Refine search

Actions for selected content:

233 results

4 - Squint

- from Part One - Getting to Tenure

-

- Book:

- The War on Tenure

- Published online:

- 30 September 2025

- Print publication:

- 30 September 2025, pp 23-30

-

- Chapter

- Export citation

The long shadow of divorce: lifecourse, gender and later-life work and retirement

-

- Journal:

- Ageing & Society , First View

- Published online by Cambridge University Press:

- 26 September 2025, pp. 1-21

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Mandatory pension contributions, household consumption, and savings

-

- Journal:

- Journal of Pension Economics & Finance , First View

- Published online by Cambridge University Press:

- 09 September 2025, pp. 1-24

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

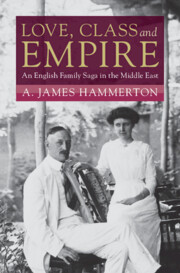

7 - Fatal Wanderlust and Home Settlement

-

- Book:

- Love, Class and Empire

- Published online:

- 10 July 2025

- Print publication:

- 04 September 2025, pp 201-223

-

- Chapter

- Export citation

6 - Liverpool 1974

-

- Book:

- Dreams and Songs to Sing

- Published online:

- 07 August 2025

- Print publication:

- 07 August 2025, pp 97-118

-

- Chapter

- Export citation

Favorable tax treatment of older workers in general equilibrium

-

- Journal:

- Macroeconomic Dynamics / Volume 29 / 2025

- Published online by Cambridge University Press:

- 17 July 2025, e119

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Understanding debt in the older population

-

- Journal:

- Journal of Pension Economics & Finance , First View

- Published online by Cambridge University Press:

- 15 July 2025, pp. 1-18

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Love, Class and Empire

- An English Family Saga in the Middle East

-

- Published online:

- 10 July 2025

- Print publication:

- 04 September 2025

State pension eligibility age and retirement behaviour: evidence from the United Kingdom household longitudinal study

-

- Journal:

- Journal of Pension Economics & Finance , First View

- Published online by Cambridge University Press:

- 08 July 2025, pp. 1-24

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

22 - Stepping Down after 21 Years

-

- Book:

- Disorderly Movements

- Published online:

- 17 May 2025

- Print publication:

- 05 June 2025, pp 322-329

-

- Chapter

- Export citation

1 - How the 100-Year Life Challenges the Legal Model of the Human Life Cycle

- from Part I - Implications across the Legal System

-

-

- Book:

- Law and the 100-Year Life

- Published online:

- 13 May 2025

- Print publication:

- 29 May 2025, pp 15-25

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

20 - Transportation Policy for the 100-Year Life

- from Part IV - The 100-Year Life and Our Broader Environment

-

-

- Book:

- Law and the 100-Year Life

- Published online:

- 13 May 2025

- Print publication:

- 29 May 2025, pp 271-282

-

- Chapter

-

- You have access

- Open access

- HTML

- Export citation

Retirement tax shields: A cohort study of traditional and Roth accounts

-

- Journal:

- Journal of Pension Economics & Finance / Volume 24 / Issue 3 / July 2025

- Published online by Cambridge University Press:

- 10 April 2025, pp. 392-413

-

- Article

- Export citation

The voluntariness of retirement-transitions: a European cohort-study

-

- Journal:

- Ageing & Society / Volume 45 / Issue 11 / November 2025

- Published online by Cambridge University Press:

- 04 April 2025, pp. 2280-2295

- Print publication:

- November 2025

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Cliff-edge or atypical retirement? Exploring retirement trajectories of post-war baby boomers in The Netherlands

-

- Journal:

- Ageing & Society / Volume 45 / Issue 11 / November 2025

- Published online by Cambridge University Press:

- 17 March 2025, pp. 2315-2338

- Print publication:

- November 2025

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

The safe withdrawal rate: evidence from a broad sample of developed markets

-

- Journal:

- Journal of Pension Economics & Finance / Volume 24 / Issue 3 / July 2025

- Published online by Cambridge University Press:

- 17 February 2025, pp. 464-500

-

- Article

- Export citation

Intergenerational and intragenerational cooperation

- Part of

-

- Journal:

- Economics & Philosophy / Volume 41 / Issue 1 / March 2025

- Published online by Cambridge University Press:

- 27 January 2025, pp. 206-211

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

How does retirement really affect physical health? A systematic review of longitudinal studies

-

- Journal:

- Ageing & Society / Volume 45 / Issue 9 / September 2025

- Published online by Cambridge University Press:

- 23 January 2025, pp. 1925-1942

- Print publication:

- September 2025

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Pensions and protestants: or why everything in retirement can’t be optimized

-

- Journal:

- Annals of Actuarial Science , First View

- Published online by Cambridge University Press:

- 04 December 2024, pp. 1-20

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

15 - Retirement Transition as a Preventive Intervention Target

- from Part Four - Across the Lifespan: Adults and Families

-

-

- Book:

- An Ounce of Prevention

- Published online:

- 14 November 2024

- Print publication:

- 28 November 2024, pp 313-334

-

- Chapter

- Export citation