators viable without burdening AI firms.

Second, as we discuss in more detail later, there are an emerging set of blockchain-based solutions. For example, we provide a case-study of Kleros, a decentralized dispute resolution system that uses randomly selected jurors to arbitrate smart contract disputes. It has been applied to copyright claims and could serve as a model for polycentric governance of AI-generated content. Another notable example is the Story Protocol.

Third, transaction costs pose a significant challenge to adopting NFTs and blockchain technology for managing intellectual property rights. The costs associated with transitioning to a new system, including the development and implementation of the necessary infrastructure and the education and onboarding of content creators and users, are substantial, much like the adoption of the internet.Footnote 6 Moreover, there is a first-mover problem, as the new system’s benefits may not be fully realized until a critical mass of participants has adopted it. This creates a chicken-and-egg situation where content creators may be reluctant to invest in the new system until there is a large enough user base to justify the costs. In contrast, users may not adopt the system until there is a sufficient amount of content available. As a result, the high transaction costs and the first-mover problem can create significant barriers to the widespread adoption of NFTs and blockchain for IP management, even if the technology can potentially address some of the challenges associated with traditional IP enforcement in the digital age.

Several technical challenges raise doubts about the feasibility of using blockchain and NFTs to manage intellectual property rights effectively. One of the primary concerns is the difficulty in establishing genuine ownership of digital assets through blockchain technology. While NFTs are designed to provide a unique and immutable record of ownership, the nature of digital content makes it vulnerable to reproduction and manipulation. AI systems, in particular, can analyze and replicate digital content, potentially stripping it of its encryption and making it indistinguishable from the original. This raises questions about the practical enforceability of ownership claims based on NFTs, as the technology may not prevent unauthorized use or replication of the associated digital assets. Therein is a tension between NFT-based enforcement and traditional frameworks: copyright law recognizes public domain elements, fair use, and fair dealing, while blockchain-based enforcement allocate rigid technological rights that may not align with legal interpretations. Future research should examine how polycentric governance models could address these gaps by integrating automated blockchain verification with judicial oversight.

Another significant issue is the limited adoption of blockchain, which makes it tough to prevent the use of copyrighted material. While blockchain can provide a tamper-proof record of ownership and transactions, it still requires a legal infrastructure to enforce the unauthorized use or distribution of the content. Some customary problems, such as proving ownership and tracking the provenance of digital assets, may be addressed by blockchain, but it is not a comprehensive solution for the full range of intellectual property rights issues. Copyright infringement, for example, can still occur even if the ownership of the original content is recorded on a blockchain, as the technology cannot physically restrict the copying and sharing of digital files. Unlike patents, which provide clear ex ante rights, copyrights require ex post adjudication to determine fair use and public domain exemptions. Blockchain-based systems currently do not integrate such discretionary mechanisms. However, polycentric governance offers a potential remedy: decentralized arbitration platforms, such as Kleros, could help resolve disputes over NFT-registered works and ensure blockchain-enforced rights align with legal norms.

The challenge posed by derivative works further complicates using blockchain and NFTs for IP management. Derivative works, based on or inspired by existing content, are common in the digital landscape. However, distinguishing between original and derivative content is a complex task that may be technologically impossible to fully achieve. AI systems could compound this problem, as they can analyze and generate content similar to existing works, making it even more difficult to determine the origins and ownership of digital assets. This lack of clarity surrounding derivative works poses a significant obstacle to the effective use of blockchain and NFTs for IP management, as the technology may struggle to identify and protect original content creators’ rights accurately.

Fundamental security issues associated with blockchain and NFTs could undermine the proposed system’s implementation. While blockchain technology is often touted for its security and immutability, it is not immune to vulnerabilities and attacks (Makridis, Reference Makridis2023). Smart contracts, which are used to automate transactions and enforce rules on the blockchain, can contain bugs or be exploited by malicious actors. Additionally, the decentralized nature of blockchain networks can make it difficult to respond to and mitigate security breaches, as there is no central authority to coordinate a response. These security concerns raise questions about the reliability and resilience of a blockchain-based IP management system, particularly when dealing with high-value digital assets and sensitive intellectual property rights, and underscore the necessity for good human oversight.

The proposed use of blockchain and NFTs for intellectual property rights management could also inadvertently lead to centralization, which would contradict the decentralized ethos often associated with these technologies. Large companies, such as OpenAI, may seek to overcome the high transaction costs and navigate the complex landscape of IP patent thickets by acquiring the rights to vast content providers. This centralization of IP rights raises fundamental questions about how property rights are institutionally established and maintained in digital contexts. As Sened (Reference Sened1997) argues, property rights emerge from political institutions through a process where governments grant and protect rights in exchange for political and economic support – a theoretical framework that warrants further exploration in the context of blockchain-based IP systems. This consolidation of IP rights could result in a centralized system where a few powerful and resourced entities control a significant portion of the digital content market.

The centralization of IP rights through corporate acquisitions also raises concerns about content creators’ bargaining power and fair compensation. Suppose large companies become the primary holders of IP rights. In that case, they may dictate the terms and conditions under which content can be used and distributed, potentially leading to unfavourable agreements for content creators. This power imbalance could result in lower royalties, limited creative control, and reduced incentives for content creators to produce new works, ultimately hampering the growth and diversity of the digital content ecosystem. Having tools that empower content creators to make their own decisions about who to sell their IP to and under what terms will be crucial to maintain competition.

Despite the significant barriers outlined above, the prohibitive costs of implementing NFTs and blockchain-based solutions for IP management should not deter us from considering them as viable institutional innovations. The costs of agreement on institutional solutions are critical factors that influence the prospects for institutional change, but these costs are not static and may evolve over time (Kingston and Caballero Miguez, Reference Kingston and Caballero Miguez2009; Eggertsson, Reference Eggertsson2009). Furthermore, seemingly prohibitive coordination costs may be overcome through incremental institutional adaptation (Ostrom and Basurto, Reference Ostrom and Basurto2010), while complementarities between institutions can both create resistance and, once overcome, accelerate adoption through positive feedback loops (Pagano, Reference Pagano2010). Mental models contributing to institutional inertia can be altered through educational efforts and technological demonstrations (Rosenbaum, Reference Rosenbaum2021). Therefore, while acknowledging the current barriers, ongoing experimentation and dialogue among stakeholders may uncover pathways to realize the potential benefits of blockchain technology in IP management.

Case-study: Kleros dispute resolution

What is Kleros?

Kleros is a decentralized arbitration protocol on Ethereum that uses game-theoretic crowdsourced juries to resolve disputes in smart contracts.Footnote 7 , Footnote 8 When an NFT or intellectual property dispute arises (e.g. a claim that an NFT art was minted without the creator’s consent), the case can be submitted to a Kleros court. The process works as follows:

-

(1) Dispute Initialization: Parties agree (often via a smart contract) to use Kleros as the arbitrator. For instance, an NFT marketplace or registry might integrate Kleros so that if authenticity or ownership is challenged, the case is escalated to Kleros. The disputed asset or funds can be automatically locked in escrow by the smart contract pending the decision.

-

(2) Juror Selection: Kleros selects jurors randomly from a pool of volunteers who have staked its native token Pinakion (PNK) in the relevant court. Staking PNK signals willingness to serve; the more one stakes, the higher the probability of being drawn as a juror. Jurors are typically pseudonymous and globally distributed (no formal legal training required), which allows a diverse ‘crowd jury.’ In specialized courts (say for copyright or art disputes), jurors with relevant skills can self-select by joining that court, although that must be properly incentivized.

-

(3) Evidence and Argument: The disputing parties submit evidence (e.g. proof of original artwork, license agreements, and transaction records) through the Kleros platform. There is a set period for evidence and arguments to be uploaded for jurors to review. Communication between jurors is forbidden, and jurors must make decisions independently to prevent collusion.

-

(4) Voting: Jurors review the evidence and then vote for the outcome they find correct or fair. Votes are committed anonymously on-chain and revealed only after the voting period ends, so jurors cannot see others’ votes beforehand. Each juror answers the dispute question (e.g., ‘Was this NFT minted by the rightful owner of the artwork?’) with a yes/no or by selecting the winning party.

-

(5) Decision and Enforcement: Once votes are revealed, the outcome with the most juror votes becomes the verdict. Then, the smart contract executes the verdict, e.g. marking an NFT as authentic or removing a fraudulent NFT from a registry. Because Kleros can be directly plugged into smart contracts, enforcement is often automatic – e.g. releasing escrowed funds to the winner or updating a token registry without needing a court order. In an ‘Authentic NFT’ registry curated by Kleros, for example, an entry will be accepted or rejected based on the jurors’ ruling on whether the NFT was minted with the creator’s consent.

Kleros has been used to verify and enforce content rights via tokenized registries. For example, the Kleros Authentic NFTs Registry lists NFTs and collections that jurors have verified as legitimately minted by the true creator or with the creator’s permission (Kleros, 2022). If someone tries to register or sell an NFT that copies someone else’s art without permission, anyone can challenge it in Kleros. Jurors then examine the evidence (e.g., original art proofs, timestamps) and rule whether the NFT is authentic. The policy aims to prevent passing off another’s work as one’s own: ‘NFTs certified through this registry should be minted by the author or with the author’s direct or indirect consent. It should not be possible to pass off another’s work as one’s own.’

Tokenomics of Kleros

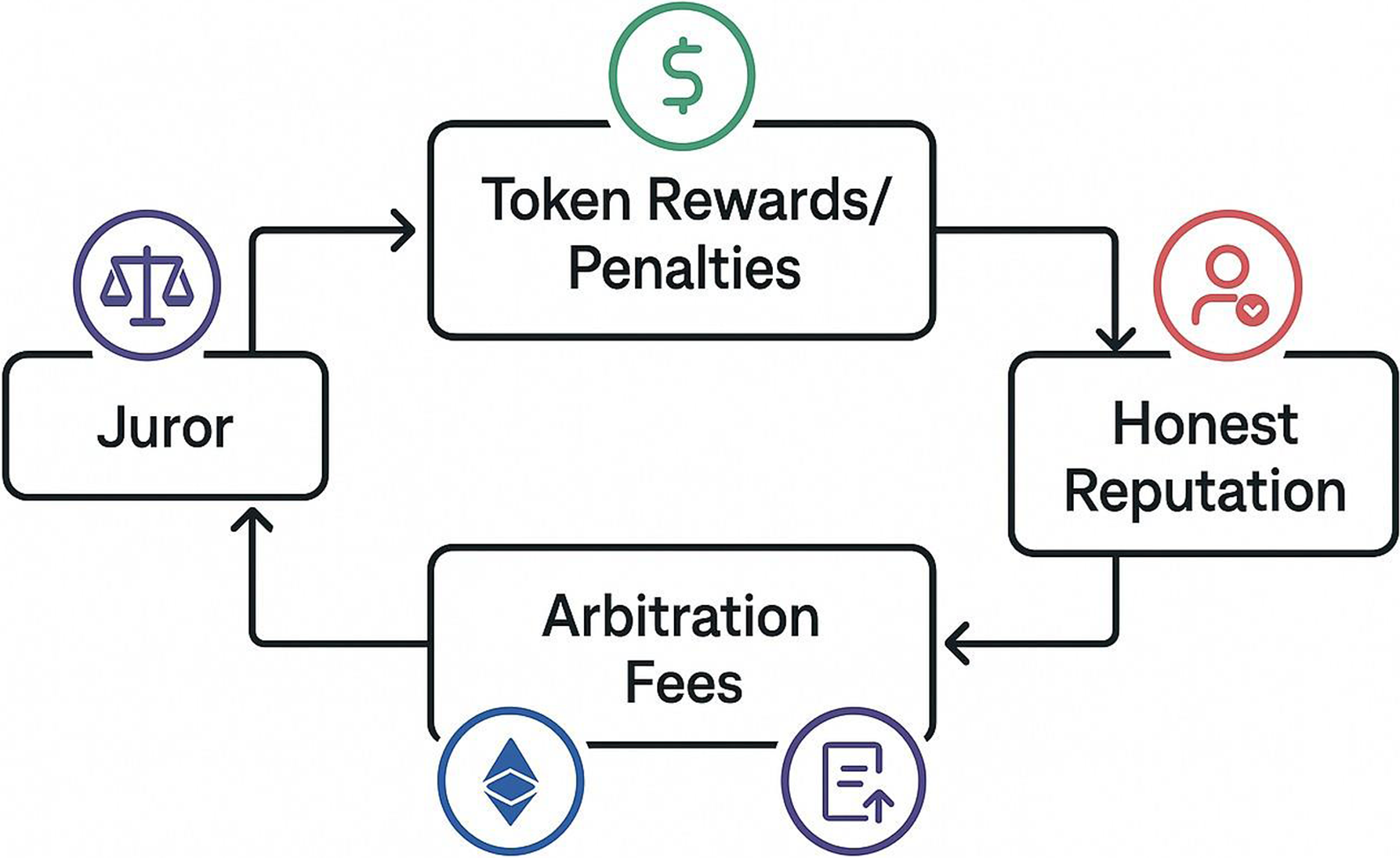

Kleros’ design relies on crypto-economic incentives to ensure jurors decide cases fairly and honestly. Jurors stake PNK tokens to be selected, and this stake is at risk depending on how they vote. The incentive mechanism is summarized as follows (see Figure 1):

-

(6) Token Rewards/Penalties: After a vote, jurors who voted with the majority outcome receive financial rewards, while those in the minority lose a portion of their staked tokens. In other words, if a juror votes for what ends up being the winning verdict, they gain tokens (partly taken from the losing side’s stakes or from arbitration fees). But if they vote against the eventual consensus, they forfeit some of their stake. This creates a Schelling point dynamic – the optimal strategy is to vote for the truthful or most likely fair outcome, which one expects the majority of honest jurors to also choose. Voting capriciously or with bias is financially disincentivized, since it risks ending up in the minority and losing tokens.

-

(7) Arbitration Fees: The parties in dispute pay a fee to Kleros (denominated in ETH or tokens) to open a case. These arbitration fees are pooled and ultimately paid out to the jurors of that case as compensation for their work. Thus, jurors earn not only tokens but also a share of the fees (often converted to the token). This provides positive incentive to participate in the system and come to a clear resolution (the faster and more unanimously they decide correctly, the more valuable their reward relative to their stake at risk).

-

(8) Appeal System: Kleros allows disputes to be appealed, but the appeal requires a higher number of jurors and a higher cost. Each round, the arbitration fees increase. This escalating cost of appeal discourages frivolous appeals and helps finalize decisions. If a party truly believes a verdict was wrong, they can pay for an appeal, pulling more jurors into the case (and ultimately even allowing the community to resolve extreme disagreements by a fork of the court if deadlock occurs). However, due to the cost, appeals are only pursued when the stake is high or there is strong belief the initial ruling was mistaken.

-

(9) Honest Reputation: By design, jurors do not earn an ongoing reputation score (anyone staking can be drawn), which prevents popularity contests, but effective reputation is earned in the form of token gains. A consistently honest juror will accumulate PNK and profits over time, increasing their ability to stake in more courts. Empirically, in a large-scale experiment Kleros ran, honest jurors did indeed ‘substantially prevail’ financially – they earned the most by consistently voting correctly, whereas dishonest votes lost tokens. One active Kleros juror noted that ‘game theory means you participate honestly in the Kleros system… If you behave in the wrong way, you lose more money on average.’ This alignment of economic self-interest with truthful judgments is at the core of Kleros’ incentive model.

Figure 1. Kleros Tokenomics visualization.

Importantly, jurors are randomly selected and anonymous, reducing the risk of bribery or intimidation. They are also penalized for collusion or vote revealing (e.g., if they try to prove how they voted before the vote is finalized). These measures, combined with the token mechanism, encourage jurors to focus only on the case facts and what they believe other honest jurors will conclude. The result is a decentralized jury system where fairness emerges from collective rationality rather than top-down supervision.

Comparison with traditional systems

Kleros provides a much faster and cheaper avenue for resolving disputes compared to traditional legal systems. On average, disputes on Kleros are resolved in a matter of days, not months. One report notes that consumer disputes handled via Kleros typically conclude ‘in just a few days, compared to consumer claims that may take up to 30 days at best’ even in alternative forums (Ast et al., Reference Ast, Pernas and T2024). The costs are also dramatically lower – often on the order of tens of dollars in fees, whereas taking a case to court or arbitration could cost hundreds or thousands of dollars in legal fees. This efficiency makes Kleros especially effective for small claims and cross-border digital disputes that would be impractical to litigate in regular courts (where jurisdiction and cost barriers often leave victims with no remedy). By lowering the barriers to justice, Kleros ‘provides a fast, inexpensive, transparent, reliable and decentralized’ way to handle the ‘vast amount of disputes that happen in online transactions’ (Aouidef et al., Reference Aouidef, Ast and Deffains2021).

While Kleros itself cannot send police to enforce a judgement, its integration with blockchain allows for automated enforcement in many cases. If an NFT or token is ruled to be owned by a certain party, the smart contract can directly transfer or freeze it accordingly. This on-chain enforcement is effective for digital assets, the code will execute the jury’s decision without needing further human intervention. For example, if Kleros jurors rule that an NFT is a plagiarized copy, that NFT can be removed from the curated registry or flagged, thus preventing its sale on integrated marketplaces. This provides a form of digital property rights enforcement: creators’ rights are upheld by removing infringing content, and buyers gain trust that ‘Kleros-certified’ items are legitimate.

Crucially, Kleros decisions can also be bridged to real-world legal systems when needed, which is a necessary condition for any feasible governance system. A landmark case in 2020 showed that Kleros-based arbitration can hold up under judicial scrutiny (Aouidef et al., Reference Aouidef, Ast and Deffains2021). In that case, a dispute over a rental agreement in Mexico was submitted to Kleros (per an arbitration clause the parties had agreed to). A panel of three Kleros jurors reviewed the evidence and unanimously ruled in favor of the landlord, who claimed unpaid rent. The arbitrator overseeing the case then issued an award reflecting the Kleros verdict, and a Mexican court recognized and enforced that arbitral award, ordering the tenant to pay the rent owed. This was reportedly the first time a blockchain arbitration protocol’s decision was enforced by a national court. It demonstrated that, at least when voluntarily adopted by the parties, Kleros rulings can translate into legally binding outcomes off-chain. The enforcement in a real court lends credibility to Kleros as a mechanism complementary to traditional law, especially for small claims. It’s ‘fast and affordable,’ yet can dovetail into formal legal enforcement if structured properly.

Kleros has grown steadily and has a proven track record in the Web3 domain. As of 2023, the platform has handled 900+ disputes spanning categories like token listings, insurance claims, escrow disagreements, and content moderation. It has been used in DeFi and prediction markets to adjudicate outcomes (for example, resolving Oracle disputes about whether certain events occurred), in identity verification (the Proof-of-Humanity project uses Kleros to verify unique personhood and catch duplicate accounts, and in NFT authentication as discussed. These cases show Kleros effectively resolving issues that traditional courts might not handle due to low value or technical complexity. The early Kleros whitepaper found that in a sample of crowdsourced cases (categorizing images of dogs vs. cats as a test scenario), the system reached the correct ‘Schelling point’ outcome the vast majority of the time – 70% of cases were resolved in favor of the rightful claimant (plaintiff), often with unanimous juror decisions, and honest jurors (those who voted truthfully) earned the highest rewards (Lesaege et al., Reference Lesaege, Ast and George2019), suggesting that the juror incentive mechanism works as intended to produce fair and accurate results in practice.

Compared to traditional legal systems, Kleros lacks some powers (no direct coercive power beyond the blockchain, and no formal requirement that jurors understand the law), but it excels in accessibility and neutrality. There’s no need to worry about jurisdiction or enforcing judgements across borders when everything happens on a public blockchain. Anyone anywhere can get a dispute resolved quickly. Moreover, the impartiality of anonymous peer jurors can in some cases be an advantage – there is no single judge or arbiter who might be biased or corrupt, and each juror has a financial motive to get it right. That said, there are open questions about ensuring quality: Complex IP cases (like fair use or patent claims) might be too nuanced for a lay jury, and outcomes rely on the evidence provided. Critics point out potential variability or bias in ‘crowd decisions,’ as randomly selected jurors may not always have the expertise for intricate copyright law. Kleros is addressing this by allowing specialized courts (so only jurors who know the subject opt in) and exploring identity-verified jurors or weighted voting to increase decision quality (Frontiers). Despite such challenges, Kleros’ effectiveness is demonstrated by its growing adoption. Many Ethereum projects have integrated Kleros as a plug-and-play dispute resolver (e.g. for DAO governance, marketplace escrow, and NFT verification), showing that it can fill gaps where traditional IP enforcement and contract law struggle.

Conclusion

The emergence of LLMs and their reliance on vast datasets containing copyrighted material has brought to the forefront the limitations of traditional intellectual property rights enforcement in the digital domain. As the lawsuits against tech giants like OpenAI demonstrate, there is a pressing need for a new approach to governing and enforcing IP rights that balances the interests of content creators, platform providers, and end-users. These challenges can be resolved by thinking about AI and blockchain as two sides of the same coin, and already we are starting to see evidence of complementarity in patenting activity (Makridis et al., Reference Makridis, Bates, Barnes and Glasgow-George2024).

This paper argues that a polycentric governance model, combined with the use of non-fungible tokens (NFTs) on blockchain technology, offers a promising solution to the IP rights challenges posed by LLMs. Polycentric governance, with its emphasis on stakeholder collaboration, flexible legal frameworks, decentralized enforcement, and incentive alignment, provides a framework for developing context-specific solutions that adapt to the realities of digital content creation and distribution.

NFTs, in turn, provide the technological means to operationalize IP rights by offering a secure and immutable record of ownership and licensing terms on the blockchain. Through smart contracts, NFTs can automate royalty distribution, ensuring that content creators are fairly compensated for their work. However, the effectiveness of NFTs in enforcing IP rights depends on their interoperability across platforms and jurisdictions, which can be facilitated through polycentric governance and the development of shared standards and protocols. By integrating polycentric governance principles with the use of NFTs, a more robust and adaptable framework for protecting and enforcing IP rights in the digital age can be achieved. This approach recognizes the complex web of stakeholders involved in the digital ecosystem and seeks to balance their diverse interests through collaboration, decentralization, and the alignment of incentives.

Several significant barriers must be addressed before widespread adoption occurs. High transaction costs, technical limitations in proving ownership and preventing unauthorized use, the challenge of derivative works, and security vulnerabilities all raise doubts about the feasibility of using NFTs and blockchain for IP management. There are also concerns that this approach could lead to centralization, with large corporations acquiring vast amounts of content and limiting competition. Furthermore, the opt-in nature of NFTs may not appeal to many content creators who would prefer an opt-out system. Implementing an opt-out model, however, would require overcoming legal, technical, and operational hurdles. Ultimately, policymakers, industry stakeholders, and technology providers will need to collaborate to find a balance that addresses these challenges while harnessing the potential benefits of NFTs and blockchain for protecting intellectual property rights in an increasingly digital world.

As the digital landscape continues to evolve, with the rapid advancement of AI technologies like LLMs, it is crucial to develop governance models that can keep pace with these changes while upholding the fundamental principles of intellectual property rights protection. As the metaverse and other large platforms evolve and serve diverse customers, new use cases and markets for IP protection may emerge. The combination of polycentric governance and NFTs offers a promising path forward, one that leverages the strengths of both institutional design and technological innovation to create a more equitable and sustainable digital economy.

Acknowledgements

We thank the Center for Governance and Markets at the University of Pittsburgh for organizing a conference and all the participants for their thoughtful feedback.